Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsAustralian Communications and Media Authority Act 2005

1 At the end of paragraph 9(h)

Add:

or (vi) Part 14AA of the Broadcasting Services Act 1992 ;

2 Subparagraph 1 0(1)(o)(ii)

After " other than " , insert " Part 14AA or " .

Broadcasting Services Act 1992

3 Subs ection 6 (1)

Insert:

"interim tax" means tax imposed by the Commercial Broadcasting ( Tax ) Act 2017 .

"transmitter licence" has the same meaning as in the Radiocommunications Act 1992 .

4 Subsection 204(1) (after table item dealing with subsection 146D(4))

Insert:

Refusal to remit the whole or part of a late payment penalty | Subsection 205AF(3) | The person liable to pay the penalty |

5 After Part 14

Insert:

Part 14AA -- Collection and recovery of interim tax

205AA Simplified outline of this Part

• The ACMA must make assessments of interim tax.

• Interim tax is due and payable 28 days after the assessment is given to the person to whom the assessment relates.

• There is a p e nalty for late payment of interim tax.

• Schemes to avoid interim tax are prohibited.

(1) If interim tax is payable by a person in relation to the issue of a transmitter licence, the ACMA must:

(a) make a written assessment setting out the interim tax payable by the person; and

(b) do so on, or as soon as practicable after, the later of the following days:

(i) the day the licence was issued;

(ii) 1 December 2017 .

(2) If interim tax is payable by a person in relation to an anniversary of the day a tran smitter licence came into force , the ACMA must:

(a) make a written assessment setting out the interim tax payable by the person; and

(b) do so on, or as soon as practicable after, the later of the following days:

(i) the anniversary;

(ii) 1 December 2017.

(3) If interim tax is paya ble by a person in relation to a transmitter licence ceasing to be in force , the ACMA must:

(a) make a written assessment setting out the interim tax payable by the person; and

(b) do so on, or as soon as practicable af ter, the later of the following days:

(i) the day the licence ceased to be in force ;

(ii) 1 December 2017.

(4) If interim tax is payable by a person in relation to the holding of a transmitter licence at the start of 1 July 2017, the ACMA must:

(a) make a written assessment setting out the interim tax payable by the person; and

(b) do so on, or as soon as practicable after, 1 December 2017.

Notification of assessment

(5) As soon as practicable after making an assessment under this section, the ACMA must give a copy of the assessment to t he person to whom the assessment relates .

Variation of assessments

(6) The ACMA may vary an assessment made under this sect ion by making such alterations and additions as it thinks necessary, even if interim tax has been paid in respect of an assessment.

(7) Unless the contrary intention appears, a varied assessment is taken, for the purposes of this Part , to be an assessment under this section .

205AC When interim tax becomes due and payable

Interim t ax becomes due and payable on:

(a) the 28th day after a copy of the assessment of the interim tax was given to the person to whom the assessment relates; or

(b) if that assessment is varied--the 28th day after a copy of the varied assessment was given to the person to whom the varied assessment relates .

Interim tax:

(a) is a debt due to the ACMA on behalf of the Commonwealth; and

(b) may be recovered by the ACMA, on behalf of the Commonwealth, in:

(i) the Federal Court; or

(ii) the Federal Circuit Court; or

(iii) a court of a State or Territory that has jurisdiction in relation to the matter.

205AE Refund of overpayment of interim tax

If there is an overpayment of interim tax, the overpayment is to be refunded by the ACMA on behalf of the Commonwealth.

(1) If an amount of interim tax that is payable by a person remains unpaid after the day on which it becomes due and payable, the person is liable to pay a penalty ( late payment penalty ) on the unpaid amount for each day until all of the interim tax has been paid.

(2) The late payment penalty rate is 20% per year, or such lower rate as the ACMA determines in writing for the purposes of this subsection.

(3) The ACMA may remit the whole or part of a late payment penalty that a person is liable to pay under subsection ( 1 ).

(4) The late payment penalty for a day is due and payable at the end of that day.

(5) Late payment penalty:

(a) is a debt due to the ACMA on behalf of the Commonwealth; and

(b) may be recovered by the ACMA, on behalf of the Commonwealth, in:

(i) the Federal Court; or

(ii) the Federal Circuit Court; or

(iii) a court of a State or Territory that has jurisdiction in relation to the matter.

