Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Amendments commencing on 6 December 2006

1 Subsection 2(1) (table item 3)

Repeal the item, substitute:

3. Schedule 2, items 1 to 91 | 1 July 2008. | 1 July 2008 |

3A. Schedule 2, items 92 to 96 | 1 January 2008. | 1 January 2008 |

3B. Schedule 2, items 97 to 116 | 1 July 2008. | 1 July 2008 |

3C. Schedule 2, item 116A | 1 January 2008. | 1 January 2008 |

3D. Schedule 2, item 117 | 1 July 2008. | 1 July 2008 |

Part 2 -- Amendments commencing the day after Royal Assent

Child Support (Assessment) Act 1989

2 Section 98V

Omit "140", substitute "111C of the Registration and Collection Act".

3 Section 98W

Omit:

• If a proceeding has been instituted in a court, or before the Registrar under Part 6A, a court may make an order staying or otherwise affecting the operation of this Act during the proceeding.

4 Subsection 109(1)

Omit "140", substitute "111C of the Registration and Collection Act".

5 After subsection 112(3)

Insert:

(3A) To avoid doubt, the court may grant leave for the Registrar to make a determination under section 98S, or for the court to make an order under section 118, irrespective of what the applicant applied for under section 111.

6 Section 113A

Omit "140", substitute "111C of the Registration and Collection Act".

7 Paragraph 116(1)(a)

Repeal the paragraph, substitute:

(a) all of the following apply:

(i) the Registrar has, under section 98E or 98R, refused to make a determination under Part 6A in respect of the administrative assessment;

(ii) an objection to the refusal has been lodged;

(iii) the Registrar has disallowed the objection; or

(aa) all of the following apply:

(i) a decision has been made in respect of the administrative assessment;

(ii) an objection to the decision has been lodged;

(iii) in making a decision on the objection, the Registrar has, under section 98E or 98R, refused to make a determination under Part 6A in respect of the administrative assessment; or

(ab) the SSAT has, under section 98E or 98R, refused to make a determination under Part 6A in respect of the administrative assessment; or

8 Subparagraphs 117(2)(a)(iv) and (b)(i)

Omit "to care for", substitute "to spend time with, or communicate with,".

9 Subsection 117(3)

Omit "to care for", substitute "to spend time with, or communicate with,".

Note: The heading to subsection 117(3) is altered by omitting " have contact with " and substituting " spend time or communicate with a ".

11 Subsection 117(3A)

Omit "sub-subparagraph 117 (2)(b)(i)(C)", substitute "subparagraph (2)(b)(ib)".

Note 1: The heading to subsection 117(6) is replaced by the heading " Proper needs of the child ".

Note 2: The heading to subsection 117(7) is replaced by the heading " Income, earning capacity, property and financial resources ".

Note 3: The headings to subsections 117(7A) and (7B) are deleted.

Note 4: The heading to subsection 117(8) is replaced by the heading " Direct and indirect costs in providing care ".

12 Section 120

Omit "140", substitute "111C of the Registration and Collection Act".

13 Division 7 of Part 7 (heading)

Repeal the heading, substitute:

Division 7 -- Urgent maintenance orders

14 Section 138A

Omit:

• If a proceeding has been instituted in a court, or before the Registrar under Part 6A, a court may make an order staying or otherwise affecting the operation of this Act during the proceeding.

15 Section 140

Repeal the section.

16 Paragraph 143(3B)(a)

Omit "knew, or should reasonably have known", substitute "knew or suspected, or should reasonably have known or suspected".

17 Section 143A

Repeal the section, substitute:

The following is a simplified outline of this Division:

• A court may dismiss, or make orders in respect of, a frivolous or vexatious proceeding.

• A decision of a court becomes final at the end of the period for appealing against the decision if no appeal is made.

• The Registrar may intervene in any proceeding under this Act.

18 After section 143A

Insert:

143B Frivolous or vexatious proceedings

(1) A court having jurisdiction under this Act may, at any stage of a proceeding instituted in the court under this Act, if it is satisfied that the proceeding is frivolous or vexatious, do one or more of the following:

(a) dismiss the proceeding;

(b) make such order as to costs as the court considers just;

(c) if the court considers it appropriate, on the application of a party to the proceeding--order that the person who instituted the proceeding must not, without leave of a court having jurisdiction under this Act, institute a proceeding under this Act or the Registration and Collection Act of the kind or kinds specified in the order.

(2) An order made by a court under paragraph (1)(c) has effect notwithstanding any other provision of this Act or the Registration and Collection Act.

(3) A court may discharge or vary an order made by that court under subsection (1).

19 Subsection 161(5)

Repeal the subsection.

20 At the end of section 4

Add:

(3) A person commits an offence if the person fails to comply with a requirement under subsection (1).

Penalty: 60 penalty units.

(4) Subsection (3) is an offence of strict liability.

Note: For strict liability , see section 6.1 of the Criminal Code .

21 At the end of the Act

Add:

Schedule 9--Transitional provision relating to court orders made before 1 July 2008

1 Assessments in relation to court orders made before 1 July 2008

(1) The Registrar is not required, after 1 July 2008:

(a) to make an administrative assessment under Part 4A of the Assessment Act; or

(b) to amend an administrative assessment under section 75 of the Assessment Act;

in respect of an order made, before that time, by a court under Division 4 of Part 7 of that Act.

(2) If such an order will be in force immediately before 1 July 2008, the Registrar must:

(a) review the administrative assessment that relates to that order; and

(b) amend the assessment, or make an administrative assessment, (as the case requires) in accordance with regulations made for the purposes of this item.

(3) For the purposes of this item, the regulations may specify how rights and obligations arising under an order made, before 1 July 2008, by a court under Division 4 of Part 7 of the Assessment Act correspond to rights and obligations under that Act as amended by:

(a) this Act; and

(4) The notice given under section 76 of the Assessment Act in relation to the assessment must (in addition to the requirements under that section) include, or be accompanied by, a statement to the effect that the party may apply, under section 116 of the Assessment Act, to a court having jurisdiction under that Act.

(5) A contravention of subitem (4) in relation to a decision does not affect the validity of the decision.

(6) The Assessment Act (as amended by this Act) applies as if subsection 116(1) of that Act included the following paragraph:

(ac) the assessment is amended or made under item 1 of Schedule 9 to the Child Support Legislation Amendment (Reform of the Child Support Scheme--New Formula and Other Measures) Act 2006 ;

(7) To the extent that a person who applies to court under section 116 of the Assessment Act by virtue of subitem (6) of this item would not otherwise have special circumstances, the person is taken to have special circumstances for the purposes of that section.

Child Support (Registration and Collection) Act 1988

22 Subsection 4(1) (at the end of the definition of final )

Add:

; and (c) in relation to a decision of the Registrar--has the meaning given by subsection 110W(4).

23 Section 17A

Before "Subject", insert "(1)".

24 At the end of section 17A

Add:

(2) Subsection (1) does not apply to the extent that a liability to pay an amount is a liability to pay any costs incurred in respect of proceedings instituted under section 143 of the Assessment Act.

25 Paragraph 26B(3)(c)

Repeal the paragraph, substitute:

(c) the Registrar is satisfied that the payment period elected by the payer will be a convenient payment period for the payer to accrue debts;

26 Paragraph 26B(5)(b)

Repeal the paragraph, substitute:

(b) either:

(i) the payer does not make an election under subsection (3); or

(ii) the Registrar is not satisfied that the payment period elected by the payer will be a convenient payment period for the payer to accrue debts;

Note: The heading to subsection 26B(5) is altered by omitting " made " and substituting " is made or election is rejected ".

27 Subsection 26B(5)

Omit "a month", substitute "any payment period determined by the Registrar to be a convenient payment period for the payer to accrue debts".

28 At the end of Part IV

Add:

Division 5 -- Application of this Part to those engaged under a contract for services

65AA Application of this Part to those engaged under a contract for services

This Part applies to a person (the independent contractor ) engaged under a contract for services as if:

(a) a reference to an employee includes a reference to the independent contractor; and

(b) a reference to an employer of the employee includes a reference to the person who engages the independent contractor; and

(c) a reference to refusing to employ a person includes a reference to refusing to engage a person under a contract for services; and

(d) if a person is an employer and also engages an independent contractor--the reference in section 65 to an employer includes the person in both of those capacities.

29 Subsection 70(1)

Repeal the subsection, substitute:

(1) If:

(a) 2 or more child support debts are owing by a person; and

(b) the debts relate to 2 or more enforceable maintenance liabilities with different payees; and

(c) an amount is paid to the Registrar in relation to all or any of the debts; and

(d) the total amount of the debts exceeds the amount paid to the Registrar;

the Registrar must, despite any direction given by or on behalf of the person, apportion the amount of the payment between the payees in proportion to the amount of the debt owing in relation to each payee, and apply the amounts so apportioned in partial discharge of each of those debts.

30 After subsection 72A(1)

Insert:

(1A) A notice given under subsection (1) requires the notified person to continue to make payments in accordance with that subsection until the support debt is satisfied.

31 Paragraph 79B(1)(a)

Omit "by the payer under item 9 of the table in subsection 80(1)", substitute "by the payer (whether under Part VII, VIIA or VIII) in respect of a decision to accept an application for administrative assessment under subsection 30(1) of the Assessment Act".

32 Subparagraph 79B(3)(b)(i)

Repeal the subparagraph, substitute:

(i) finally refused by the Registrar, the SSAT or a court (within the meaning of section 110W); or

33 Division 4 of Part VII (heading)

Repeal the heading, substitute:

Division 4 -- Requirements relating to objections

34 Section 85 (table heading)

Omit " Recipients of grounds of objections ", substitute " Recipients of objections and accompanying documents ".

Note: The heading to section 85 is altered by omitting " grounds of objections " and substituting " objections and accompanying documents ".

35 Section 85 (table, heading to column 3)

Omit " grounds of objection ", substitute " objection, and any document that accompanied the objection, ".

36 Subsection 86(1)

Omit "grounds of objection", substitute "objection and any accompanying documents".

37 Subsection 86(2)

Omit "grounds of objection", substitute "objection and any accompanying documents".

38 Paragraph 87(2)(b)

Omit "grounds of objection", substitute "objection and the accompanying documents".

39 Subsection 89(1) (table item 2, column headed "Who may apply for review")

Omit "grounds of objection", insert "objection and any accompanying documents".

40 Subsection 89(2)

Repeal the subsection, substitute:

(2) However, a person may not apply to the SSAT for review of a decision under subsection 87(1) on an objection if:

(a) both of the following apply:

(i) the objection was to a refusal by the Registrar, under section 98E or 98R of the Assessment Act, to make a determination under Part 6A of that Act in respect of a child support assessment;

(ii) the Registrar disallowed the objection; or

(b) both of the following apply:

(i) the objection was to a decision by the Registrar made in respect of a child support assessment;

(ii) in making a decision on the objection, the Registrar, under section 98E or 98R of the Assessment Act, refused to make a determination under Part 6A of that Act in respect of the assessment.

Note: In that case, the person may apply to a court for an order under Division 4 of Part 7 (departure orders) of the Assessment Act.

41 Subsection 92(2)

Repeal the subsection.

Note: The heading to section 92 is altered by omitting " lodging objections " and substituting " applying for review ".

42 Before paragraph 93(a)

Insert:

(aa) the Registrar must send to the SSAT Executive Director the statement described in paragraph 95(3)(a), within 28 days after receiving a request for the statement from the SSAT Executive Director; and

43 Paragraph 95(3)(b)

Omit "the original or".

44 Subsection 96(1)

Omit "Within", substitute "Subject to sections 97 and 98, within".

45 Subsection 96(2)

Omit "has received", substitute "is entitled to receive".

46 Subsection 97(1)

Omit "subsection 93(5)", substitute "subsection 95(5)".

47 Paragraph 97(1)(e)

Omit "application for" (second occurring).

48 After subsection 97(1)

Insert:

(1A) Subject to section 98, the Registrar is not required, under subsection 96(1), to give a document, or part of a document, referred to in paragraph 95(3)(b) while the Registrar is not required to send the document or the part under subsection (1) of this section.

