ACT Numbered Regulations - Explanatory Statements

ACT Numbered Regulations - Explanatory Statements ACT Numbered Regulations - Explanatory Statements

ACT Numbered Regulations - Explanatory Statements[Index] [Search] [Download] [Related Items] [Help]

PLANNING AND DEVELOPMENT AMENDMENT REGULATION 2008 (NO 4) (NO 41 OF 2008)

2008

LEGISLATIVE

ASSEMBLY FOR THE

AUSTRALIAN CAPITAL

TERRITORY

Planning and Development

Amendment Regulation 2008 (No

4)

SL2008-41

EXPLANATORY

STATEMENT

Circulated by authority of the

Minister for Planning

Mr

Andrew Barr MLA

Planning and Development Amendment Regulation 2008 (No

4)

Overview

Application for an extension of time to commence

and complete (refer to clauses 5, 16 and 17) - for extensions to commence

and complete development provisions in a lease. The Act is modified and the

regulation amended to provide for a reduced fee regime; removal of a maximum

extension period; makes provision for hardship; and allows for delays in

obtaining statutory approvals to be taken into account.

Designated

Land (refer to clauses 14 and 15) - the interrelationship of territory land

and designation under Commonwealth law is a complex matter. The Territory has

exempted effectively all development in a designated area from requiring any

territory approvals, requiring only lease variations to be subject to approval

processes.

The regulation modifies the Act to apply merit track

provisions to the processing of an application of a development proposal for a

lease variation in a designated area. The regulation also excludes any

reference to the territory plan in determining such applications, as

Commonwealth law provides that the territory plan does not apply to designated

areas.

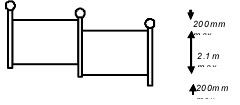

Fences (refer to clauses 10, 11 and 12) - the

regulation provides an exemption from requiring a development application

approval for fences up to 2.3 metres in height. Building Act provisions and the

Common Boundaries Act 1981 provisions still apply. The 2.3 metres is

intended to allow fences with standard length panels or palings of 2.1 metres to

be constructed while allowing 200mm variance to accommodate for any fall in the

land. There is also a 200mm allowance for capping (knobs etc) to fence

posts.

Further Rural Leases (refer to clause 15) - the

regulation modifies the Act to allow a further grant of a rural lease to be made

where an undertaking to pay rent and/or payment instalments is made. This

restores practice prior to the commencement of the new Act.

Concessional Leases (refer to clauses 8 and 9) - the

regulation removes any doubt that leases granted under the City Area Leases

Act 1936 (CALA) are not concessional leases as defined in the Act. However,

such leases that were subject to either a dealing restriction under the terms of

lease or by the operation of CALA, are not covered by this provision, and

therefore their concessional lease status will have to be determined in

accordance with the Act.

Transitional arrangements for leases applied

for before 31 March 2008(refer to clause 18) - the regulation

simplifies the transitional arrangements by modifying the Act. The regulation

does this by modifying the Act so that the repealed Act applies to any

application for a lease made before 31 March 2008 irrespective of when the

decision on the application is made. This is the default arrangement, however

the applicant can elect to have the new Act apply to the application. This

arrangement applies for the life of the modification (31 March 2010). The

former six month cut off period for transitional arrangements is also removed.

Minor technical corrections (refer to clauses 14, 15, 16, 17,

18) - the regulation also introduces a number of minor technical changes

to clarify certain provisions or ensure consistency. For example, the

modification of s114 of the Act to ensure consistency in the use of development

tables and the application of s123 of the Act on impact matters.

Act

modifications - made under section 429 expire on 31 March 2010 as a result

of the operation of section 431 of the Act.

Clauses 1 – Name of Regulation –states the name of the

regulation, which is the Planning and Development Regulation 2008 (No

4).

Clause 2 – Commencement –states that the

regulation commences the day after its notification.

Clause 3

– Legislation amended – states that the regulation amends the

Planning and Development Regulation 2008.

