Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

A New Tax System (Family Assistance) (Administration) Act 1999

1 Subsection 3(1)

Insert:

"indexed actual income" :

(a) for an individual in relation to family tax benefit--means the amount stated for the individual in a notice under subsection 20B(2); and

(b) for an individual in relation to child care benefit--means the amount stated for the individual in a notice under subsection 55AB(2).

2 Subsection 3(1)

Insert:

"indexed estimate" :

(a) for an individual in relation to family tax benefit--means the amount stated for the individual in a notice under subsection 20A(2); and

(b) for an individual in relation to child care benefit--means the amount stated for the individual in a notice under subsection 55AA(2).

3 At the end of paragraph 20(1)(d)

Add "and".

4 After paragraph 20(1)(d)

Insert:

(e) since the estimate was given, the Secretary has not given the individual a notice under subsection 20A(2) or 20B(2) with a start day that has arrived or passed;

Note: The heading to section 20 is altered by adding at the end " , indexed estimate or indexed actual income ".

5 After subsection 20(2)

Insert:

(2A) If:

(a) an individual's eligibility for, or rate of, family tax benefit is required to be determined for the purposes of this Division or Division 3; and

(b) information about the amount of adjusted taxable income needed for the determination of the eligibility or rate is not available (for example, because the taxable income of the individual or another individual cannot be known until after the end of the relevant income year); and

(c) the Secretary has given the individual a notice under subsection 20A(2) or 20B(2) with a start day that has arrived or passed; and

(d) since the notice was given, the individual has not given the Secretary an estimate of the individual's adjusted taxable income that the Secretary considers to be reasonable;

the Secretary may determine the individual's eligibility for, or rate of, family tax benefit on the basis of the indexed estimate or indexed actual income stated in the notice (or, if the Secretary has given the individual more than one such notice--the notice with the most recent start day).

Note: Section 20C affects the meaning of this provision for members of couples.

6 After section 20

Insert:

(1) The Secretary may calculate an indexed estimate for an individual under subsection (5), with a start day chosen by the Secretary, if:

(a) the individual is a claimant, or the partner of a claimant, for family tax benefit; and

(b) a determination is in force under which the claimant is entitled to be paid family tax benefit by instalment; and

(c) the determination includes a determination of the claimant's rate of family tax benefit worked out on the basis of a reasonable estimate of the claimant's adjusted taxable income, an indexed estimate for the claimant or an indexed actual income for the claimant.

Note: Section 20C affects the meaning of paragraph (c) for members of couples.

(2) If the Secretary calculates an indexed estimate for the individual, the Secretary may give the claimant a notice:

(a) stating the indexed estimate for the individual; and

(b) specifying the start day used in the Secretary's calculation (which must be at least 14 days after the day on which the notice is given).

(3) The Secretary must not give a notice under subsection (2) stating an indexed estimate for the individual with a start day in an income year if the Secretary has already given a notice under subsection (2) stating an indexed estimate for that individual with a start day in the same income year.

(4) A notice given to a claimant under subsection (2) stating an indexed estimate for an individual has no effect if, before the start day specified in the notice for the indexed estimate, the Secretary gives the claimant a notice under subsection 20B(2) stating an indexed actual income for the same individual. Any such notice under subsection 20B(2) must specify a start day that is no earlier than the start day specified in the superseded notice.

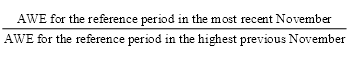

(5) Calculate an indexed estimate (which may be nil) for the individual by multiplying the individual's current ATI number (see subsection (6)) by the indexation factor, rounding the result to the nearest dollar and rounding 50 cents upwards. The indexation factor is the greater of 1 and the factor worked out to 3 decimal places as follows (increasing the factor by 0.001 if it would, if worked out to 4 decimal places, end in a number greater than 4):

where:

"AWE" means the amount published by the Australian Statistician in a document titled "Average Weekly Earnings" under the headings "Average Weekly Earnings, Australia --Original--Persons--All employees total earnings" (or, if any of those change, in a replacement document or under replacement headings).

"highest previous November" means the November in which, of all the Novembers from November 2004 to the November before the most recent November (inclusive), AWE was the highest.

"most recent November" means the November of the income year before the income year in which the start day occurs.

"reference period" , in a particular November, means the period described by the Australian Statistician as the last pay period ending on or before a specified day that is the third Friday of that November.

(6) For the purposes of subsection (5), the individual's current ATI number is:

(a) if, at the time of calculation, the Secretary has given the claimant a notice under subsection 20B(2) stating an indexed actual income for the individual with a start day that has not arrived--the indexed actual income stated in the notice; or

(b) if paragraph (a) does not apply and the individual is the claimant--the amount the Secretary is permitted to use for the individual under section 20 (disregarding the effect for couples of section 20C of this Act and clause 3 of Schedule 3 to the Family Assistance Act); or

(c) if paragraph (a) does not apply and the individual is the claimant's partner--the amount the Secretary would be permitted to use for the individual under section 20 if the individual were the claimant (disregarding the effect for couples of section 20C of this Act and clause 3 of Schedule 3 to the Family Assistance Act).

(7) A notice under subsection (2) is not a legislative instrument.

(1) The Secretary may calculate an indexed actual income for an individual under subsection (4), with a start day chosen by the Secretary, if:

(a) the individual is a claimant for, or the partner of a claimant for, family tax benefit; and

(b) a determination is in force under which the claimant is entitled to be paid family tax benefit by instalment; and

(c) the determination includes a determination of the claimant's rate of family tax benefit worked out on the basis of an indexed estimate for the claimant or an indexed actual income for the claimant; and

(d) since the claimant was last given a notice under subsection 20A(2) or subsection (2) of this section stating an indexed estimate or indexed actual income for an individual, the claimant has not given the Secretary an estimate of the claimant's adjusted taxable income that the Secretary considers to be reasonable; and

(e) the adjusted taxable income for an income year ( actual income ) of the individual (disregarding the effect for couples of clause 3 of Schedule 3 to the Family Assistance Act) becomes known to the Secretary and it is the most recent income year for which the individual's actual income is known to the Secretary.

Note: Section 20C affects the meaning of paragraph (1)(c) for members of couples.

(2) If:

(a) the Secretary calculates an indexed actual income for the individual; and

(b) the indexed actual income is greater than the individual's current ATI number (see subsection (5));

the Secretary may give the claimant a notice:

(c) stating the indexed actual income for the individual; and

(d) specifying the start day used in the Secretary's calculation (which must be at least 14 days after the day on which the notice is given).

(3) A notice given to a claimant under subsection (2) stating an indexed actual income for an individual has no effect if, before the start day specified in the notice, the Secretary gives the claimant another notice under that subsection or a notice under subsection 20A(2) stating an indexed estimate or indexed actual income for the same individual. Any other such notice must specify a start day that is no earlier than the start day specified in the superseded notice.

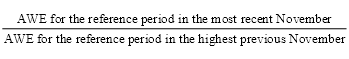

(4) Calculate an indexed actual income (which may be nil) for the individual by multiplying the actual income of the individual which became known to the Secretary by the indexation factor, rounding the result to the nearest dollar and rounding 50 cents upwards. The indexation factor is the greater of 1 and the factor worked out to 3 decimal places as follows (increasing the factor by 0.001 if it would, if worked out to 4 decimal places, end in a number greater than 4):

where:

"AWE" means the amount published by the Australian Statistician in a document titled "Average Weekly Earnings" under the headings "Average Weekly Earnings, Australia --Original--Persons--All employees total earnings" (or, if any of those change, in a replacement document or under replacement headings).

"highest previous November" means the November in which, of all the Novembers from November 2004 to the November before the most recent November (inclusive), AWE was the highest.

"most recent November" means the November of the income year before the income year in which the start day occurs.

"reference period" , in a particular November, means the period described by the Australian Statistician as the last pay period ending on or before a specified day that is the third Friday of that November.

(5) For the purposes of paragraph (2)(b), the individual's current ATI number is:

(a) if, at the time of calculation, the Secretary has given the claimant a notice under subsection 20A(2) or subsection (2) of this section stating an indexed estimate or indexed actual income for the individual with a start day that has not arrived--the indexed estimate or indexed actual income stated in the notice; or

(b) if paragraph (a) does not apply and the individual is the claimant--the amount the Secretary is permitted to use for the individual under section 20 (disregarding the effect for couples of section 20C of this Act and clause 3 of Schedule 3 to the Family Assistance Act); or

(c) if paragraph (a) does not apply and the individual is the claimant's partner--the amount the Secretary would be permitted to use for the individual under section 20 if the individual were the claimant (disregarding the effect for couples of section 20C of this Act and clause 3 of Schedule 3 to the Family Assistance Act).