49 Subsection 97(2)

Repeal the subsection, substitute:

(2) Subsections (1) and (1A) do not affect the obligation of the Registrar to comply with paragraph 95(3)(b) or subsection 95(5) or 96(1) in relation to any document or part of a document to which subsection (1) or (1A) does not apply.

50 Subsection 98(1)

Omit "send the document or the part of the document under paragraph 95(3)(b) or subsection 93(5)", substitute "give each party to a review, under subsection 96(1), the document or the part of the document referred to in paragraph 95(3)(b)".

51 At the end of section 98

Add:

(3) The SSAT Executive Director must give a copy of a direction given under subsection (2) to each party to the review.

52 Subsection 99(3)

Omit "either".

53 Paragraph 99(3)(d)

Repeal the paragraph, substitute:

(d) request the SSAT Executive Director to dismiss the application under section 100; or

(e) notify, under section 100A, the SSAT that the application is discontinued or withdrawn.

54 Subsection 100(1)

Omit "the application of", substitute "the request of".

55 At the end of Division 2 of Part VIIA

Add:

100A Dismissal of an application on request of party

(1) An applicant may, in writing lodged with the SSAT, at any time notify the SSAT that the application for review is discontinued or withdrawn.

(2) If notification is so given, the SSAT is taken to have dismissed the application without proceeding to review the decision.

(3) If the SSAT dismisses an application under subsection (2), a party to the review may, within 28 days after receiving notification that the application has been dismissed, request that the SSAT reinstate the application.

(4) If it considers it appropriate to do so, the SSAT may reinstate the application and give such directions as appear to it to be appropriate in the circumstances.

(5) If it appears to the SSAT that an application has been dismissed under subsection (2) in error, the SSAT may, on the request of a party to the review or on its own initiative, reinstate the application and give such directions as appear to it to be appropriate in the circumstances.

56 Paragraph 103K(1)(b)

Omit "the SSAT Executive Director (or an officer authorised by the SSAT Executive Director for the purpose)", substitute "the SSAT".

57 Paragraph 103X(1)(b)

Before "document", insert "original".

58 Section 103ZB

Omit:

• If a proceeding has been instituted in a court or before the SSAT or the Registrar, the court may make an order staying or otherwise affecting the operation of the Assessment Act or this Act during the proceeding.

59 Paragraph 110E(a)

After "Full Court", insert "(if the court can be constituted as a Full Court)".

60 Paragraph 110E(b)

Omit "Judge", substitute "judge (including a Federal Magistrate) or by a single magistrate".

61 Section 110J

Omit "must", substitute "may".

62 Paragraph 110J(a)

After "Full Court", insert "(if the court can be constituted as a Full Court)".

Note: The heading to section 110J is replaced by the heading " Constitution of courts ".

63 Paragraph 110J(b)

Omit "Judge", substitute "judge (including a Federal Magistrate) or by a single magistrate".

64 Section 110K

Repeal the section, substitute:

110K Sending of documents to, and disclosure of documents by, the court

When an appeal is instituted in a court, or a question of law is referred to a court, under this Division, the SSAT Executive Director must cause to be sent to the court all documents:

(a) that were before the SSAT in relation to the proceeding to which the appeal or the reference relates; and

(b) that are relevant to the appeal or the reference.

65 At the end of section 110W

Add:

Registrar

(4) For the purposes of the Assessment Act and this Act, if:

(a) a decision is a decision of the Registrar under the Assessment Act or this Act; and

(b) any of the following applies:

(i) an objection to the decision may be lodged with the Registrar under Part VII of this Act;

(ii) an application may be made to the SSAT under Part VIIA of this Act for review of that decision;

(iii) an appeal may be made to a court under Subdivision B of Division 3 of Part VIII of this Act in respect of the decision; and

(c) an objection, application or appeal (as the case requires) is not made within the period for doing so;

the decision becomes final at the end of that period.

66 Subparagraph 110X(1)(b)(i)

After "proceedings", insert "(other than the Registrar)".

67 Subparagraph 110X(1)(b)(ii)

After "person", insert "(other than the Registrar)".

68 Paragraph 110X(3)(b)

After "parties to the proceedings", insert "(other than by reference to the Registrar)".

69 Section 111A

After:

• If a proceeding has been instituted under this Act in a court or before the SSAT or the Registrar, a court may make an order staying or otherwise affecting the operation of the Assessment Act or this Act during the proceeding.

insert:

• A court may dismiss, or make orders in respect of, a frivolous or vexatious proceeding.

70 At the end of section 111A

Add:

• A court order might cease to be in effect because a terminating event happens.

71 At the end of subsection 111C(1)

Add:

; or (d) under Part 6A or 7 of the Assessment Act.

72 Subsection 111C(6)

Repeal the subsection.

73 After section 111C

Insert:

111CA Frivolous or vexatious proceedings

(1) A court having jurisdiction under this Act may, at any stage of a proceeding instituted in the court under this Act, if it is satisfied that the proceeding is frivolous or vexatious, do one or more of the following:

(a) dismiss the proceeding;

(b) make such order as to costs as the court considers just;

(c) if the court considers it appropriate, on the application of a party to the proceeding--order that the person who instituted the proceeding must not, without leave of a court having jurisdiction under this Act, institute a proceeding under this Act or the Assessment Act of the kind or kinds specified in the order.

(2) An order made by a court under paragraph (1)(c) has effect notwithstanding any other provision of this Act or the Assessment Act.

(3) A court may discharge or vary an order made by that court under subsection (1).

74 Section 111F

Repeal the section, substitute:

111F Court order for payment in proceedings instituted by payee to recover debt

(1) If, in relation to a proceeding instituted by the payee of a registered maintenance liability under section 113A, the court makes an order for payment of an amount by the payer of the liability, the payment must be made to the Registrar.

(2) The Registrar must, as soon as practicable after receiving a payment in accordance with subsection (1), pay the amount received by the Registrar to the payee.

75 At the end of Part VIIIB

Add:

111H Cessation of orders under Act

(1) An order made under this Act that varies a child support assessment in relation to a child ceases to be in force if:

(a) a terminating event happens in relation to the child; or

(b) a terminating event happens in relation to the payee or payer of the registered maintenance liability that relates to the child, or all 3 of them.

