Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsRelease of lump sum under a release authority

(1) A lump sum (the release authority lump sum ) may be paid at a time in compliance with a release authority issued to a person under item 3 of the table in subsection 135 - 10(1) in Schedule 1 to the Taxation Administration Act 1953 and given to the Finance Secretary in accordance with Subdivision 135 - B in that Schedule.

Note: The purpose of the release authority is to allow a lump sum to be paid to the Commissioner to meet a debt the person has under Subdivision 133 - C in Schedule 1 to the Taxation Administration Act 1953 .

Finance Secretary treated as superannuation provider

(2) For the purposes of this Act, the Division 293 tax law (within the meaning of the Income Tax Assessment Act 1997 ) applies as if the Finance Secretary was the superannuation provider in relation to the defined benefit interest (within the meaning of that Act) established under this Act.

Limit on amount that may be released

(3) In addition to any requirements in Division 135 in Schedule 1 to the Taxation Administration Act 1953 , the amount of the release authority lump sum must not have the effect that the person's allowance is reduced below zero.

(4) For the purpose of subsection (3), the effect of the release authority lump sum on the amount of the person's allowance is to be worked out after taking account of any reduction under another provision of this Act.

Appropriation

(5) Payment of a release authority lump sum must be made out of the Consolidated Revenue Fund, which is appropriated accordingly.

Calculation of allowance after payment of release authority lump sum

(6) If:

(a) a release authority lump sum is paid in relation to a release authority issued to a person; and

(b) an allowance is payable to the person under subsection 4(1);

the rate of the allowance is the applicable percentage of the rate of allowance that would, apart from this section (but having regard to any other provisions of this Act that affect that rate) be payable to the person.

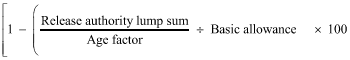

(7) For the purposes of subsection (6), the applicable percentage is worked out using this formula:

where:

"age factor" means the age factor for the person on the day on which the allowance becomes payable (see subsection (10)).

"basic allowance" means the rate of the allowance that would, apart from this subsection (but having regard to any other provisions of this Act that affect that rate), be payable to the person at the time the allowance becomes payable.

(8) The applicable percentage mentioned in subsection (7) is to be calculated to 3 decimal places (rounding up if the fourth decimal place is 5 or more).

(9) If:

(a) the rate of allowance payable to a person is worked out under subsection (6) having regard to a particular applicable percentage; and

(b) a spouse allowance becomes payable to a spouse of the person;

the rate of the spouse allowance is that applicable percentage of the rate of spouse allowance that would, apart from this section (but having regard to any other provisions of this Act that affect that rate) be payable to the spouse.

(10) The Finance Secretary may, by legislative instrument, determine the age factor, or the method for working out the age factor, for the purposes of subsection (7).