Clause 4 – New

division 5.7.1 heading – creates a new division under Part 5.7

Transfer or assignment of leases subject to building and development

provision. The new division provides for the transfer or assignment of a

lease subject to building and development provisions. The provisions within the

new division are unchanged.

Previously provisions now in new division

5.7.1, that is section 200 & 201, were located within Part 5.7. Other

provisions that were in Part 5.7 are now located within new division 5.7.2

Applications for extension of time commence and complete required works.

Clause 5 relates to this.

Clause 5 – Sections 202 and 203

– inserts a new division 5.7.2 Applications for extension of time

to commence or complete required works, and amends existing section 202 and

203 and inserts new sections 204 - 207.

New division 5.7.2 –

creates a division that deals specifically with applications for an extension of

time to commence and complete required works.

New section 202

– defines for the division period of extension as either the

period sought in the application for extension, or if there has been 1 or more

extensions of time sought (other than an extension of time under section 205,

206 or 207), the combined total of all extensions of time approved.

The

provision also provides that an application for an extension of time that seeks

an extension for 2 or more building and development provisions in a lease, that

the period of extension, for the application, is the longest of the periods

sought. For instance a typical single residential house lease has 2 building

and development provisions, 1 for commencement and 1 for completion. Therefore

an applicant (the lessee) may apply for an extension of time to commence the

required works, say for 12 months, and also an extension of time to complete the

required works, say 24 months. The provision provides that the longest period,

that is 24 months, would be used in determining the period of extension

sought.

The period of extension is applied when working out, under

section 298A of the Act and new sections 203 and 204 of the regulation, the

required fee for an application for an extension of time to commence or complete

building and development.

New section 203 – specifies the

general rules for an application for an extension of time under s298A (5), def

A, par (b) of the Planning and Development Act 2007. Section 298A

provides the method for working out the fee for an application for an extension

of time to commence or complete building and development provisions. Section

298A (5) def A, par (b) provides that a lower figure (for use in working

out the amount of the required fee) may be prescribed by regulation for

A, otherwise the figure for A is 5 (s298A (5) def A, pa

(a)).

The provision applies to all lease types other than those leases

to which section 204, section 205, section 206 or section 207 would

apply.

New section 204 – provides for an application for an

extension of time in relation to a single dwelling house lease or a lease

granted to a community organisation for community use where the planning and

land authority is satisfied that hardship reasons apply and that the extension

is necessary because of the hardship reason. The provision does not apply if

section 205 or 206 applies.

New section 204 (4) defines

hardship by reference to sections 298 (2) (b) (i), (ii) or

(iii) of the Act. In summary hardship reasons, for an individual

include personal reasons, financial reasons or an unforeseen major event

outside of the lessee’s control. In any other case (e.g. corporation or

association) hardship reasons include financial reasons or an unforeseen major

event outside of the lessee’s control.

However, this section does

not apply to an application in relation to a single dwelling house if the lessee

is the lessee of another lease and has applied for or been granted an extension

of time to commence or complete required works for that lease.

Section

298A of the Act provides the method for working out the fee for an application

for an extension of time to commence or complete building and development

provisions. Section 298A (5) def A, par (b) provides that a lower figure

(for use in working out the amount of the required fee) may be prescribed by

regulation for A, otherwise the figure for A is 5 (s298A (5) def

A, pa (a)). The provision prescribes figures for A where the

planning and land authority is satisfied that hardship reasons apply and that

the extension is necessary because of the hardship reason. The maximum figure

for A, under new section 204, is 4 (refer to Table 203 column 1 item 4 -

column 3 figure 4).

New section 205 – provides for an

application for an extension of time in relation to a lease where the planning

and land authority is satisfied that an external reason applies and that the

extension is necessary because of the external reason.

The provision

defines external reason as when a lessee is unable to commence or

complete required works because road or traffic infrastructure, is not complete;

or because sewerage, electricity, water or gas service, to be provided by the

Territory, is not installed or connected; or because there is a delay in

obtaining statutory approvals, other than that wholly or partly caused by the

lessee or a decision to refuse, or impose a condition on a required statutory

approval.

