Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Amendments relating to Family and Community Services' payment of utilities allowance

Income Tax Assessment Act 1997

1 Section 52 - 10 (after table item 31.1)

Insert:

31A.1 | Utilities | Exempt | Exempt | Not applicable | Not applicable |

2 Section 52 - 40 (after table item 31)

Insert:

31A | Utilities allowance | Part 2.25A | Not applicable | Not applicable |

3 Subsection 23(1)

Insert:

"utilities allowance" means utilities allowance under Part 2.25A.

4 After Part 2.25 of Chapter 2

Insert:

Part 2.25A -- Utilities allowance

Division 1 -- Qualification for and payability of utilities allowance

1061T Qualification for utilities allowance

A person is qualified for utilities allowance if the person:

(a) has reached pension age; and

(b) is receiving an income support payment; and

(c) either:

(i) is in Australia; or

(ii) is temporarily absent from Australia and has been so for a continuous period not exceeding 13 weeks.

1061TA When utilities allowance is payable

(1) Utilities allowance is payable to a person in relation to each utilities allowance test day on which the person is qualified for the allowance.

(2) However, utilities allowance is not payable to the person in relation to that day if:

(a) a service pension or an income support supplement is payable to the person on that day; or

(b) before that day, 2 instalments of any, or any combination, of the following allowances were payable to the person in the financial year in which that day occurs:

(i) utilities allowance under this Act;

(ii) utilities allowance under the Veterans' Entitlements Act;

(iii) seniors concession allowance under this Act;

(iv) seniors concession allowance under the Veterans' Entitlements Act; or

(c) before that day:

(i) the person had elected not to be covered by this Part; and

(ii) that election had not been withdrawn.

(3) In this section:

"utilities allowance test day" means:

(a) 20 March; and

(b) 20 September.

Division 2 -- Rate of utilities allowance

1061TB Rate of utilities allowance

A person's annual rate of utilities allowance is worked out using the following table:

Utilities allowance rate table | ||

Column 1 | Column 2 | Column 3 |

Item | Person's situation | Annual rate |

1 | not a member of a couple | $100 |

2 | member of an illness separated couple | $100 |

3 | member of a respite care couple | $100 |

4 | member of a temporarily separated couple | $100 |

5 | member of a couple (other than an illness separated couple, respite care couple or temporarily separated couple) | half the rate specified in column 3 of item 1 |

Note: The annual rates of utilities allowance are indexed twice a year in line with CPI increases (see sections 1191 to 1194).

5 Section 1190 (after table item 56)

Insert:

56A. | Rate of utilities allowance for a person who is not a member of a couple | UA "single" rate | [section 1061TB--Table--column 3--item 1] |

56B. | Rate of utilities allowance for a member of an illness separated couple | UA "partnered" (item 2) rate | [section 1061TB--Table--column 3--item 2] |

56C. | Rate of utilities allowance for a member of a respite care couple | UA "partnered" (item 3) rate | [section 1061TB--Table--column 3--item 3] |

56D. | Rate of utilities allowance for a member of a temporarily separated couple | UA "partnered" (item 4) rate | [section 1061TB--Table--column 3--item 4] |

6 Subsection 1191(1) (after table item 33)

Insert:

33AA | UA "single" rate | (a) 20 March (b) 20 September | (a) December (b) June | highest June or December quarter before reference quarter (but not earlier than June quarter 1991) | $0.40 |

33AB | UA "partnered" (item 2) rate | (a) 20 March (b) 20 September | (a) December (b) June | highest June or December quarter before reference quarter (but not earlier than June quarter 1991) | $0.40 |

33AC | UA "partnered" (item 3) rate | (a) 20 March (b) 20 September | (a) December (b) June | highest June or December quarter before reference quarter (but not earlier than June quarter 1991) | $0.40 |

33AD | UA "partnered" (item 4) rate | (a) 20 March (b) 20 September | (a) December (b) June | highest June or December quarter before reference quarter (but not earlier than June quarter 1991) | $0.40 |

7 After subsection 1192(5)

Insert:

(6) The first indexation of amounts under items 33AA, 33AB, 33AC and 33AD of the CPI Indexation Table in subsection 1191(1) is to take place on 20 September 2005.

Social Security (Administration) Act 1999

8 After section 12B

Insert:

A claim is not required for utilities allowance.

9 After section 48

Insert:

48A Payment of utilities allowance

(1) Utilities allowance is to be paid by instalments.

(2) If utilities allowance is payable to a person in relation to a utilities allowance test day, then an instalment of the allowance is to be paid to the person on the person's first payday on or after that test day.