(6) If the amount of the late payment penalty for a day is not an amount of whole dollars, the late payment penalty is rounded to the nearest dollar (rounding 50 cents upwards).

(7) If there is an overpayment of late payment penalty, the overpayment is to be refunded by the ACMA on behalf of the Commonwealth.

(8 ) A determination under subsection ( 2) is a legislative instrument.

(1) The holder of a transmitter licence must not, either alone or together with one or more other persons, do any of the following:

(a) enter into a scheme;

(b) begin to carry out a scheme;

(c) carry out a scheme;

if it would be concluded that the holder of the transmitter licence did so for the sole or dominant purpose of avoiding the application of any provision of the Commercial Broadcasting ( Tax ) Act 2017 (other than section 14 of that Act) in relation to:

( d ) the holder of the transmitter licence; or

(e ) the holder of any other transmitter licence.

Civil penalty provision

(2 ) Subsection ( 1) is a civil penalty provision .

Note: Part 14B deals with civil penalties.

Validity of transactions

(3) A contravention of subsection ( 1) does not affect the validity of any transaction.

Scheme

(4) For the purposes of this section, scheme means:

(a) any agreement, arrangement, understanding, promise or undertaking, whether express or implied; or

(b) any scheme, plan, proposal, action, course of action or course of conduct, whether unilateral or otherwise.

6 Subsection 205F(4)

After " other than subsection " , insert " 205AG(1) or " .

7 Subsection 205F(5)

After " another civil penalty provision " , insert " (other than subsection 205AG(1) ) " .

8 After subsection 205F(5)

Insert:

(5A ) The pecuniary penalty payable by a person in respect of a contravention of subsection 205AG(1) must not exceed the sum of:

(a) whichever of the following is applicable:

(i) if the person is a body corporate-- 2 ,000 penalty units;

(ii) if the person is not a body corporate-- 40 0 penalty units; and

(b) if the Federal Court is satisfied that, as a result of the scheme to which the contravention relates, the person or another person has avoided becoming liable to pay an amount of interim tax --200% of the amount of interim tax avoided.

(5 B ) The pecuniary penalty payable by a person in respect of a contravention of subsection 205E(1) that relates to subsection 205AG(1) must not exceed the sum of:

(a) whichever of the following is applicable:

(i) if the person is a body corporate-- 2,000 penalty units;

(ii) if the person is not a body corporate --4 00 penalty units; and

(b) if the Federal Court is satisfied that, as a result of the scheme to which the contravention of subsection 205AG(1) relates, the person or another person has avoided becoming liable to pay an amount of interim tax--200% of the amount of interim tax avoided.

9 Section 5

Insert:

"interim tax" means tax imposed by the Commercial Broadcasting ( Tax ) Act 2017 .

10 After subsection 100(3B)

Insert:

(3BA) The ACMA must not issue a transmitter licence authorising operation of a r adiocommunications transmitter for transmitting or re - transmitting a com mercial broadcasting service if:

(a) the ACMA has reasonable grounds to believe that the application for the licence is part of a scheme:

(i ) entered into; or

(ii ) being carried out; or

(iii) that has been carried out;

for the sole or dominant purpose of avoiding the application of any provision of the Commercial Broadcasting ( Tax ) Act 2017 (other than section 14 of that Act); and

(b) the applicant has not satisfied the ACMA that the application for the licence is not part of such a scheme.

( 3BB) For the purposes of subsection ( 3BA), scheme means:

(a) any agreement, arrangement, understanding, promise or undertaking, whether express or implied; or

(b) any scheme, plan, proposal, action, course of action or course of conduct, whether unilateral or otherwise.

11 After subsection 100(5)

Insert:

(5A) In deciding whether to issue a transmitter licence authorising operation of a radiocommunications transmitter :

(a) within a part of the spectrum designated under subsection 31(1) or (1A); and

(b) at a particular location (the relevant location ) ;

for transmitting or re - transmitting a commercial broadcasting service, the ACMA must also have regard to:

(c) whether:

(i) the commercial t elevision broadcasting licensee; or

(ii) the commerc ial radio broadcasting licensee;

who provides the commercial broadcasting service has previously held a transmitter licence authorising operation of a radiocommunications transmitter for transmitting or re - transmitting the commercial broadcasting service at a location that is the same as , or substantially similar to, the relevant location ; and

(d) whether there is a commercial arrangement between:

(i) the applicant for the transmitter licence; and

(ii) the commercial television broadcasting licensee or the commercial radio broadcasting licensee who provides the commercial broadcasting service;

in relation to:

(iii) the application; or

(iv) the transmission of the commercial b roadcasting service at a location that is the same as , or substantially similar to, the relevant location .