Section 298A of the Act provides the method for working out

the fee for an application for an extension of time to commence or complete

building and development provisions. Section 298A (5) def A, par (b)

provides that a lower figure (for use in working out the amount of the required

fee) may be prescribed by regulation for A, otherwise the figure for

A is 5 (s298A (5) def A, pa (a)). New section 205 prescribes

figures for A where the planning and land authority is satisfied those

external reasons apply and that the extension is necessary because of the

external reason. For these applications the figure for A is always zero

(refer subsection 205 (2)).

New section 206 – provides for

an application for an extension of time where the lease has been transferred or

assigned in special circumstances and before the end of the period allowed under

the building and development provisions. The extension, if granted, is

considered to have commenced on the day or after the day of the transfer or

assignment. The extension cannot be for a period longer than that allowed under

the original lease.

Special circumstances, specified in subsection 206

(3) include:

§ where the lessee has died;

or

§ the transfer or assignment is made

under a Family Court Order; or

§ an order

of another court having jurisdiction under the Family Law Act 1975

(Cwlth), an order under the Domestic Relationships Act 1994, div 3.2;

or

§ as a result of bankruptcy or

insolvency, or where an authorised deposit taking institution or a finance

company has exercised a power under the Land Titles Act 1925, section 94

as a result of default in payment of the mortgage. Section 94 provides that a

mortgagee or encumbrancee may sell all the interest of the mortgagor or

encumbrancer if required payments are in default for a period specified in the

notice. Breach of mortgage covenants other than default in payment do not

constitute a special circumstance.

Section 298A of the Act provides the

method for working out the fee for an application for an extension of time to

commence or complete building and development provisions. Section 298A (5) def

A, par (b) provides that a lower figure (for use in working out the

amount of the required fee) may be prescribed by regulation for A,

otherwise the figure for A is 5 (s298A (5) def A, pa (a)). For

applications under new section 206 the figure for A is always zero (refer

subsection 206 (2)).

New section 207 – applies to an

application for an extension of time in relation to a lease granted before 31

March 2008 is the planning and land authority is satisfied that the time

provided to commence or complete required works was not sufficient at the time

of grant.

The provision specifies that the application for an extension

of time to commence must not be for more than 1 year after the end of the period

allowed under the original lease. This means, for example, that if the period

allowed to commence expired on 2 April 2008 that the extension of time to

commence can only be for a period up until 2 April 2009.

An application

for an extension of time to complete must not be for more than 2 years after the

end of the period allowed for in the original lease. This means, for example,

that if the period allowed to complete expires on 2 April 2009 that the

extension of time to complete can only be for a period up until 2 April

2011.

Note that under section 456A of the Act, applications for an

extension of time covering periods prior to commencement of the Act on 31 March

2008 must be dealt with under the provisions of the repealed

Act.

Clause 6 – New section 210 (1) (c) – inserts a

new subsection to include an additional lease type for the section. The

additional lease type is a lease terminated for a breach of a building and

development provision. New section 210 (1) (c) together with new section 211

(1) (c), inserted by clause 7, permit compensation to be paid for termination of

leases of this type and other leases already identified. The amount of

compensation is specified in existing subsection 210 (2) and 210

(3).

Clause 7 – New section 211 (1) (c) - inserts a new

subsection to include an additional lease type for the section. The additional

lease type is a lease that has been terminated, for a breach of a building and

development provision. Otherwise the provision is unchanged. New section 211

(1) (c) permits the planning and land authority to pay compensation (of an

amount set out in existing subsections 210 (2) and 210 (3).

Clause 8

– New section 240 (e) – existing section 240 (under section 235

(1) of the Act) lists lease types that are deemed to not be

concessional leases for the purposes of the Act. New section 240

(e) adds to this list. Under section 240 (e) leases granted before 1 January

1971 under the City Area Leases Act 1936 are deemed to not be

concessional unless:

§ when the lease was

granted it was subject to a restriction in dealing under the terms of the lease;

or

§ operation of City Area Leases Act

1936; or immediately prior to the repeal of the City Area Leases Act 1936,

the lease was subject to a restriction in dealing in the

lease.

