Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Amendment of Dairy Produce Act 1986

1 Title

Omit " the Australian Dairy Corporation, ".

2 Subsection 3(1) (definition of acting Managing Director )

Repeal the definition.

3 Subsection 3(1) (definition of annual operational plan )

Repeal the definition.

4 Subsection 3(1) (definition of annual report )

Repeal the definition.

5 Subsection 3(1) (definition of appointed member )

Repeal the definition.

6 Subsection 3(1) (definition of Chairperson )

Repeal the definition.

7 Subsection 3(1)

Insert:

"conversion time" means the time when Schedule 1 to the Dairy Industry Service Reform Act 2003 commences.

8 Subsection 3(1) (definition of corporate plan )

Repeal the definition.

9 Subsection 3(1) (definition of Corporation )

Repeal the definition.

10 Subsection 3(1) (definition of Corporation levy )

After "Schedule 6 to the Primary Industries (Excise) Levies Act 1999 ", insert "(as in force before the conversion time)".

11 Subsection 3(1) ( paragraph ( c) of the definition of dairy produce )

Omit "Corporation", substitute "Minister".

12 Subsection 3(1)

Insert:

"dairy service levy" means dairy service levy imposed by Schedule 6 to the Primary Industries (Excise) Levies Act 1999 .

13 Subsection 3(1)

Insert:

"dairy service payments" means payments referred to in paragraph 5(1)(a).

14 Subsection 3(1) (definition of Deputy Chairperson )

Repeal the definition.

15 Subsection 3(1) (definition of Domestic Fund )

Repeal the definition.

16 Subsection 3(1)

Insert:

"eligible body" means a body that is registered under the Corporations Act 2001 as a company limited by guarantee.

17 Subsection 3(1) (definition of equal employment opportunity program )

Repeal the definition.

18 Subsection 3(1) (definition of executive )

Repeal the definition.

19 Subsection 3(1)

Insert:

"funding contract" means a contract under section 5.

20 Subsection 3(1) (definition of futures contract )

Repeal the definition.

21 Subsection 3(1) (definition of futures market )

Repeal the definition.

22 Subsection 3(1) (definition of Industry Fund )

Repeal the definition.

23 Subsection 3(1)

Insert:

"industry services body" means the body declared as the industry services body under section 7.

24 Subsection 3(1) (definition of Managing Director )

Repeal the definition.

25 Subsection 3(1) (definition of Market Support Fund )

Repeal the definition.

26 Subsection 3(1) (definition of market support payment )

Repeal the definition.

27 Subsection 3(1)

Insert:

"matching payments" means payments referred to in paragraph 5(1)(b).

28 Subsection 3(1) (definition of member )

Repeal the definition.

29 Subsection 3(1) (definition of money of the Corporation )

Repeal the definition.

30 Subsection 3(1)

Insert:

"new dairy levy amounts" means:

(a) amounts of dairy service levy received by the Commonwealth after the conversion time; and

(b) amounts received by the Commonwealth after the conversion time under section 7 of the Levies and Charges Collection Act in relation to dairy service levy; and

(c) amounts payable by way of penalty under section 15 of the Levies and Charges Collection Act in relation to dairy service levy that are received by the Commonwealth after the conversion time.

31 Subsection 3(1) (definition of old corporation levy )

Repeal the definition.

32 Subsection 3(1)

Insert:

"old dairy levy amounts" means:

(a) amounts of Corporation levy, promotion levy or research levy received by the Commonwealth after the conversion time; and

(b) amounts received by the Commonwealth after the conversion time under section 7 of the Levies and Charges Collection Act in relation to Corporation levy, promotion levy or research levy; and

(c) amounts of Corporation levy received by the Commonwealth before the conversion time, but in respect of which a corresponding payment had not been made out of the Consolidated Revenue Fund under section 71 of this Act before the conversion time; and

(d) amounts received by the Commonwealth before the conversion time under section 7 of the Levies and Charges Collection Act in relation to Corporation levy, but in respect of which a corresponding payment had not been made out of the Consolidated Revenue Fund under section 71 of this Act before the conversion time; and