(3) The amount of an instalment of utilities allowance is worked out by dividing the amount of the annual rate of utilities allowance by 2.

(4) In this section:

"utilities allowance test day" means:

(a) 20 March; and

(b) 20 September.

10 Subsection 55(1)

After "48", insert ", 48A".

11 Subsection 68(1)

After "payment", insert "(other than utilities allowance or seniors concession allowance)".

12 Subsection 69(1)

After "payment" (last occurring), insert "(other than utilities allowance or seniors concession allowance)".

13 Paragraph 75(1)(b)

After "payment", insert "(other than utilities allowance or seniors concession allowance)".

14 Before section 78

Insert:

78A When this Subdivision does not apply

This Subdivision does not apply in relation to utilities allowance and seniors concession allowance.

15 Before section 90

Insert:

90A When this Subdivision does not apply

This Subdivision does not apply in relation to utilities allowance and seniors concession allowance.

16 Section 123A (at the end of the definition of relevant payment )

Add:

; or (d) instalments of utilities allowance; or

(e) instalments of seniors concession allowance.

Part 2 -- Amendments relating to Veterans' Affairs' payment of utilities allowance

Income Tax Assessment Act 1997

17 Section 52 - 65 (after table item 20.1)

Insert:

20A.1 | Utilities allowance | Exempt | Not applicable |

18 Section 52 - 75 (after table item 20)

Insert:

20A | Utilities allowance | Part VIIAC | Not applicable |

19 After subparagraph 8(8)(y)(vii)

Insert:

(viia) utilities allowance under Part VIIAC of that Act; or

Veterans' Entitlements Act 1986

20 After paragraph 5H(8)(g)

Insert:

(ga) a payment under Part VIIAC (utilities allowance);

21 Subsection 5Q(1)

Insert:

"utilities allowance" means utilities allowance under Part VIIAC.

22 After Part VIIAB

Insert:

Part VIIAC -- Utilities allowance

Division 1 -- Eligibility for and payability of utilities allowance

In this Part:

"utilities allowance test day" means:

(a) 20 March; and

(b) 20 September.

118OA Eligibility for utilities allowance

(1) A person is eligible for utilities allowance if:

(a) the person has reached qualifying age (see subsection ( 2); and

(b) a service pension or an income support supplement is payable to the person; and

(c) the person:

(i) is in Australia; or

(ii) is temporarily absent from Australia and has been so for a continuous period not exceeding 13 weeks.

(2) For the purposes of paragraph ( 1)(a), the qualifying age for a person is:

(a) if the person is a veteran--the pension age for that person; or

(b) if the person is not a veteran--the age that would be the pension age for that person if he or she were a veteran.

Note: For pension age see section 5QA.

118OB When utilities allowance is payable

(1) Utilities allowance is payable to a person in relation to each utilities allowance test day on which the person is eligible for the allowance.

(2) However, utilities allowance is not payable to the person in relation to that day if:

(a) before that day, 2 instalments of any, or any combination, of the following allowances were payable to the person in the financial year in which that day occurs:

(i) utilities allowance under this Act;

(ii) utilities allowance under the Social Security Act;

(iii) seniors concession allowance under this Act;

(iv) seniors concession allowance under the Social Security Act; or

(b) before that day:

(i) the person had elected not to be covered by this Part; and

(ii) that election had not been withdrawn.

(3) An election, or a withdrawal of an election, under paragraph ( 2)(b):

(a) must be by document lodged at an office of the Department in Australia in accordance with section 5T; and

(b) is taken to have been made on a day determined under that section.

Division 2 -- Rate of utilities allowance

118OC Rate of utilities allowance

A person's annual rate of utilities allowance is worked out using the following table:

Utilities allowance rate table | ||

Column 1 | Column 2 | Column 3 |

Item | Person's situation | Annual rate |

1 | not a member of a couple | $100 |

2 | member of an illness separated couple | $100 |

3 | member of a respite care couple | $100 |

4 | member of a couple (other than an illness separated couple or a respite care couple) | half the rate specified in column 3 of item 1 |

Note: The annual rates of utilities allowance are indexed twice a year in line with CPI increases (see section 198E).

Division 3 -- Payment of utilities allowance

118OD Payment of utilities allowance by instalments

(1) Utilities allowance is to be paid by instalments.

(2) If utilities allowance is payable to a person in relation to a utilities allowance test day, then an instalment of the allowance is to be paid to the person on the person's first pension payday on or after that test day.

