Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

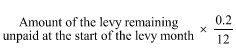

Commonwealth Consolidated Acts(1) If any levy payable by an ADI or general insurer remains unpaid at the start of a levy month after the levy became due for payment, the ADI or general insurer is liable to pay the Commonwealth, for that levy month, a penalty worked out using the formula:

(2) Late payment penalty for a levy month is due and payable at the end of the levy month.

(3) However, APRA may, by written notice given to the ADI or general insurer before, on or after the day on which late payment penalty would be due and payable apart from this subsection, specify a later day as the day on which the late payment penalty is due and payable. The notice has effect, and is taken always to have had effect, according to its terms.