Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsNote: See section 125A.

The following is a simplified outline of this Schedule:

• This Schedule provides a framework for the implementation of the Dairy Industry Adjustment Program.

• The main object of the Dairy Industry Adjustment Program is to help the dairy industry or dairy communities adjust to deregulation by providing for 4 types of grants, as follows:

(a) DSAP payments (made under this Schedule);

(b) SDA payments (made under this Schedule);

(d) payments under the Dairy Regional Assistance Programme (see clause 86).

• Generally, DSAP payments are calculated by reference to 1998 - 1999 milk deliveries at a rate of 46.23 cents per litre for market milk and a national average rate of 8.96 cents per litre for manufacturing milk.

• There are 3 types of SDA payment rights: basic market milk payment rights, additional market milk payment rights and discretionary payment rights.

• The Dairy Adjustment Authority will administer DSAP and SDA payment rights.

• The Dairy Industry Adjustment Program will be funded by a dairy adjustment levy on milk products.

• The levy will be paid into a Dairy Structural Adjustment Fund, and DSAP payments, SDA payments and payments under the Dairy Regional Assistance Programme will be paid out of that Fund.

In this Schedule, unless the contrary intention appears:

"annual" means per financial year.

"business day" means a day that is not a Saturday, a Sunday, or a public holiday in the Australian Capital Territory .

"claim" means a claim for a payment right.

"DAA" means the Dairy Adjustment Authority established by this Schedule.

"DAA Chair" means the Chair of the DAA.

Note: Section 18B of the Acts Interpretation Act 1901 deals with how chairs may be referred to.

"DAA member" means a member of the DAA.

"dairy cattle" means cattle held for use for the production of milk, or for purposes incidental to the production of milk, and includes:

(a) dairy cows; and

(b) dairy heifers; and

(c) calves that are the progeny of dairy cows; and

(d) bulls used, or held for use, for the purpose of fertilising dairy cows or dairy heifers.

"dairy farm enterprise" has the meaning given by clause 6.

"deliver" means:

(a) in relation to market milk--supply as mentioned in whichever of the following is applicable:

(i) paragraph 5(1)(a) of the repealed Dairy Produce Levy (No. 1) Act 1986 ;

(ii) paragraph 6(1)(a) of Schedule 6 to the Primary Industries (Excise) Levies Act 1999 ; and

(b) in relation to manufacturing milk covered by paragraph ( a) of the definition of manufacturing milk in this clause--deliver as mentioned in that paragraph; and

(c) in relation to manufacturing milk covered by paragraph ( b) of the definition of manufacturing milk in this clause--use as mentioned in that paragraph.

"DSAP claim period" has the meaning given by clause 4.

"DSAP payment" means a payment under the DSAP payment scheme.

"DSAP payment start day" has the meaning given by clause 3.

"DSAP scheme" means the scheme referred to in clause 10.

"eligible interest in a dairy farm enterprise" has the meaning given by clause 7.

"engage in conduct" means:

(a) do an act; or

(b) omit to perform an act.

"entity" has the meaning given by clause 5.

"manufacturing milk" means:

(a) relevant dairy produce delivered by the producer to a manufacturer during a month ending before 1 July 2000, in respect of which a domestic market support payment has been paid under section 108A of this Act as in force before the conversion time; or

(b) relevant dairy produce produced by a manufacturer and used by the manufacturer, during a month ending before 1 July 2000, in the manufacture of dairy produce, in respect of which a domestic market support payment has been paid under section 108A of this Act as in force before the conversion time;

other than market milk.

"market milk" means milk on which levy was imposed by whichever of the following is applicable:

(a) paragraph 5(1)(a) of the repealed Dairy Produce Levy (No. 1) Act 1986 ;

(b) paragraph 6(1)(a) of Schedule 6 to the Primary Industries (Excise) Levies Act 1999 .

"non-premium component" , in relation to the overall enterprise amount of a dairy farm enterprise, means so much of the overall enterprise amount as does not consist of the premium component of the overall enterprise amount.

"ordinary DAA member" means a DAA member other than the Secretary.

"overall enterprise amount" , in relation to a dairy farm enterprise, means the sum of:

(a) the amount calculated at the rate of 46.23 cents per litre of market milk delivered by the enterprise in the 1998 - 1999 financial year; and

(b) the amount calculated at the rate of 76.03 cents per kilogram of the milk fat content of manufacturing milk delivered by the enterprise in the 1998 - 1999 financial year; and

(c) the amount calculated at the rate of 178.77 cents per kilogram of the protein content of manufacturing milk delivered by the enterprise in the 1998 - 1999 financial year.

Note 1: It is expected that the result of applying the rates mentioned in paragraphs ( b) and (c) will be a national average rate of 8.96 cents per litre of manufacturing milk.

Note 2: See also clause 30 (which deals with the transfer of the whole or part of market milk delivery rights).

Note 3: See also clause 31 (which deals with abnormal market milk pool distributions).

"payment right" means a payment right under the DSAP scheme or the SDA scheme.

"premium component" , in relation to the overall enterprise amount of a dairy farm enterprise, means so much of the overall enterprise amount as is attributable to 37.27 cents per litre of market milk delivered by the enterprise in the 1998 - 1999 financial year.

Note 1: See also clause 30 (which deals with the transfer of the whole or part of market milk delivery rights).

Note 2: See also clause 31 (which deals with abnormal market milk pool distributions).

"quarter" means a period of 3 months beginning on 1 January, 1 April, 1 July or 1 October of any year.

"SDA payment" means a payment under the SDA scheme.

"SDA scheme" means the scheme referred to in clause 37B.

"Secretary" means the Secretary of the Department.

"trustee" includes an executor and an administrator.

"unit" means a unit in a payment right.

(1) For the purposes of this Schedule, the DSAP payment start day means a day to be fixed by Proclamation for the purposes of this subclause.

(2) The DSAP payment start day must not be earlier than 1 July 2000.

(3) If the DSAP payment start day is not fixed by a Proclamation published in the Gazette within the period of 6 months beginning on the day on which the Dairy Industry Adjustment Act 2000 receives the Royal Assent, Part 2 of this Schedule is repealed on the first day after the end of that period.

(4) To avoid doubt, if:

(a) Part 2 of this Schedule is repealed as a result of the operation of subclause ( 3); and

(b) an entity was granted a payment right before the repeal;

that payment right is taken never to have come into existence.

(1) The Minister may, by notice published in the Gazette , declare that a 3 - month period specified in the notice is the DSAP claim period for the purposes of this Schedule.

(2) The declaration has effect accordingly.

(1) For the purposes of this Schedule, each of the following is an entity :

(a) an individual;

(b) a body corporate;

(c) a body politic;

(d) a trustee of a particular trust estate.

(2) A person can have a number of different capacities in which the person does things. In each of those capacities, the person is taken to be a different entity .

Note: For example, take the case of a person who, in addition to his or her personal capacity, is a trustee of 2 trusts. In his or her personal capacity, he or she is one entity. As a trustee of each trust, he or she is a different entity.

(1) For the purposes of this Schedule, a dairy farm enterprise is a business in Australia that delivers market milk and/or manufacturing milk.

Eligible dairy sharefarming arrangements

(2) For the purposes of this clause, if:

(a) under the DSAP scheme, an arrangement is taken to be an eligible dairy sharefarming arrangement; and

(b) apart from this subclause, that arrangement involves 2 or more businesses;

those businesses are to be treated as a single business.

Eligible dairy leasing arrangements

(3) For the purposes of this clause, if:

(a) under the DSAP scheme, an arrangement is taken to be an eligible dairy leasing arrangement; and

(b) apart from this subclause, that arrangement involves 2 or more businesses;

those businesses are to be treated as a single business.

Continuity of a business or dairy farm enterprise

(4) For the purposes of this Schedule, the continuity of a business or a dairy farm enterprise is not affected by:

(a) any change in the identity of the entity or entities who carry on the business or enterprise; or

(b) any change in the ownership of the business or enterprise.

7 Eligible interest in a dairy farm enterprise

(1) For the purposes of this Schedule, an entity has an eligible interest in a dairy farm enterprise if:

(a) both:

(i) under the DSAP scheme, the enterprise is not taken to be subject to an eligible dairy sharefarming arrangement or an eligible leasing arrangement; and

(ii) the entity carries on the enterprise (whether alone or together with one or more other entities); or

(b) both:

(i) under the DSAP scheme, the enterprise is taken to be subject to an eligible dairy sharefarming arrangement; and

(ii) under the DSAP scheme, the entity is taken to be a party to that arrangement; or

(c) both:

(i) under the DSAP scheme, the enterprise is taken to be subject to an eligible dairy leasing arrangement; and

(ii) under the DSAP scheme, the entity is taken to be a party to that arrangement.

(2) For the purposes of this Schedule, if:

(a) an individual had an eligible interest in a dairy farm enterprise at 6.30 pm on 28 September 1999; and

(b) the individual dies after that time, but before making a claim for a payment right;

this Schedule has effect as if the trustee of the deceased individual's estate had held that interest at that time.

8 Application to things happening before commencement

The use of the present tense in a provision of this Part does not imply that the provision does not apply to things happening before the commencement of this Schedule.

Part 2 -- DSAP payments and SDA payments

The following is a simplified outline of this Division:

• This Division provides a framework for the making of DSAP payments.

• The Minister is required to formulate a scheme (the DSAP scheme ) for the grant of payment rights to entities who held an eligible interest in a dairy farm enterprise on 28 September 1999.

• The DSAP scheme will provide for 3 types of payment rights, as follows:

(a) standard payment rights;

(b) exceptional events supplementary payment rights.

(c) anomalous circumstances payment rights.

• Standard payment rights will be based on milk deliveries in 1998 - 1999, and will be worked out by reference to a rate of 46.23 cents per litre for market milk and a national average rate of 8.96 cents per litre for manufacturing milk.

• Exceptional events supplementary payment rights may be granted in cases where, because of exceptional events, the volume of milk deliveries in 1998 - 1999 is less than 70% of the average milk deliveries in the 3 previous financial years.

• Anomalous circumstances payment rights may be granted to entities who have been affected by anomalous circumstances.

• Entities who wish to obtain a payment right under the DSAP scheme must undertake a farm business assessment.

• The total value of the payment rights granted to an entity must not exceed $350,000 unless more than 70% of the entity's total gross income consists of dairy income.

• Payment rights will be divided into units, where each unit has a face value of $32.

• A registered owner of a unit will be entitled to a quarterly payment of $1 for each of the 32 quarters in the 8 - year period beginning on 1 July 2000.

Within 14 days after the commencement of this Schedule, the Minister must, by writing, formulate a scheme (the DSAP scheme ) for:

(a) the grant of payment rights to entities who:

(i) held an eligible interest in a dairy farm enterprise at 6.30 pm on 28 September 1999; and

(ii) satisfy such other conditions as are set out in the scheme; and

(b) the division of payment rights into units; and

(c) the registration of units; and

(d) the making of payments out of the Dairy Structural Adjustment Fund to registered owners of units.

11 General policy objectives for the DSAP scheme

The DSAP scheme must be directed towards ensuring the achievement of the policy objectives set out in clauses 12 to 23.

(1) This clause sets out a policy objective for the DSAP scheme.

(2) The objective is that there are to be 3 types of payment rights, as follows:

(a) the first type of payment rights are to be known as standard payment rights ;

(b) the second type of payment rights are to be known as exceptional events supplementary payment rights ;

(c) the third type of payment rights are to be known as anomalous circumstances payment rights .

(1) This clause sets out policy objectives for the DSAP scheme.

Basic eligibility criteria

(2) The first objective is that an entity is not eligible to be granted a standard payment right unless:

(a) the entity held an eligible interest in a dairy farm enterprise at 6.30 pm on 28 September 1999; and

(b) either or both of the following conditions are satisfied:

(i) during the 1998 - 1999 financial year, the dairy farm enterprise delivered market milk;

(ii) during the 1998 - 1999 financial year, the dairy farm enterprise delivered manufacturing milk.

Calculation of face value

(3) The second objective is that the calculation of the face value of an entity's standard payment right must be consistent with the following examples:

(a) if the entity is the only entity who had an eligible interest in the dairy farm enterprise at 6.30 pm on 28 September 1999--the face value of the entity's standard payment right equals the overall enterprise amount;

(b) if:

(i) there are 2 or more entities who had an eligible interest in the dairy farm enterprise at 6.30 pm on 28 September 1999; and

(ii) under the scheme, the enterprise is not taken to be subject to an eligible dairy sharefarming arrangement or an eligible dairy leasing arrangement;

the face value of the first - mentioned entity's standard payment right is that entity's share of the overall enterprise amount, worked out on a basis that corresponds to the basis on which milk revenues were shared between the entities as at 6.30 pm on 28 September 1999;

(c) if:

(i) there are 2 entities who had an eligible interest in the dairy farm enterprise at 6.30 pm on 28 September 1999; and

(ii) under the scheme, the enterprise is taken to be subject to an eligible dairy sharefarming arrangement and those entities are taken to be parties to that arrangement; and

(iii) the first - mentioned entity is an entity who, under the scheme, is taken to have provided the essential capital contribution required to achieve access to the market milk premium;

the face value of the first - mentioned entity's standard payment right is the sum of:

(iv) the premium component of the overall enterprise amount; and

(v) that entity's share of the non - premium component of the overall enterprise amount, worked out on a basis that corresponds to the basis on which milk revenues were shared between the entities as at 6.30 pm on 28 September 1999;

(d) if:

(i) there are 2 entities who had an eligible interest in the dairy farm enterprise at 6.30 pm on 28 September 1999; and

(ii) under the scheme, the enterprise is taken to be subject to an eligible dairy sharefarming arrangement and those entities are taken to be parties to that arrangement; and

(iii) the first - mentioned entity is not an entity who, under the scheme, is taken to have provided the essential capital contribution required to achieve access to the market milk premium;

the face value of the first - mentioned entity's standard payment right is that entity's share of the non - premium component of the overall enterprise amount, worked out on a basis that corresponds to the basis on which milk revenues were shared between the entities as at 6.30 pm on 28 September 1999;

(e) if:

(i) there are 2 entities who had an eligible interest in the dairy farm enterprise at 6.30 pm on 28 September 1999; and

(ii) under the scheme, the enterprise is taken to be subject to an eligible dairy leasing arrangement and those entities are taken to be parties to that arrangement; and

(iii) the first - mentioned entity is an entity who, under the scheme, is taken to have provided the essential capital contribution required to achieve access to the market milk premium;

the face value of the first - mentioned entity's standard payment right is the premium component of the overall enterprise amount;

(f) if:

(i) there are 2 entities who had an eligible interest in the dairy farm enterprise at 6.30 pm on 28 September 1999; and

(ii) under the scheme, the enterprise is taken to be subject to an eligible dairy leasing arrangement and those entities are taken to be parties to that arrangement; and

(iii) the first - mentioned entity is not an entity who, under the scheme, is taken to have provided the essential capital contribution required to achieve access to the market milk premium;

the face value of the first - mentioned entity's standard payment right is the non - premium component of the overall enterprise amount.

(4) Paragraphs ( 3)(c), (d), (e) and (f) deal with common types of arrangements that involve 2 parties. Those paragraphs do not, by implication, limit the capacity of the DSAP scheme to deal with less common types of arrangements that involve 3 or more parties--see clause 34.

Essential capital contribution

(5) In formulating a provision of the DSAP scheme under which an entity is taken to have provided the essential capital contribution required to achieve access to the market milk premium, the Minister must not have regard to any matters other than the following:

(a) whether the entity is the owner of a quota relating to the delivery of market milk;

(b) whether the entity is the owner of the land on which the eligible dairy farm enterprise is carried on;

(c) whether the entity is the owner of a significant proportion of the livestock used in, or for purposes incidental to, the carrying on of the eligible dairy farm enterprise.

(6) For the purposes of paragraph ( 5)(c), the proportion of livestock owned by a partner in a partnership is taken to be the same as the proportion of the livestock owned by the partnership.

(7) For the purposes of paragraph ( 5)(c), a proportion of less than 25% is taken not to be a significant proportion.

14 Exceptional events supplementary payment right

(1) This clause sets out policy objectives for the DSAP scheme.

Basic eligibility criteria

(2) The first objective is that an exceptional events supplementary payment right must not be granted to an entity in respect of a particular dairy farm enterprise unless:

(a) the entity has already been granted a standard payment right in respect of the enterprise; and

(b) the entity satisfies the DAA that, as a result of one or more events that, under the scheme, are taken to be recognised exceptional events, the volume of market milk and manufacturing milk delivered by the enterprise during the 1998 - 1999 financial year is less than 70% of the average annual volume of market milk and manufacturing milk delivered by the enterprise in the following 3 financial years:

(i) the 1997 - 1998 financial year;

(ii) the 1996 - 1997 financial year;

(iii) the 1995 - 1996 financial year.

Total face value of payment rights

(3) The second objective is that the sum of:

(a) the face value of a standard payment right granted to an entity in respect of a particular dairy farm enterprise; and

(b) the total face value of the exceptional events supplementary payment rights granted to the entity in respect of the enterprise;

must not exceed the amount that would have been the total face value of the standard payment right if:

(c) the volume of market milk delivered by the dairy farm enterprise during the 1998 - 1999 financial year had equalled the average annual volume of market milk delivered by the enterprise in the following 3 financial years:

(i) the 1997 - 1998 financial year;

(ii) the 1996 - 1997 financial year;

(iii) the 1995 - 1996 financial year; and

(d) the volume of manufacturing milk delivered by the dairy farm enterprise during the 1998 - 1999 financial year had equalled the average annual volume of manufacturing milk delivered by the enterprise in the following 3 financial years:

(i) the 1997 - 1998 financial year;

(ii) the 1996 - 1997 financial year;

(iii) the 1995 - 1996 financial year.

Discretionary grant

(4) The third objective is that the grant of an exceptional events payment right is to be at the discretion of the DAA.

15 Anomalous circumstances payment right

(1) This clause sets out policy objectives for the DSAP scheme.

Basic eligibility criteria

(2) The first objective is that an entity is not eligible for the grant of an anomalous circumstances payment right unless:

(a) the entity did not pass the standard DSAP test; and

(b) the entity held an eligible interest in a dairy farm enterprise during the whole or a part of the 1998 - 1999 financial year; and

(c) under the scheme, the entity is taken to have been affected by anomalous circumstances.

Standard DSAP test

(3) For the purposes of this clause, an entity passes the standard DSAP test if, and only if:

(a) the entity held an eligible interest in a dairy farm enterprise at 6.30 pm on 28 September 1999; and

(b) either or both of the following conditions are satisfied:

(i) during the 1998 - 1999 financial year, the dairy farm enterprise delivered market milk;

(ii) during the 1998 - 1999 financial year, the dairy farm enterprise delivered manufacturing milk.

Discretionary grant

(4) The second objective is that the grant of an anomalous circumstances payment right is to be at the discretion of the DAA.

(1) This clause sets out a policy objective for the DSAP scheme.

(2) The objective is that the total face value of payment rights granted to an entity in respect of a particular dairy farm enterprise must not exceed $350,000 unless a person who, under the scheme, is taken to be a qualified financial adviser certifies in writing that, to the best of the adviser's knowledge and belief:

(a) the entity has given the adviser full access to the entity's accounts and financial records; and

(b) the entity passes the 70% dairy income test.

70% dairy income test

(3) For the purposes of this clause, an entity passes the 70% dairy income test if, and only if:

(a) more than 70% of the total gross income derived by the entity in the 1998 - 1999 financial year consisted of eligible dairy income; or

(b) more than 70% of the total gross income derived by the entity in the period comprising:

(i) the 1998 - 1999 financial year; and

(ii) the 1997 - 1998 financial year; and

(iii) the 1996 - 1997 financial year;

consisted of eligible dairy income.

Gross income

(4) For the purposes of subclause ( 3), the gross income derived by an entity is to be worked out in accordance with:

(a) generally accepted accounting principles; or

(b) if, under the scheme, the generally accepted accounting principles are taken to be modified for the purposes of the scheme--those principles as so modified.

Eligible dairy income

(5) For the purposes of this clause, eligible dairy income means:

(a) proceeds from the sale of market milk; and

(b) proceeds from the sale of manufacturing milk; and

(c) proceeds from the sale or lease of dairy cattle; and

(d) dividends payable in respect of shares in bodies that, under the scheme, are taken to be eligible dairy cooperatives; and

(e) dividends payable in respect of shares in companies that, under the scheme, are taken to be eligible dairy companies;

(f) an amount that, under the scheme, is taken to be the income test value of a bonus share issued by a company that, under the scheme, is an eligible dairy cooperative;

(g) an amount that, under the scheme, is taken to be the income test value of a bonus share issued by a company that, under the scheme, is an eligible dairy company.

Shares issued in lieu of payment for the sale of milk

(6) For the purposes of this clause, if a share in a body or company that, under the scheme, is taken to be:

(a) an eligible dairy cooperative; or

(b) an eligible dairy company;

is issued to a shareholder in the cooperative or company in lieu of a particular payment for the sale of market milk or manufacturing milk:

(c) the shareholder is taken to have derived an amount, by way of proceeds from the sale of that milk, equal to the amount of that payment; and

(d) those proceeds are taken to be gross income according to generally accepted accounting principles.

Bonus shares

(7) For the purposes of this clause, if a bonus share in a body or company that, under the scheme, is taken to be:

(a) an eligible dairy cooperative; or

(b) an eligible dairy company;

is issued to a shareholder in the cooperative or company:

(c) the shareholder is taken to have derived an amount of income equal to the amount that, under the scheme, is the income test value of the bonus share; and

(d) that amount of income is taken to be gross income according to generally accepted accounting principles.

False or misleading statements in certificates

(8) For the purposes of clause 50, a statement made in a certificate of a kind referred to in subclause ( 2) of this clause is taken to be made to a person who was exercising powers, or performing functions, under or in connection with the DSAP scheme.

Note: Clause 50 deals with false or misleading statements.

(9) For the purposes of section 136.1 of the Criminal Code , a statement made in a certificate of a kind referred to in subclause ( 2) of this clause is taken to be a statement made in connection with a claim for a payment right.

Note: Section 136.1 of the Criminal Code deals with false or misleading statements.

(1) This clause sets out policy objectives for the DSAP scheme.

(2) The first objective is that an entity is not eligible for the grant of a payment right unless:

(a) the entity has complied with such rules as are set out in the scheme in relation to the carrying out of a farm business assessment by a person who, under the scheme, is taken to be a qualified financial adviser; or

(b) a person who, under the scheme, is taken to be a qualified financial adviser has certified in writing that the entity has complied with such rules as are set out in the scheme in relation to the carrying out by the entity of a farm business assessment; or

(c) under the scheme, the entity is exempt from carrying out a farm business assessment.

Note: For example, the DSAP scheme may provide that an entity who has exited the dairy industry is exempt from carrying out a farm business assessment.

Compliance after making claim

(3) The second objective is that an entity is not to be prevented from making a claim for the grant of a payment right at a time when the entity has not complied with requirements mentioned in subclause ( 2), so long as those requirements are complied with before the time ascertained in accordance with the scheme.

False or misleading statements in certificates

(4) For the purposes of clause 50, a statement made in a certificate of a kind referred to in paragraph ( 2)(b) of this clause is taken to be made to a person who was exercising powers, or performing functions, under or in connection with the DSAP scheme.