(e) amounts of promotion levy received by the Commonwealth before the conversion time, but in respect of which a corresponding payment had not been made out of the Consolidated Revenue Fund under section 90 of this Act before the conversion time; and

(f) amounts received by the Commonwealth before the conversion time under section 7 of the Levies and Charges Collection Act in relation to promotion levy, but in respect of which a corresponding payment had not been made out of the Consolidated Revenue Fund under section 90 of this Act before the conversion time; and

(g) amounts of research levy received by the Commonwealth before the conversion time, but in respect of which a corresponding payment had not been made out of the Consolidated Revenue Fund under section 30 of the Primary Industries and Energy Research and Development Act 1989 before the conversion time; and

(h) amounts received by the Commonwealth before the conversion time under section 7 of the Levies and Charges Collection Act in relation to research levy, but in respect of which a corresponding payment had not been made out of the Consolidated Revenue Fund under section 30 of the Primary Industries and Energy Research and Development Act 1989 before the conversion time; and

(i) amounts payable to the Dairy Research and Development Corporation under paragraph 30(1)(b) of the Primary Industries and Energy Research and Development Act 1989 before the conversion time, but not paid out of the Consolidated Revenue Fund under that Act before the conversion time.

33 Subsection 3(1) (definition of old dairy products levy )

Repeal the definition.

34 Subsection 3(1) (definition of old market support levy )

Repeal the definition.

35 Subsection 3(1) (definition of old promotion levy )

Repeal the definition.

36 Subsection 3(1) (definition of old research levy )

Repeal the definition.

37 Subsection 3(1) (definition of Promotion Fund )

Repeal the definition.

38 Subsection 3(1) (definition of promotion levy )

After "Schedule 6 to the Primary Industries (Excise) Levies Act 1999 ", insert "(as in force before the conversion time)".

39 Subsection 3(1) (definition of R&D Corporation )

Repeal the definition.

40 Subsection 3(1) (definition of R&D Fund )

Repeal the definition.

41 Subsection 3(1) (definition of relevant fund )

Repeal the definition.

42 Subsection 3(1)

Insert:

"research levy" means research levy imposed by Schedule 6 to the Primary Industries (Excise) Levies Act 1999 (as in force before the conversion time), and includes amounts of penalty (if any) payable under the Levies and Charges Collection Act in relation to that levy.

43 Subsection 3(1) (definition of RIR&D Corporation )

Repeal the definition.

44 Subsection 3(1) (definition of Selection Committee )

Repeal the definition.

45 Subsection 3(1) (definition of WTO Agreement )

Repeal the definition.

46 Subsection 3(1) (definition of WTO Agreement day )

Repeal the definition.

47 Subsection 3(1) (definition of WTO Agreement year )

Repeal the definition.

48 Subsection 3(1A)

Repeal the subsection.

49 Subsection 3(1B)

Repeal the subsection.

50 Section 3 (note)

Repeal the note.

51 Parts II to IV

Repeal the Parts, substitute:

Part II -- Provision of services to the dairy industry

Division 1 -- Funding contract

(1) The Minister may, on behalf of the Commonwealth, enter into a contract with an eligible body that provides for the Commonwealth to make payments of the following kinds to the body:

(a) payments referred to as dairy service payments ;

(b) payments made in respect of particular financial years, referred to as matching payments .

Note: After a contract has been entered into, the eligible body can be declared as the industry services body under section 7.

(2) Before entering into the contract, the Minister must be satisfied that the terms of the contract make adequate provision to ensure that:

(a) dairy service payments are spent by the body on marketing, promotion, strategic policy development, research and development activities or other activities, for the benefit of the Australian dairy industry; and

(b) matching payments are spent by the body on research and development activities for the benefit of the Australian dairy industry and the Australian community generally.

(3) The contract does not have to oblige the Commonwealth to pay the full amounts that could be paid out of the money appropriated under section 6.

Note: For example, the contract may provide for payments less than the limits specified in section 6 to take account of the costs of collecting new dairy levy amounts or old dairy levy amounts and to take account of refunds and payments made in error.

(4) The contract may include provisions relating to assets and liabilities that are transferred to the body under the Dairy Industry Service Reform Act 2003 . This subsection does not impliedly limit the matters that may be included in the contract.

(5) This section does not impliedly limit the executive power of the Commonwealth to enter into agreements.

(6) The Minister must cause a copy of the contract to be tabled in each House of the Parliament within 14 sitting days of that House after the day on which the contract was entered into.

(7) If the contract is varied, the Minister must cause a copy of the contract as varied to be tabled in each House of the Parliament within 14 sitting days of that House after the variation occurred.

6 Appropriation for payments under funding contract

(1) The Consolidated Revenue Fund is appropriated for the purposes of payments by the Commonwealth under section 5.

Overall limit for dairy service payments

(2) For dairy service payments, the total limit on the appropriation is the sum of:

(a) the total amount of new dairy levy amounts; and

(b) the total amount of old dairy levy amounts.

Overall limit for matching payments

(3) For matching payments, the total limit on the appropriation is the sum of:

(a) the total amount of new dairy levy amounts; and

(b) the total amount of old dairy levy amounts.

Matching payments--annual limit

(4) For matching payments in respect of a particular financial year, the limit on the appropriation is the lesser of:

(a) 0.5% of the amount determined by the Minister to be the gross value of whole milk produced in Australia in that financial year; and

(b) 50% of the amount spent by the eligible body in that financial year on activities that qualify, under the funding contract, as research and development activities.

(5) For the purposes of subsection ( 4), the regulations may prescribe the manner in which the Minister is to determine the gross value of whole milk produced in Australia in a financial year.

Matching payments--unmatched R&D excess

(6) If there is an unmatched R&D excess for a financial year, the amount spent by the eligible body in the following financial year on activities that qualify, under the funding contract, as research and development activities is taken, for the purposes of this section (including for the purposes of this subsection and subsection ( 7)), to be increased by the amount of the unmatched R&D excess.

Note: This means that research and development expenditure that is not "50% matched" in one financial year because of the cap in paragraph ( 4)(a) can be carried forward into later years.

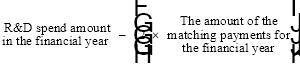

(7) For the purposes of subsection ( 6), there is an unmatched R&D excess for a financial year if:

(a) the eligible body spends a particular amount (the R&D spend amount ) in the financial year on activities that qualify, under the funding contract, as research and development activities; and

(b) because of the operation of paragraph ( 4)(a), the matching payments for the financial year are less than 50% of the R&D spend amount;

and the amount of the unmatched R&D excess is:

Division 2 -- Industry services body

7 Declaration of industry services body

(1) The Minister may, in writing, declare an eligible body to be the industry services body if:

(a) the Commonwealth and the eligible body have entered into a funding contract; and

(b) the Minister is satisfied that, if the body is so declared, it will comply with its obligations under the funding contract and this Act.

Note: Subsection 33(3) of the Acts Interpretation Act 1901 provides for the repeal, variation etc. of instruments.

Declaration takes effect immediately

(2) A declaration under this section takes effect immediately after it is made.

Tabling in Parliament

(3) The Minister must cause a copy of a declaration under this section to be tabled in each House of the Parliament within 15 sitting days of that House after the day on which the declaration is made.

8 Use of levy information provided to the industry services body

The industry services body may use information provided to it under subsection 27(3A) of the Levies and Charges Collection Act for any of the following purposes:

(a) to determine whether a person is or remains eligible to be a member of the industry services body;

(b) to maintain a register of members of the industry services body;

(c) to maintain a register of those persons eligible to vote in a poll mentioned in section 9;

(d) to make public any information of a statistical nature;

(e) in performing any of its functions under this Act or the funding contract.

Note: Subsection 27(3A) of the Levies and Charges Collection Act allows an authorised person under that Act to provide certain levy information to the industry services body.