(6) A notice under subsection (2) is not a legislative instrument.

20C Indexed estimates and indexed actual incomes of members of couples

Section applies to couples

(1) This section applies in relation to any individual who is a member of a couple.

Family tax benefit Part A

(2) For the purposes of the Family Assistance Act other than Part 4 of Schedule 1, any reference in this Act to eligibility for, or rate of, family tax benefit being determined or worked out on the basis of an indexed estimate, or an indexed actual income, for an individual or stated in a notice, is affected by subsection (3).

(3) The reference is taken to be a reference to eligibility for, or rate of, family tax benefit being determined or worked out on the basis of the indexed estimate, or the indexed actual income, for that individual or stated in that notice, combined with the most recent indexed estimate or indexed actual income for the individual's partner (see subsection (6)).

Family tax benefit Part B

(4) For the purposes of Part 4 of Schedule 1 to the Family Assistance Act, any reference in this Act to eligibility for, or rate of, family tax benefit being determined or worked out on the basis of an indexed estimate, or an indexed actual income, for an individual or stated in a notice, is affected by subsection (5).

(5) The reference is taken to be a reference to eligibility for, or rate of, family tax benefit being determined or worked out on the basis of the lower of these:

(a) the indexed estimate or indexed actual income for that individual or stated in that notice;

(b) the most recent indexed estimate or indexed actual income for the individual's partner (see subsection (6)).

If the amounts in paragraphs (a) and (b) are equal, the reference is taken to be a reference to:

(c) if the individual is the claimant for family tax benefit--the amount in paragraph (a); or

(d) if the individual is the partner of the claimant for family tax benefit--the amount in paragraph (b).

Most recent indexed estimate or indexed actual income for individual's partner

(6) In subsections (3) and (5), the most recent indexed estimate or indexed actual income for the individual's partner is the indexed estimate or indexed actual income for the individual's partner stated in a notice given to:

(a) if the individual is the claimant for family tax benefit--the individual; or

(b) if the individual is the partner of the claimant for family tax benefit--the individual's partner;

under subsection 20A(2) or 20B(2) with a start day that has arrived or passed (or, if the Secretary has given more than one such notice--the notice with the most recent start day).

7 Subsection 28A(2)

Omit "must", substitute "may".

8 Paragraphs 31A(1)(b) and (c)

Repeal the paragraphs, substitute:

(b) the determination includes a determination of the claimant's rate of family tax benefit worked out on the basis of a reasonable estimate of the claimant's adjusted taxable income, an indexed estimate for the claimant or an indexed actual income for the claimant; and

(c) the claimant provides the Secretary with a revised estimate of the claimant's adjusted taxable income for the current income year or the next income year that is not attributable to an event mentioned in paragraph 31(1B)(c) or (d); and

9 At the end of subsection 31A(1)

Add:

Note: Section 20C affects the meaning of paragraph (1)(b) for couples.

10 After section 31B

Insert:

(1) If:

(a) a determination is in force under which a claimant is entitled to be paid family tax benefit by instalment; and

(b) the Secretary gives the claimant a notice under subsection 20A(2); and

(c) the claimant does not, before the start day specified in the notice, give the Secretary an estimate of the claimant's adjusted taxable income that the Secretary considers to be reasonable; and

(d) if the claimant's rate of family tax benefit were calculated using the indexed estimate stated in the notice--a new rate of family tax benefit would be required;

the Secretary may vary the determination so that the claimant's rate of family tax benefit is determined on the basis of the indexed estimate stated in the notice.

Note: Section 20C affects the meaning of this provision for members of couples.

(2) The variation has effect:

(a) from the start day specified in the notice for the indexed estimate; or

(b) if the variation is made after that start day--from the later of the start day and the first day of the instalment period in which the variation is made.