Note: Clause 50 deals with false or misleading statements.

(5) For the purposes of section 136.1 of the Criminal Code , a statement made in a certificate of a kind referred to in paragraph ( 2)(b) of this clause is taken to be a statement made in connection with a claim for a payment right.

Note: Section 136.1 of the Criminal Code deals with false or misleading statements.

(1) This clause sets out policy objectives for the DSAP scheme.

(2) The first objective is that each payment right is to be divided into units, where each unit has a face value of $32.

(3) The second objective is that the number of units into which a payment right is divided is to be worked out as follows:

(a) divide the number of dollars in the face value of the payment right by 32;

(b) if the result of the division is a whole number--that number is the number of units in the payment right;

(c) if the result of the division is less than 1--there is 1 unit in the payment right;

(d) if the result of the division is greater than 1, but is not a whole number:

(i) round the result of the division up or down to the nearest whole number (rounding up in the case exactly half - way between 2 whole numbers); and

(ii) the rounded number is the number of units in the payment right.

(1) This clause sets out a policy objective for the DSAP scheme.

(2) The objective is that a payment right is to be granted subject to the powers of cancellation conferred on the DAA under the authority of clauses 50, 51 and 52 .

Note 1: Clause 50 deals with cancellation of units because of the making of a false statement.

Note 2: Clause 51 deals with cancellation of units because of an error made by the DAA.

Note 3: Clause 52 deals with cancellation of units because of a breach of an undertaking to dispose of the units.

(1) This clause sets out policy objectives for the DSAP scheme.

(2) The first objective is that a payment right relating to a particular dairy farm enterprise must not be granted to an entity unless the entity, or a person acting on behalf of the entity, makes a claim for the payment right:

(a) during the DSAP claim period; or

(b) if:

(i) one or more units in another payment right were cancelled as authorised under clause 50 or 51; and

(ii) the other payment right relates to the enterprise; and

(iii) the DAA allows the claim for the first - mentioned payment right to be made within a particular period after the end of the DSAP claim period;

within that particular period.

(3) The second objective is that DSAP payments are not to be made before the DSAP payment start day.

(4) The third objective is that DSAP payments are not to be made in respect of a quarter that is later than the quarter ending on 30 June 2008.

(5) Subclause ( 2) does not prevent the DSAP scheme from making provision for the amendment of claims.

(1) This clause sets out policy objectives for the DSAP scheme.

Register

(2) The first objective is that the DAA is to keep a register in which the DAA includes particulars of units.

Registration of ownership

(3) The second objective is that an entity's ownership of a unit is not to be counted for the purposes of the scheme unless that ownership is entered on the register.

(4) The third objective is that the transfer of the ownership of a unit is not to be registered unless:

(a) the transferee is an eligible entity; or

(b) the transferee gives the DAA a written undertaking to assign the unit to an eligible entity within 60 days after the transfer is registered.

Note: For enforcement of the undertaking, see clause 52.

Registration of charges

(5) The fourth objective is that the scheme may provide for the registration of charges over units.

Inspection of register

(6) The fifth objective is that an entry on the register relating to a unit is to be open for inspection in the following circumstances:

(a) the owner of the unit consents to the entry being open for inspection;

(b) such circumstances as are set out in the scheme.

Form of register

(7) The sixth objective is that the DAA may keep the register in electronic form or otherwise.

No declaration of trust in respect of unit

(8) The seventh objective is that:

(a) the owner of a unit must not dispose of a unit by way of declaration of trust; and

(b) if a purported disposal contravenes the rule in paragraph ( a), it is of no effect.

Beneficial interest in unit must not be transferred independently of legal interest

(9) The eighth objective is that:

(a) a beneficial interest in a unit must not be transferred independently of the legal interest in the unit; and

(b) if a purported transfer contravenes the rule in paragraph ( a), it is of no effect.

(10) In this clause:

"eligible entity" means an entity included in a class of entities declared by the DSAP scheme to be entities who are eligible to become transferees of units.

22 Invitations to make claims for payment rights etc.

(1) This clause sets out policy objectives for the DSAP scheme.

Public information program

(2) The first objective is that the DAA is to conduct a public information program about the scheme.

DAA to obtain and record information

(3) The second objective is that the DAA is to obtain and record information that:

(a) is likely to assist entities in making claims for payment rights; or

(b) is likely to assist the DAA in determining claims for payment rights.

Formal invitations to make claims

(4) The third objective is that:

(a) if the DAA has reasonable grounds to believe, on the basis of the information referred to in subclause ( 4), that it may be in the interests of an entity for the entity to make a claim for a payment right; and

(b) if the DAA were to give the entity a formal invitation to make such a claim, there would be sufficient time for the claim to be made before the end of the DSAP claim period;

the DAA must make all reasonable efforts to give the entity a formal invitation to make such a claim.

(5) The fourth objective is that an entity who does not receive a formal invitation is not to be prevented from making a claim for a payment right.

(1) This clause sets out policy objectives for the DSAP scheme.

Payment rights not to be granted within 30 days after the end of the DSAP claim period

(2) The first objective is that a payment right must not be granted before the end of the 30 - day period beginning at the end of the DSAP claim period.

Initial payment day

(3) The second objective is that there is to be an initial payment day for each payment right, worked out as follows:

(a) if, during the 28 - day period beginning at the end of the 30 - day period mentioned in subclause ( 2), the DAA does not receive a request to reconsider its decision to grant the payment right:

(i) the initial payment day is the first day after the end of that 28 - day period; or

(ii) if that first day is earlier than the DSAP payment start day, the initial payment day is the DSAP payment start day;

(b) if, during the 28 - day period beginning at the end of the 30 - day period mentioned in subclause ( 2), the DAA receives a request to reconsider its decision to grant the payment right:

(i) the initial payment day is the day ascertained in accordance with the scheme; or

(ii) if that day is earlier than the DSAP payment start day, the initial payment day is the DSAP payment start day.

DSAP payments in respect of early quarters

(4) The third objective is that, if an entity is the registered owner of a unit in a payment right on the initial payment day for the payment right, the entity is entitled to be paid, out of the Dairy Structural Adjustment Fund, in relation to that unit, the sum of:

(a) $1 in respect of the quarter in which the initial payment day occurred; and

(b) if there is an earlier quarter in the period:

(i) beginning on 1 July 2000; and

(ii) ending on 30 June 2008;

$1 in respect of that earlier quarter.

DSAP payments in respect of later quarters

(5) The fourth objective is that, if:

(a) an entity is the registered owner of a unit in a payment right on the first day of a quarter in the period:

(i) beginning on the DSAP payment start day; and

(ii) ending on 30 June 2008; and

(b) that quarter is later than the quarter in which the initial payment day for the right occurred;

the entity is entitled to be paid, out of the Dairy Structural Adjustment Fund, in relation to that unit, $1 in respect of that quarter.

When a DSAP payment becomes due to be paid

(6) The fifth objective is that, if an entity is entitled to be paid a DSAP payment, the day on which that payment is due to be paid:

(a) is to be ascertained in accordance with the scheme; and

(b) must not be later than the end of the 10th business day after:

(i) if subclause ( 4) applies--the initial payment day concerned; or

(ii) if subclause ( 5) applies--the first day of the quarter concerned.

DSAP payments are debts

(7) The sixth objective is that, if a DSAP payment is due to be paid to an entity, the payment may be recovered, as a debt due to the entity, by action in a court of competent jurisdiction.

Death of recipient of DSAP payment

(8) The seventh objective is that, if an individual is entitled to receive a DSAP payment and the payment has not been made at the date of the death of the individual, the amount of that payment is payable to the legal personal representative of the individual.

24 Scheme may confer administrative powers on the DAA

The DSAP scheme may make provision with respect to a matter by conferring on the DAA a power to make a decision of an administrative character.

