Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If a supply (the actual supply ) is:

(a) partly a * taxable supply; and

(b) partly a supply that is * GST - free or * input taxed;

the value of the part of the actual supply that is a taxable supply is the proportion of the value of the actual supply that the taxable supply represents.

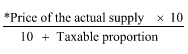

(2) The value of the actual supply, for the purposes of subsection (1), is as follows:

where:

"taxable proportion" is the proportion of the value of the actual supply that represents the value of the * taxable supply (expressed as a number between 0 and 1).