(3) The amount of an instalment of utilities allowance is worked out by dividing the amount of the annual rate of utilities allowance by 2.

(4) If the amount of the instalment is not a multiple of 10 cents, the amount is to be increased to the nearest multiple of 10 cents.

23 Subsection 121(7) (definition of pension )

Omit "or loss of earnings allowance under section 108", substitute ", loss of earnings allowance under section 108, utilities allowance under Part VIIAC or seniors concession allowance under Part VIIAD".

24 Subsection 128A(1) ( paragraph ( d) of the definition of income payment )

After "allowance", insert "(other than utilities allowance or seniors concession allowance)".

25 After section 198D

Insert:

198E Indexation of utilities allowance

Rates in table to be indexed under this section

(1) A rate referred to in the following table is to be indexed under this section on each indexation day for the rate, using the reference quarter and base quarter for the rate and indexation day and rounding off to the nearest multiple of the rounding base:

Indexation table | |||||

Column Item | Column Rate | Column Indexation days | Column Reference quarter (most recent before indexation day) | Column Base quarter | Column Rounding base |

1 | Rate of utilities allowance under item 1, column 3 of the table in section 118OC (single) | (a) 20 March (b) 20 September | (a) December (b) June | highest June or December quarter before reference quarter (but not earlier than June quarter 1991) | $0.40 |

2 | Rate of utilities allowance under item 2, column 3 of the table in section 118OC (illness separated couple) | (a) 20 March (b) 20 September | (a) December (b) June | highest June or December quarter before reference quarter (but not earlier than June quarter 1991) | $0.40 |

3 | Rate of utilities allowance under item 3, column 3 of the table in section 118OC (respite care couple) | (a) 20 March (b) 20 September | (a) December (b) June | highest June or December quarter before reference quarter (but not earlier than June quarter 1991) | $0.40 |

Indexed rate substituted for the previous rate

(2) If a rate is to be indexed under this section on an indexation day, this Act has effect as if the indexed rate were substituted for that rate on that day.

How to work out the indexed rate

(3) This is how to work out the indexed rate for a rate that is to be indexed under this section on an indexation day:

Method statement

Step 1. Use subsections ( 4), (5) and (6) to work out the indexation factor for the rate on the indexation day.

Step 2. Work out the current figure for the rate immediately before the indexation day.

Step 3. Multiply the current figure by the indexation factor: the result is the provisional indexed rate .

Step 4. Use subsections ( 7), (8) and (9) to round off the provisional indexed rate: the result is the indexed rate .

Note: For current figure see subsection ( 12).

Indexation factor

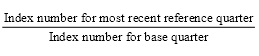

(4) Subject to subsections ( 5) and (6), the indexation factor for a rate that is to be indexed under this section on an indexation day is:

worked out to 3 decimal places.

Note 1: For index number see subsection ( 12).

Note 2: For reference quarter and base quarter see the table in subsection ( 1).

(5) If an indexation factor worked out under subsection ( 4) would, if it were worked out to 4 decimal places, end in a number that is greater than 4, the indexation factor is to be increased by 0.001.

(6) If an indexation factor worked out under subsections ( 4) and (5) would be less than 1, the indexation factor is to be increased to 1.

Rounding

(7) If a provisional indexed rate is a multiple of the rounding base, the provisional indexed rate becomes the indexed rate.

Note: For provisional indexed rate see step 3 in subsection ( 3).

(8) Subject to subsection ( 9), if a provisional indexed rate is not a multiple of the rounding base, the indexed rate is the provisional indexed rate rounded up or down to the nearest multiple of the rounding base.

(9) If a provisional indexed rate is not a multiple of the rounding base but is a multiple of half the rounding base, the indexed rate is the provisional indexed rate rounded up to the nearest multiple of the rounding base.

When first indexation is to take place

(10) The first indexation of the rates specified in items 1, 2 and 3 of the table in subsection ( 1) is to take place on 20 September 2005.

(11) Subsections 198D(2) and (3) also apply for the purposes of this section.

Definitions

(12) In this section:

"current figure" , as at a particular time and in relation to a rate that is to be indexed under this section, means:

(a) if the rate has not yet been indexed under this section before that time--the rate; and

(b) if the rate has been indexed under this section before that time--the rate most recently substituted for the rate under this section before that time.

"highest of a group of quarters" , in relation to a group of quarters, means the quarter in that group that has the highest index number.

"index number" , in relation to a quarter, means the All Groups Consumer Price Index number that is the weighted average of the 8 capital cities and is published by the Australian Statistician in respect of that quarter.