25 Reconsideration and review of decisions

(1) The DSAP scheme must contain provisions under which:

(a) an entity who is affected by a decision of the DAA under the scheme may, if dissatisfied with the decision, by notice given to the DAA within such period as is ascertained in accordance with the scheme, request the DAA to reconsider the decision; and

(b) the DAA is required to reconsider the decision and is empowered to confirm or revoke the decision or to vary the decision in such manner as the DAA thinks fit; and

(c) applications may be made to the Administrative Appeals Tribunal for review of decisions of the DAA that have been confirmed or varied as mentioned in paragraph ( b).

(2) The period mentioned in paragraph ( 1)(a) must be 28 days after the day on which the decision first comes to the attention of the entity concerned.

(3) The DSAP scheme must provide that the reasons for making a request mentioned in paragraph ( 1)(a) must be set out in the request.

(4) If a request is made as mentioned in paragraph ( 1)(a) in respect of a decision, section 41 of the Administrative Appeals Tribunal Act 1975 applies as if the making of the request were the making of an application to the Administrative Appeals Tribunal for a review of that decision.

(5) The DSAP scheme must provide that, if the DAA does not confirm, revoke or vary a decision before the end of the period of 60 days after the day on which the DAA received the request to reconsider the decision, the DAA is taken, at the end of that period, to have confirmed the decision.

(6) The DSAP scheme must provide that, if the DAA confirms, revokes or varies the decision before the end of the period referred to in subclause ( 5), the DAA must, by notice given to the applicant, inform the applicant of the result of the reconsideration of the decision and the reasons for confirming, revoking or varying the decision, as the case may be.

(7) If, because of the operation of a provision covered by subclause ( 5), a decision is taken to be confirmed, section 29 of the Administrative Appeals Tribunal Act 1975 applies as if the prescribed time for making application for review of the decision were the period:

(a) commencing on the day on which the decision is taken to have been confirmed; and

(b) ending on the 28th day after that day.

26 Statement to accompany notification of decisions

(1) The DSAP scheme must provide that, if:

(a) written notice is given to an entity affected by a decision of the DAA under the scheme; and

(b) that notice is to the effect that the decision has been made;

that notice must include a statement to the effect that:

(c) the entity may, if dissatisfied with the decision, seek a reconsideration of the decision by the DAA; and

(d) the entity may, subject to the Administrative Appeals Tribunal Act 1975 , if dissatisfied with a decision made by the DAA upon that reconsideration confirming or varying the first - mentioned decision, make application to the Administrative Appeals Tribunal for review of the decision so confirmed or varied.

(2) The DSAP scheme must provide that, if:

(a) the DAA confirms or varies a decision as mentioned in paragraph 25(1)(b); and

(b) gives to the entity written notice of the confirmation or variation of the decision;

that notice must include a statement to the effect that the entity may, subject to the Administrative Appeals Tribunal Act 1975 , if dissatisfied with the decision so confirmed or varied, make application to the Administrative Appeals Tribunal for review of the decision.

(3) A failure to include a statement in a notice as mentioned in subclause ( 1) or (2) does not affect the validity of a decision.

(1) The DSAP scheme may provide for fees.

(2) The amount of a fee under the DSAP scheme must not be such as to amount to taxation.

The DSAP scheme may provide for statements in claims to be verified by statutory declaration.

29 Methods by which DSAP payments may be made

(1) The DSAP scheme may make provision for the methods by which DSAP payments may be made.

(2) The DSAP scheme may require that DSAP payments be made using an electronic funds transfer system.

(3) Subclause ( 2) does not limit subclause ( 1).

30 Adjustment of eligibility for payment rights--transfer of milk delivery rights

(1) The DSAP scheme may make provision for and in relation to the adjustment of eligibility for payment rights in relation to the transfer of the whole or part of market milk delivery rights.

(2) Those provisions may include (but are not limited to):

(a) treating the transferor's dairy farm enterprise, for the purposes of this Part and the scheme, as if the enterprise had delivered a particular volume of manufacturing milk during a particular financial year instead of a particular volume of market milk; and

(b) treating the transferee's dairy farm enterprise, for the purposes of this Part and the scheme, as if the enterprise had delivered a particular volume of market milk during a particular financial year.

(3) In this clause:

"this Part" includes:

(a) the definition of overall enterprise amount in clause 2; and

(b) the definition of premium component in clause 2.

31 Adjustment of eligibility for payment rights--abnormal market milk pool distributions

(1) The DSAP scheme may make provision for and in relation to the adjustment of eligibility for payment rights in relation to a distribution that, under the scheme, is taken to be an abnormal market milk pool distribution.

(2) Those provisions may include (but are not limited to):

(a) treating a particular dairy farm enterprise, for the purposes of this Part and the scheme, as if the enterprise had delivered a particular volume of market milk during a particular financial year instead of a particular volume of manufacturing milk; and

(b) treating a particular dairy farm enterprise, for the purposes of this Part and the scheme, as if the enterprise had delivered a particular volume of manufacturing milk during a particular financial year instead of a particular volume of market milk.

(3) In this clause:

"this Part" includes:

(a) the definition of overall enterprise amount in clause 2; and

(b) the definition of premium component in clause 2.

32 Adjustment of eligibility for payment rights--death

(1) The DSAP scheme may make provision for and in relation to the adjustment of eligibility for payment rights in relation to the death of an individual who held an eligible interest in a dairy farm enterprise at 6.30 pm on 28 September 1999.

(2) Those provisions may include (but are not limited to) treating the trustee of the deceased individual's estate, for the purposes of this Part and the scheme, as if the trustee had done particular things.

(3) In this clause:

"this Part" includes:

(a) the definition of overall enterprise amount in clause 2; and

(b) the definition of premium component in clause 2.

33 Ancillary or incidental provisions

The DSAP scheme may contain such ancillary or incidental provisions as the Minister considers appropriate.

34 Scheme - making power not limited

Clauses 11 to 33 (inclusive) do not, by implication, limit clause 10.

(1) The DSAP scheme may be varied, but not revoked, in accordance with subsection 33(3) of the Acts Interpretation Act 1901 .

(2) Subclause ( 1) does not limit the application of subsection 33(3) of the Acts Interpretation Act 1901 to other instruments under this Act.

(3) To avoid doubt, the DSAP scheme may be varied after the end of the period of 14 days beginning on the commencement of this Schedule.

36 Scheme to be a legislative instrument

An instrument under clause 10 is a legislative instrument .

37 Application to things happening before commencement

The use of the present tense in a provision of this Division does not imply that the provision does not apply to things happening before the commencement of this Schedule.

Division 1A -- Supplementary Dairy Assistance (SDA) scheme

The following is a simplified outline of this Division:

• This Division provides a framework for the making of SDA payments.

• The Minister is required to formulate a scheme (the SDA scheme ) for the grant of the following types of payment rights to entities:

(aa) basic market milk payment rights;

(a) additional market milk payment rights;

(b) discretionary payment rights.

• Additional market milk payment rights will be based on market milk deliveries in 1998 - 1999, and will range from 0.12 cents per litre to 12 cents per litre depending on the percentage of market milk deliveries in that year.

• Discretionary payment rights may be granted to entities in the circumstances set out in clause 37G.

• Payment rights will be divided into units, where each unit has a face value of $32.

• Payments will be made to registered owners of units in accordance with the SDA scheme.

The Minister must, by writing, formulate a scheme (the SDA scheme ) for:

(a) the grant of payment rights to entities who satisfy the conditions set out in the scheme; and

(b) the division of payment rights into units; and

(c) the registration of units; and

(d) the making of payments out of the Dairy Structural Adjustment Fund to registered owners of units.

37C General policy objectives for the SDA scheme

The SDA scheme must be directed towards ensuring the achievement of the policy objectives set out in clauses 37D to 37P.

(1) It is a policy objective that there are to be 3 types of payment rights, as follows:

(aa) a type called basic market milk payment rights ;

(a) a type called additional market milk payment rights ;

(b) a type called discretionary payment rights .

