Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsNote: See section 6 - 1.

This Schedule provides for loans, called VET FEE - HELP assistance, to be made available to students enrolled in certain vocational education and training (VET) courses.

Note: VET FEE - HELP assistance will be phased out during 2017 and 2018: see subclauses 6(5) and 43(3) to (7).

A body has to be approved as a VET provider before its students can receive VET FEE - HELP. This Part sets out VET provider application and approval processes.

VET providers are subject to the VET quality and accountability requirements.

As part of the phasing out of VET FEE - HELP assistance, VET provider approvals in force immediately before 1 July 2021 are revoked by clause 29 of this Schedule. However, under that clause, provisions of this Act, the VET Guidelines and conditions on the approvals may continue to apply to a body that had been approved as a VET provider.

Note: The Minister must not approve a body as a VET provider after 4 October 2016: see subclause 6(5).

* VET providers and the * VET quality and accountability requirements are also dealt with in the * VET Guidelines. The provisions of this Part indicate when a particular matter is or may be dealt with in these Guidelines.

Note: The VET Guidelines are made by the Minister under clause 99.

Division 3 -- What is a VET provider?

A VET provider is a body that is approved under this Division.

5 When a body becomes or ceases to be a VET provider

(1) A body becomes a * VET provider if approved by the Minister under clause 6.

(2) A * VET provider ceases to be a provider if the provider's approval is revoked or suspended under Division 5 or the notice of the provider's approval ceases to have effect under Part 2 of Chapter 3 (parliamentary scrutiny of legislative instruments) of the Legislation Act 2003 .

Note: As part of the phasing out of VET FEE - HELP assistance, VET provider approvals are revoked by clause 29 of this Schedule. However, provisions of this Act, the VET Guidelines and conditions on the approvals, may continue to apply to a body that had been approved as a VET provider: see subclauses 29(2) to (4).

Subdivision 3 - B -- How are bodies approved as VET providers?

(1) The Minister, in writing, may approve a body as a * VET provider if:

(aa) the body is a body corporate that is not the trustee of a trust; and

(a) the body:

(i) is established under the law of the Commonwealth, a State or a Territory; and

(ii) carries on business in Australia; and

(iii) has its central management and control in Australia; and

(b) subject to subclause (2), providing education is, or is taken to be, the body's principal purpose; and

(c) the body is a * registered training organisation, as listed on the * National Register, that has been a registered training organisation since at least 1 January 2011; and

(ca) the body has been offering:

(i) at least one * qualifying VET course continuously since at least 1 January 2011; or

(ii) one or more series of qualifying VET courses since at least 1 January 2011, with each course in a series superseding the other without interruption; and

(d) the body either fulfils the * VET tuition assurance requirements or is exempted from those requirements under clause 8; and

(da) the body offers at least one * VET course of study; and

(e) the body applies for approval as provided for in clause 9; and

(f) the Minister is satisfied that the body is willing and able to meet the * VET quality and accountability requirements; and

(g) the body complies with any requirements set out in the VET Guidelines; and

(h) the Minister is satisfied that:

(i) the body; and

(ii) each person who makes, or participates in making, decisions that affect the whole, or a substantial part, of the body's affairs;

is a fit and proper person.

(1A) The Minister, in writing, may also approve a body as a * VET provider if:

(a) the body is of a kind specified in the * VET Guidelines; and

(b) the body:

(i) is established under the law of the Commonwealth, a State or a Territory; and

(ii) carries on business in Australia; and

(iii) has its central management and control in Australia; and

(c) subject to subclause (2), providing education is, or is taken to be, the body's principal purpose; and

(d) the body is a * registered training organisation as listed on the * National Register; and

(da) the body has been offering:

(i) at least one * qualifying VET course continuously since at least 1 January 2011; or

(ii) one or more series of qualifying VET courses since at least 1 January 2011, with each course in a series superseding the other without interruption; and

(e) the body either fulfils the * VET tuition assurance requirements or is exempted from those requirements under clause 8; and

(f) the body offers at least one * VET course of study; and

(g) the body applies for approval as provided for in clause 9; and

(h) the Minister is satisfied that the body is willing and able to meet the * VET quality and accountability requirements; and

(i) the body complies with any requirements set out in the VET Guidelines.

(2) For the purpose of paragraph (1)(b) or (1A)(c), the Minister may determine that providing education is taken to be a body's principal purpose if the Minister is satisfied that any of the body's purposes do not conflict with the body's purpose of providing education.

(2A) For the purposes of (but without limiting) paragraph (1)(g) or (1A)(i), the requirements set out in the * VET Guidelines can include requirements relating to a body's capacity to satisfactorily and sustainably provide * VET courses of study.

Note: These requirements could, for example, relate to the stability of the body's ownership and management, its experience, its business relationships with particular kinds of educational institutions and its record in providing quality student outcomes.

(3) The Minister must, in deciding whether he or she is satisfied that a person is a fit and proper person, take into account the matters specified in an instrument under subclause (4). The Minister may take into account any other matters he or she considers relevant.

(4) The Minister must, by legislative instrument, specify matters for the purposes of subclause (3).