(1) If:

(a) a determination is in force under which a claimant is entitled to be paid family tax benefit by instalment; and

(b) the Secretary gives the claimant a notice under subsection 20B(2); and

(c) the claimant does not, before the start day specified in the notice, give the Secretary an estimate of the claimant's adjusted taxable income that the Secretary considers to be reasonable; and

(d) if the claimant's rate of family tax benefit were calculated using the indexed actual income stated in the notice--a new rate of family tax benefit would be required;

the Secretary may vary the determination so that the claimant's rate of family tax benefit is determined on the basis of the indexed actual income stated in the notice.

Note: Section 20C affects the meaning of this provision for members of couples.

(2) The variation has effect:

(a) from the start day specified in the notice for the indexed actual income; or

(b) if the variation is made after that start day--from the later of the start day and the first day of the instalment period in which the variation is made.

11 At the end of paragraph 55(1)(e)

Add "and".

12 After paragraph 55(1)(e)

Insert:

(f) since the estimate was given, the Secretary has not given the individual a notice under subsection 55AA(2) or 55AB(2) with a start day that has arrived or passed;

13 At the end of section 55

Add:

(3) If:

(a) a CCB % applicable to a claimant who is an individual is required to be calculated under Schedule 2 to the Family Assistance Act for the purpose of varying a determination of CCB % under Subdivision M, N, P, R, S or V of Division 4 of this Part; and

(b) the information about an amount needed by the Secretary to calculate the CCB % applicable to the claimant is not available; and

(c) the Secretary has given the claimant a notice under subsection 55AA(2) or 55AB(2) with a start day that has arrived or passed; and

(d) since the notice was given, the claimant has not given the Secretary an estimate of the claimant's adjusted taxable income that the Secretary considers to be reasonable;

the Secretary may determine the CCB % applicable to the claimant on the basis of the indexed estimate or indexed actual income stated in the notice (or, if the Secretary has given the claimant more than one notice with a start day that has arrived or passed--the notice with the most recent start day).

Note: Section 55AC affects the meaning of this provision for members of couples.

Note: The heading to section 55 is altered by adding at the end " , indexed estimate or indexed actual income ".

14 After section 55

Insert:

(1) The Secretary may calculate an indexed estimate for an individual under subsection (5), with a start day chosen by the Secretary, if:

(a) the individual is a claimant, or the partner of a claimant, for child care benefit; and

(b) determinations of conditional eligibility under section 50F and of CCB % under section 50J are in force in respect of the claimant and the effect of the former determination is that the claimant is conditionally eligible for child care benefit by fee reduction; and

(c) the CCB % is worked out on the basis of an estimate of the claimant's adjusted taxable income, an indexed estimate for the claimant or an indexed actual income for the claimant.

Note: Section 55AC affects the meaning of paragraph (1)(c) for members of couples.

(2) If the Secretary calculates an indexed estimate for the individual, the Secretary may give the claimant a notice:

(a) stating the indexed estimate for the individual; and

(b) specifying the start day used in the Secretary's calculation (which must be a Monday at least 14 days after the day on which the notice is given).

(3) The Secretary must not give a notice under subsection (2) stating an indexed estimate for the individual with a start day in an income year if the Secretary has already given a notice under subsection (2) stating an indexed estimate for that individual with a start day in the same income year.

(4) A notice given to a claimant under subsection (2) stating an indexed estimate for an individual has no effect if, before the start day specified in the notice for the indexed estimate, the Secretary gives the claimant a notice under subsection 55AB(2) stating an indexed actual income for the same individual. Any such notice under subsection 55AB(2) must specify a start day that is no earlier than the start day specified in the superseded notice.

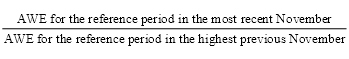

(5) Calculate an indexed estimate (which may be nil) for the individual by multiplying the individual's current ATI number (see subsection (6)) by the indexation factor, rounding the result to the nearest dollar and rounding 50 cents upwards. The indexation factor is the greater of 1 and the factor worked out to 3 decimal places as follows (increasing the factor by 0.001 if it would, if worked out to 4 decimal places, end in a number greater than 4):

where:

"AWE" means the amount published by the Australian Statistician in a document titled "Average Weekly Earnings" under the headings "Average Weekly Earnings, Australia --Original--Persons--All employees total earnings" (or, if any of those change, in a replacement document or under replacement headings).

"highest previous November" means the November in which, of all the Novembers from November 2004 to the November before the most recent November (inclusive), AWE was the highest.

