Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) Each of the following amounts:

(a) the lifetime limit;

(b) a yearly rate;

is to be indexed, on 1 July 2017 and each later 1 July (each such 1 July is an indexation day ), in accordance with this section.

(2) If an amount is to be indexed on an indexation day, this Act has effect as if the indexed amount were substituted for that amount on that day.

(3) This is how to work out the indexed amount for an amount that is to be indexed on an indexation day:

Method statement

Step 1. Use subsection (4) to work out the annual indexation factor for the amount on the indexation day.

Step 2. Multiply the amount that is to be indexed by the annual indexation factor.

Step 3. If the result of step 2 is an amount of whole dollars, the result is the indexed amount . If the result of step 2 is an amount of whole dollars and cents, round the amount up or down (up in the case of 50 cents) to the nearest dollar. The result is the indexed amount .

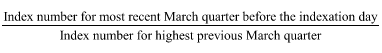

(4) Subject to subsections (5) and (6), the annual indexation factor for an amount that is to be indexed under this section on an indexation day is:

rounded to 3 decimal places.

(5) For the purposes of subsection (4):

(a) the highest previous March quarter is the March quarter, before the most recent March quarter before the indexation day, with the highest index number (disregarding any March quarter that is earlier than the 2014 March quarter); and

(b) the third decimal place is rounded up if, apart from the rounding:

(i) the factor would have 4 or more decimal places; and

(ii) the fourth decimal place would be a number greater than 4.

Note: See section 33 for the definition of index number .

(6) If an annual indexation factor worked out under subsections (4) and (5) would be less than 1, the indexation factor is to be increased to 1.