Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) You have an increasing adjustment if:

(a) your * registration is cancelled; and

(b) immediately before the cancellation takes effect, your assets include anything in respect of which you were, or are, entitled to an input tax credit.

Note: Increasing adjustments increase your net amounts.

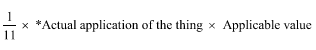

(2) The amount of the adjustment, for each thing referred to in paragraph (1)(b), is as follows:

where:

"applicable value" is:

(a) the * GST inclusive market value of the thing immediately before the cancellation takes effect; or

(b) if you were, or are, entitled to an input tax credit for acquiring the thing--the amount of the * consideration that you provided, or were liable to provide, for your acquisition of the thing, but only if the amount is less than that value; or

(c) if you were, or are, entitled to an input tax credit for importing the thing--the cost to you of acquiring or producing the thing (plus the * assessed GST paid on its importation), but only if the amount is less than that value.

(3) However, an * adjustment does not arise under this section in respect of an asset if:

(a) there were one or more * adjustment periods for your acquisition or importation of the asset; and

(b) the last of those adjustment periods has ended before the cancellation of your * registration takes effect.