(2) It is a policy objective that, if an entity is eligible to be granted a basic market milk payment right and an additional market milk payment right, the entity is eligible to be granted the payment right with the higher face value and is not eligible to be granted the other payment right.

37DA Basic market milk payment rights--eligibility etc.

Basic eligibility criteria

(1) It is a policy objective that an entity is not eligible to be granted a basic market milk payment right unless:

(a) the entity has been granted a payment right under the DSAP scheme in respect of a dairy farm enterprise (the qualifying enterprise ); and

(b) the entity held an interest (of a kind referred to in the SDA scheme) in that enterprise, or in any other dairy farm enterprise, at a time referred to in the SDA scheme; and

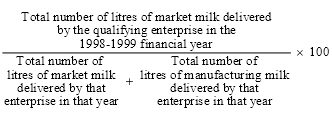

(c) the number (the market milk number ) worked out in accordance with the following formula is at least 25.1 (rounding to 1 decimal place and rounding up if the second decimal place is 5 or more):

Note: See also subclause ( 4) for how those delivery numbers are worked out.

Calculation of face value

(2) It is a policy objective that the face value of an entity's basic market milk payment right is to be a share (worked out in accordance with the SDA scheme) of the overall market milk amount for the qualifying enterprise.

Interpretation

(3) For the purposes of this clause, the overall market milk amount for the qualifying enterprise is:

(a) if the market milk number is at least 25.1 and less than 30.1--$10,000; or

(b) if the market milk number is at least 30.1--$15,000.

(4) A reference in this clause to the total number of litres of market milk, or the total number of litres of manufacturing milk, delivered by the qualifying enterprise in the 1998 - 1999 financial year is a reference to that number as determined by the DAA to have taken to have been delivered by that enterprise in that year.

(5) This clause is subject to clause 37V (about the effect of death on eligibility etc. for the grant of payment rights).

37E Additional market milk payment rights--eligibility etc.

Basic eligibility criteria

(1) It is a policy objective that an entity is not eligible to be granted an additional market milk payment right unless:

(a) the entity has been granted a payment right under the DSAP scheme in respect of a dairy farm enterprise (the qualifying enterprise ); and

(b) the entity held an interest (of a kind referred to in the SDA scheme) in that enterprise, or in any other dairy farm enterprise, at a time referred to in the SDA scheme; and

(c) the number (the market milk number ) worked out in accordance with the following formula is at least 35.1 (rounding to 1 decimal place and rounding up if the second decimal place is 5 or more):

Note: See also subclause ( 5) for how those delivery numbers are worked out.

Calculation of face value

(2) It is a policy objective that the face value of an entity's additional market milk payment right is to be a share (worked out in accordance with the SDA scheme) of the overall market milk amount for the qualifying enterprise.

Interpretation

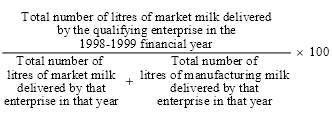

(3) For the purposes of this clause, the overall market milk amount for the qualifying enterprise is the amount worked out in accordance with the following formula:

where:

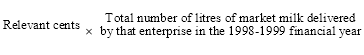

"relevant cents" means:

(a) if the market milk number is at least 45--12 cents; or

(b) if the market milk number is at least 35.1 and less than 45--the number of cents worked out in accordance with the following formula:

![]()

(4) However, if the amount calculated under subclause ( 3) is more than $60,000, then the overall market milk amount for the qualifying enterprise is taken to be $60,000.

(5) A reference in this clause to the total number of litres of market milk, or the total number of litres of manufacturing milk, delivered by the qualifying enterprise in the 1998 - 1999 financial year is a reference to that number as determined by the DAA to have taken to have been delivered by that enterprise in that year.

(6) This clause is subject to clause 37V (about the effect of death on eligibility etc. for the grant of payment rights).

37F Market milk payment rights--offsetting

(1) It is a policy objective that the face value of an entity's basic market milk payment right or additional market milk payment right is to be reduced if:

(a) the entity has been granted a payment right (the DSAP payment right ) under the DSAP scheme; and

(b) the conditions in paragraphs 51(1)(a), (b) and (c) of this Schedule are satisfied (about the DAA having made an error); and

(c) the DAA has been unable to cancel a number of units (the protected units ) in the DSAP payment right because of the operation of subclause 51(2).

(2) It is a policy objective that the amount of the reduction is to be equal to the total face value of the protected units.

(3) If the amount of the reduction would exceed the face value of the entity's basic market milk payment right or additional market milk payment right, then it is a policy objective that the face value of that payment right is to be reduced to zero.

37G Discretionary payment rights--eligibility

(1) It is a policy objective that an entity is not eligible to be granted a discretionary payment right unless the entity satisfies clause 37H or 37J.

(2) This clause is subject to clause 37V (about the effect of death on eligibility etc. for the grant of payment rights).

(1) An entity satisfies this clause if:

(a) the entity held an interest (of a kind referred to in the SDA scheme) in a dairy farm enterprise at any time during the period (the qualifying period ) beginning on 1 July 1998 and ending at 6.30 pm on 28 September 1999; and

(b) the entity is taken, under the SDA scheme, to have been affected by a significant event, a significant crisis or significant anomalous circumstances.

(2) For the purposes of this clause, dairy farm enterprise includes a business in Australia that is carried on with a view to delivering market milk and/or manufacturing milk during the qualifying period, but that did not deliver such milk during that period.

37J Discretionary payment rights--entity suffered a fall in lease income etc.

(1) An entity satisfies this clause if:

(a) the entity was granted a payment right under the DSAP scheme in respect of a lessor interest the entity held in a dairy farm enterprise; and

(b) the entity is not taken, under the SDA scheme, to have been affected by a significant event, a significant crisis or significant anomalous circumstances; and

(c) the entity passes the lease income test.

Cap

(2) It is a policy objective that the total face value of discretionary payment rights, granted in respect of a dairy farm enterprise to entities who satisfy this clause in relation to that enterprise, must not exceed an amount specified in the SDA scheme.

Interpretation

(3) For the purposes of this clause, an entity held a lessor interest in a dairy farm enterprise if:

(a) under the DSAP scheme, the enterprise was taken to be subject to an eligible dairy leasing arrangement; and

(b) under the DSAP scheme, the entity was taken to be a party to that arrangement as the lessor of land.

(4) For the purposes of this clause, an entity passes the lease income test if:

(a) both:

(i) more than 50% of the total gross income derived by the entity in the 1999 - 2000 financial year consisted of eligible lease income; and

(ii) the eligible lease income derived by the entity in the 2000 - 2001 financial year is at least 20% less than the eligible lease income derived by the entity in the 1999 - 2000 financial year; or

(b) both:

(i) more than 50% of the total gross income derived by the entity in the 1999 - 2000, 1998 - 1999 and 1997 - 1998 financial years consisted of eligible lease income; and

(ii) the eligible lease income derived by the entity in the 2000 - 2001 financial year is at least 20% less than the average of the eligible lease income derived by the entity in the 1999 - 2000, 1998 - 1999 and 1997 - 1998 financial years.

(5) For the purposes of this clause, the gross income derived by an entity is to be worked out in accordance with:

(a) generally accepted accounting principles; or

(b) if, under the SDA scheme, the generally accepted accounting principles are taken to be modified for the purposes of the scheme--those principles as so modified.

(6) For the purposes of this clause, eligible lease income has the same meaning as in the SDA scheme.

(1) It is a policy objective that each payment right under the SDA scheme is to be divided into units, where each unit has a face value of $32.

(2) It is a policy objective that the number of units into which a payment right is divided is to be worked out as follows:

(a) divide the number of dollars in the face value of the payment right by 32;

(b) if the result of the division is a whole number--that number is the number of units in the payment right;

(c) if the result of the division is less than 1--there is 1 unit in the payment right;

(d) if the result of the division is greater than 1, but is not a whole number:

(i) round the result of the division up or down to the nearest whole number (rounding up in the case exactly half - way between 2 whole numbers); and

(ii) the rounded number is the number of units in the payment right.

