Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

1 Subsection 9(1) (paragraph (d) of the definition of income stream )

Repeal the paragraph, substitute:

(d) an income stream provided as life insurance business by a life company registered under the Life Insurance Act 1995 ; or

2 Subsection 9(1) (paragraph (e) of the definition of income stream )

Repeal the paragraph.

3 Paragraph 9(1F)(b)

Before "the income stream", insert "except in the case of an income stream arising under a superannuation fund established before 20 September 1998--".

4 After paragraph 9(1F)(b)

Insert:

(ba) in the case of an income stream arising under a superannuation fund established before 20 September 1998--the income stream is provided under rules that meet the standards determined, by legislative instrument, by the Minister; and

5 Paragraph 9(1F)(c)

Before "the income stream", insert "in any case--".

6 At the end of subsection 9B(1A)

Add:

; and (d) in the case of an income stream acquired before 20 September 2004 that is provided to a primary beneficiary's reversionary beneficiary--the remaining term (in years) of the income stream is equal to the life expectancy (in years) of the primary beneficiary's reversionary beneficiary.

7 Subparagraph 1099DAA(1)(b)(i)

After " Superannuation Industry (Supervision) Regulations 1994 ", insert ", or is any other pension determined, by legislative instrument, by the Minister".

8 Subparagraph 1099DAA(1)(b)(ii)

Omit "of subregulation 1.05(4) of the Superannuation Industry (Supervision) Regulations 1994 ", substitute "determined, by legislative instrument, by the Minister".

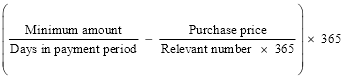

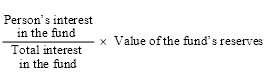

9 Subsection 1099DAA(3) (formula)

Repeal the formula, substitute:

Note: The heading to subsection 1099DAA(3) is altered by omitting " limit " and substituting " amount ".

10 Subsection 1099DAA(3)

Insert:

"minimum amount" means the minimum amount calculated in accordance with the method determined, by legislative instrument, by the Minister for the purposes of this definition.

11 Subsection 1099DAA(3) (definition of minimum limit )

Repeal the definition.

12 After section 1120B

Insert:

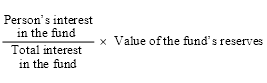

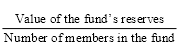

1120C Value of superannuation reserves for superannuation funds of 4 members or less

(1) This section applies in calculating the value of a person's investment in a superannuation fund if:

(a) the fund has 4 or fewer members; and

(b) the fund has reserves (within the meaning of section 115 of the Superannuation Industry (Supervision) Act 1993 ).

Note: The value of a person's investment in a superannuation fund is only included in the value of the person's assets after the person reaches pension age or starts to receive a pension or annuity out of the fund (see paragraph 1118(1)(f)).

(2) Despite paragraph 1118(1)(h), the value of the person's investment in the superannuation fund includes the following amount:

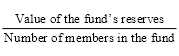

(3) However, if it is not possible to work out the person's interest in the superannuation fund, the value of the person's investment in the fund includes the following amount:

13 At the end of Part 3 of Schedule 1A

Add:

136 Transitional definition of deductible amount (commencing 1 July 2007)

(1) This clause applies if:

(a) a person has received at least one payment from a defined benefit income stream before 1 July 2007, and is still receiving payments from the income stream; and

(b) the person receives income support payment in respect of a continuous period starting before, and ending on or after, the person's trigger day (see subsection (5)); and

(c) the amount of the income support payment received before the person's trigger day was affected by the deduction of a deductible amount (within the meaning of this Act or the Veterans' Entitlements Act, as the case requires, apart from this clause) from the amount of the payments payable to the person for a year under the income stream; and

(d) if the person's trigger day is after 1 July 2007--the income stream has not been partially commuted on or after 1 July 2007 and before the person's trigger day.

Note 1: If the income stream is wholly commuted, this clause will stop applying because the person will no longer be receiving payments from the income stream (see paragraphs (1)(a) and (d)).

Note 2: For the deduction of a deductible amount from amounts payable under certain defined benefit income streams, see sections 1099A and 1099D of this Act and sections 46V and 46Y of the Veterans' Entitlements Act.

(2) Despite the amendment of this Act by Part 2 of Schedule 8 to the Tax Laws Amendment (Simplified Superannuation) Act 2007 , for the purposes of working out the amount of any income support payment (other than a service pension or income support supplement) received by the person on or after the trigger day in respect of the remaining part of the period mentioned in paragraph (1)(b), the deductible amount , in relation to the income stream for a year, is the greater of the following amounts:

(a) the deductible amount mentioned in paragraph (1)(c);

(b) the sum of the amounts that are the tax free components (worked out under subsections 307 - 125(4) to (7) of the Income Tax (Transitional Provisions) Act 1997 ) of the payments received from the income stream during the year.

(3) However, this clause stops applying to an income stream immediately after the time (if any) that the deductible amount in relation to the income stream is, under subclause (2), the amount mentioned in paragraph (2)(b).

(4) For the purposes of this clause, without limiting paragraph (1)(b), if the form of a person's income support payment mentioned in paragraph (1)(b) changes during a period, the continuity of the period is not broken by the change.

Example: The form of a person's income support payment may change from one kind of payment (for instance, a service pension under the Veterans' Entitlements Act) to another (for instance, a social security pension under this Act).

(5) In this clause:

"trigger day" , for a person, means:

(a) if the person is under 60 years at the end of 30 June 2007--the day the person turns 60; or

(b) if the person is 60 years or over at the end of 30 June 2007--1 July 2007.

Veterans' Entitlements Act 1986

14 Subsection 5J(1) (paragraph (d) of the definition of income stream )

Repeal the paragraph, substitute:

(d) an income stream provided as life insurance business by a life company registered under the Life Insurance Act 1995 ; or

15 Subsection 5J(1) (paragraph (e) of the definition of income stream )

Repeal the paragraph.

16 Paragraph 5J(1E)(b)

Before "the income stream", insert "except in the case of an income stream arising under a superannuation fund established before 20 September 1998--".

17 After paragraph 5J(1E)(b)

Insert:

(ba) in the case of an income stream arising under a superannuation fund established before 20 September 1998--the income stream is provided under rules that meet the standards determined, by legislative instrument, by the Minister; and

18 Paragraph 5J(1E)(c)

Before "the income stream", insert "in any case--".

19 At the end of subsection 5JB(1A)

Add:

; and (d) in the case of an income stream acquired before 20 September 2004 that is provided to a primary beneficiary's reversionary beneficiary--the remaining term (in years) of the income stream is equal to the life expectancy (in years) of the primary beneficiary's reversionary beneficiary.

20 Subparagraph 46YA(1)(b)(i)

After " Superannuation Industry (Supervision) Regulations 1994 ", insert ", or is any other pension determined, by legislative instrument, by the Minister".

21 Subparagraph 46YA(1)(b)(ii)

Omit "of subregulation 1.05(4) of the Superannuation Industry (Supervision) Regulations 1994 ", substitute "determined, by legislative instrument, by the Minister".

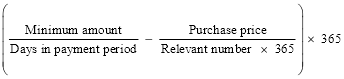

22 Subsection 46YA(3) (formula)

Repeal the formula, substitute:

Note: The heading to subsection 46YA(3) is altered by omitting " limit " and substituting " amount ".

23 Subsection 46YA(3)

Insert:

"minimum amount" means the minimum amount calculated in accordance with the method determined, by legislative instrument, by the Minister for the purposes of this definition.

24 Subsection 46YA(3) (definition of minimum limit )

Repeal the definition.

25 After section 52BB

Insert:

52BC Value of superannuation reserves for superannuation funds of 4 members or less

(1) This section applies in calculating the value of a person's investment in a superannuation fund if:

(a) the fund has 4 or fewer members; and

(b) the fund has reserves (within the meaning of section 115 of the Superannuation Industry (Supervision) Act 1993 ).

Note: The value of a person's investment in a superannuation fund is only included in the value of the person's assets after the person reaches pension age or starts to receive a pension or annuity out of the fund (see paragraph 52(1)(f)).

(2) Despite paragraph 52(1)(g), the value of the person's investment in the superannuation fund includes the following amount:

(3) However, if it is not possible to work out the person's interest in the superannuation fund, the value of the person's investment in the fund includes the following amount:

26 At the end of Part 1 of Schedule 5

Add:

11B Transitional definition of deductible amount (commencing 1 July 2007)

(1) This clause applies if:

(a) a person has received at least one payment from a defined benefit income stream before 1 July 2007, and is still receiving payments from the income stream; and

(b) the person receives income support payment in respect of a continuous period starting before, and ending on or after, the person's trigger day (see subclause (5)); and

(c) the amount of the income support payment received before the person's trigger day was affected by the deduction of a deductible amount (within the meaning of this Act or the Social Security Act, as the case requires, apart from this clause) from the amount of the payments payable to the person for a year under the income stream; and

(d) if the person's trigger day is after 1 July 2007--the income stream has not been partially commuted on or after 1 July 2007 and before the person's trigger day.

Note 1: If the income stream is wholly commuted, this clause will stop applying because the person will no longer be receiving payments from the income stream (see paragraphs (1)(a) and (d)).

Note 2: For the deduction of a deductible amount from amounts payable under certain defined benefit income streams, see sections 46V and 46Y of this Act and sections 1099A and 1099D of the Social Security Act.

(2) Despite the amendment of this Act by Part 2 of Schedule 9 to the Tax Laws Amendment (Simplified Superannuation) Act 2007 , for the purposes of working out the amount of any service pension or income support supplement received by the person on or after the trigger day in respect of the remaining part of the period mentioned in paragraph (1)(b), the deductible amount , in relation to the income stream for a year, is the greater of the following amounts:

(a) the deductible amount mentioned in paragraph (1)(c);

(b) the sum of the amounts that are the tax free components (worked out under subsections 307 - 125(4) to (7) of the Income Tax (Transitional Provisions) Act 1997 ) of the payments received from the income stream during the year.

Note: Service pension and income support supplement are income support payments within the meaning of the Social Security Act (see subsection 23(1) of that Act).

(3) However, this clause stops applying to an income stream immediately after the time (if any) that the deductible amount in relation to the income stream is, under subclause (2), the amount mentioned in paragraph (2)(b).

(4) For the purposes of this clause, without limiting paragraph (1)(b), if the form of a person's income support payment mentioned in paragraph (1)(b) changes during a period, the continuity of the period is not broken by the change.

Example: The form of a person's income support payment may change from one kind of payment (for instance, a social security pension under the Social Security Act) to another (for instance, a service pension under this Act).

(5) In this clause:

"income support payment" has the same meaning as in the Social Security Act.

"trigger day" , for a person, means:

(a) if the person is under 60 years at the end of 30 June 2007--the day the person turns 60; or

(b) if the person is 60 years or over at the end of 30 June 2007--1 July 2007.