Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsNo input tax credit for the premium

(1) If there was no entitlement to an input tax credit for the premium paid in relation to the period during which the event giving rise to the claim happened, the amount of the decreasing adjustment is 1 / 11 of the * settlement amount.

Partial input tax credit for the premium

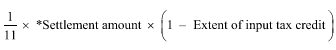

(2) If there was an entitlement to such an input tax credit, the amount of the decreasing adjustment is as follows:

where:

"extent of input tax credit" is the amount of the input tax credit expressed as a fraction of the GST payable for the supply of the * insurance policy for the period to which the premium relates.

Note: There is no decreasing adjustment if there is a full input tax credit for the premium paid: see paragraph 78 - 10(2)(b).

Non - creditable insurance events

(3) The amount of the decreasing adjustment under subsection (1) or (2) is reduced to the extent (if any) that the settlement relates to one or more * non - creditable insurance events.

(4) The settlement amount is worked out using this method statement.

Method statement

Step 1. Add together:

(a) the sum of the payments of * money, or * digital currency, (if any) made in settlement of the claim; and

(b) the * GST inclusive market value of the supplies (if any) made by the insurer in settlement of the claim (other than supplies that would have been * taxable supplies but for section 78 - 25).

Step 2. If any payments of excess were made to the insurer under the * insurance policy in question, subtract from the step 1 amount the sum of all those payments (except to the extent that they are payments of excess to which section 78 - 18 applies).

Step 3. Multiply the step 1 amount, or (if step 2 applies) the step 2 amount, by the following:

![]()

where:

extent of input tax credit has the meaning given by subsection (2).