It is a policy objective that a payment right under the SDA scheme is to be granted subject to the powers of cancellation conferred on the DAA under the authority of clauses 50, 51 and 52 .

Note 1: Clause 50 deals with cancellation of units because of the making of a false statement.

Note 2: Clause 51 deals with cancellation of units because of an error made by the DAA.

Note 3: Clause 52 deals with cancellation of units because of a breach of an undertaking to dispose of the units.

It is a policy objective that SDA payments are not to be made in respect of a quarter that is later than the quarter ending on 30 June 2008.

Register

(1) It is a policy objective that the DAA is to include particulars of units in payment rights under the SDA scheme on the register referred to in clause 21.

Registration of ownership

(2) It is a policy objective that an entity's ownership of a unit is not to be counted for the purposes of the SDA scheme unless that ownership is entered on the register.

(3) It is a policy objective that the transfer of the ownership of a unit is not to be registered unless:

(a) the transferee is an eligible entity; or

(b) the transferee gives the DAA a written undertaking to assign the unit to an eligible entity within 60 days after the transfer is registered.

Note: For enforcement of the undertaking, see clause 52.

Registration of charges

(4) It is a policy objective that the SDA scheme may provide for the registration of charges over units.

Inspection of register

(5) It is a policy objective that an entry on the register relating to a unit is to be open for inspection in the following circumstances:

(a) the owner of the unit consents to the entry being open for inspection;

(b) such circumstances as are set out in the SDA scheme.

No declaration of trust in respect of unit

(6) It is a policy objective that:

(a) the owner of a unit must not dispose of a unit by way of declaration of trust; and

(b) if a purported disposal contravenes the rule in paragraph ( a), it is of no effect.

Beneficial interest in unit must not be transferred independently of legal interest

(7) It is a policy objective that:

(a) a beneficial interest in a unit must not be transferred independently of the legal interest in the unit; and

(b) if a purported transfer contravenes the rule in paragraph ( a), it is of no effect.

(8) In this clause:

"eligible entity" means an entity included in a class of entities declared by the SDA scheme to be entities who are eligible to become transferees of units.

(1) It is a policy objective that, in accordance with the SDA scheme, lump sum payments or quarterly payments will be paid to registered owners of units in payment rights under the scheme.

(2) It is a policy objective that, if an SDA payment is due to be paid to an entity, the payment may be recovered, as a debt due to the entity, by action in a court of competent jurisdiction.

(3) It is a policy objective that, if an individual is entitled to receive an SDA payment and the payment has not been made at the date of the death of the individual, the amount of that payment is payable to the legal personal representative of the individual.

37Q Conferral of administrative powers etc.

(1) The SDA scheme may make provision with respect to a matter by conferring on the DAA, or the Minister, a power to make a decision of an administrative character.

(2) If the SDA scheme confers on the Minister a power to make a decision of an administrative character, the scheme may also make provision for and in relation to the Minister delegating that power to the DAA.

(1) The SDA scheme must contain provisions for and in relation to the review of decisions of the DAA, or the Minister, under the scheme that affect an entity.

(2) Those provisions must provide for review by the Administrative Appeals Tribunal.

(3) Subclause ( 2) does not limit subclause ( 1).

(1) The SDA scheme may provide for fees.

(2) The amount of a fee under the SDA scheme must not be such as to amount to taxation.

The SDA scheme may provide for statements in claims to be verified by statutory declaration.

37U Methods by which SDA payments may be made

(1) The SDA scheme may make provision for the methods by which SDA payments may be made.

(2) The SDA scheme may require that SDA payments be made using an electronic funds transfer system.

(3) Subclause ( 2) does not limit subclause ( 1).

37V Adjustment of eligibility for payment rights etc.--death

The SDA scheme may make provision for and in relation to the adjustment of:

(a) eligibility for the grant of payment rights under the scheme; and

(b) the calculation of the face value of payment rights under the scheme;

in relation to the death of an individual who would have otherwise been eligible to be granted a payment right under the SDA scheme.

Note: For example, the SDA scheme may contain provisions setting out the eligibility of the trustee of the deceased estate, or of one or more beneficiaries in the estate, to be granted a payment right under the scheme and setting out the calculation of the face value of that right.

37W Ancillary or incidental provisions

The SDA scheme may contain such ancillary or incidental provisions as the Minister considers appropriate.

37X Scheme - making power not limited

Clauses 37C to 37W do not, by implication, limit clause 37B.

(1) The SDA scheme may be varied, but not revoked, in accordance with subsection 33(3) of the Acts Interpretation Act 1901 .

(2) Subclause ( 1) does not limit the application of subsection 33(3) of the Acts Interpretation Act 1901 to other instruments under this Act.

37Z Scheme to be a legislative instrument

An instrument under clause 37B is a legislative instrument .

37ZA Application to things happening before commencement

The use of the present tense in a provision of this Division does not imply that the provision does not apply to things happening before the commencement of this Division.

37ZB Use and disclosure of information obtained under the DSAP scheme

(1) An APP entity that holds a record that contains personal information that was obtained for the purposes of the administration of the DSAP scheme may use the information, or disclose the information to a person, body or agency, for the purposes of the administration of the SDA scheme.

(2) Unless the contrary intention appears, an expression used in this clause has the same meaning as in the Privacy Act 1988 .

Division 2 -- Information - gathering powers

38 DAA may obtain information and documents

(1) This clause applies to a person if the DAA has reason to believe that the entity:

(a) has information or a document that is relevant to the operation of the DSAP scheme or the SDA scheme; or

(b) is capable of giving evidence which the DAA has reason to believe is relevant to the operation of the DSAP scheme or the SDA scheme.

(2) The DAA may, by written notice given to the person, require the person:

(a) to give to the DAA, within the period and in the manner and form specified in the notice, any such information; or

(b) to produce to the DAA, within the period and in the manner specified in the notice, any such documents; or

(c) to make copies of any such documents and to produce to the DAA, within the period and in the manner specified in the notice, those copies; or

(d) if the person is an individual--to appear before the DAA at a time and place specified in the notice to give any such evidence, either orally or in writing, and produce any such documents; or

(e) if the person is a body corporate--to cause a competent officer of the body to appear before the DAA at a time and place specified in the notice to give any such evidence, either orally or in writing, and produce any such documents.

(3) A period specified under paragraph ( 2)(a), (b) or (c) must not be shorter than 14 days after the notice is given.

(4) A time specified under paragraph ( 2)(d) or (e) must be at least 14 days after the notice is given.

(5) A person commits an offence if:

(a) the person has been given a notice under subclause ( 2); and

(b) the person engages in conduct; and

(c) the person's conduct contravenes a requirement in the notice.

Note: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

(6) A notice under subclause ( 2) must set out the effect of the following provisions:

(a) subclause ( 5);

(b) clause 133;

(c) section 136.1 of the Criminal Code ;

(d) section 137.1 of the Criminal Code ;

(e) section 137.2 of the Criminal Code .

39 Copying documents--reasonable compensation

A person is entitled to be paid reasonable compensation for complying with a requirement covered by paragraph 38(2)(c).

(1) An individual is not excused from giving information or evidence or producing a document or a copy of a document under this Division on the ground that the information or evidence or the production of the document or copy might tend to incriminate the individual or expose the individual to a penalty.

(2) However:

(a) giving the information or evidence or producing the document or copy; or

(b) any information, document or thing obtained as a direct or indirect consequence of giving the information or evidence or producing the document or copy;

is not admissible in evidence against the individual in criminal proceedings other than:

(c) proceedings for an offence against subclause 38(5) or clause 133; or

(d) proceedings for an offence against section 136.1, 137.1 or 137.2 of the Criminal Code that relates to this Division.