Division 3 -- Recommendations about amount of dairy service levy

9 Recommendations about amount of dairy service levy

Recommendations

(1) The industry services body must make recommendations to the Minister in relation to the amount of the dairy service levy. The recommendations must be made by the times prescribed by the regulations.

Poll

(2) Before making each recommendation, the industry services body must conduct a poll in accordance with the regulations. The recommendation must be in accordance with the results of the poll.

Method of conducting poll

(3) Regulations for the conduct of a poll must include provisions allocating votes to each dairy service levy payer.

Division 4 -- Other provisions

(1) The Minister may, by writing, delegate all or any of his or her powers and functions under this Part to:

(a) the Secretary of the Department; or

(b) an SES employee, or acting SES employee, in the Department.

(2) In exercising powers or functions under a delegation, the delegate must comply with any directions of the Minister.

11 Declarations etc. taken to be authentic etc.

A document that appears to be a declaration or other document made or issued under this Part:

(a) is taken to be such a declaration or other document; and

(b) is taken to have been properly given;

unless the contrary is established.

12 Publication of declarations

(1) A copy of each declaration made by the Minister under this Part must be published in the Gazette not later than the 14th day after the day on which the declaration is made.

(2) Failure to comply with this section does not affect the validity of a declaration.

13 Tabling of financial reports

(1) The industry services body must, within 14 days of lodging a financial report (the annual report ) mentioned in section 292 of the Corporations Act 2001 , give the Minister a copy of the report.

(2) The Minister must cause a copy of the report to be tabled in each House of the Parliament within 14 sitting days of that House after the day on which the copy of the report was given to the Minister.

(3) In addition to the matters mentioned in section 295 of the Corporations Act 2001 , the annual report must include details of the following in relation to the financial year to which the report relates:

(a) the amount of dairy service payments and matching payments made to the industry services body;

(b) the amount of those payments that were spent;

(c) outcomes as measured against objectives that apply in relation to the industry services body.

(1) The Minister must, as soon as practicable after the holding of each annual general meeting of the industry services body, cause to be tabled in each House of the Parliament a report in relation to the year ending on 30 June before the holding of that meeting.

(2) The report must include the following in relation to that year:

(a) a statement as to the amount of dairy service levy received by the Commonwealth;

(b) a statement as to whether the Minister is satisfied, on the basis of information provided by the industry services body, that the spending of dairy service payments and matching payments complies with the funding contract;

(c) if the Minister is not so satisfied--details of why the Minister is satisfied that the spending does not so comply.

52 Sections 51 to 59

Repeal the sections, substitute:

In this Part:

"export" means export from Australia .

"market" means a place.

"regulated dairy market" , in relation to regulated dairy produce, means a market that is declared to be a regulated dairy market in relation to the produce under section 52.

"regulated dairy produce" means dairy produce that is declared to be regulated dairy produce under section 52.

52 Regulated dairy produce and regulated dairy markets

The regulations may declare that, on and after a specified day:

(a) specified dairy produce is regulated dairy produce; and

(b) a specified market is a regulated dairy market in respect of that produce.

53 Prohibitions on certain exports of regulated dairy produce to regulated dairy markets

Export where no approval to do so

(1) A person is guilty of an offence if:

(a) the person exports regulated dairy produce to a regulated dairy market in respect of that produce; and

(b) the person does not hold an approval issued in accordance with section 54 in relation to that export.

Penalty: 180 penalty units.

Export in contravention of conditions of approval

(2) A person is guilty of an offence if:

(a) the person exports regulated dairy produce to a regulated dairy market in respect of that produce; and

(b) the person holds an approval issued in accordance with section 54 in relation to that export but the export is not in accordance with the conditions of that approval.

Penalty: 60 penalty units.

54 Approvals to export regulated dairy produce to regulated dairy markets

(1) The regulations may make provision for and in relation to the granting of approvals to persons to export regulated dairy produce to regulated dairy markets.

