Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) You have an increasing adjustment if:

(a) you are the * recipient of a * supply of a going concern, or a supply that is * GST - free under section 38 - 480; and

(b) you intend that some or all of the supplies made through the * enterprise to which the supply relates will be supplies that are neither * taxable supplies nor * GST - free supplies.

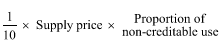

(2) The amount of the increasing adjustment is as follows:

where:

"proportion of non-creditable use" is the proportion of all the supplies made through the * enterprise that you intend will be supplies that are neither * taxable supplies nor * GST - free supplies, expressed as a percentage worked out on the basis of the * prices of those supplies.

"supply price" means the * price of the supply in relation to which the increasing adjustment arises.