Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

Commonwealth Electoral Act 1918

1 Subparagraph 304(5)(b)(ii)

Omit "less than $200", substitute "$10,000 or less".

2 Paragraph 304(5)(c)

Omit "less than $1,000", substitute "$10,000 or less".

3 At the end of subsection 304(5)

Add:

Note: The dollar amounts mentioned in this subsection are indexed under section 321A.

4 Paragraph 304(6)(b)

Omit "is equal to or exceeds $200", substitute "exceeds $10,000".

5 Paragraph 304(6)(c)

Omit "is equal to or exceeds $1,000", substitute "exceeds $10,000".

6 At the end of subsection 304(6)

Add:

Note: The dollar amounts mentioned in this subsection are indexed under section 321A.

7 Subsection 305B(1)

Omit "$1,500 or more", substitute "more than $10,000".

8 At the end of subsection 305B(1)

Add:

Note: The dollar amount mentioned in this subsection is indexed under section 321A.

9 Subsection 305B(3A)

Omit "$1,500 or more", substitute "more than $10,000".

10 Subsection 305B(3A)

Omit "is equal to or exceeds $1,000", substitute "exceeds $10,000".

11 At the end of subsection 305B(3A)

Add:

Note: The dollar amounts mentioned in this subsection are indexed under section 321A.

12 Subsections 306(1) and (2)

Repeal the subsections, substitute:

(1) It is unlawful for:

(a) a political party; or

(b) a State branch of a political party; or

(c) a person acting on behalf of a political party or a State branch of a political party;

to receive a gift made to or for the benefit of the party or branch by another person, being a gift the amount or value of which exceeds $10,000, unless:

(d) the name and address of the person making the gift are known to the person receiving the gift; or

(e) at the time when the gift is made:

(i) the person making the gift gives to the person receiving the gift his or her name and address; and

(ii) the person receiving the gift has no grounds to believe that the name and address so given are not the true name and address of the person making the gift.

Note: The dollar amount mentioned in this subsection is indexed under section 321A.

(2) It is unlawful for:

(a) a candidate; or

(b) a member of a group; or

(c) a person acting on behalf of a candidate or group;

to receive a gift made to or for the benefit of the candidate or the group, as the case may be, being a gift the amount or value of which exceeds $10,000, unless:

(d) the name and address of the person making the gift are known to the person receiving the gift; or

(e) at the time when the gift is made:

(i) the person making the gift gives to the person receiving the gift his or her name and address; and

(ii) the person receiving the gift has no grounds to believe that the name and address so given are not the true name and address of the person making the gift.

Note: The dollar amount mentioned in this subsection is indexed under section 321A.

13 Subsection 306A(1)

Omit "$1,500 or more", substitute "more than $10,000".

14 At the end of subsection 306A(1)

Add:

Note: The dollar amount mentioned in this subsection is indexed under section 321A.

15 Subsection 306A(2)

Omit "$1,500 or more", substitute "more than $10,000".

16 At the end of subsection 306A(2)

Add:

Note: The dollar amount mentioned in this subsection is indexed under section 321A.

17 Paragraph 306B(a)

Omit "is equal to or exceeds $1,000", substitute "exceeds $10,000".

18 At the end of section 306B

Add:

Note 3: The dollar amount mentioned in this section is indexed under section 321A.

19 Subsection 311A(2)

Omit "less than $1,500", substitute "$10,000 or less".

20 At the end of subsection 311A(2)

Add:

Note: The dollar amount mentioned in this subsection is indexed under section 321A.

21 Subsection 314AC(1)

Omit "$1,500 or more", substitute "more than $10,000".

22 At the end of subsection 314AC(1)

Add:

Note: The dollar amount mentioned in this subsection is indexed under section 321A.

23 Subsection 314AC(2)

Omit "less than $1,500", substitute "$10,000 or less".

24 At the end of subsection 314AC(2)

Add:

Note: The dollar amount mentioned in this subsection is indexed under section 321A.

25 Subsection 314AE(1)

Omit "$1,500 or more", substitute "more than $10,000".

26 At the end of subsection 314AE(1)

Add:

Note: The dollar amount mentioned in this subsection is indexed under section 321A.

27 At the end of Part XX

Add:

(1) This section applies to the dollar amounts mentioned in the following provisions:

(a) subparagraph 304(5)(b)(ii);

(b) paragraph 304(5)(c);

(c) paragraphs 304(6)(b) and (c);

(d) section 305A;

(e) subsections 305B(1) and (3A);

(f) subsections 306(1) and (2);

(g) subsections 306A(1) and (2);

(h) paragraph 306B(a);

(i) subsection 311A(2);

(j) subsections 314AC(1) and (2);

(k) subsection 314AE(1).

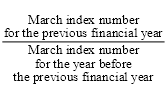

(2) The dollar amount mentioned in the provision, for an indexation year whose indexation factor is greater than 1, is replaced by the amount worked out using the following formula (rounded to the nearest $100):

![]()

(3) The dollar amount mentioned in the provision for an indexation year is not replaced in respect of a disclosure period in relation to an election if the indexation year begins between the issue of the writ for the election and the polling day for the election.

(4) The indexation factor for an indexation year is the number worked out using the following formula:

(5) The indexation factor is to be calculated to 3 decimal places, but increased by .001 if the fourth decimal place is more than 4.

(6) Calculations under subsection (4):

(a) are to be made using only the March index numbers published in terms of the most recently published reference base for the Consumer Price Index; and

(b) are to be made disregarding March index numbers that are published in substitution for previously published March index numbers (except where the substituted numbers are published to take account of changes in the reference base).

(7) In this section:

"indexation year" means the financial year commencing on 1 July 2006, and each subsequent financial year.

"March index number" means the All Groups Consumer Price Index number, being the weighted average of the 8 capital cities, published by the Australian Statistician in respect of the 3 months ending on 31 March.

28 At the end of subsection 321A(1)

Add:

; (m) paragraph 314AEB(1)(b);

(n) paragraph 314AEC(1)(c);

(o) subsection 314AEC(2).

29 Application of this Schedule

(1) The amendments made by this Schedule (other than item 28) apply to:

(a) that part of the 2005 - 06 financial year that commences on the day on which the Bill for this Act is introduced into the Parliament; and

(b) later financial years.

(2) The amendment made by item 28 applies to the 2006 - 07 financial year and later financial years.