(2) Regulations made for the purposes of subsection ( 1) may make provision for and in relation to any one or more of the following:

(a) the making of an application for an approval;

(b) the payment of fees to the Commonwealth in respect of such an application;

(c) the waiver or remission of such fees;

(d) the grant of an approval;

(e) the grant of an approval subject to compliance with conditions by the holder of the approval (which may include, but are not limited to, conditions relating to matters occurring either before or after the export of the dairy produce);

(f) whether an approval is in force in relation to exports during a specified period or is in force in relation to a particular export only;

(g) the variation of an approval or of a condition of an approval;

(h) the revocation or suspension of an approval;

(i) the review of decisions made under the regulations.

(3) Regulations made for the purposes of subsection ( 1) may make different provision in respect of matters arising in relation to different regulated dairy produce and different regulated dairy markets.

(4) Subsection ( 3) does not, by implication, limit subsection 33(3A) of the Acts Interpretation Act 1901 .

53 Section 60

Omit "Neither this Part nor a direction under this Part affects", substitute "This Part does not affect".

54 Part VII

Repeal the Part.

55 Subsections 109(1) and (2)

Repeal the subsections, substitute:

(1) For the purposes of this section, for so long as the industry services body is in a position to control the operations of Asia Dairy Industries (H.K.) Limited, a company incorporated in Hong Kong, that company is taken to be the subsidiary company.

(2) If:

(a) the subsidiary company is wound - up; and

(b) the liabilities of the subsidiary company payable on the winding - up are not able to be met in full from the assets of the subsidiary company;

the industry services body is liable to meet those liabilities, to the extent that they are not able to be met out of the assets of the subsidiary company, as if the liabilities had been incurred by the industry services body.

Note: The heading to section 109 is replaced by the heading " Liability of industry services body for the subsidiary company ".

56 Section 109A

Repeal the section.

57 Section 109B

Repeal the section.

58 Section 109C

Repeal the section.

59 Section 110

Repeal the section.

60 Section 114

Repeal the section.

61 Section 115

Repeal the section.

62 Section 117

Repeal the section.

63 Section 118

Repeal the section.

64 Subsection 119(1)

Omit "a member of the Corporation or of the staff assisting the Corporation", substitute "an officer or an employee of the industry services body".

65 Paragraph 119(2)(a)

Omit "as a member of the Corporation or as a member of the staff assisting the Corporation", substitute "or employment with the industry services body and acquired under or for the purposes of this Act".

66 Paragraph 119(2)(b)

Repeal the paragraph, substitute:

(b) produce to any person:

(i) an application or other document given to the Australian Dairy Corporation by a manufacturer of dairy produce for the purpose of obtaining a market support payment under this Act as in force before the conversion time; or

(ii) an application or other document given to that Corporation by a person for the purposes of section 99 of this Act as in force before the conversion time; or

(iii) a return furnished to that Corporation by an exporter of dairy produce pursuant to section 110 of this Act as in force before the conversion time.

67 Subsection 119(2A)

Omit "clause 42", substitute "clause 43".

68 Subsection 119(4)

Omit "Corporation", substitute "industry services body".

69 Sections 121 to 125

Repeal the sections.

70 Paragraph 126(c)

Repeal the paragraph.

71 Schedule 1

Repeal the Schedule.

72 Clause 2 of Schedule 2 ( paragraphs ( b) and (c) of the definition of deliver )

Repeal the paragraphs, substitute:

(b) in relation to manufacturing milk covered by paragraph ( a) of the definition of manufacturing milk in this clause--deliver as mentioned in that paragraph; and

(c) in relation to manufacturing milk covered by paragraph ( b) of the definition of manufacturing milk in this clause--use as mentioned in that paragraph.

73 Clause 2 of Schedule 2 (definition of manufacturing milk )

Repeal the definition, substitute:

"manufacturing milk" means:

(a) relevant dairy produce delivered by the producer to a manufacturer during a month ending before 1 July 2000, in respect of which a domestic market support payment has been paid under section 108A of this Act as in force before the conversion time; or

(b) relevant dairy produce produced by a manufacturer and used by the manufacturer, during a month ending before 1 July 2000, in the manufacture of dairy produce, in respect of which a domestic market support payment has been paid under section 108A of this Act as in force before the conversion time;

other than market milk.