"most recent November" means the November of the income year before the income year in which the start day occurs.

"reference period" , in a particular November, means the period described by the Australian Statistician as the last pay period ending on or before a specified day that is the third Friday of that November.

(6) For the purposes of subsection (5), the individual's current ATI number is:

(a) if, at the time of calculation, the Secretary has given the claimant a notice under subsection 55AB(2) stating an indexed actual income for the individual with a start day that has not arrived--the indexed actual income stated in the notice; or

(b) if paragraph (a) does not apply and the individual is the claimant--the amount the Secretary is permitted to use for the individual under section 55 (disregarding the effect for couples of section 55AC of this Act and clause 3 of Schedule 3 to the Family Assistance Act); or

(c) if paragraph (a) does not apply and the individual is the claimant's partner--the amount the Secretary would be permitted to use for the individual under section 55 if the individual were the claimant (disregarding the effect for couples of section 55AC of this Act and clause 3 of Schedule 3 to the Family Assistance Act).

(7) A notice under subsection (2) is not a legislative instrument.

(1) The Secretary may calculate an indexed actual income for an individual under subsection (4), with a start day chosen by the Secretary, if:

(a) the individual is a claimant for, or the partner of a claimant for, child care benefit; and

(b) determinations of conditional eligibility under section 50F and of CCB % under section 50J are in force in respect of the claimant and the effect of the former determination is that the claimant is conditionally eligible for child care benefit by fee reduction; and

(c) the CCB % is worked out on the basis of an indexed estimate for the claimant or an indexed actual income for the claimant; and

(d) since the claimant was last given a notice under subsection 55AA(2) or subsection (2) of this section stating an indexed estimate or indexed actual income for an individual, the claimant has not given the Secretary an estimate of the claimant's adjusted taxable income that the Secretary considers to be reasonable; and

(e) the adjusted taxable income for an income year ( actual income ) of the individual (disregarding the effect for couples of clause 3 of Schedule 3 to the Family Assistance Act) becomes known to the Secretary and it is the most recent income year for which the individual's actual income is known to the Secretary.

Note: Section 55AC affects the meaning of paragraph (1)(c) for members of couples.

(2) If:

(a) the Secretary calculates an indexed actual income for the individual; and

(b) the indexed actual income is greater than the individual's current ATI number (see subsection (5));

the Secretary may give the claimant a notice:

(c) stating the indexed actual income for the individual; and

(d) specifying the start day used in the Secretary's calculation (which must be a Monday at least 14 days after the day on which the notice is given).

(3) A notice given to a claimant under subsection (2) stating an indexed actual income for an individual has no effect if, before the start day specified in the notice, the Secretary gives the claimant another notice under that subsection or a notice under subsection 55AA(2) stating an indexed estimate or indexed actual income for the same individual. Any other such notice must specify a start day that is no earlier than the start day specified in the superseded notice.

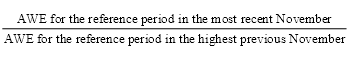

(4) Calculate an indexed actual income (which may be nil) for the individual by multiplying the actual income of the individual which became known to the Secretary by the indexation factor, rounding the result to the nearest dollar and rounding 50 cents upwards. The indexation factor is the greater of 1 and the factor worked out to 3 decimal places as follows (increasing the factor by 0.001 if it would, if worked out to 4 decimal places, end in a number greater than 4):

where:

"AWE" means the amount published by the Australian Statistician in a document titled "Average Weekly Earnings" under the headings "Average Weekly Earnings, Australia --Original--Persons--All employees total earnings" (or, if any of those change, in a replacement document or under replacement headings).

"highest previous November" means the November in which, of all the Novembers from November 2004 to the November before the most recent November (inclusive), AWE was the highest.

"most recent November" means the November of the income year before the income year in which the start day occurs.

"reference period" , in a particular November, means the period described by the Australian Statistician as the last pay period ending on or before a specified day that is the third Friday of that November.

(5) For the purposes of paragraph (2)(b), the individual's current ATI number is:

(a) if, at the time of calculation, the Secretary has given the claimant a notice under subsection 55AA(2) or subsection (2) of this section stating an indexed estimate or indexed actual income for the individual with a start day that has not arrived--the indexed estimate or indexed actual income stated in the notice; or

(b) if paragraph (a) does not apply and the individual is the claimant--the amount the Secretary is permitted to use for the individual under section 55 (disregarding the effect for couples of section 55AC of this Act and clause 3 of Schedule 3 to the Family Assistance Act); or

(c) if paragraph (a) does not apply and the individual is the claimant's partner--the amount the Secretary would be permitted to use for the individual under section 55 if the individual were the claimant (disregarding the effect for couples of section 55AC of this Act and clause 3 of Schedule 3 to the Family Assistance Act).

(6) A notice under subsection (2) is not a legislative instrument.

55AC Indexed estimates and indexed actual incomes for members of couples

(1) This section applies in relation to any individual who is a member of a couple.

(2) For the purposes of the Family Assistance Act, any reference in this Act to CCB % being determined or worked out on the basis of an indexed estimate, or an indexed actual income, for an individual or stated in a notice, is affected by subsection (3).

(3) The reference is taken to be a reference to CCB % being determined or worked out on the basis of the indexed estimate, or the indexed actual income, for that individual or stated in that notice, combined with the indexed estimate or indexed actual income for the individual's partner stated in a notice given to:

(a) if the individual is the claimant for child care benefit--the individual; or

(b) if the individual is the partner of the claimant for child care benefit--the individual's partner;

under subsection 55AA(2) or 55AB(2) with a start day that has arrived or passed (or, if the Secretary has given more than one such notice--the notice with the most recent start day).

15 Subsection 60E(1)

Omit "must", substitute "may".

16 Paragraphs 65B(1)(b) and (c)

Repeal the paragraphs, substitute:

(b) the CCB %:

(i) is worked out on the basis of an estimate of the claimant's adjusted taxable income, an indexed estimate for the claimant or an indexed actual income for the claimant; or

(ii) is varied under section 60E; and

(c) the claimant provides the Secretary with a revised estimate of the claimant's adjusted taxable income for the current income year or the next income year that is not attributable to an event mentioned in paragraph 65A(3)(a) or (b); and

17 At the end of subsection 65B(1)

Add:

Note: Section 55AC affects the meaning of subparagraph (1)(b)(i) for members of couples.

18 After section 65B

Insert:

(1) If:

(a) determinations of conditional eligibility under section 50F and of CCB % under section 50J are in force in respect of a claimant who is an individual and the effect of the former determination is that the individual is conditionally eligible for child care benefit by fee reduction; and

(b) the Secretary gives the claimant a notice under subsection 55AA(2); and

(c) the claimant does not, before the start day specified in the notice, give the Secretary an estimate of the claimant's adjusted taxable income that the Secretary considers to be reasonable; and

(d) if the claimant's CCB % were calculated using the indexed estimate stated in the notice--a new CCB % would be required;

the Secretary must vary the determination of CCB % so that it is determined on the basis of the indexed estimate stated in the notice.

Note: Section 55AC affects the meaning of this provision for members of couples.

(2) The variation has effect:

(a) from the start day specified in the notice; or

(b) if the variation is made after that start day--from the Monday after the variation is made.

65BB Variation of determination of CCB % to reflect indexation of adjusted taxable income

(1) If:

(a) determinations of conditional eligibility under section 50F and of CCB % under section 50J are in force in respect of a claimant who is an individual and the effect of the former determination is that the individual is conditionally eligible for child care benefit by fee reduction; and

(b) the Secretary gives the claimant a notice under subsection 55AB(2); and

(c) the claimant does not, before the start day specified in the notice, give the Secretary an estimate of the claimant's adjusted taxable income that the Secretary considers to be reasonable; and

(d) if the claimant's CCB % were calculated using the indexed actual income stated in the notice--a new CCB % would be required;

the Secretary must vary the determination of CCB % so that it is determined on the basis of the indexed actual income stated in the notice.

Note: Section 55AC affects the meaning of this provision for members of couples.

(2) The variation has effect:

(a) from the start day specified in the notice; or

(b) if the variation is made after that start day--from the Monday after the variation is made.

19 Subsection 219A(2) (table item 8, column 1)

Omit "or 65B", substitute ", 65B, 65BA or 65BB".

20 Application of amendments

The amendments made by this Schedule apply in relation to:

(a) family tax benefit for the 2006 - 2007 income year and later income years; and

(b) child care benefit for the 2006 - 2007 income year and later income years.