Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Notional assessments

A New Tax System (Family Assistance) Act 1999

1 After subclause 20B(3) of Schedule 1

Insert:

Underpayments--non - periodic payments and lump sum payments

(3A) For the purposes of the formula in subclause (3), the amount received by the individual under the agreement or order, for the child for the period, is taken to include:

(a) if the agreement or order is a non - periodic payments agreement or order--the amount by which the annual rate of child support payable for the child is reduced for the period under the agreement or order; and

(b) if the agreement or order is a lump sum payments agreement or order--the total amount of the lump sum payment that is credited for each day in the period under section 69A of the Child Support (Registration and Collection) Act 1988 against the amount payable under the liability under the agreement or order.

(3B) If the agreement or order is a non - periodic payments agreement or order, for the purposes of the formula in subclause (3), the amount payable to the individual under the agreement or order for the child for the period is taken to include the amount by which the annual rate of child support payable for the child is reduced for the period under the agreement or order.

2 At the end of clause 20B of Schedule 1

Add:

(8) In this clause:

"lump sum payments agreement or order" means:

(a) an agreement containing lump sum payment provisions (within the meaning of the Child Support (Assessment) Act 1989 ); or

(b) a court order made under section 123A of that Act.

"non-periodic payments agreement or order" means:

(a) an agreement containing non - periodic payment provisions (within the meaning of the Child Support (Assessment) Act 1989 ); or

(b) a court order made under section 124 of that Act that includes a statement made under section 125 of that Act that the annual rate of child support payable by a liable parent under an administrative assessment is to be reduced.

Part 2 -- Maintenance income ceiling

A New Tax System (Family Assistance) Act 1999

3 Clause 24F of Schedule 1

Repeal the clause, substitute:

24F Subdivision not always to apply

This Subdivision does not apply to an individual if:

(a) the individual, and the individual's partner, between them are entitled to apply for maintenance income:

(i) from only one other individual; and

(ii) in respect of all of the FTB children of the individual; and

(b) the individual has no regular care children who are rent assistance children.

4 Clause 24M of Schedule 1

Repeal the clause, substitute:

24M Subdivision not always to apply

This Subdivision does not apply to an individual if:

(a) the individual, and the individual's partner, between them are entitled to apply for maintenance income:

(i) from only one other individual; and

(ii) in respect of all of the FTB children of the individual; and

(b) the individual has no regular care children who are rent assistance children.

Part 3 -- Maintenance income credit

Division 1--Amendments commencing on 1 July 2006

A New Tax System (Family Assistance) Act 1999

5 At the end of clause 20 of Schedule 1

Add:

(3) Paragraph (c) of step 1 of the method statement in subclause (1) does not apply to an amount received by the individual (or the individual's partner) in an income year if:

(a) the subclause applies in relation to a claim for payment of family tax benefit for a past period (as mentioned in paragraph 7(1)(b) of the A New Tax System (Family Assistance) (Administration) Act 1999 ) that falls wholly within that year; and

(b) the claim is made in a form approved by an officer of the Australian Taxation Office for the purposes of subsection 7(2) of that Act, acting under a delegation from the Secretary under section 221 of that Act.

6 Application of item 5

The amendment made by item 5 applies to family tax benefit for the 2006 - 2007 income year and later income years.

7 Subclause 24A(2) of Schedule 1

Repeal the subclause, substitute:

(2) Despite subclause (1), a maintenance income credit balance for a registered entitlement, at the end of an income year, cannot exceed the total arrears owing from that registered entitlement, at that time, for all income years for which the entitlement has existed.

8 Application of item 7

The amendment made by item 7 applies to maintenance income credit balances for registered entitlements at the end of the 2005 - 2006 income year and later income years.

9 Subclause 24C(1) of Schedule 1 (method statement, at the end of step 4)

Add "and round the result of the division to the nearest cent (rounding 0.5 cents upwards)".

10 Subclause 24C(2) of Schedule 1 (method statement, step 1)

Repeal the step, substitute:

Step 1. Work out the daily cap for each relevant balance as follows:

(a) work out the annualised amount mentioned in paragraph 24D(1)(a) that is due in the income year from the registered entitlement to which the balance relates;

(b) work out under subclause (4) the annualised amount of maintenance income received in the income year from that registered entitlement;

(c) the daily cap is the excess of the amount mentioned in paragraph (a) over the amount mentioned in paragraph (b), divided by 365 and rounded to the nearest cent (rounding 0.5 cents upwards).

11 Subclause 24C(2) of Schedule 1 (method statement, at the end of step 5)

Add ", with that sum rounded to the nearest cent (rounding 0.5 cents upwards)".

12 At the end of clause 24C of Schedule 1

Add:

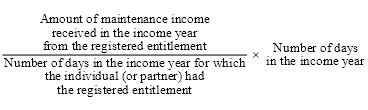

(4) For the purposes of step 1 of the method statement in subclause (2), the annualised amount of maintenance income received in an income year from a registered entitlement of an individual (or an individual's partner) is the amount worked out by using this formula:

13 Paragraph 24D(1)(a) of Schedule 1

Omit "the amounts", substitute "the annualised amounts".

14 Application of items 9 to 13

The amendments made by items 9 to 13 apply to family tax benefit for the 2000 - 2001 income year and later income years.

Division 2--Amendments commencing on 1 July 2007

A New Tax System (Family Assistance) Act 1999

15 Subclause 24C(2) of Schedule 1 (method statement, step 1, at the end of paragraphs (a) and (b))

Add ", and any related private collection entitlement".

16 Subclause 24C(4) of Schedule 1

Repeal the subclause, substitute:

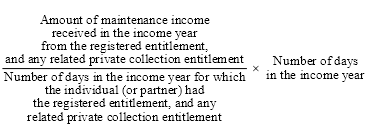

(4) For the purposes of step 1 of the method statement in subclause (2), the annualised amount of maintenance income received in an income year from a registered entitlement, and any related private collection entitlement, of an individual (or an individual's partner) is the amount worked out by using this formula:

(5) In this clause:

"related private collection entitlement" , in relation to a registered entitlement, has the same meaning as in clause 24D.

17 Subparagraphs 24D(1)(a)(i) and (ii) of Schedule 1

Repeal the subparagraphs, substitute:

(i) each registered entitlement for the day, and any related private collection entitlement, of the eligible person; and

(ii) if the eligible person is a member of a couple on the day--each registered entitlement for the day, and any related private collection entitlement, of the eligible person's partner; and

18 Subclause 24D(2) of Schedule 1 (formula)

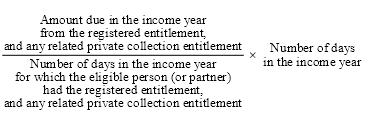

Repeal the formula, substitute:

19 Paragraph 24D(3)(a) of Schedule 1

Repeal the paragraph, substitute:

(a) in respect of:

(i) a registered entitlement for the day, and any related private collection entitlement, of the eligible person; or

(ii) if the eligible person is a member of a couple on the day--a registered entitlement for the day, and any related private collection entitlement, of the eligible person's partner;

the maintenance income received by the eligible person or partner for the income year exceeds the amount due in the income year from the registered entitlement, and any related private collection entitlement; and

20 Subclause 24D(3) of Schedule 1 (formula)

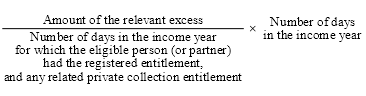

Repeal the formula, substitute:

21 At the end of clause 24D of Schedule 1

Add:

(4) For the purposes of this clause, an individual's private collection entitlement is related to the individual's registered entitlement if the private collection entitlement and registered entitlement relate to the same registrable maintenance liability, within the meaning of the Child Support (Registration and Collection) Act 1988 .

(5) In this clause:

"private collection entitlement" , of an individual, means the individual's entitlement to receive maintenance income from a particular payer, if the payer's liability to pay that maintenance income is a registrable maintenance liability that is not an enforceable maintenance liability, within the meaning of the Child Support (Registration and Collection) Act 1988 .

22 Application of this Division

The amendments made by this Division apply to family tax benefit for the 2007 - 2008 income year and later income years.

Division 3--Amendment commencing on 1 July 2008

A New Tax System (Family Assistance) Act 1999

23 After clause 24E of Schedule 1

Insert:

24EA Amounts due under notional assessments

(1) This clause applies if:

(a) an individual receives child maintenance for an FTB child of the individual under a child support agreement or court order; and

(b) there is, in relation to the agreement or order, a notional assessment of the annual rate of child support that would be payable to the individual for the child for a particular day in a child support period if that annual rate were payable under Part 5 of the Child Support (Assessment) Act 1989 instead of under the agreement or order; and

(c) the child maintenance is received, wholly or in part, from a registered entitlement.

(2) For the purposes of this Subdivision, the amount of child maintenance that is taken to be due to the individual under the agreement or order (whether from the registered entitlement or from a related private collection entitlement within the meaning of clause 24D), for the child for a period, is the amount that would have been due if the amount due to the individual had been the annual rate of child support for the child for the period that is included in the notional assessment.

(3) To avoid doubt, subclause (2) does not apply in relation to the total arrears owing from a registered entitlement, as mentioned in subclause 24A(2).