Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Increasing allowable percentage and annual limit

A New Tax System (Family Assistance) Act 1999

1 Section 84A (method statement, step 4, formula)

Omit "30%", substitute "50%".

2 At the end of subsection 84F(1)

Add:

; and (c) for the income year ending on 30 June 2009--$7,500.

3 Subsection 84F(2)

Omit "1 July 2008", substitute "1 July 2009".

4 Subclause 3(6) of Schedule 4

Omit "1 July 2008", substitute "1 July 2009".

5 Application of item 1

The amendment made by item 1 applies in relation to care provided by an approved child care service to a child on or after 1 July 2008.

Part 2 -- Paying child care tax rebate quarterly

A New Tax System (Family Assistance) Act 1999

6 Before section 57F

Insert:

57EA Eligibility for child care tax rebate--for a quarter

(1) An individual is eligible for child care tax rebate for a quarter in respect of a child if:

(a) a determination is in force:

(i) under section 50F of the Family Assistance Administration Act; and

(ii) during at least one week that falls wholly or partly in the quarter;

to the effect that the individual is conditionally eligible for child care benefit by fee reduction in respect of the child; and

(b) one or more sessions of care are provided by one or more approved child care services to the child during the week; and

(c) under Subdivision G of Division 4, one or more of the following is the weekly limit of hours applicable to the individual in the week:

(i) the 50 hour limit (see section 54);

(ii) the more than 50 hour limit (see section 55);

(iii) the 24 hour care limit under section 56; and

(d) the Secretary has calculated an amount of fee reduction under subsection 50Z(1) of the Family Assistance Administration Act in respect of the individual and the child for at least one of those sessions of care provided in the week; and

(e) the amount referred to in paragraph (d) is:

(i) an amount greater than a nil amount; or

(ii) a nil amount because the CCB % applicable to the individual is zero %.

Note 1: If one of the paragraph (c) limits applies, the individual satisfies the paragraph (c) condition, even if the individual has not used child care for the child during the week up to the full extent of the limit.

Note 2: For the purposes of paragraph (d), it does not matter if the amount is later recalculated under subsection 50ZA(1) of the Family Assistance Administration Act.

(2) If:

(a) a limit mentioned in paragraph (1)(c) does not apply under a determination in force under section 50H of the Family Assistance Administration Act for the individual and the child in the week; but

(b) the circumstances in which such a limit applies were applicable to the individual in that week;

then that limit is taken, for the purposes of that paragraph, to be the weekly limit of hours applicable to the individual in the week.

Note: If the only limit applicable to the individual in the week was the limit of 24 hours under subsection 53(3), then the condition in paragraph (1)(c) will not be satisfied.

(3) The 50 hour limit is taken, for the purposes of paragraph (1)(c), to be applicable to the individual in the week if it would have been applicable to the individual in the week but for the fact that the individual failed to meet the requirements of paragraph 17A(1)(b) in relation to the week.

Note: The heading to section 57F is altered by adding at the end " --for an income year ".

7 Before section 84A

Insert:

Subdivision A -- Child care tax rebate for a quarter

84AA Amount of the child care tax rebate--for a quarter

If the Secretary must, under subsection 65EAA(1) of the Family Assistance Administration Act, calculate the amount of child care tax rebate applicable in respect of an individual and a child for a quarter in an income year, the amount is worked out as follows:

Method statement

Step 1. Work out the total amount of the individual's approved child care fees for the child in each base week for the individual and the child in the quarter.

Step 2. Work out the total amount (if any) of so much of the fee reductions:

(a) calculated under subsection 50Z(1) of the Family Assistance Administration Act; or

(b) recalculated under subsection 50ZA(1) of that Act;

in respect of the individual and the child as are attributable to each base week in the quarter.

Step 3. Work out the total amount of Jobs Education and Training (JET) Child Care fee assistance (if any) that the individual is eligible to receive for the child in each base week for the individual and the child in the quarter.

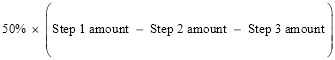

Step 4. Work out the lesser of the following amounts for the child:

(a) the amount worked out using the formula:

(b) the amount worked out by subtracting the total of the child care tax rebate (if any) applicable in respect of the individual and the child for each earlier quarter in the income year from the child care tax rebate limit for the income year.

