Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If:

(a) a * reduced credit acquisition is a * creditable acquisition; and

(b) it is not wholly for a * creditable purpose because of this Division;

it is * partly creditable.

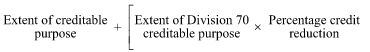

(2) The extent to which the acquisition is acquired or applied for a * creditable purpose is worked out using the following formula:

where:

"extent of creditable purpose" is the extent to which the purpose for which you applied or acquired the acquisition was a * creditable purpose otherwise than because of this Division, expressed as a percentage.

"extent of Division 70 creditable purpose" is the extent to which the purpose for which you applied or acquired the acquisition was a * creditable purpose because of this Division, expressed as a percentage.

"percentage credit reduction" is the reduced input tax credit percentage prescribed for the purposes of subsection 70 - 5(2) for an acquisition of that kind.

Note: This section affects sections 11 - 30 and 129 - 40. It is used even if the reduced credit acquisition is used wholly in carrying on your enterprise (unless the acquisition was wholly for a creditable purpose because of this Division, then section 70 - 15 applies).

Example 1: You make a reduced credit acquisition of $110,000, wholly for the purposes of carrying on your enterprise, partly for the purpose of making financial supplies (40%) and partly for the purpose of making taxable supplies (60%). Assume the percentage credit reduction to be 50%. The extent to which you make the acquisition for a creditable purpose is:

![]()

Applying section 11 - 30, your input tax credit is $8,000 (assuming you were liable for all the consideration).

Example 2: You subsequently apply the acquisition partly in making financial supplies (40%), partly in making taxable supplies (40%) and partly for private use (20%). The extent to which you made the acquisition for a creditable purpose is:

![]()

Applying Division 129, your input tax credit is reduced to $6,000, giving you an increasing adjustment of $2,000.

(3) The Commissioner may determine, in writing, one or more ways in which to work out, for the purpose of subsection (2), the extent to which an acquisition is for a * creditable purpose.