12 At the end of paragraph 107(1)(c)

Add:

and (iii) amounts of interim tax ;

13 At the end of paragraph 109(1)(b)

Add:

and (iii) amounts of interim tax;

Radiocommunications Taxes Collection Act 1983

14 After section 4

Insert:

4A Transmitter licence associated with a commercial broadcasting licence

For the purposes of this Act, the question whether a transmitter licence is associated with a commercial broadcasting licence is to be determined in the same manner as that question is determined for the purposes of the Commercial Broadcasting ( Tax ) Act 2017 .

15 A fter sub section 7A (1A)

Insert :

( 1B ) If there is an overpayment of penalty, the overpayment is to be refunded by the ACMA on behalf of the Commonwealth.

16 After section 10A

Insert:

If there is an overpayment of tax, the overpayment is to be refunded by the ACMA on behalf of the Commonwealth.

10C Pro - rata refund of tax imposed on the issue of a transmitter licence

(1) If:

(a) a transmitter licence was issued to a person under section 100 or 102 of the Radiocommunications Act 1992 before 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence; and

(c) the transmitter licence was in force at the start of 1 July 2017; and

(d) tax was imposed by subsection 6(1), (2) or (7) of the Radiocommunications (Transmitter Licence Tax) Act 1983 on the issue of the transmitter licence; and

(e) the person has paid the tax;

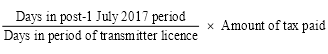

the amount worked out using the following formula must be refunded by the ACMA on behalf of the Commonwealth:

where:

"days in period of transmitter licence" means the number of days in the period of the transmitter licence.

"days in post-1 July 2017 period" means the number of days in the period:

(a) beginning at the start of 1 July 2017; and

(b) ending at the end of the period of the transmitter licence.

(2) If:

(a) a transmitter licence was issued to a person under section 100 or 102 of the Radiocommunications Act 1992 before 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence; and

(c) the transmitter licence was in force at the start of 1 July 2017; and

(d) tax was imposed by subsection 6(3) or (8) of the Radiocommunications (Transmitter Licence Tax) Act 1983 on the issue of the transmitter licence; and

(e) the person has paid the tax;

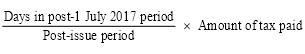

the amount worked out using the following formula must be refunded by the ACMA on behalf of the Commonwealth:

where:

"days in post-1 July 2017 period" means the number of days in the period:

(a) beginning at the start of 1 July 2017; and

(b) ending at the end of the anniversary of the day the transmitter licence came into force that occurs during the financial year ending on 30 June 2018.

"post-issue period" means the number of days in the period:

(a) beginning at the start of the day after the transmitter licence was issued; and

(b) ending at the end of the anniversary of the day the transmitter licence came into force that occurs during the financial year ending on 30 June 2018.

(3 ) For the purposes of this section, disregard:

(a) Division 6 of Part 3.3 of the Radiocommunications Act 1992 ; and

(b) Part 10 of the Broadcasting Services Act 1992 ;

in working out the period of a transmitter licence.

Note 1: See subsection 103(2) of the Radiocommunications Act 1992 , which deals with the duration of transmitter licences issued under section 100 of that Act.

Note 2: See subsection 103(4A) of the Radiocommunications Act 1992 , which deals with the duration of transmitter licences issued under section 102 of that Act.

( 1 ) If:

(a) a transmitter licence was issued to a person under section 100 or 102 of the Radiocommunications Act 1992 before 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence; and

(c) the transmitter licence was in force at the start of 1 July 2017; and

(d) t ax was imposed by subsection 6(3 ) or ( 8 ) of the Radiocommunications (Transmitter Licence Tax) Act 1983 on the anniversary of the day the transmitter licence came into force that occurred during the financial year ending on 30 June 2017; and

(e) the person has paid the tax;

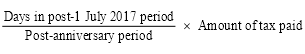

the amount worked out using the following formula must be refunded by the ACMA on behalf of the Commonwealth:

where:

"days in post-1 July 2017 period" means the number of days in the period:

(a) beginning at the start of 1 July 2017; and

(b) ending at whichever is the earlier of the following:

(i) the end of the anniversary of the day the transmitter licence came into force that occurs during the financial year ending on 30 June 2018;

(ii) the end of the period of the transmitter licence.

