Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsProposing to vary a debt agreement

(1) A debtor or creditor who is a party to a debt agreement may give the Official Receiver a written proposal to vary the agreement.

(1A) The proposal must be in the approved form.

(1B) The proposal must be accompanied by an explanatory statement in the approved form containing such information as the form requires.

(1C) The subsection (1B) statement may be set out in the same document as the proposal.

(1D) The proposal must not seek to vary the agreement so that the agreement would provide for the debtor to make payments under the agreement, in respect of provable debts in relation to the agreement, after:

(a) 3 years beginning on the day the agreement was made; or

(b) if subsection (1DA) or (1DB) applies--5 years beginning on the day the agreement was made.

Note: Section 185H deals with when a debt agreement is made.

(1DA) This subsection applies if subsection 185C(2AB) applied to the debtor at the time the relevant debt agreement proposal was given to the Official Receiver.

(1DB) This subsection applies if:

(a) the proposal given to the Official Receiver is accompanied by a certificate signed by the administrator of the agreement stating that the administrator has reasonable grounds to believe:

(i) that the debtor has suffered a substantial change in circumstances after the agreement was made that was not foreseen at the time the agreement was made; and

(ii) that the debtor is not likely to be able to discharge the obligations created by the agreement as and when they fall due because of that change; and

(b) the proposal does not increase the total of the payments that the debtor would be required to make under the agreement.

(1E) If:

(a) subsection 185C(2AB) did not apply to the debtor at the time (the proposal time ) the relevant debt agreement proposal was given to the Official Receiver; and

(b) a person did not give a certificate under paragraph 185C(4C)(b) in relation to the relevant debt agreement proposal;

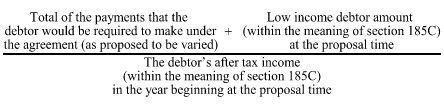

the proposal under subsection (1) of this section must not seek to vary the agreement so that the amount worked out using the following formula (expressed as a percentage) exceeds the percentage in effect under an instrument under subsection 185C(4B) at the proposal time:

(1F) The proposal given to the Official Receiver must be accompanied by a certificate signed by the administrator of the agreement stating that, having regard to:

(a) the circumstances in existence at the time the administrator signs the certificate; and

(b) any other relevant matters;

the administrator has reasonable grounds to believe that the debtor is likely to be able to discharge the obligations created by the agreement (as proposed to be varied) as and when they fall due.

Processing a proposal to vary a debt agreement

(2) The Official Receiver must process the proposal in accordance with section 185MA if the Official Receiver is satisfied that subsections (1A), (1B), (1D), (1E) and (1F) of this section have been complied with.

(2A) However, the Official Receiver is not required by subsection (2) to process the proposal if:

(a) the Official Receiver reasonably believes that complying with the agreement (as proposed to be varied) would cause undue hardship to the debtor; or

(b) the Official Receiver thinks that the creditors' interests would be better served by not processing the proposal.

(2B) If the Official Receiver decides not to process the proposal because of subsection (2A), the Official Receiver must give written notice of the decision, and the reasons for it, to:

(a) the debtor; and

(b) affected creditors who are known to the Official Receiver.

(2C) If the Official Receiver decides not to process the proposal because of subsection (2A), the debtor or an affected creditor may apply to the Administrative Review Tribunal for review of the decision.

Varying the agreement

(3) If the proposal is accepted, the agreement is varied in the way set out in the proposal.

Note: Section 185MC explains how a proposal is accepted.