Clause 9 – Section 240, examples for par (c) –

relocates examples currently located under subsection (240 (d) to subsection 240

(c) as the examples are only applicable to that subsection.

Clause 10

– Schedule 1, section 1.51 (1) – substitutes existing

schedule 1, part 1.3, section 1.51 (1). The provision defines excluded

criteria for the section as those that, if applied, would

unintentionally affect the function and application other exemptions (Clause 10

and clause 11 refer to this). For example, section 1.50 (1) (a) (ii) provides

that a structure, to which the section applies, must not be higher than 1.85m

above natural ground level. Therefore, if s1.50 was applied an exemption

provided for under new section 1.52 (2) (a) (ii), for instance, would be of no

effect as it provides for a height of 2.3m. The provision rectifies this

anomaly by excluding application of s1.50 to s1.51.

The provision defines

a fence and a wall for the section. Previously the

provision only provided a definition of a fence however proceeding subsections

use the term wall.

Clause 11 – Schedule 1, section 1.51 (2) (a)

(ii) – substitutes existing schedule 1, section 1.51 (2) (a) (ii) with

a new section to specify that the height of a fence or wall must be no higher

than 2.3m above natural ground level, and that the support structure of the

fence or wall be no higher than 2.5m above natural ground level. Natural ground

level is defined, in the volume 2 of the territory plan, as the ground level at

the date of the grant of the lease of the block.

The increase in height,

from 1.85m to 2.3m, is to cater for standard modular fence sizes up to 2.1m

nominal height, including the following for example: Metal fence panels

generally range in size up to 2.1m high, as 2.1m is a standard length of many

building products including corrugated metal sheeting for fencing. However, to

protect the sharp edges of metal sheeting used as fencing, a top and bottom

capping strip is usually installed over the top end of the sheet and under the

bottom end of the sheet.

To avoid compromising metal fencing product

warranties, some products must be kept out of contact with the ground. The 2.3m

increased fence height therefore allows for a 2.1m high panel, plus an extra

200mm for the thickness of the top and bottom capping strips, and a gap between

the ground and the bottom of the panel. The 200mm extra will also allow for

panels to be installed horizontally over sloping ground, such as where one of

the panel is close to the ground but as the ground slopes away beneath parts the

panel, those parts become higher above the ground. The 200mm extra will

similarly cater for undulating or rough ground. The following diagram is an

example of this:

The

provision also allows the support structure for relevant fences or walls to no

higher than 2.5m above natural ground level. That is intended to allow posts or

columns to project above wall or fence panels for decorative effect. It will

also allow column or post caps, including decorative spherical knob-type column

or post caps to project above the fence or wall panels.

The amendment

will also cater for a popular standard decorative fencing product that provides

for a 1.8m high solid metal fence sheet with an integral 300mm high open lattice

panel above the sheet, including capping strips etc. The following diagram is

an example of the product mentioned:

Clause 12 – Schedule 1, section 1.51 (2) (d),

except the notes - specifies that an exemption, provided for by the section,

must comply with general exemption criteria, specified in part 1.2, and only

s1.41 in part 1.3.2. This is because all other exemptions, other than s1.41, in

part 1.3.2 are not applicable to the exemption provided for at s1.51. For

example, section 1.50 (1) (a) (ii) provides that a structure, to which the

section applies, must not be higher than 1.85m above natural ground level.

Therefore, if s1.50 was applied an exemption provided for under new section 1.52

(2) (a) (ii), for instance, would be of no effect as it provides for a height of

2.3m. The provision rectifies this anomaly by excluding application of s1.50 to

s1.51.

Clause 13 – Schedule 20, new modification 20.1 heading

– substitutes a new heading to include new section 429G.

