Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts1 Point 1068 - G11

Omit "70%", substitute "60%".

2 Point 1068 - G11 (example)

Repeal the example, substitute:

Example:

Facts: Susan's partner Colin has an ordinary income of $800. Assume that the partner income free area under point 1068 - G9 is $640.

Application: Colin's ordinary income exceeds the partner income free area. He therefore has a partner income excess under point 1068 - G10 of:

![]()

Susan's partner income reduction under point 1068 - G11 is therefore:

![]()

3 Point 1068 - G15

Omit "$80", substitute "$188".

4 Point 1068 - G16

Omit "70%", substitute "60%".

5 Point 1068 - G16

Omit "$80", substitute "$188".

Part 2 -- Maximum basic rate for certain newstart allowance recipients

6 At the end of point 1068 - B1

Add:

Note 8: Some recipients of newstart allowance have a maximum basic rate based on the maximum basic rate under the Pension PP (Single) Rate Calculator (see point 1068 - B5).

7 After point 1068 - B4

Insert in Module B :

Maximum basic rate for certain newstart allowance recipients

1068 - B5 Despite point 1068 - B1, if a person:

(a) is not a member of a couple; and

(b) receives newstart allowance; and

(c) is not required to satisfy the activity test because of a determination in relation to the person under subsection 602C(3) or (3A) ;

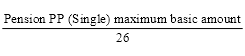

the person's maximum basic rate is the amount worked out as follows:

where:

"pension PP (Single) maximum basic amount" is the sum of:

(a) the amount that would have been the person's maximum basic rate under Module B of the Pension PP (Single) Rate Calculator if the person was receiving parenting payment; and

(b) the amount that would have been the person's pension supplement under Module BA of the Pension PP (Single) Rate Calculator if the person was receiving parenting payment.

Note 1: A person's maximum basic rate under Module B of the Pension PP (Single) Rate Calculator is indexed 6 monthly in line with increases in Male Total Average Weekly Earnings (see section 1195).

Note 2: A person's pension supplement amount under Module BA of the Pension PP (Single) Rate Calculator is indexed 6 monthly in line with CPI increases (see sections 1191 to 1194).

Part 3 -- Pharmaceutical allowance

8 Subparagraph ( c)(ii) of point 1068 - D1

Repeal the subparagraph, substitute:

(ii) the person is receiving widow allowance, newstart allowance or partner allowance and point 1068 - D2, 1068 - D2A, 1068 - D2B or 1068 - D3 applies to the person.

9 After point 1068 - D2A

Insert:

Newstart recipients who have a partial capacity to work or are principal carers

1068 - D2B This point applies to a person who is receiving newstart allowance if the person:

(a) has a partial capacity to work; or

(b) is the principal carer of at least one child and is not a member of a couple.

Note 1: For partial capacity to work see section 16B.

Note 2: For principal carer see subsections 5(15) to (24).

Part 4 -- Income maintenance periods

10 Point 1068 - G7AF

Omit "leave" (wherever occurring), substitute "termination".

Note: The heading to point 1068 - G7AF is altered by omitting " leave ".

11 Paragraph ( b) of point 1068 - G7AH

Omit "leave", substitute "termination".

Note: The heading to point 1068 - G7AH is replaced by the heading " Certain termination payments taken to be ordinary income ".

12 Point 1068 - G7AH

Omit "leave" (last occurring).

13 Paragraph ( b) of point 1068 - G7AJ

Omit "leave", substitute "termination".

Note: The heading to point 1068 - G7AJ is altered by omitting " leave " and substituting " termination ".

14 Point 1068 - G7AJ

Omit "leave" (last occurring).

15 Point 1068 - G7AKA

Omit "leave", substitute "termination".

16 Point 1068 - G7AKB

Omit "leave" (wherever occurring), substitute "termination".

Note: The heading to point 1068 - G7AKB is altered by omitting " leave payment--employment terminated " and substituting " termination payment ".

17 Paragraph ( a) of point 1068 - G7AL

After "leave payment", insert "or termination payment".

Note: The heading to point 1068 - G7AL is altered by inserting " or termination payments " after " Leave payments ".

18 Paragraphs ( b), (c) and (d) of point 1068 - G7AL

Omit "of leave".

19 Point 1068 - G7AN

After "leave payment", insert "or termination payment".

Note: The heading to point 1068 - G7AN is altered by inserting " or a termination payment " after " leave payment ".

20 Point 1068 - G7AP

Omit "leave" (first occurring), substitute "termination payments".

Note: The heading to point 1068 - G7AP is altered by omitting " leave--employment terminated " and substituting " termination payments ".

21 Point 1068 - G7AP

Omit "leave" (second occurring), substitute "termination payment".

22 Point 1068 - G7AP

Omit "leave" (last occurring).

23 Point 1068 - G7AQ

Insert:

"period to which the payment relates" means:

(a) if the payment is a leave payment--the leave period to which the payment relates; or

(b) if the payment is a redundancy payment and is calculated as an amount equivalent to an amount of ordinary income that the person would (but for the redundancy) have received from the employment that was terminated--the period for which the person would have received that amount of ordinary income; or

(c) if the payment is a redundancy payment and paragraph ( b) does not apply--the period of weeks (rounded down to the nearest whole number) in respect of which the person would have received ordinary income, from the employment that was terminated, of an amount equal to the amount of the redundancy payment if:

(i) the person's employment had continued; and

(ii) the person received ordinary income from the employment at the rate per week at which the person usually received ordinary income from the employment prior to the termination.

24 Point 1068 - G7AQ

Insert:

"redundancy payment" does not include a qualifying eligible termination payment within the meaning of Subdivision AA of Division 2 of Part III of the Income Tax Assessment Act 1936 .

25 Point 1068 - G7AQ (definition of roll - over )

After "leave payment", insert "or lump sum redundancy payment".

26 Point 1068 - G7AQ

Insert:

"termination payment" means:

(a) a leave payment relating to a person's employment that has been terminated; or

(b) a redundancy payment.

Note: The heading to point 1068 - G7 is replaced by the heading " Lump sum payments arising from termination of employment ".

27 Application

The amendments made by this Part apply in relation to termination payments to which a person becomes entitled, or that a person receives, on or after 20 September 2006.