(2) Nothing in this section affects the recovery of arrears due under an order when the order ceases to be in force.

76 Subsections 113A(2) and (3)

Repeal the subsections, substitute:

Payee to notify Registrar of orders made

(2) A payee of a registered maintenance liability who has instituted a proceeding in a court to recover a debt in accordance with subsection (1) must give notice to the Registrar, in the manner specified by the Registrar, of any orders (including orders as to costs) made by the court in relation to the payee and the debt due in relation to the liability, within 14 days of the order being made.

Note: Section 16A provides for the Registrar to specify the manner in which a notice may be given.

(3) A payee commits an offence if:

(a) the court makes an order in relation to the payee and the debt due in relation to the liability; and

(b) the payee fails to notify the Registrar under subsection (2) of the order being made.

Penalty: 10 penalty units.

77 Subsection 113A(5)

Omit "or of the receipt of the relevant payment, as the case may be".

Division 2--Application provisions

78 Application of item 7

The amendment made by item 7 of this Schedule applies in respect of any decision made under section 98E or 98R of the Assessment Act (whether the decision is made before or after this item commences).

79 Application of item 16

The amendment made by item 16 of this Schedule applies in respect of any order made after this item commences in a proceeding instituted under section 143 of the Assessment Act (whether the proceeding was instituted before or after this item commences).

80 Application of item 20

The amendment made by item 20 of this Schedule applies in respect of requirements made after this item commences.

81 Application of item 24

The amendment made by item 24 of this Schedule applies in respect of liabilities that are registered after this item commences.

82 Application of items 25 to 27

The amendments made by items 25 to 27 of this Schedule apply in respect of:

(a) registrable maintenance liabilities that are registered after this item commences; and

(b) registered maintenance liabilities whose particulars are varied after this item commences.

83 Application of item 29

The amendment made by item 29 of this Schedule applies in respect of payments made to the Registrar after this item commences.

84 Application of item 32

The amendment made by item 32 of this Schedule applies in respect of any suspension determination (whether the determination is made before or after this item commences).

85 Application of items 34 to 39

The amendments made by items 34 to 39 of this Schedule apply in respect of objections lodged with the Registrar under section 80 of the Registration and Collection Act after this item commences.

86 Application of items 40 to 54

The amendments made by items 40 to 54 of this Schedule apply in respect of applications made under section 89 of the Registration and Collection Act after this item commences.

87 Application of items 55 to 57

The amendments made by items 55 to 57 of this Schedule apply in respect of any applications made under section 89 (whether the application is made before or after this item commences).

88 Application of item 64

The amendment made by item 64 of this Schedule applies in respect of any appeal instituted in a court, and any question of law referred to a court, under Division 3 of Part VIII of the Registration and Collection Act (whether the appeal is instituted or the question referred before or after this item commences).

89 Application of item 71

The amendment made by item 71 of this Schedule applies in respect of any proceedings instituted under Part 6A or 7 of the Assessment Act (whether the proceedings are instituted before or after this item commences).

90 Application of item 74

The amendment made by item 74 of this Schedule applies in respect of any orders made after this item commences (whether the proceedings are instituted under section 113A before or after this item commences).

91 Application of item 75

The amendment made by item 75 of this Schedule applies in respect of terminating events that happen after this item commences (whether the relevant court order is made before or after this item commences).

Part 3 -- Amendments commencing on 1 January 2008

Child Support (Assessment) Act 1989

92 Section 59 (sub-subparagraph (a)(i)(A) of the definition of income amount order )

After "to the carer", insert "by setting that annual rate".

93 Section 59 (sub-subparagraph (a)(i)(B) of the definition of income amount order )

Omit "or making provision with respect to the calculation of that amount", substitute "by setting that amount".

94 Section 59 (sub-subparagraph (a)(i)(C) of the definition of income amount order )

Repeal the sub - subparagraph.

95 Section 59 (sub-subparagraph (b)(i)(A) of the definition of income amount order )

After "by the liable parent", insert "by setting that annual rate".

96 Section 59 (sub-subparagraph (b)(i)(B) of the definition of income amount order )

Omit "or making provision with respect to the calculation of either amount", substitute "by setting either amount".

97 Section 59 (sub-subparagraph (b)(i)(C) of the definition of income amount order )

Repeal the sub - subparagraph.

98 Application of items 92 to 97

The amendments made by items 92 to 97 of this Schedule apply in respect of elections made under section 60 of the Assessment Act after this item commences.

99 Subitem 115(1) of Schedule 2

After "items 1 and 2", insert "and 92 to 96".

100 After item 116 of Schedule 2

Insert:

116A Application

The amendments made by items 92 to 96 of this Schedule apply in relation to a day in a child support period, being a day that is, or is after, 1 January 2008.

Child Support (Registration and Collection) Act 1988

101 Subsection 72A(1A)

Omit "support debt", substitute "maximum notified deduction total".

Part 4 -- Amendments commencing on 1 July 2008

Division 1--Amendment of principal Acts

A New Tax System (Family Assistance) Act 1999

102 Subclauses 20C(1) and (2) of Schedule 1

After " 1988 against", insert "the amount payable under".

Child Support (Assessment) Act 1989

103 Subsection 5(1) (definition of administrative assessment )

After "means assessment", insert "(other than assessment for the purposes of a notional assessment)".

104 Subsection 5(1) (definition of costs of a child )

After "55H", insert "or 55HA (as the case requires)".

105 Subsection 5(1) (subparagraph (a)(i) of the definition of income amount order )

After "child support case", insert "by setting that annual rate".

106 Subsection 5(1) (subparagraph (a)(ii) of the definition of income amount order )

Omit "or provides for the calculation of that amount", substitute "by setting that adjusted taxable income or child support income".

107 Subsection 5(1) (definition of multi - case child costs )

Omit "step 4", substitute "step 3".

108 Subsection 5(1) (subparagraph (b)(ii) of the definition of relevant dependent child )

Repeal the subparagraph, substitute:

(ii) if the child or step - child is not under 18--a child support terminating event has not happened under subsection 151D(1) in relation to the child; and

109 Section 35 (method statement, step 7)

Omit "(see sections 55G and 55H)", substitute "under sections 55G and 55H".