Clause 14 - New sections 429AA and 429G – inserts before

s429A a new section 429AA and new section 429AB.

New section 429AA

– Modification-s 114 (Application of assessment tracks to development

proposals) - provides that subsection 114 (2) of the Act should be read as

if it was omitted and substituted with a new subsection 114 (2). New subsection

114 (2) provides that a development application for a development

proposal must be assessed in the assessment track determined by the Act

development table. The provision also inserts a new subsection (3) and states

that the section is subject to section 123 of the Act.

This amendment

ensures consistency in the Act, through reference to s123. Section 123 requires

a development application to be assessed be in the impact track in the specified

circumstances. Therefore the development tables are not the sole determinant of

the required assessment track. The amendment makes this clear.

New

section 429AB – Modification-div 7.2.5 (Development proposals not in

development table and not exempted) – provides that div 7.2.5, of the

Act, should be read as if new section 131A were inserted. New section 131A

determines how a development application for approval of a lease variation in a

designated area must be assessed and dealt with under the Act.

New

section 131A – Development proposal for lease variation in

designated area - states that the section applies if the development

application is for a development proposal that is a lease variation for a lease

in a designated area.

Designated area is defined

in the Planning and Development Act 2007, dictionary: the Australian

Capital Territory (Planning and Land Management) Act 1988 (Cwlth).

Section 10 of PALM Act provides for the identification of designated

area in the National Capital Plan. Subsection 10 (1) states that

“...the [National Capital} Plan may specify areas of land that have the

special characteristics of the National Capital to be designated

areas”.

New section 131A provides that section 50 of the Act and

the territory plan do not apply to a development application that relates to

designated land. This recognises the fact that under the PALM Act the territory

plan cannot apply to designated areas (refer to section 25 (1) (b) and section

25 (6) of the PALM Act).

The provision further provides that the

development application must be dealt with under provisions of the Act (other

than any territory-plan related provisions) that apply to the merit track unless

under section 123 (b), (c), (d) or (e) of the Act the impact track applies.

The provision also defines territory plan-related

provision as a provision as provisions of the Act that applies a

relevant development table, code, rules or criteria, objects for a zone,

statement of strategic directions, or anything else in the territory

plan.

This means, for example that sections 50, 112 (2) (b), 119 (1) (a),

119 (2) (b), 120 (a), 121 (2), 123 (a), 128 (1) (b) (i), 128 (2) (b), 129

(a), 129 (b), 132, 139 (2) (e) and 139 (2) (f) (i) are territory plan-related

provisions and as such would not be used in the processing of a development

application for a lease variation in a designated area. These examples noted

here are not exhaustive.

The clause modifies the Act and inserts a new

section 131A through a transitional regulation making power under section 429 of

the Planning and Development Act 2007. Act modifications under section

429 expire on 31 March 2010 as a result of the operation of section 431 of the

Act.

Clause 15 – Schedule 20, modification 20.1, new sections

429EA to 429ED – inserts after existing section 429E new section 429

EA – 429ED.

New section 429EA – modifications-s

246 (Payment for leases) –amends existing section 246 (2) (c) &

(d) by omitting those sections and replacing them with a new

section 246 (2) (d). This effectively omits reference to

“further rural leases” and “rural leases granted on payment of

an amount under s280”. These references are redundant because of the

operation of s254 and s280.

New section 429EB –

Modification-s 254 (Grant of further leases) – amends existing section

254 of the Act to provide for rural leases that are rental leases. New

subsection 254 (1) (e) provides that the section applies if the amount

determined under section 280 of the Act for a rental rural lease has been paid

or for a rural lease, that is not a rental lease, that any amounts, determined

under section 280, allowed to be paid by instalments has been paid.

New section 429EC – Modification-s 255 (Grant of further lease

includes authorised use) - amends section 255 of the Act to insert new

subsection 255 (3A) which provides that a further lease may include provisions

that are different to those in the original lease. This is a ‘to remove

any doubt’ provision. However, the further lease must retain all existing

authorisations of use of the land under the lease as required by section 255

(2).