74 Paragraph 10(d) of Schedule 2

Omit "by the Corporation", substitute "out of the Dairy Structural Adjustment Fund".

75 Subclause 23(4) of Schedule 2

Omit "by the Corporation".

76 Subclause 23(5) of Schedule 2

Omit "by the Corporation".

77 Paragraph 37B(d) of Schedule 2

Omit "by the Corporation", substitute "out of the Dairy Structural Adjustment Fund".

78 Paragraph 43(3)(a) of Schedule 2

After "SDA scheme", insert "or is otherwise required by any law of the Commonwealth".

79 Clause 45 of Schedule 2

Omit "Corporation", substitute "industry services body".

Note: The heading to clause 45 is altered by omitting " Corporation " and substituting " industry services body ".

80 Subclause 46(1) of Schedule 2

Omit "Corporation", substitute "industry services body".

81 Subclause 48(1) of Schedule 2

Omit "the Corporation to collect money", substitute "for the collection of money".

Note: The heading to clause 48 is altered by omitting " Corporation " and substituting " Industry services body ".

82 Subclause 48(2) of Schedule 2

Omit "Corporation", substitute "industry services body".

83 Subclause 48(3) of Schedule 2

Omit "Corporation", substitute "industry services body".

84 Subclause 48(6) of Schedule 2

Omit "Corporation", substitute "industry services body".

85 Subclause 49(6) of Schedule 2

Omit "Corporation", substitute "industry services body".

86 Subclause 70(1) of Schedule 2

Omit "Corporation", substitute "industry services body".

Note: The heading to clause 70 is altered by omitting " Corporation " and substituting " Industry services body ".

87 Subclause 70(2) of Schedule 2

Omit "Corporation" (first occurring), substitute "industry services body".

88 Subclause 70(2) of Schedule 2

Omit "Corporation or of the Managing Director", substitute "industry services body".

89 Subclause 70(3) of Schedule 2

Omit "Corporation", substitute "industry services body".

90 Paragraph 72(1)(b) of Schedule 2

Omit "Corporation", substitute "industry services body".

91 Subclause 72(7) of Schedule 2

Repeal the subclause, substitute:

(7) A reference in this clause to a senior employee of the industry services body is a reference to a person who:

(a) is an employee of the industry services body; and

(b) holds or performs the duties of a position of General Manager.

92 Subclauses 77(2) and (3) of Schedule 2

Repeal the subclauses.

93 After clause 77 of Schedule 2

Insert:

77A The industry services body to keep the Dairy Structural Adjustment Fund

(1) The industry services body must keep and administer the Dairy Structural Adjustment Fund.

(2) The assets of the Dairy Structural Adjustment Fund are the property of the industry services body, but must be kept separate from all other property and must be held on trust by the body for the purposes of this Part.

(3) No stamp duty or other tax is payable under a law of a State or Territory in respect of the operation of subclause ( 2).

77B What the Dairy Structural Adjustment Fund consists of

The Dairy Structural Adjustment Fund consists of the following:

(a) money credited to the Fund under clause 78;

(b) investments the industry services body has as a result of investing money in the Fund under clause 79B;

(c) all other money and property lawfully paid into, or forming part of, the Fund.

77C Power to borrow for the purposes of the Dairy Structural Adjustment Fund

(1) The industry services body may borrow money for the purpose of making payments for which money of the Dairy Structural Adjustment Fund may be expended.

(2) The industry services body may give security, including over the assets of the Dairy Structural Adjustment Fund, in respect of the body's obligations in relation to a borrowing under subclause ( 1).

77D Funding contract may include provisions relating to the Dairy Structural Adjustment Fund

A funding contract with the industry services body may include provisions relating to the Dairy Structural Adjustment Fund. This clause does not impliedly limit the matters that may be included in the contract.

94 Paragraphs 78(a), (b), (c), (d), (e), (f) and (fa) of Schedule 2

Omit "Corporation", substitute "industry services body".