110 Section 37 (method statement, step 1)

Omit "1 to 8", substitute "1 to 6".

111 Section 37 (method statement, after step 1)

Insert:

Step 1A. Work out the costs of the child for the day under section 55HA.

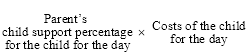

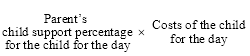

Step 1B . If a parent has a positive child support percentage under step 6 of the method statement in section 35, work out the following rate:

112 Section 37 (method statement, step 3, paragraph (a))

Repeal the paragraph, substitute:

(a) the rate worked out under step 1B of the method statement in this section; and

113 Subsection 38(2)

Omit "1 to 8", substitute "1 to 6".

114 After subsection 38(2)

Insert:

(2A) Work out the costs of the child for the day under section 55HA.

(2B) If a parent has a positive child support percentage under step 6 of the method statement in section 35, work out the following rate:

115 Paragraph 38(4)(a)

Repeal the paragraph, substitute:

(a) the rate worked out under subsection (2B); and

116 Section 39 (method statement, step 4)

Repeal the step, substitute:

Step 4. If the parent is assessed in respect of the costs of another child who is in another child support case, work out the costs of the child for the day under section 55HA. Otherwise, work out the costs of the child for the day under sections 55G and 55H. Assume, in applying section 55G or 55HA and Schedule 1, that the reference to the child support income of the parent in the Costs of the Children Table is a reference to the amount worked out under step 1.

117 Section 40 (method statement, step 4)

Repeal the step, substitute:

Step 4. If the parent is assessed in respect of the costs of another child who is in another child support case, work out the costs of the child for the day under section 55HA. Otherwise, work out the costs of the child for the day under sections 55G and 55H.

118 Paragraph 44(1)(b)

Repeal the paragraph, substitute:

(b) the separation, following that 6 month period, of the applicant from the other parent occurred:

(i) within the last 3 years; and

(ii) before the application for administrative assessment of child support for the child was made under section 25 or 25A; and

119 Paragraph 44(1)(d)

Omit "the applicant earned, derived or received income", substitute ", or in the remaining period (if the parent has made an election under section 60), the applicant earns, derives or receives income".

120 Subparagraph 44(1)(d)(i)

Repeal the subparagraph, substitute:

(i) in accordance with a pattern of earnings, derivation or receipt that is established after the applicant and the other parent first separate; and

121 Section 46 (method statement, step 4)

Omit "(see sections 55G and 55H)", substitute "under sections 55G and 55H".

122 Subsection 47(1) (method statement, steps 3, 4 and 5)

Repeal the steps, substitute:

Step 3 . For each of the children (the multi - case children ) for whom the parent is assessed in respect of the costs of the child for the day, work out the multi - case child costs for the particular child for the day under section 55HA, as if:

(a) the parent's annual rate of child support were assessed under Subdivision D of Division 2; and

(b) the reference in subsection 55HA(2) to the parent's child support income were a reference to the amount worked out under step 1 or 2 (as the case requires); and

(c) references in section 55HA to children in the child support case that relates to the child were references to all of the parent's multi - case children.

Step 4. The parent's multi - case allowance for the particular child for the day is the sum of the multi - case child costs for each of the other multi - case children (excluding the particular child and any other children in the child support case that relates to the particular child).

123 Subparagraph 48(1)(b)(i)

After "person has", insert "that affects the annual rate of child support payable for the child".

124 At the end of subsection 48(1)

Add:

; or (c) if the child is a relevant dependent child in respect of whom section 73A applies--the day specified in that section as the first day on which the parent is taken to have had the child.

125 Subsection 55G(1)

Omit ", 36, 37 or 38 (Formulas 1 to 4)", substitute "or 36 (Formulas 1 and 2)".

126 Subsection 55G(2)

Repeal the subsection, substitute:

(2) If:

(a) an annual rate of child support for a day in a child support period is assessed for a child under Subdivision D of Division 2 (Formulas 5 and 6); and

(b) the parent of the child is not assessed in respect of the costs of another child who is in another child support case;

identify the column in the Costs of the Children Table for that child support period that covers the child support income of the parent of the child.

Note: This subsection also applies in working out the relevant dependent child amount (see step 4 of the method statement in section 46).

127 Subsection 55G(4)

Omit "at the time the administrative assessment is made", substitute "on the day".

128 Section 55H

Omit "The", substitute "For the purposes of section 55G, the".

129 At the end of Division 6 of Part 5

Add:

55HA Working out the costs of the child if parents have multiple child support cases

(1) If an annual rate of child support for a day in a child support period is assessed for a child under section 37 or 38 (Formulas 3 and 4), identify the column in the Costs of the Children Table for that child support period that covers the combined child support income of the parents of the child.

Note: The Secretary publishes the updated Costs of the Children Table in the Gazette each year for child support periods that begin in the next year (see section 155).

(2) If:

(a) an annual rate of child support for a day in a child support period is assessed for a child under Subdivision D of Division 2 (Formulas 5 and 6); and

(b) the parent of the child is assessed in respect of the costs of another child who is in another child support case;

identify the column in the Costs of the Children Table for that child support period that covers the child support income of the parent of the child.

Note: This subsection also applies in working out the multi - case allowance (step 3 of the method statement in section 47).

(3) Identify the number of children (the child support children ) in the child support case that relates to the child.

(4) Identify the ages of the child support children on the day.

(5) In respect of each of the child support children:

(a) assume that all of the child support children are the same age as that child; and

(b) identify the item in the relevant column in the Costs of the Children Table that covers that number of child support children of that age.

(If there are more than 3 child support children, use the row for 3 children.)

(6) For the purposes of this section, the costs of the child for a day in a child support period, in respect of each child, is the amount worked out, in accordance with Schedule 1 to this Act, for the item identified for that child divided by the number of child support children.

130 Subsection 58(3)

After "determined to be", insert "at least".

131 After subsection 58(3)

Insert:

Determination if tax return lodged 2 years ago

(3A) The Registrar may make a determination if:

(a) a parent has not, under an Income Tax Assessment Act, lodged a tax return for the year of income; and

(b) the parent lodged a tax return under that Act for the previous year of income; and

(c) the amount determined by the Registrar under subsection (1) is the amount based on the tax return for the previous year of income multiplied by a factor specified in the regulations for the purposes of this subsection.