Step 5. The result is the amount of the individual's child care tax rebate for the child for the quarter.

84AB Component of formula-- approved child care fees

General rule--approved child care fees for a base week for an individual and a child

(1) For the purposes of section 84AA, the amount of an individual's approved child care fees for a child in a base week for the individual and the child is the amount of fees for which:

(a) the individual; or

(b) the individual's partner during the week;

is liable for care provided by an approved child care service or services for the child during the week. For this purpose, disregard the weekly limit of hours applicable to the individual in the week.

Special rule if the week is also a base week for the individual's partner for the child

(2) However, the individual's approved child care fees for the week do not include fees that the individual's partner is liable to pay if the base week is also a base week for the individual's partner and the child.

Disregard amounts passed on to reduce fees

(3) For the purposes of this section, disregard any amount passed on to the individual under section 219B of the Family Assistance Administration Act.

84AC Component of formula-- base week

For the purposes of section 84AA, a week is a base week for an individual for a child in a quarter if:

(a) all or part of the week falls within the quarter; and

(b) paragraphs 57EA(1)(b) to (e) (as affected by subsections 57EA(2) and (3)) are satisfied for the individual, the child and the week.

Subdivision B -- Child care tax rebate for an income year

Note: The heading to section 84A is altered by adding at the end " --for an income year ".

8 Subsection 84B(1)

Omit "The", substitute "For the purposes of section 84A, the".

9 Section 84C

Omit "A week", substitute "For the purposes of section 84A, a week".

10 After section 84D

Insert:

Subdivision C -- Common components of each formula

11 Section 84E

Before " Jobs ", insert "For the purposes of sections 84AA and 84A,".

Note: The heading to section 84E is altered by inserting " each " before " formula ".

12 Subsection 84F(1)

Omit "The", substitute "For the purposes of sections 84AA and 84A, the".

Note: The heading to section 84F is altered by inserting " each " before " formula ".

A New Tax System (Family Assistance) (Administration) Act 1999

13 Before Subdivision A of Division 4AA of Part 3

Insert:

Subdivision AA -- Quarterly payments of child care tax rebate

65EAA Quarterly payments of child care tax rebate

When Secretary must calculate and pay quarterly payments

(1) If:

(a) the Secretary is satisfied that an individual is eligible under subsection 57EA(1) of the Family Assistance Act for child care tax rebate for a quarter in respect of a child; and

(b) the quarter has passed;

the Secretary must calculate the amount of the rebate which the Secretary considers is applicable in respect of the individual and the child for the quarter.

Note: The calculation is made in accordance with section 84AA of the Family Assistance Act.

(2) The Secretary must pay the amount of child care tax rebate calculated under subsection (1) to the individual at such time as the Secretary considers appropriate and to the credit of a bank account nominated and maintained by the individual.

Secretary may make direction as to the manner of making payments

(3) The Secretary may direct that the whole or a part of an amount that is to be paid under this section is to be paid in a different way from that provided for by subsection (2). If the Secretary gives the direction, the amount is to be paid in accordance with the direction.

(4) This section is subject to Part 4 and to Division 3 of Part 8B.

65EAB Revising a calculation of quarterly child care tax rebate

(1) The Secretary may recalculate an amount of child care tax rebate which the Secretary considers applicable:

(a) under subsection 65EAA(1); or

(b) under a previous application of this subsection;

in respect of an individual and a child for a quarter, so long as a determination of entitlement has not been made under Subdivision A in respect of the individual and child for the income year that includes the quarter.

(2) If:

(a) an amount of child care tax rebate applicable under this Subdivision in respect of an individual and a child for a quarter has been paid to the individual; and

(b) a recalculation under subsection (1) increases the amount of child care tax rebate applicable in respect of the individual and the child for the quarter;

then subsections 65EAA(2) to (4) apply to the increase as if the increase were the amount applicable under subsection 65EAA(1).