"post-anniversary period" means the number of days in the period:

(a) beginning at the start of the anniversary mentioned in paragraph ( d); and

(b) ending at whichever is the earlier of the following:

(i) the end of the anniversary of the day the transmitter licence came into force that occurs during the financial year ending on 30 June 2018;

(ii) the end of the period of the transmitter licence.

(2) If:

(a) a transmitter licence was issued to a person under section 100 or 102 of the Radiocommunications Act 1992 before 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence; and

(c) the transmitter licence was in force at the start of 1 July 2017; and

(d) tax was imposed by subsection 6(5) or (11) of the Radiocommunications (Transmitter Licence Tax) Act 1983 on the holding of the transmitter licence on an anniversary of the day the transmitter licence came into force that occurred before 1 July 2017; and

(e) the person has paid the tax;

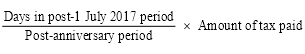

the amount worked out using the following formula must be refunded by the ACMA on behalf of the Commonwealth:

where:

"days in post-1 July 2017 period" means the number of days in the period:

(a) beginning at the start of 1 July 2017; and

(b) ending at the end of the period of the transmitter licence.

"post-anniversary period" means the number of days in the period:

(a) beginning at the start of the anniversary mentioned in paragraph ( d); and

(b) ending at the end of the period of the transmitter licence.

(3) For the purposes of this section, disregard:

(a) Division 6 of Part 3.3 of the Radiocommunications Act 1992 ; and

(b) Part 10 of the Broadcasting Services Act 1992 ;

in working out the period of a transmitter licence.

Note 1: See subsection 103(2) of the Radiocommunications Act 1992 , which deals with the duration of transmitter licences issued under section 100 of that Act.

Note 2: See subsection 103(4A) of the Radiocommunications Act 1992 , which deals with the duration of transmitter licences issued under section 102 of that Act.

If:

(a) an amount of interim tax is payable by a person (the first amount ); and

(b) an amount is payable by the Commonwealth to the person under section 10B, 10C or 10D (the second amount );

the ACMA may, on behalf of the Commonwealth, set off the whole or a part of the first amount against the whole or a part of the second amount.

Part 2 -- Termination of the liability of commercial broadcasters to pay transmitter licence tax

Radiocommunications (Transmitter Licence Tax) Act 1983

17 After section 4

Insert:

4A Transmitter licence associated with a commercial broadcasting licence

For the purposes of this Act, the question whether a transmitter licence is associated with a commercial broadcasting licence is to be determined in the same manner as that question is determined for the purposes of the Commercial Broadcasting ( Tax ) Act 2017 .

18 At the end of s ubsection 6(1)

Add " This subsection has effect s ubject to subsection ( 1A) . " .

19 After subsection 6(1)

Insert:

(1A) Subsection ( 1) does not impose a tax on the issue of a transmitter licence if:

(a) the transmitter licence is issued on or after 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence.

20 Subsection 6(2)

Omit " If " , substitute " Subject to subsection ( 2A), if " .

21 After subsection 6(2)

Insert:

(2A) Subsection ( 2) does not impose a tax on the issue of a transmitter licence if:

(a) the transmitter licence is issued on or after 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence.

22 Subsection 6(3)

After " subsections " insert " (3A), (3B), " .

23 After subsection 6(3)

Insert:

(3A) Subsection ( 3) does not impose a tax on the issue of a transmitter licence if:

(a) the transmitter licence is issued on or after 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence.

(3B) Subsection ( 3) does not impose a tax on a particular anniversary of the day a transmitter licence came into force if:

(a) the anniversary occurs on or after 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence.

24 After subsection 6(4)

Insert:

(4A) Subsection ( 4) does not apply in relation to the issue of a transmitter licence if:

(a) the transmitter licence is issued on or after 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence.

