Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This is how to work out the annual rate of child support payable for a child for a day in a child support period if one or more non - parent carers have a percentage of care for the child for the day.

(2) Follow steps 1 to 6 of the method statement in section 35 for each parent (disregarding subsection 55D(2) (negative child support percentages)).

(2A) Work out the costs of the child for the day under section 55HA.

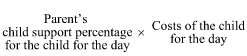

(2B) If a parent has a positive child support percentage under step 6 of the method statement in section 35, work out the following rate:

(3) Work out each parent's multi - case cap (if any) for the child for the day (see section 55E).

Annual rate payable by parent

(4) If a parent's (the first parent's ) child support percentage under step 6 of the method statement in section 35 is positive, then the annual rate of child support payable by the first parent for the child for the day is the lower of:

(a) the rate worked out under subsection (2B); and

(b) the first parent's multi - case cap (if any) for the child for the day.

Annual rate payable only to non - parent carers

(5) If:

(a) the second parent's child support percentage is also positive; or

(b) the second parent's child support percentage is nil or negative, and the second parent does not have at least shared care of the child during the relevant care period;

then, subject to section 40B, the first parent must pay the annual rate of child support that is payable by the first parent for the child under subsection (4) to the non - parent carer or carers in accordance with section 40A.

Note 1: If both parents have a positive child support percentage, then the non - parent carer or carers are entitled to be paid the total of the 2 annual rates of child support that are payable by the parents for the child.

Note 2: Under section 40B, a non - parent carer of a child is not entitled to be paid child support unless he or she applies under section 25A in relation to the child.

Annual rate payable to parent and non - parent carer

(6) If:

(a) the second parent's child support percentage is negative; and

(b) the second parent has at least shared care of the child during the relevant care period;

then, subject to section 40B, the first parent must pay the annual rate of child support that is payable by the first parent for the child under subsection (4) to the second parent and the non - parent carer in accordance with section 40A.