95 Paragraph 78(g) of Schedule 2

Omit "Corporation as interest", substitute "industry services body as interest or profits".

96 Paragraph 78(h) of Schedule 2

Omit "Corporation under section 75", substitute "industry services body".

97 Paragraph 78(i) of Schedule 2

Omit "Corporation", substitute "industry services body".

98 Paragraph 79(c) of Schedule 2

Omit "Corporation", substitute "industry services body".

99 Paragraph 79(d) of Schedule 2

Repeal the paragraph.

100 Paragraph 79(g) of Schedule 2

Omit "Corporation", substitute "industry services body".

101 Paragraph 79(k) of Schedule 2

Repeal the paragraph.

102 Paragraph 79(l) of Schedule 2

Omit "Corporation", substitute "industry services body".

103 Paragraph 79(m) of Schedule 2

Omit "by the Corporation".

104 Paragraph 79(n) of Schedule 2

Omit "Corporation", substitute "industry services body".

105 After clause 79 of Schedule 2

Insert:

(1) Money in the Dairy Structural Adjustment Fund must:

(a) until applied for the purposes of this Part; or

(b) until invested under clause 79B;

be kept by the industry services body in an account or accounts with an Australian ADI separate from any account or accounts in which other money is kept.

(2) In this clause:

"Australian ADI" means:

(a) an ADI (authorised deposit - taking institution) within the meaning of the Banking Act 1959 ; or

(b) a person who carries on State banking within the meaning of paragraph 51(xiii) of the Constitution.

79B Money in Dairy Structural Adjustment Fund may be invested

Money in the Dairy Structural Adjustment Fund that is not immediately required for the purposes of this Part may be invested in any way in which trustees are for the time being authorised by a law in force in a State or Territory to invest trust funds.

(1) The industry services body must, as soon as practicable after 30 June in each year, prepare and give to the Minister a report on the administration of the Dairy Structural Adjustment Fund during the year that ended on that 30 June.

(2) The Minister must cause a copy of each report to be tabled in each House of the Parliament within 15 sitting days of that House after the day on which the Minister receives the report.

106 Clause 80 of Schedule 2

Omit "Corporation", substitute "industry services body".

107 Clauses 81 and 82 of Schedule 2

Repeal the clauses.

108 Subclause 83(1) of Schedule 2

Omit "Corporation", substitute "industry services body".

Note: The heading to clause 83 is altered by omitting " Corporation " and substituting " industry services body ".

109 Subclause 83(2) of Schedule 2

Omit "Corporation", substitute "industry services body".

110 Subclause 84(1) of Schedule 2

Omit "Corporation", substitute "industry services body".

Note: The heading to clause 84 is altered by omitting " Corporation " and substituting " industry services body ".

111 Subclause 85(1) of Schedule 2

Omit "Corporation", substitute "industry services body".

Note: The heading to clause 85 is altered by omitting " Corporation " and substituting " industry services body ".

112 Paragraph 94(2)(c) of Schedule 2

Omit "by the Corporation".

113 Paragraph 94(2)(d) of Schedule 2

Omit "Corporation", substitute "industry services body".

Part 2 -- Amendment of other Acts

Administrative Decisions (Judicial Review) Act 1977

114 Paragraph ( k) of Schedule 2

Omit "Australian Dairy Corporation".

Equal Employment Opportunity (Commonwealth Authorities) Act 1987

115 Subsection 3(1) (definition of authority )

Omit all the words after "but does not include", substitute "a relevant employer as defined in section 3 of the Equal Opportunity for Women in the Workplace Act 1999 .".

Farm Household Support Act 1992

116 Subsection 3(2)

Insert:

"industry services body" has the same meaning as in the Dairy Produce Act 1986 .

117 Paragraph 52A(5A)(b)

Omit "Australian Dairy Corporation", substitute "industry services body".

118 Paragraph 52C(5)(b)

Omit "Australian Dairy Corporation", substitute "industry services body".

119 Subsection 56(2A)

Omit "Australian Dairy Corporation" (wherever occurring), substitute "industry services body".

