Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

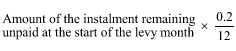

Commonwealth Consolidated Acts(1) If any instalment of levy payable by a person remains unpaid at the start of the levy month after the instalment became due for payment, the person is liable to pay the Commonwealth, for that levy month, a penalty worked out using the following formula:

(2) Late payment penalty for a levy month is due and payable at the end of the levy month.

(3) However, the AUSTRAC CEO may, by written notice given to the person before, on or after the day on which late payment penalty would be due and payable apart from this subsection, specify a later day as the day on which the late payment penalty is due and payable. The notice has effect, and is taken always to have had effect, according to its terms.