(3) If:

(a) an amount of child care tax rebate applicable under this Subdivision in respect of an individual and a child for a quarter has been paid to the individual; and

(b) a recalculation under subsection (1) decreases the amount of child care tax rebate applicable in respect of the individual and the child for the quarter;

the Secretary may set off all or a part of the decrease against an amount of child care tax rebate applicable under this Subdivision in respect of the individual and the child for a later quarter in the same income year.

65EAC Notices relating to quarterly payments of child care tax rebate

(1) The Secretary must give notice of an amount of child care tax rebate (the rebate amount ) applicable under this Subdivision to the individual, stating:

(a) the child's name and the quarter in respect of which the rebate amount is applicable; and

(b) the rebate amount; and

(c) the total amount of the individual's approved child care fees for the child worked out under step 1 of the method statement in section 84AA of the Family Assistance Act when calculating the rebate amount; and

(d) the total amount (if any) of fee reductions worked out under step 2 of the method statement in section 84AA of the Family Assistance Act when calculating the rebate amount; and

(e) if the rebate amount is the result of a recalculation covered by subsection 65EAB(2)--the amount of the increase in rebate as a result of the recalculation; and

(f) if the rebate amount is the result of a recalculation covered by subsection 65EAB(3)--the amount of the decrease in rebate as a result of the recalculation, and whether an amount will be set off as described in that subsection.

(2) The calculation and payment of an amount of child care tax rebate applicable under this Subdivision is not ineffective by reason only that any, or all, of the requirements of subsection (1) are not complied with.

14 Subsection 65EF(1)

Omit "or 65EB", substitute ", 65EB or 65EC".

15 Subsection 65EF(2)

Repeal the subsection, substitute:

(2) Subsection (1) has effect subject to subsections (2A), (2B) and (2C).

(2A) If the determination of entitlement is made under section 65EA, the Secretary must reduce the amount to be paid under subsection (1) by the amount of any child care tax rebate already paid under Subdivision AA in respect of the individual and the child for a quarter included in the income year.

(2B) If:

(a) the determination of entitlement is made under section 65EC; and

(b) when working out the amount of the entitlement under section 84A of the Family Assistance Act, the base weeks included one or more base weeks for which a determination under section 51B, or subsection 51C(1), was applicable;

the Secretary must reduce the amount to be paid under subsection (1) by the amount of any child care tax rebate already paid:

(c) under Subdivision AA in respect of the individual and the child for a quarter included in the income year; and

(d) under subsection (1) in respect of the individual and the child for the income year.

(2C) If the determination of entitlement is made under section 65EC in a case not covered by subsection (2B), the Secretary must reduce the amount to be paid under subsection (1) by the amount of any child care tax rebate already paid under subsection (1) in respect of the individual and the child for the income year.

16 Subsection 65EF(3)

Omit "or (2)".

17 After paragraph 66(2)(a)

Insert:

(aa) subsections 65EAA(3) and 65EF(3) (about payment of child care tax rebate in a different way); and

(ab) subsection 65EAB(3) (about setting off a decrease in a quarterly amount of child care tax rebate against rebate for a later quarter); and

18 Subsection 93A(6) (paragraph (bb) of the definition of family assistance payment )

After "section", insert "65EAA (including as that section applies because of subsection 65EAB(2)) or".

19 After paragraph 104(1)(d)

Insert:

(da) a calculation of an amount of child care tax rebate for a quarter under section 65EAA, or a recalculation of such an amount under section 65EAB; or

20 After paragraph 108(2)(da)

Insert:

(db) a calculation of an amount of child care tax rebate for a quarter under section 65EAA, or a recalculation of such an amount under section 65EAB; or

21 Paragraph 154(4A)(c)

After "eligible", insert "under subsection 57EA(1) or 57F(1) of the Family Assistance Act".

22 Paragraph 154(4A)(d)

Omit all the words after "amount of", substitute:

child care tax rebate:

(i) applicable to an individual under Subdivision AA of Division 4AA of Part 3; or

(ii) to which an individual is entitled.

23 At the end of paragraph 173(1)(d)

Add:

; or (vi) affects, or might affect, eligibility for child care tax rebate under subsection 57EA(1) of the Family Assistance Act, or the amount of child care tax rebate applicable under Subdivision AA of Division 4AA of Part 3.