132 Paragraph 58(4)(b)

Repeal the paragraph.

133 After paragraph 58A(2)(b)

Insert:

or (c) neither paragraph (a) nor (b) applies, but circumstances prescribed by the regulations for the purposes of this section apply in relation to the parent;

134 Subsection 60(3)

Repeal the subsection, substitute:

First election must be for amount less than adjusted taxable income for last relevant year of income

(3) The parent may make a first election relating to a child support period only if the amount that he or she works out under this section is not more than 85% of:

(a) the total of the parent's adjusted taxable income determined in accordance with section 43 for the last relevant year of income for the child support period; or

(b) an amount that:

(i) the parent declares is the total of the parent's adjusted taxable income for the last relevant year of income for the child support period; and

(ii) the Registrar is satisfied is correct.

135 Subsection 64(2)

After "child support period,", insert "subject to subsections (2A) and (3),".

136 After subsection 64(2)

Insert:

(2A) If, under section 63A, 63B or 63C, the Registrar amends an assessment of child support payable by or to a parent, subsection (2) only applies in respect of the parent if the Registrar determines that subsection (2) should apply.

137 Subsection 65B(3) (second occurring)

Renumber as subsection (5).

138 Paragraph 66(1)(b)

Repeal the paragraph, substitute:

(b) the total payable by the parent for all the children in the child support case would (apart from this section) be assessed as less than the minimum annual rate of child support for the child support period.

139 Subsection 66(3)

Repeal the subsection (not including the heading).

140 Subsection 66(4)

Omit "subparagraph (1)(b)(ii)", substitute "paragraph (1)(b)".

141 After section 66A

Insert:

66B Amendment of assessment made under section 65B or 66A

The Registrar may amend an assessment at any time if:

(a) either:

(i) under section 65B, the Registrar has determined that section 65A does not apply to a parent; or

(ii) under section 66A, the Registrar has reduced an annual rate of child support payable by a parent to nil; and

(b) the Registrar becomes satisfied that the parent does not satisfy the condition in subsection 65B(4) or 66A(2) (as the case requires).

142 Subsection 66C(1)

After "66A,", insert "or amends an assessment in accordance with section 66B,".

143 Paragraph 66C(2)(a)

Repeal the paragraph, substitute:

(a) that the parent may, subject to the Registration and Collection Act, object to the particulars of:

(i) the assessment in relation to which the unsuccessful application was made; or

(ii) the assessment that was amended;

(as the case requires); and

144 Subparagraph 74A(b)(i)

After "7.1%", insert ", and the change affects the annual rate of child support payable for the child".

145 After paragraph 74A(c)

Insert:

and (d) section 53 (Registrar determinations if care less than 14%) does not apply in respect of the child;

146 Section 74A (note)

Omit "Note", substitute "Note 1".

147 At the end of section 74A

Add:

Note 2: If the Registrar becomes aware of a relevant dependent child who was not taken into account for the purposes of making an assessment, the Registrar must take action in accordance with section 73A.

148 Subsection 75(1)

After "this Act", insert "or the Registration and Collection Act".

149 Paragraph 75(2)(a)

After "7.1%", insert ", and the change affects the annual rate of child support payable for the child".

150 At the end of subsection 75(2)

Add:

; or (d) the child is a relevant dependent child and the Registrar has become aware that the child was not taken into account for the purpose of making the assessment.

151 Paragraph 75(3)(c)

After "this Act", insert "or the Registration and Collection Act, or in the SSAT,".

152 Paragraph 75(4)(d)

After "this Act", insert "or the Registration and Collection Act".

153 Paragraph 75(4)(f)

After "this Act", insert "or the Registration and Collection Act, or of the SSAT".

154 Subsection 75(5)

After "this Act", insert "or the Registration and Collection Act".

155 Subsection 75(6)

After "this Act" (first occurring), insert "or the Registration and Collection Act".

156 Subsection 75(6)

After "this Act" (second occurring), insert "and the Registration and Collection Act".

157 Paragraph 76(2)(f)

Repeal the paragraph.

158 Paragraph 76(3)(ca)

After "credited against", insert "the amount payable under".

159 Subsection 78(2)

Omit "the liability to pay child support in relation to all or part of that amount", substitute "that amount".

160 Section 80A

Omit:

• Payments made under lump sum payment provisions are credited against the liability of a party to the agreement (rather than reducing the annual rate of child support payable).

substitute:

• Payments made under lump sum payment provisions are credited against the amount payable under the liability of a party to the agreement (rather than reducing the annual rate of child support payable).

161 Subparagraph 84(1)(e)(ii)

Repeal the subparagraph, substitute:

(ii) that the lump sum payment is to be credited against the amount payable under the liable party's liability under the relevant administrative assessment;

162 Subsection 84(7) (note)

After "Act against", insert "the amount payable under".

163 Subsection 84(8)

Repeal the subsection, substitute:

(8) An agreement that includes lump sum payment provisions may also state that the lump sum payment is to be credited against 100%, or another specified percentage that is less than 100%, of the amount payable under the liability.

Note: If an agreement does not specify a percentage, the lump sum payment is credited against 100% of the amount payable under the liability (see section 69A of the Registration and Collection Act).

164 Paragraph 117(2)(aa)

Omit "another child (the resident child ) of the parent", substitute "a resident child of the parent (see subsection (10))".

165 Subsection 117(2A)

Repeal the subsection.

166 Subsection 117(2C)

Omit "to care for", substitute "to spend time with, or communicate with,".

167 At the end of paragraph 117(4)(g)

Add:

; and (iii) to any resident child of the parent (see subsection (10)) by the making of, or the refusal to make, the order.

168 At the end of section 117

Add:

Definition of resident child

(10) For the purposes of this section, a child is a resident child of a person only if:

(a) the child normally lives with the person, but is not a child of the person; and

(b) the person is, or was, for 2 continuous years, a member of a couple; and

(c) the other member of the couple is, or was, a parent of the child; and

(d) the child is aged under 18; and

(e) the child is not a member of a couple; and

(f) one or more of the following applies in respect of each parent of the child:

(i) the parent has died;

(ii) the parent is unable to support the child due to the ill - health of the parent;

(iii) the parent is unable to support the child due to the caring responsibilities of the parent; and

(g) the court is satisfied that the resident child requires financial assistance.

169 Paragraph 123(1)(b)

Repeal the paragraph, substitute:

(b) an order that a liable parent provide child support in the form of a lump sum payment to be credited against the amount payable under the liability under the relevant administrative assessment.

170 Subsection 123A(1)

Omit "the liability under the relevant administrative assessment in relation to amounts payable under the liability", insert "the amount payable under the liability under the relevant administrative assessment".

Note: The heading to section 123A is altered by inserting " amounts payable under " after " credited against ".

171 Subsection 123A(1) (note)

After "Act against", insert "the amount payable under".

172 Paragraph 123A(3)(b)

Repeal the paragraph, substitute:

(b) must specify that the lump sum payment is to be credited against 100%, or another specified percentage that is less than 100%, of the amounts payable under the liability.

173 Paragraph 129(1)(f)

Omit "statement made by a court under section 125 in an order made under section 124", substitute "matter specified under subsection 123A(3), or any statement made under section 125, included in the order".

174 Subsection 129(2)

Omit "any statement included in the last - mentioned order under section 125", substitute "any matter specified under subsection 123A(3), or any statement made under section 125".

175 Subsection 129(4)

Repeal the subsection, substitute:

(4) If the court proposes to vary an order made under section 123A or 124 otherwise than by varying any matter specified in the order under subsection 123A(3), or any statement included in the order under section 125, the court must consider whether, having regard to the proposed variation, it should also order the variation of any such matter or statement.

176 Section 135

Repeal the section, substitute:

The following is a simplified outline of this Division:

• Certain courts may set aside a child support agreement or a termination agreement if:

(a) the agreement of one of the parties was obtained by fraud, undue influence or unconscionable conduct; or

(b) there has been a significant change in circumstances; or

(c) the annual rate of child support payable under the agreement is not proper or adequate; or

(d) exceptional circumstances arise after the agreement is made.

177 Paragraphs 136(2)(c) and (d)

Repeal the paragraphs, substitute:

(c) in the case of a limited child support agreement:

(i) that because of a significant change in the circumstances of one of the parties to the agreement, or a child in respect of whom the agreement is made, it would be unjust not to set aside the agreement; or

(ii) that the agreement provides for an annual rate of child support that is not proper or adequate, taking into account all the circumstances of the case (including the financial circumstances of the parties to the agreement); or

(d) in the case of a binding child support agreement--that because of exceptional circumstances, relating to a party to the agreement or a child in respect of whom the agreement is made, that have arisen since the agreement was made, the applicant or the child will suffer hardship if the agreement is not set aside.

178 Subsection 146B(2)

After "Part 7", insert ", and taking into account section 146BA".

179 After section 146B

Insert:

146BA Application of Part 5 to provisional notional assessments

(1) In making a provisional notional assessment, Part 5 applies as if:

(a) subject to this section, a reference in the Part to an assessment, or an administrative assessment, were a reference to a provisional notional assessment; and

(b) subsections 44(5) and (6), Subdivision C of Division 7, and sections 35C, 66C, 69 and 76 to 79 did not apply; and

(c) in paragraph 48(1)(a), the reference to the day on which an application is made under section 25 or 25A were a reference to the particular day in respect of which the provisional notional assessment is made; and

(d) in subparagraph 65A(1)(b)(ii):

(i) a reference to section 60 were a reference to section 146G; and

(ii) a reference to the amount worked out for the parent under step 2 of the method statement in subsection 60(5) using the parent's estimate were a reference to the amount estimated by the parent under subsection 146G(1).

(2) Part 5 ceases to apply once a provisional notional assessment becomes a notional assessment.

180 After paragraph 146C(1)(a)

Insert:

(aa) by making an application under section 44 to amend the provisional notional assessment;

(ab) by making an application under section 66A to reduce the annual rate of child support payable to nil;

181 After subparagraph 146C(2)(b)(i)

Insert:

(ia) if paragraph (1)(ab) applies--the Registrar makes a determination under subsection 44(2);

(ib) if paragraph (1)(aa) applies--the Registrar reduces the annual rate of child support payable to nil;

182 After subparagraph 146C(3)(b)(i)

Insert:

(ia) if paragraph (1)(ab) applies--the Registrar refuses to make a determination under subsection 44(2);

(ib) if paragraph (1)(aa) applies--the Registrar refuses to grant an application under section 66A;

183 After section 146E

Insert:

146EA Amendment of notional assessment

(1) The Registrar must amend a notional assessment of the annual rate of child support that would be payable for a child (the first child ) for a particular day in a child support period if:

(a) another child in the child support case that relates to the first child is not covered by the relevant child support agreement or the order that was made in relation to the first child; and

(b) the administrative assessment of the child support payable for the other child for any day (the changed assessment day ) in any child support period changes.

(2) The Registrar must amend the notional assessment as if:

(a) despite subsection 146BA(2), section 67A (offsetting) applied on the changed assessment day; and

(b) the annual rate of child support that would be payable for the first child for the particular day were instead payable for the changed assessment day.

184 Subsection 146G(2)

After "in force", insert ", or would be in force but for the existence of the relevant child support agreement,".

185 At the end of section 150E

Add:

Parent taken not to be assessed in respect of the costs of the child

(6) For the purposes of this Act and the Registration and Collection Act, a parent of a child is taken not to be assessed in respect of the costs of the child during the period in which child support is not payable by or to the parent under subsection (2).

186 Paragraphs 153(c) and (d)

Repeal the paragraphs, substitute:

(c) that a specified person applied on a specified day for one or both parents of a child to be assessed in respect of the costs of the child; or

(d) that a specified person did not apply on or before a specified day for one or both parents of a child to be assessed in respect of the costs of the child; or

187 Schedule 1 (note to heading)

Omit "section 55G", substitute "sections 55G and 55HA".

188 Subclauses 3(2) and (3) of Schedule 1

After "55G", insert "or 55HA".

189 Paragraph 3(3)(a) of Schedule 1

Repeal the paragraph, substitute:

(aa) the amount worked out for the item in that row in the first column by multiplying the percentage specified in that item by the highest combined child support income, or child support income, covered by that column;

(a) if the relevant column is the third, fourth or fifth column--the amounts worked out for each item in that row in each of the previous columns (other than the first column) by multiplying the percentage specified in that item by the difference between:

(i) the highest combined child support income, or child support income, covered by that column; and

(ii) the highest combined child support income or child support income in the previous column;

190 Paragraph 3(3)(b) of Schedule 1

Before "the amount", insert "in any case--".

191 Subclause 3(4) of Schedule 1

After "55G", insert "or 55HA".

192 Subclause 3(4) of Schedule 1

Omit "paragraph (3)(a)", substitute "paragraphs (3)(aa) and (a)".

Child Support (Registration and Collection) Act 1988

193 Subsection 4(1) (paragraph (c) of the definition of appealable refusal decision )

After "amount against", insert "the amount payable under".

194 Subsection 4(1) (definition of child support assessment )

After "an assessment", insert "(other than a notional assessment)".

195 Subsection 4(1)

Insert:

"year of income" , in relation to a person, means:

(a) a year of income (within the meaning of the Income Tax Assessment Act 1936 ); or

(b) an income year (within the meaning of the Income Tax Assessment Act 1997 ).

196 Subsections 28A(7) and 39A(8)

Omit "against that liability", insert "against that unpaid amount".

197 Subsection 66(3)

Omit "a liability in relation to all or part of that amount", substitute "that amount".

198 Paragraph 69A(2)(a)

Repeal the paragraph, substitute:

(a) in respect of a day in an initial period, or in respect of a day in a payment period, in a year of income, for a registered maintenance liability, credit the remaining lump sum payment against:

(i) if the agreement or order states that the lump sum payment is to be credited against a specified percentage of the amount payable under the liability--that percentage of the amount payable under the liability; and

(ii) if subparagraph (i) does not apply--100% of the amount payable under the liability; and

199 Subsections 69A(4) and (5)

Repeal the subsections, substitute:

(4) The remaining lump sum payment , in relation to the lump sum payment paid under the agreement or order, means:

(a) for the first day after the agreement is accepted or the order is made--the lump sum payment; and

(b) for 1 July in a year of income (except if that 1 July is covered by paragraph (a))--the remaining lump sum payment for the previous day as indexed under subsection (5); and

(c) otherwise--so much of the remaining lump sum payment as remains after crediting under the previous application of this section.

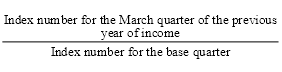

(5) The remaining lump sum payment, for 1 July in a year of income, is indexed as follows:

![]()

where:

"base quarter" means the March quarter (before the March quarter for the previous year of income, but after the agreement is accepted or the order is made) with the highest index number.

"indexation factor" means:

"index number" for a quarter is the All Groups Consumer Price Index number that is the weighted average of the 8 capital cities and is published by the Australian Statistician in respect of that quarter.

"March quarter" means the quarter ending on 31 March.

200 Subsection 71(1)

Omit "against the liability of the payer to the Commonwealth in relation to the amount payable under the liability", substitute "against the amount payable under the enforceable maintenance liability".

201 Subsection 71A(1)

Omit "credit the amount, or part of the amount, received by the third party against the liability of the payer to the Commonwealth in relation to the amount payable under the enforceable maintenance liability", substitute "credit the amount, or part of the amount, received by the third party against the amount payable under the enforceable maintenance liability".

202 Subsections 71A(2) and (3)

Repeal the subsections, substitute:

(2) If:

(a) the application referred to in paragraph (1)(b) specifies that the amount, or part of the amount, received by the third party is to be credited against a specified percentage (that is less than 100%) of the amount payable under the liability; and

(b) the Registrar is satisfied that the payer and the payee agree that the amount received is to be so credited;

then the Registrar must credit the amount, or the part of the amount, received against that percentage of the amount payable under the liability.

(3) Otherwise, the Registrar must credit the amount, or the part of the amount, received against all of the amount payable under the liability.

203 Subsection 71B(2)

After "against", insert "the amount payable under".

204 Paragraph 71C(1)(c)

After "section against", insert "the amount payable under".

205 Subsection 71C(1)

Omit ", up to a maximum amount that is equal to 30% of the amount payable under the payer's liability for the period, against the liability in relation to the amount payable under the liability for the period", substitute "against the amount payable under the payer's liability for the period, up to a maximum of 30% of the amount payable".

206 Subsection 71C(4)

Omit "the liability of the payer in relation to the amount payable under the enforcement maintenance liability", substitute "the amount payable under the enforceable maintenance liability".

207 Subsection 71C(5)

Repeal the subsection, substitute:

(5) This section does not apply in relation to an enforceable maintenance liability in relation to a payment period or an initial period if:

(a) the liability is covered by section 17A or 18; or

(b) both of the following apply:

(i) the payer of the liability has provided child support to the payee of the liability in the form of a lump sum payment;

(ii) the lump sum payment will be credited, under section 69A, against all or part of the amount payable under the liability in relation to the days in the payment period or the initial period.

208 Subsection 71E(1)

After "against", insert "the amount payable under".

209 Subsection 80(1) (table item 5)

Omit "against the liability of the payer of the liability to the Commonwealth", substitute "against the amount payable under the liability".

210 Subsection 80(1) (table item 9)

Repeal the item, substitute:

9 | to accept an application for administrative assessment of child support for a child under subsection 30(1) of the Assessment Act | a parent who is to be assessed in respect of the costs of the child |

211 Subsection 85(1) (table item 2)

Omit "against the liability of the payer of the liability to the Commonwealth", substitute "against the amount payable under the liability".

Division 2--Amendment of the New Formula Act

212 Item 104 of Schedule 2

Repeal the item, substitute:

104 Subsection 85(1) (table item 4)

Omit "the person to whom or from whom the application seeks payment of child support, as the case requires", substitute "each parent who the application sought to be assessed in respect of the costs of the child, and any non - parent carer of the child, (other than the person who objects to the decision)".

213 Items 1 and 2 of Schedule 6

Repeal the items.

214 Item 4 of Schedule 6

Repeal the item.