Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) You have an increasing adjustment if:

(a) you are the executor or trustee of a deceased estate; and

(b) you are * registered or * required to be registered; and

(c) you supply an asset of the deceased estate to a beneficiary of the deceased estate; and

(d) the supply is not a * taxable supply and is not a supply that is * GST - free or * input taxed; and

(e) you were, or are, or the deceased person was, entitled to an input tax credit for the deceased person's acquisition or importation of the asset.

Note: Increasing adjustments increase your net amounts.

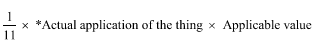

(2) The amount of the adjustment, for the asset, is as follows:

where:

"applicable value" is:

(a) the * GST inclusive market value of the asset immediately before it is supplied; or

(b) if you were, or are, or the deceased person was, entitled to an input tax credit for the deceased person acquiring the thing--the amount of the * consideration that you or the deceased person provided, or was liable to provide, for the acquisition of the thing, but only if the amount is less than that value; or

(c) if you were, or are, or the deceased person was, entitled to an input tax credit for the deceased person importing the thing--the cost to you or the deceased person of acquiring or producing the thing (plus the * assessed GST paid on its importation), but only if the amount is less than that value.

(3) However, an * adjustment does not arise under this section in respect of the asset if:

(a) the asset related to an * enterprise that the deceased person * carried on, and the beneficiary intends to continue to carry on that enterprise; or

(b) there were one or more * adjustment periods for the deceased person's acquisition or importation of the asset, and the last of those adjustment periods has ended before the cancellation of your * registration takes effect.