24 Paragraph 175(a)

After "family assistance", insert "(other than child care tax rebate for a quarter under Subdivision AA of Division 4AA of Part 3)".

25 After section 175

Insert:

175AA Obtaining child care tax rebate for a quarter if ineligible

A person contravenes this section if:

(a) the person obtains a payment of child care tax rebate for a quarter under Subdivision AA of Division 4AA of Part 3; and

(b) the person does so knowing that he or she is:

(i) ineligible for the payment; or

(ii) only eligible for part of the payment.

26 Subsection 224(1)

Omit "affecting".

27 Paragraphs 224(1)(a) and (b)

Before "a person's", insert "affecting".

28 Paragraph 224(1)(c)

Before "a weekly", insert "affecting".

29 At the end of paragraph 224(1)(c)

Add "or".

30 After paragraph 224(1)(c)

Insert:

(ca) about the amount of child care tax rebate applicable in respect of a person and a child for a quarter under Subdivision AA of Division 4AA of Part 3;

31 Subsection 224(2)

Omit "affecting a matter referred to in paragraph (1) (a), (b) or (c)", substitute "affecting or about a matter referred to in paragraph (1)(a), (b), (c) or (ca)".

32 Application

The amendments made by this Part apply in relation to care provided by an approved child care service to a child on or after 1 July 2008.

33 Definitions

In this Division:

Administration Act means the A New Tax System (Family Assistance) (Administration) Act 1999 .

Assistance Act means the A New Tax System (Family Assistance) Act 1999 .

34 When this Division applies

This Division applies if:

(a) one or more sessions of care are provided by an approved child care service to a child during a week that falls wholly or partly in a quarter; and

(b) the service's application day (within the meaning of item 91 of Schedule 1 to the Family Assistance Legislation Amendment (Child Care Management System and Other Measures) Act 2007 ) has not happened before the last week that falls wholly or partly in the quarter.

35 Changed effect of the Assistance Act

(1) The Assistance Act has effect in relation to that care as if paragraph 57EA(1)(d) of that Act were as follows:

(d) the service has calculated an amount of fee reductions under section 219A of the Family Assistance Administration Act applicable to the individual and the child for at least one of those sessions of care provided in the week; and

(2) The Assistance Act has effect in relation to that care as if note 3 at the end of subsection 57EA(1) of that Act were omitted.

(3) The Assistance Act has effect in relation to that care as if the total amount to be worked out under step 2 of the method statement in section 84AA of that Act also included so much of the fee reductions:

(a) reported under subsection 219N(1) or 219P(1) of the Family Assistance Administration Act; and

(b) made in respect of the individual and the child;

as are attributable to each base week in the quarter.

Note: Those fee reductions may be nil (see section 4A of the Administration Act (as replaced by subitem 36(1))).

(4) The Assistance Act has effect in relation to that care as if subsection 84AB(3) of that Act were as follows:

If fee reduction applies, count unreduced amount of fees

(3) If fees for child care by an approved child care service have been reduced under Division 1 of Part 8A of the Family Assistance Administration Act, then for the purposes of this section, a reference to the fees for which the individual, or the individual's partner, is liable is taken to be a reference to the fees for which the individual, or the individual's partner, would have been liable for the care if they had not been so reduced.

36 Changed effect of the Administration Act

(1) The Administration Act has effect in relation to that care as if section 4A of that Act were as follows:

4A Rate and amount of CCB by fee reduction may be zero

For the purposes of this Act and the Family Assistance Act:

(a) a rate calculated under column 2 of the table in section 219A may be a zero rate; and

(b) an amount calculated under column 2 of the table in section 219A may be a nil amount.

(2) The Administration Act has effect in relation to that care as if the following paragraph were inserted after paragraph 65EAA(1)(b) of that Act:

; and (c) the Secretary is given a report under subsection 219N(1) or 219P(1) in respect of the individual and the child for at least one session of care provided to the child during a week for which the individual is so eligible for child care rebate in respect of the child;

37 Interpretation

(1) In this Division:

Administration Act means the A New Tax System (Family Assistance) (Administration) Act 1999 .

