Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) Subject to subsection ( 2), the amount of levy payable by an authorised NOHC for a financial year is:

(a) if the authorised NOHC is an authorised NOHC within the meaning of the Banking Act 1959 --the amount determined , by legislative instrument, by the Treasurer for the purpose of this paragraph in relation to the financial year; or

(b) if the authorised NOHC is an authorised NOHC within the meaning of the Insurance Act 1973 --the amount determined , by legislative instrument, by the Treasurer for the purpose of this paragraph in relation to the financial year; or

(c) if the authorised NOHC is a registered NOHC within the meaning of the Life Insurance Act 1995 --the amount determined, by legislative instrument, by the Treasurer for the purpose of this paragraph in relation to the financial year.

The amount determined under paragraph ( a), (b) or (c) in relation to a financial year must not exceed the statutory upper limit for the financial year .

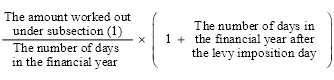

(2) If the levy imposition day for the authorised NOHC for the financial year is later than 1 July in the financial year, the amount of levy payable by the authorised NOHC for the financial year is the amount worked out using the following formula: