Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsAdd together the amounts applicable under this section for each eligible child

(1) The amount of the economic security strategy payment to the entitled individual is worked out by adding together the amounts applicable under this section for each eligible child.

Amount is $1,000 unless another subsection applies

(2) Subject to this section, the amount applicable for an eligible child is $1,000.

Reduced amount if applicable rate took account of an individual's shared care percentage

(3) If the applicable rate (see section 89) took account of a shared care percentage in relation to an eligible child covered by paragraph 90(a), (b) or (c), the amount applicable for the eligible child is that percentage of $1,000.

Reduced amount if applicable rate took account of a section 28 percentage determination

(4) If the applicable rate (see section 89) took account of a determination under section 28 of a particular percentage in relation to one or more FTB children (being an eligible child or eligible children)--the amount applicable for the eligible child, or for each of those eligible children, is:

(a) unless paragraph (b) applies--that percentage of $1,000; or

(b) if subsection (3) also applies in relation to the eligible child--that percentage of the amount worked out under subsection (3) for the eligible child.

Reduced amount if applicable rate took account of a section 29 percentage determination

(5) If the applicable rate (see section 89) took account of a determination under section 29 of a particular percentage in relation to one or more FTB children (being an eligible child or eligible children)--the amount applicable for the eligible child, or for each of those eligible children, is:

(a) unless paragraph (b) applies--that percentage of $1,000; or

(b) if subsection (3) also applies in relation to the eligible child--that percentage of the amount worked out under subsection (3) for the eligible child.

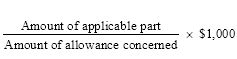

Reduced amount for part of education allowance

(6) If:

(a) subsection 89(7) or (8) applies in circumstances where the entitled individual was paid a part (the applicable part ) of the allowance concerned in relation to an eligible child; and

(b) another parent or guardian of the eligible child was paid a part of the allowance concerned;

the amount applicable for the eligible child is worked out as follows: