Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The Consolidated Revenue Fund is appropriated for the purposes of payments by the Commonwealth under section 8.

Overall limit for forestry service payments

(2) For forestry service payments, the total limit on the appropriation is the sum of the tax - related amounts.

Overall limit for matching payments

(3) For matching payments, the total limit on the appropriation is the sum of:

(a) the tax - related amounts; and

(b) amounts prescribed by the regulations.

(3A) Subsection ( 3) does not apply if the company is prescribed by the regulations as a company to which the subsection does not apply.

Matching payments--retention limit

(4) The matching payments made to the company during a particular financial year are subject to the condition that, if:

(a) before the end of 31 October next following the financial year, the Minister determines the amount of the gross value of production of the Australian forestry industry in the financial year; and

(b) as at the end of 31 October next following the financial year, the sum of the matching payments that were paid to the company during the financial year exceeds the lesser of:

(i) 0.5% of the amount of the gross value of production of the Australian forestry industry in the financial year as determined by the Minister; and

(ii) 50% of the amount spent by the company in the financial year on activities that qualify, under the funding contract, as research and development activities;

the company will pay to the Commonwealth an amount equal to the excess.

Note: This ensures that the sum of the matching payments that are retained by the company in relation to the financial year does not exceed the lesser of the amounts calculated under subparagraphs ( b)(i) and (b)(ii).

(4A) If:

(a) before the end of 31 October next following a financial year, the Minister has not determined under subsection ( 4) the amount of the gross value of production of the Australian forestry industry in the financial year; and

(b) the Minister has determined under subsection ( 4) the amount of the gross value of production of the Australian forestry industry in the previous financial year;

the Minister is taken to have made, immediately before the end of that 31 October, a determination under subsection ( 4) that the amount of the gross value of production of the Australian forestry industry in the financial year is equal to the amount of the gross value of production of the Australian forestry industry determined under subsection ( 3) for the previous financial year.

(4B) An amount payable under subsection ( 4) by a company:

(a) is a debt due to the Commonwealth; and

(b) may be recovered by the Minister, on behalf of the Commonwealth, by action in a court of competent jurisdiction.

(4C) A determination made under subsection ( 4) is not a legislative instrument.

(5) For the purposes of subsection ( 4), the regulations may prescribe the manner in which the Minister is to determine the gross value of production of the Australian forestry industry in a financial year.

Matching payments--unmatched R and D excess

(6) If there is an unmatched R and D excess for a financial year, the amount spent by the company in the following financial year on activities that qualify, under the funding contract, as research and development activities is taken, for the purposes of this section (including for the purposes of this subsection and subsection ( 7)), to be increased by the amount of the unmatched R and D excess.

Note: This means that research and development expenditure that is not "50% matched" in one financial year because of the condition in subparagraph ( 4)(b)(i) can be carried forward into later years.

(7) For the purposes of subsection ( 6), there is an unmatched R and D excess for a financial year if:

(a) the company spends a particular amount (the R and D spend amount ) in the financial year on activities that qualify, under the funding contract, as research and development activities; and

(b) because of subparagraph ( 4)(b)(i) , the net matching payments for the financial year are less than 50% of the R and D spend amount.

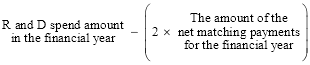

The amount of the unmatched R and D excess is:

Note: Amounts spent and received by the Forest and Wood Products Research and Development Corporation before it ceased to exist may also affect whether there is an unmatched R and D excess, and its amount: see the Forestry Marketing and Research and Development Services (Transitional and Consequential Provisions) Act 2007 .

Set off

(8) If:

(a) an amount (the first amount ) is payable by the company under subsection ( 4); and

(b) another amount (the second amount ) is payable by the Commonwealth to the company under the funding contract;

the Minister may, on behalf of the Commonwealth, set off the whole or a part of the first amount against the whole or a part of the second amount.

Net matching payments

(9) For the purposes of this section, net matching payments for a financial year means the total of the matching payments made to the company during the financial year, less the amount payable by the company under subsection ( 4) as a condition of those matching payments.