(1) The DAA may inspect a document or copy produced under this Division and may make and retain copies of, or take and retain extracts from, such a document.

(2) The DAA may retain possession of a copy of a document produced in accordance with a requirement covered by paragraph 38(2)(c).

(1) The DAA may take, and retain for as long as is necessary, possession of a document produced under this Division.

(2) The person otherwise entitled to possession of the document is entitled to be supplied, as soon as practicable, with a copy certified by the DAA to be a true copy.

(3) The certified copy must be received in all courts and tribunals as evidence as if it were the original.

(4) Until a certified copy is supplied, the DAA must provide the person otherwise entitled to possession of the document, or a person authorised by that person, reasonable access to the document for the purposes of inspecting and making copies of, or taking extracts from, the document.

Division 3 -- Protection of confidentiality of information

43 Protection of confidentiality of information

(1) This clause restricts what a person (the entrusted person ) may do with protected information, or protected documents, that the person has obtained in the course of official employment.

(2) The entrusted person:

(a) must not make a record of protected information; and

(b) must not disclose it to anyone else;

if the recording or disclosure is not in accordance with subclause ( 3).

Penalty: Imprisonment for 2 years.

Note: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

(3) It is not an offence against subclause ( 2) if any of the following apply to the recording or disclosure:

(a) the recording or disclosure is for the purposes of this Part, the DSAP scheme or the SDA scheme or is otherwise required by any law of the Commonwealth;

(b) the recording or disclosure happens in the course of the performance of the duties of the entrusted person's official employment;

(c) the disclosure is not likely to enable the identification of a particular entity;

(d) both:

(i) the disclosure is to an entity who had an eligible interest in a dairy farm enterprise at 6.30 pm on 28 September 1999; and

(ii) the information relates to that enterprise.

Note: A defendant bears an evidential burden in relation to a matter in paragraph ( 3)(a) or (b) --see subsection 13.3(3) of the Criminal Code .

(4) Despite subsection 13.3(3) of the Criminal Code , the defendant does not bear an evidential burden in relation to a matter in paragraph ( 3)(c) or (d) of this clause.

(5) Unless it is necessary for the purposes of this Part, the DSAP scheme or the SDA scheme, the entrusted person is not to be required:

(a) to produce any protected document to a court; or

(b) to disclose protected information to a court.

(6) In this clause:

"disclose" means divulge or communicate.

"official employment" means:

(a) service as a DAA member; or

(b) the performance of services for the DAA; or

(c) the exercise of powers or performance of functions under a delegation by the DAA.

"protected document" means any document made or given under, or for the purposes of, this Part, the DSAP scheme or the SDA scheme.

"protected information" means information that meets all the following conditions:

(a) it relates to the affairs of a person other than the entrusted person;

(b) it was obtained by the entrusted person, or by any other person, in the course of official employment;

(c) it was disclosed or obtained for the purposes of this Part, the DSAP scheme or the SDA scheme.

"this Part" includes any other provision of this Schedule in so far as that other provision relates to this Part.

Division 4 -- Recovery of scheme debts

For the purposes of this Division, a scheme debt is so much of an amount paid, or purportedly paid, to an entity by way of a DSAP payment or an SDA payment as represents an overpayment.

45 Scheme debts are debts due to the industry services body

A scheme debt is a debt due to the industry services body.

46 Recovery by legal proceedings

(1) A scheme debt may be recovered by the DAA, on behalf of the industry services body, by action in a court of competent jurisdiction.

(2) An action under subclause ( 1) may be instituted by the DAA in its official name.

If an entity is liable to pay a scheme debt, the scheme debt may be deducted from one or more DSAP payments or SDA payments that are payable to the entity, and if the scheme debt is so deducted, the DSAP payment or SDA payment (as the case may be) is taken to have been paid in full to the entity.

48 Industry services body may collect money from a person who owes money to an entity

What this clause does

(1) This clause allows for the collection of money from a person who owes money to an entity that has a scheme debt.

The DAA may give direction

(2) The DAA may direct a person (the third party ) who owes, or may later owe, money (the available money ) to the entity to pay some or all of the available money to the industry services body in accordance with the direction. The DAA must give a copy of the direction to the entity.

Limit on directions

(3) The direction cannot require an amount to be paid to the industry services body at a time before it becomes owing by the third party to the entity.

Third party to comply

(4) The third party must comply with the direction.

Note: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

(5) The third party does not commit an offence against subclause ( 4) if the third party complies with the direction so far as the third party is able to do so.

Note: A defendant bears an evidential burden in relation to the matter in subclause ( 5). See subsection 13.3(3) of the Criminal Code .

Court orders

(6) If a person is convicted of an offence in relation to a refusal or failure of the third party to comply with subclause ( 4), the court may (in addition to imposing a penalty on the convicted person) order the convicted person to pay to the industry services body an amount up to the amount involved in the refusal or failure of the third party.

Indemnity

(7) Any payment made by the third party under this clause is taken to have been made with the authority of the entity and of all other persons concerned, and the third party is indemnified for the payment.

Notice

(8) If the whole of the scheme debt of the entity is discharged before any payment is made by the third party, the DAA must immediately give notice to the third party of that fact.

(9) If a part of the scheme debt of the entity is discharged before any payment is made by the third party, the DAA must:

(a) immediately give notice to the third party of that fact; and

(b) make an appropriate variation to the direction; and

(c) give a copy of the varied direction to the entity.

When third party is taken to owe money

(10) The third party is taken to owe money to the entity if:

(a) money is due or accruing by the third party to the entity; or

(b) the third party holds money for or on account of the entity; or

(c) the third party holds money on account of some other person for payment to the entity; or

(d) the third party has authority from some other person to pay money to the entity;

whether or not the payment of the money to the entity is dependent on a pre - condition that has not been fulfilled.

49 Penalty for unpaid scheme debts

(1) If an amount of a scheme debt that is payable by an entity remains unpaid after the day by which it must be paid, the entity is liable to a penalty at the rate of 16% per year on the unpaid amount.

(2) The penalty is calculated from the day on which the amount becomes due to be paid.

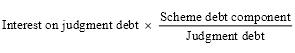

(3) The fact that a judgment is entered or given in a court for the payment of an amount of a scheme debt, or of a composite amount that includes an amount of a scheme debt, does not of itself cause the amount of a scheme debt to stop being unpaid for the purposes of this clause.

(4) If the judgment debt bears interest, the penalty payable under this clause is reduced (but not beyond nil) by the following amount:

where:

"scheme debt component" means so much of the judgment debt as consists of a scheme debt.

(5) For the purposes of this clause, the day on which a scheme debt is due to be paid is the day on which the DSAP payment or SDA payment concerned was paid.

(6) This clause does not apply to a scheme debt that is attributable (in whole or in part) to an error made by the DAA or the industry services body, where the DSAP payment or SDA payment concerned was received in good faith.

(7) The DSAP scheme or the SDA scheme (as the case may be) must empower the DAA to remit the whole or a part of an amount of penalty payable under this clause.

(8) A penalty payable under this clause may be recovered by the Commonwealth as a debt to the Commonwealth.

(9) This clause has no effect to the extent (if any) to which it imposes taxation (within the meaning of section 55 of the Constitution).

Division 5 -- Cancellation of units

50 Cancellation of units because of the making of a false statement

(1) If:

(a) before a payment right was granted, an entity made a false statement to a person who was exercising powers, or performing functions, under or in connection with this Part, the DSAP scheme or the SDA scheme; and

(b) either:

(i) the payment right was granted because of the making of the false statement; or

(ii) as a result of the making of the false statement, the face value of the payment right exceeds the proper amount of the face value;

the DSAP scheme or the SDA scheme (as the case may be) must authorise the DAA to:

(c) if subparagraph ( b)(i) applies--cancel all of the units in the payment right; or

(d) if subparagraph ( b)(ii) applies--cancel the number of units in the payment right worked out by:

(i) dividing the number of whole dollars in the amount of the excess by 32; and