Assistance Act means the A New Tax System (Family Assistance) Act 1999 .

(2) For the purposes of this Division, section 219N of the Administration Act applies with the effect it has under item 96 of Schedule 1 to the Family Assistance Legislation Amendment (Child Care Management System and Other Measures) Act 2007 .

38 When this Division applies

This Division applies if:

(a) one or more sessions of care are provided by an approved child care service to a child during a week that falls wholly or partly in a quarter; and

(b) the service's application day (within the meaning of item 91 of Schedule 1 to the Family Assistance Legislation Amendment (Child Care Management System and Other Measures) Act 2007) happens during the quarter (other than during the last week that falls wholly or partly in the quarter).

39 Changed effect of the Assistance Act

(1) The Assistance Act has effect in relation to that care as if subsection 3(1) of that Act included the following definition:

application day , for an approved child care service, has the meaning given by item 91 of Schedule 1 to the Family Assistance Legislation Amendment (Child Care Management System and Other Measures) Act 2007.

(2) The Assistance Act has effect in relation to that care as if paragraph 57EA(1)(d) of that Act were as follows:

(d) either:

(i) if the week falls before or includes the service's application day--the service has calculated an amount of fee reductions under section 219A of the Family Assistance Administration Act applicable to the individual and the child for at least one of those sessions of care provided in the week; or

(ii) if the week falls wholly after the service's application day--the Secretary has calculated an amount of fee reduction under subsection 50Z(1) of the Family Assistance Administration Act in respect of the individual and the child for at least one of those sessions of care provided in the week; and

(3) The Assistance Act has effect in relation to that care as if note 3 at the end of subsection 57EA(1) of that Act were as follows:

Note 3: For the purposes of subparagraph (d)(ii), it does not matter if the amount is later recalculated under subsection 50ZA(1) of the Family Assistance Administration Act.

(4) The Assistance Act has effect in relation to any sessions of that care that were provided in a base week in the quarter, where the week falls before or includes the service's application day, as if the total amount to be worked out under step 2 of the method statement in section 84AA of that Act for the quarter also included so much of the fee reductions:

(a) reported under subsection 219N(1) or 219P(1) of the Family Assistance Administration Act; and

(b) made in respect of the individual and the child;

as are attributable to that base week.

Note 1: Those fee reductions may be nil (see section 4A of the Administration Act (as replaced by subitem 40(1))).

Note 2: The normal application of step 2 of that method statement will include in the total amount the fee reductions calculated in respect of care provided in base weeks falling wholly after the service's application day. Those fee reductions may also be nil (see section 4A of the Administration Act as it applies to the service in the weeks after its application day).

(5) The Assistance Act has effect in relation to any sessions of that care that were provided in a week falling before, or including, the service's application day as if subsection 84AB(3) of that Act were as follows:

If fee reduction applies, count unreduced amount of fees

(3) If:

(a) an approved child care service provides care to the child; and

(b) fees for the care have been reduced under Division 1 of Part 8A of the Family Assistance Administration Act;

then for the purposes of this section, a reference to the fees for which the individual, or the individual's partner, is liable is taken to be a reference to the fees for which the individual, or the individual's partner, would have been liable for that care if they had not been so reduced.

40 Changed effect of the Administration Act

(1) The Administration Act has effect in relation to any sessions of that care that were provided in a week falling before, or including, the service's application day as if section 4A of that Act were as follows:

4A Rate and amount of CCB by fee reduction may be zero

For the purposes of this Act and the Family Assistance Act:

(a) a rate calculated under column 2 of the table in section 219A may be a zero rate; and

(b) an amount calculated under column 2 of the table in section 219A may be a nil amount.

(2) The Administration Act has effect in relation to that care as if the following paragraph were inserted after paragraph 65EAA(1)(b) of that Act:

; and (c) if the individual is so eligible in relation to at least one session of care provided by an approved child care service in a week falling before, or including, the service's application day--the Secretary is given a report under subsection 219N(1) or 219P(1) in respect of the individual and the child for the care;