The provision includes an example that suggests that a restriction

on the number of dwellings permitted on the lease may be included in the further

lease where no restriction had been in the original lease. The example provided

is not exhaustive and may extend, but does not limit the

provision.

New section 429ED – Modification-s 280

(Determination of amount payable for further leases-rural land) –

amends section 280 of the Act so that the section reflects the amendments made

under new section 429EA and 429EB; and provides that the amount payable for a

further rural lease may be paid in instalments.

The clause modifies the

Act through a transitional regulation making power under section 429 of the

Planning and Development Act 2007. Act modifications under section 429

expire on 31 March 2010 as a result of the operation of section 431 of the

Act.

Clause 16 – Schedule 20, modification 20.1, section

429F – inserts a new section 429F (1) which provides that section 298A

(of the Planning and Development Act 2007) should be read as if

subsection 298A (4) were omitted. Section 298A (4) if not omitted would

conflict with the intended operation of new section 203 and new section 204 of

the regulation.

The clause modifies, through a transitional regulation

making power under section 429 of the Planning and Development Act 2007,

section 298A of the Planning and Development Act 2007. Act modifications

under section 429 expire on 31 March 2010 as a result of the operation of

section 431 of the Act.

Clause 17 - Schedule 20, modification 20.1,

new section 429G – inserts a new subsection 429G which provides that

section 298A (of the Planning and Development Act 2007) should be read as

if subsection 298B (5) and (6) were omitted. This means that there is no upper

limit on the number of extensions that can be granted provided the required fee

is paid. This change reflects the amendment of the regulation at clause 5. The

provision is otherwise unchanged.

The clause modifies, through a

transitional regulation making power under section 429 of the Planning and

Development Act 2007, section 298B of the Planning and Development Act

2007. Act modifications under section 429 expire on 31 March 2010 as a

result of the operation of section 431 of the Act.

Clause 18 -

Schedule 20, new modification 20.6A - substitutes existing section 458 and

deletes existing section 459. New section 458 provides for where an applicant

(potential lessee) has applied for a grant of a lease under the repealed Act,

section 161 (granting of leases), or section 163 (Leases to community

organisations) or section 164 (Special leases), and the lease is not granted

before commencement day i.e. 31 March 2008. In this case the lease may be

granted either under the repealed Act or if agreed to by the applicant, the Act.

Importantly this modification applies irrespective of when the

application was ‘decided’. The existing sections 458 and 459

determines the relevant transitional arrangements by reference to the date of

the decision on the application. This approach is simplified so the

transitional arrangements are determined soley by the date of

application.

This means that a lease applied for but not granted before

31 March 2008 may be granted under the Land (Planning and Environment) Act

1991 (repealed) or the Planning and Development Act 2007. The

potential lessee (the person) must agree in writing to a lease being granted

under this Act if that person applied for the grant before 31 March 2008.

Subsection 458 (3) provides that the lease may be registered under the

Land Titles Act 1925, as if the repealed Act had not been repealed, and

is taken to have been granted under this Act.

New section 458 also

removes the requirement for deciding the application, for the grant of the

lease, within 6 months of commencement day.

The clause deletes section

459 as the amendments to section 458 no longer makes the distinction of whether

or not an application, for the grant of a lease, has been decided within 6

months or not of commencement day. Section 459 had provided for the grant of a

lease applied for before commencement day but not decided within 6 months of

commencement day.

New section 458 is taken to have commenced on 31 March

2008 and apply unitl the period provided for by section 431 of the Act i.e. 31

March 2010..

The clause modifies, through a transitional regulation

making power under section 429 of the Planning and Development Act 2007,

section 458 and deletes section 459 of the Planning and Development Act

2007. Act modifications under section 429 expire on 31 March 2010 as a

result of the operation of section 431 of the Act.

Clause 19 –

Dictionary, new definitions – inserts a new definitions for period of

extension (refer to clause 5, section 202).