25 Subsection 6(5)

Omit "If", substitute "Subject to subsection ( 5A), if".

26 After subsection 6(5)

Insert:

(5A) Subsection ( 5) does not impose a tax on the holding of a transmitter licence on a particular anniversary of the day the transmitter licence came into force if:

(a) the anniversary occurs on or after 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence.

27 Subsection 6(6)

Omit "If", subs titute "Subject to subsection ( 6 A), if".

28 After subsection 6(6)

Insert:

(6A) Subsection ( 6) does not apply to a particular anniversary of the day a transmitter licence came into force if:

(a) the anniversary occurs on or after 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence.

29 Subsection 6(7)

Omit "If", substitute "Subject to subsection ( 7A), if".

30 After subsection 6(7)

Insert:

(7A) Subsection ( 7) does not impose a tax on the issue of a transmitter licence if:

(a) the transmitter licence is issued on or after 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence.

31 Subsection 6(8)

After " subsections " insert " (8A), (8B), " .

32 After subsection 6(8)

Insert:

(8A) Subsection ( 8) does not impose a tax on the issue of a transmitter licence if:

(a) the transmitter licence is issued on or after 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence.

(8B) Subsection ( 8) does not impose a tax on a particular anniversary of the day a transmitter licence came into force if:

(a) the anniversary occurs on or after 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence.

33 After subsection 6(10)

Insert:

(10A) Subsections ( 9) and (10) do not apply in relation to the issue of a transmitter licence if:

(a) the transmitter licence is issued on or after 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence.

34 Subsection 6(11)

Omit "If", subs titute "Subject to subsection ( 11 A), if".

35 After subsection 6(11)

Insert:

(11A) Subsection ( 11) does not impose a tax on the holding of a transmitter licence on a particular anniversary of the day the transmitter licence came into force if:

(a) the anniversary occurs on or after 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence.

36 Subsection 6(12)

Omit "If", substitute "Subject to subsection ( 13), if".

37 At the end of section 6

Add:

(13) Subsection ( 12) does not apply to a particular anniversary of the day a transmitter licence came into force if:

(a) the anniversary occurs on or after 1 July 2017; and

(b) the transmitter licence is associated with a commercial broadcasting licence.

Part 3 -- Transitional support payments

38 Definitions

In this Part :

broadcasting service has the same meaning as in the Broadcasting Services Act 1992 .

commercial radio broadcasting licence has the same meaning as in the Broadcasting Services Act 1992 .

commercial television broadcasting licence has the same meaning as in the Broadcasting Services Act 1992 .

designated day :

(a) for the financial year beginning on 1 July 2017--means 1 November 2017; or

(b) for a later financial year--means 1 July in the financial year.

eligible financial year means:

(a) the financial year beginning on 1 July 2017; or

(b) the financial year beginning on 1 July 2018; or

(c) the financial year beginning on 1 July 2019; or

(d) the financial year beginning on 1 July 2020; or

(e) the financial year beginning on 1 July 2021.

Secretary means the Secretary of the Department.

39 Transitional support payments

(1) If:

(a) a company is specified in the table set out in item 4 0 ; and

(b) at the start of the designated day for an eligible financial year, the company held:

(i) a commercial television broadcasting licence; or

(ii) a commercial radio broadcasting licence; and

(c) the Secretary is satisfied that it is likely that company will hold:

(i) a commercial television broadcasting licence; or

(ii) a commercial radio broadcasting licence;

throughout the period:

(iii) beginning at the start of the designated day; and

(iv) ending at the end of the financial year; and

(d) the company has not given the Secretary a notice under subitem ( 2);

the Secretary must:

(e ) determine, in writing, that the amount specified in the table opposite the name of the company is payable by the Commonwealth to the company by way of financial assistance in respect of the financial year; and

(f ) do so on, or as soon as practicable after, the designated day for the financial year.

(2) A company may, before 1 November 2017, give the Secretary a written notice stating that the company does not want to receive any payments under this item.

(3 ) A determination made under subitem ( 1) is not a legislative instrument.

40 Table

This is the table mentioned in item 3 9 .

