Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

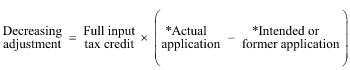

Commonwealth Consolidated ActsThe amount of a * decreasing adjustment that you have under Step 4 of the Method statement in section 129 - 40 for the thing acquired or imported is worked out as follows:

where:

"full input tax credit" is the amount of the input tax credit to which you would have been entitled for acquiring or importing the thing for the purpose of your * enterprise if:

(a) the acquisition or importation had been solely for a * creditable purpose; and

(b) in the case where the supply to you was a * taxable supply because of section 72 - 5 or 84 - 5--the supply had been or is a * taxable supply under section 9 - 5.