Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If levy payable by a person remains unpaid after it has become due for payment, the person is liable to pay (in addition to the levy) a prescribed penalty on the unpaid amount of levy, calculated from the day the levy became due for payment, and compounded.

(2) The regulations must not prescribe a penalty exceeding the equivalent of 1.5% of the amount of unpaid levy for each month or part of a month during which it is unpaid.

(3) Subsection (2) does not require the penalty to be calculated on a monthly basis.

(4) The fact that a judgment is entered or given in a court for the payment of levy, or of a composite amount that includes levy, does not of itself cause the levy to stop being unpaid for the purposes of subsection (1).

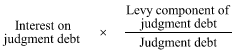

(5) If the judgment debt bears interest, the penalty payable under subsection (1) is reduced by the following amount: