Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) You are liable to pay a penalty, for a * GST instalment quarter of an * instalment tax period applying to you, if:

(a) you have a * varied instalment amount for the GST instalment quarter; and

(b) you are not liable to pay a penalty, for the GST instalment quarter, under section 162 - 175; and

(c) your * estimated annual GST amount relating to the GST instalment quarter is less than:

(i) 85% of your * annual GST liability for the instalment tax period; or

(ii) if the GST instalment quarter ends on 30 September 2001--75% of your * annual GST liability for the instalment tax period; and

(d) the varied instalment amount is less than or equal to 25% of your annual GST liability for the instalment tax period.

(2) The amount of the penalty, for a particular day, is worked out by applying the * general interest charge:

(a) for each day in the period in section 162 - 190; and

(b) in the way set out in subsection 8AAC(4) of the Taxation Administration Act 1953 ;

to your * GST instalment shortfall, under this section, for the * GST instalment quarter.

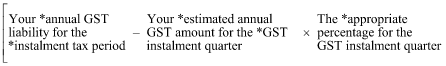

(3) Your GST instalment shortfall , under this section, for the * GST instalment quarter is the amount worked out as follows:

(4) However, if:

(a) the * GST instalment quarter is not the first GST instalment quarter of the * instalment tax period in question; and

(b) you are liable for one or more penalties under this section in relation to any of the earlier GST instalment quarters of the instalment tax period;

then:

(c) your GST instalment shortfall , under this section, for the * GST instalment quarter is the difference between:

(i) the amount worked out using the formula in subsection (3); and

(ii) the sum of all your GST instalment shortfalls for those earlier GST instalment quarters; and

(d) if that sum is greater than the amount worked out using the formula in subsection (3)--you are not liable to pay a penalty under this section in relation to the GST instalment quarter.

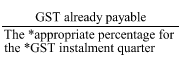

(5) For the purpose of working out your * GST instalment shortfall under this section, your * estimated annual GST amount relating to the * GST instalment quarter is taken to be the amount worked out as follows, if the amount is less than that estimated annual GST amount:

where:

"GST already payable" is the sum of:

(a) the * varied instalment amount in question; and

(b) all your other * GST instalments (if any) for earlier * GST instalment quarters of the * instalment tax period in question; and

(c) if the instalment tax period is only part of a * financial year--your * early net amounts for the financial year (subtracting any of those amounts that are less than zero).