Companies and amounts | ||

Item | Company | Amount ($) |

1 | Australian Capital Television Pty Ltd | 1,398,000 |

2 | Prime Television (Southern) Pty Limited | 945,000 |

3 | Network Investments Pty Ltd | 819,000 |

4 | WIN Television NSW Pty Limited | 1,331,000 |

5 | Star Broadcasting Network Pty Ltd | 3,000 |

6 | South Coast & Tablelands Broadcasting Pty Ltd | 22,000 |

7 | Blue Mountains Broadcasters Pty Limited | 2,000 |

8 | Tweed Radio & Broadcasting Co Pty Ltd | 2,000 |

9 | WIN Radio Pty Limited | 22,000 |

10 | Wollongong Broadcasters Pty Ltd | 22,000 |

11 | WIN Television Griffith Pty Ltd | 16,000 |

12 | WIN Television SA Pty Ltd | 66,000 |

13 | Rebel FM Stereo Pty Ltd | 9,000 |

14 | Midwest Radio Network Pty Ltd | 4,000 |

15 | Darwin Digital Television Pty Ltd | 6,000 |

16 | West Digital Television No.2 Pty Limited | 19,000 |

17 | West Digital Television Pty Ltd | 47,000 |

18 | Spencer Gulf Telecasters Pty Limited | 16,000 |

19 | Mildura Digital Television Pty Ltd | 15,000 |

41 Conditions of payments

(1) A payment to a company under item 3 9 in respect of a financial year is subject to the condition that, if the company ceases to be the holder of:

(a) a commercial television broadcasting licence; or

(b) a commercial radio broadcasting licence;

at a time (the cessation time ) during the period:

(c) beginning at the start of the designated day for the financial year; and

(d) ending at the end of the financial year;

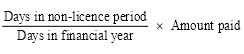

the company will re pay to the Commonwealth the amount worked out using the formula:

where:

a mount paid means the amount of the payment to the company.

d ays in financial year means the number of days in the financial year.

d ays in non - licence period means the number of days in the period:

(a) beginning at the start of the day after the cessation time; and

(b) ending at the end of the financial year.

(2) A payment to a company under item 3 9 in respect of a financial year is subject to the condition that the company will:

(a) spend the amount of the payment (reduced by any amount payable by the company under subitem ( 1) of this item in relation to the financial year) in connection with the provision by the company of broadcasting services authorised by the commercial television broadcasting licence, or the commercial radio broadcasting licence, held by company; and

(b) do so before the end of the financial year.

(3) A payment to a company under item 3 9 in respect of a financial year is subject to the condition that the company will:

(a) give the Secretary a written statement declaring that the company has complied with the condition set out in subitem ( 2) of this item in relation to the financial year; and

(b) do so within 28 day s after the end of the financial year.

(4) A payment to a company under item 3 9 is subject to the condition that, if the company does not fulfil a condition to which the payment is subject under subitem ( 2) or (3) of this item, the company will, if the Secretary so determines, re pay to the Commonwealth the amount specified in the determination.

(5) The amount specified in the determination under subitem ( 4) must not be more than the amount of the payment (reduced by any amount payable by the company under subitem ( 1) in relation to the financial year) .

(6) A determination made under subitem ( 4) is not a legislative instrument.

(7) An amount payable by a company to the Commonwealth under this item :

(a) is a debt due to the Commonwealth; and

(b) may be recovered by the Secretary, on behalf of the Commonwealth, in:

(i) the Federal Court of Australia; or

(ii) the Federal Circuit and Family Court of Australia (Division 2); or

(iii) a court of a State or Territory that has jurisdiction in relation to the matter.

42 Delegation by the Secretary

(1) The Secretary may, by writing, delegate any or all of his or her powers under this Part to an SES employee, or acting SES employee, in the Department.

Note: The expressions SES employee and acting SES employee are defined in section 2B of the Acts Interpretation Act 1901 .

(2) In exercising powers under a delegation under subitem ( 1), the delegate must comply with any directions of the Secretary.

43 Modified operation of Part

This Part has effect in relation to Network Investments Pty Ltd (see table item 3 of the table in item 4 0) as if:

(a) the designated day for the financial year beginning on 1 July 2017 were the day that is 28 days after the day on which this item commences; and

(b) paragraph 39(1)(c) did not apply; and

(c) the reference to 1 November 2017 in sub item 3 9(2) were a reference to the day that is 28 days after the day on which this item commences.