120 Subsection 56(3)

Omit "Australian Dairy Corporation" (wherever occurring), substitute "industry services body".

Primary Industries Levies and Charges Collection Act 1991

121 After subsection 27(3)

Insert:

(3A) An authorised person may provide the following information to the industry services body:

(a) the name, address, contact details and ABN of any person who has paid, or is liable to pay, dairy levy;

(b) details relating to the amount of dairy levy that the person has paid, or is liable to pay.

122 Subsection 27(4)

Insert:

"ABN" has the meaning given by section 41 of the A New Tax System (Australian Business Number) Act 1999 .

123 Subsection 27(4)

Insert:

"dairy levy" means levy that:

(a) is or has been collected under this Act; and

(b) is prescribed by regulations under this Act.

124 Subsection 27(4)

Insert:

"industry services body" has the same meaning as in the Dairy Produce Act 1986 .

Safety, Rehabilitation and Compensation Act 1988

125 Subsection 128A(4) ( paragraph ( e) of the definition of prescribed Commonwealth authority )

Repeal the paragraph.

Part 3 -- Repeal of regulations

Dairy Research and Development Corporation Regulations 1990

126 The whole of the regulations

Repeal the regulations.

Part 4 -- Transitional provisions

127 Dairy produce

A product that is dairy produce, immediately before the commencement of this item, under paragraph ( c) of the definition of dairy produce in subsection 3(1) of the Dairy Produce Act 1986 is taken, after the commencement of this item, to continue to be dairy produce under that paragraph.

128 Continuation of secrecy obligations

Section 119 of the Dairy Produce Act 1986 as in force before the commencement of this item continues to apply after the commencement of this item to a person who, immediately before the commencement of this item, was a person to whom that section applied as if the amendments to that section made by this Schedule had not been made.

129 Final annual reports

(1) For the final reporting period, the directors of Dairy Australia Limited must, in relation to the Australian Dairy Corporation and the Dairy Research and Development Corporation, prepare the report referred to in section 9 of the Commonwealth Authorities and Companies Act 1997 . The report may include such other matters as the directors consider appropriate.

(2) For the purposes of this item, the final reporting period is to be treated as a financial year.

(3) In this item:

final reporting period means the period that:

(a) started on 1 July 2002 ; and

(b) ends at the commencement of this item.

Notes to the Dairy Industry Service Reform Act 2003

Note 1

The Dairy Industry Service Reform Act 2003 as shown in this compilation comprises Act No. 32, 2003 amended as indicated in the Tables below.

The Dairy Industry Service Reform Act 2003 was amended by the Workplace Relations Amendment (Work Choices) (Consequential Amendments) Regulations 2006 (No. 1) (SLI 2006 No. 50). The amendment is incorporated in this compilation.

Table of Acts

Act | Number | Date | Date of commencement | Application, saving or transitional provisions |

32, 2003 | 15 Apr 2003 | Schedule 1:

1 July 2003 ( see Gazette 2003, S228) |

| |

Fair Work (State Referral and Consequential and Other Amendments) Act 2009 | 54, 2009 | 25 June 2009 | Schedule 4 (items 2, 3): (a) | -- |

(a ) Subsection 2(1) (item 10 ) of the Fair Work (State Referral and Consequential and Other Amendments) Act 2009 provides as follows:

(1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms.

Commencement information | ||

Column 1 | Column 2 | Column 3 |

Provision(s) | Commencement | Date/Details |

10. Schedule 4 | Immediately after the commencement of Part 2 - 4 of the Fair Work Act 2009 . | 1 July 2009 ( see F2009L02563) |

Table of Amendments

ad. = added or inserted am. = amended rep. = repealed rs. = repealed and substituted | |

Provision affected | How affected |

Part 3 |

|

Division 4 |

|

Subdivision A |

|

S. 21 ................... | am. SLI 2006 No. 50 |

S. 22 ................... | am. No. 54, 2009 |

Subdivision E |

|

S. 38 ................... | am. No. 54, 2009 |