Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The Secretary may calculate an indexed estimate for an individual under subsection (5), with a start day chosen by the Secretary, if:

(a) the individual is a claimant, or the partner of a claimant, for family tax benefit; and

(b) a determination is in force under which the claimant is entitled to be paid family tax benefit by instalment; and

(c) the determination includes a determination of the claimant's rate of family tax benefit worked out on the basis of a reasonable estimate of the claimant's adjusted taxable income, an indexed estimate for the claimant or an indexed actual income for the claimant.

Note: Section 20C affects the meaning of paragraph (c) for members of couples.

(2) If the Secretary calculates an indexed estimate for the individual, the Secretary may give the claimant a notice:

(a) stating the indexed estimate for the individual; and

(b) specifying the start day used in the Secretary's calculation (which must be at least 14 days after the day on which the notice is given).

(3) The Secretary must not give a notice under subsection (2) stating an indexed estimate for the individual with a start day in an income year if the Secretary has already given a notice under subsection (2) stating an indexed estimate for that individual with a start day in the same income year.

(4) A notice given to a claimant under subsection (2) stating an indexed estimate for an individual has no effect if, before the start day specified in the notice for the indexed estimate, the Secretary gives the claimant a notice under subsection 20B(2) stating an indexed actual income for the same individual. Any such notice under subsection 20B(2) must specify a start day that is no earlier than the start day specified in the superseded notice.

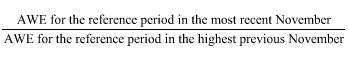

(5) Calculate an indexed estimate (which may be nil) for the individual by multiplying the individual's current ATI number (see subsection (6)) by the indexation factor, rounding the result to the nearest dollar and rounding 50 cents upwards. The indexation factor is the greater of 1 and the factor worked out to 3 decimal places as follows (increasing the factor by 0.001 if it would, if worked out to 4 decimal places, end in a number greater than 4):

where:

"AWE" means the amount published by the Australian Statistician in a document titled "Average Weekly Earnings" under the headings "Average Weekly Earnings, Australia--Original--Persons--All employees total earnings" (or, if any of those change, in a replacement document or under replacement headings).

"highest previous November" means the November in which, of all the Novembers from November 2004 to the November before the most recent November (inclusive), AWE was the highest.

"most recent November" means the November of the income year before the income year in which the start day occurs.

"reference period" , in a particular November, means the period described by the Australian Statistician as the last pay period ending on or before a specified day that is the third Friday of that November.

(6) For the purposes of subsection (5), the individual's current ATI number is:

(a) if, at the time of calculation, the Secretary has given the claimant a notice under subsection 20B(2) stating an indexed actual income for the individual with a start day that has not arrived--the indexed actual income stated in the notice; or

(b) if paragraph (a) does not apply and the individual is the claimant--the amount the Secretary is permitted to use for the individual under section 20 (disregarding the effect for couples of section 20C of this Act and clause 3 of Schedule 3 to the Family Assistance Act); or

(c) if paragraph (a) does not apply and the individual is the claimant's partner--the amount the Secretary would be permitted to use for the individual under section 20 if the individual were the claimant (disregarding the effect for couples of section 20C of this Act and clause 3 of Schedule 3 to the Family Assistance Act).

(7) A notice under subsection (2) is not a legislative instrument.