(5) The Minister must not approve a body as a * VET provider after 4 October 2016.

7 The VET tuition assurance requirements

The VET tuition assurance requirements are that the body complies with the requirements for VET tuition assurance set out in the * VET Guidelines.

8 VET tuition assurance requirements exemption for approvals

(1) The Minister may, in writing, exempt a body from the * VET tuition assurance requirements for the purposes of approving the body under clause 6.

Note: This clause only deals with exemptions from the VET tuition assurance requirements when approving bodies as VET providers. The VET Guidelines will deal with exemptions from the VET tuition assurance requirements after approval has happened.

(2) An exemption is subject to such conditions as are specified in the exemption.

Note: A body will not be exempt if a condition of the exemption is not complied with.

(3) An exemption given under this clause is not a legislative instrument.

(1) A body that is a * registered training organisation may apply, in writing, to the Minister for approval as a * VET provider.

(2) The application:

(a) must be in the form approved by the Minister; and

(b) must be accompanied by such information as the Minister requests.

(3) If:

(a) a body applies to the Minister for approval as a * VET provider; and

(b) the Minister decides, under clause 6, not to approve the body as a VET provider;

the body cannot make a subsequent application for approval as a VET provider during the 6 - month period starting on the date of the notice given to the applicant under paragraph 11(1)(b) about the decision.

10 Minister may seek further information

(1) For the purposes of determining an application, the Minister may, by notice in writing, require an applicant to provide such further information as the Minister directs within the period specified in the notice.

(2) If an applicant does not comply with a requirement under subclause (1), the application is taken to have been withdrawn.

(3) A notice under this clause must include a statement about the effect of subclause (2).

11 Minister to decide application

(1A) The Minister is not required to comply with this clause after 4 October 2016.

Note: The Minister must not approve a body as a VET provider after 4 October 2016: see subclause 6(5).

(1) The Minister must:

(a) decide an application for approval as a * VET provider; and

(b) cause the applicant to be notified in writing whether or not the applicant is approved as a VET provider.

(2) For the purposes of paragraph 6(1)(f) or 6(1A)(h):

(a) the Minister may be satisfied that a body is willing and able to meet the * VET quality and accountability requirements if the body gives the Minister such written undertakings as the Minister requires; and

(b) the Minister may be satisfied that a body is willing and able to meet:

(i) the * VET quality and accountability requirements; or

(ii) one or more of the requirements referred to in paragraphs 13(a) to (f);

if a body approved under the * VET Guidelines so recommends in accordance with those guidelines.

(2A) Subclause (2) does not limit the circumstances in which the Minister may be satisfied, for the purposes of paragraph 6(1)(f) or 6(1A)(h), that a body is willing and able to meet the * VET quality and accountability requirements.

(3) The Minister's decision must be made:

(a) within 90 days after receiving the application; or

(b) if further information is requested under clause 10--within 60 days after the end of the period within which the information was required to be provided under that clause;

whichever is the later.

(3A) However, contravention of subclause (3) does not affect the Minister's power to decide the application or the Minister's obligation to comply with subclause (1).

(4) If the Minister decides that an applicant is approved as a * VET provider, the notice must also contain such information as is specified in the * VET Guidelines as information that must be provided to an applicant upon approval as a VET provider.

12 Approvals are legislative instruments

(1) A notice of approval under paragraph 11(1)(b) is a legislative instrument.

(2) A decision of the Minister to approve a body as a * VET provider takes effect when the notice of approval commences under the Legislation Act 2003 .

Note: Section 12 of the Legislation Act 2003 provides for when a legislative instrument commences.

(1) The Minister may impose conditions on a body's approval as a * VET provider. Such conditions need not be imposed at the time notice of approval is given to the provider.

(2) The Minister may vary a condition imposed under subclause (1).

12B Minister to cause VET provider to be notified of change in condition of approval

The Minister must, within 30 days of his or her decision to impose or vary a condition on a * VET provider, cause the provider to be notified, in writing, of:

(a) the decision; and

(b) the reasons for the decision; and

(c) the period for which the condition is imposed.

12C Variation of approval if body's name changes

(1) If a body is approved as a * VET provider under clause 6 and the body's name changes, the Minister may vary the approval to include the new name.

(2) The Minister must notify the body in writing of the variation.

(3) A notice of variation under subclause (2) is a legislative instrument.

(4) The variation takes effect when the notice of variation commences under the Legislation Act 2003 .

Note: Section 12 of the Legislation Act 2003 provides for when a legislative instrument commences.

Division 4 -- What are the VET quality and accountability requirements?

13 The VET quality and accountability requirements

The VET quality and accountability requirements are:

(a) the * VET financial viability requirements (see Subdivision 4 - B); and

(b) the * VET quality requirements (see Subdivision 4 - C); and

(c) the * VET fairness requirements (see Subdivision 4 - D); and

(d) the * VET compliance requirements (see Subdivision 4 - E); and

(e) the * VET fee requirements (see Subdivision 4 - F); and

(f) any other requirements for VET quality and accountability set out in the * VET Guidelines.

Subdivision 4 - B -- The VET financial viability requirements

A * VET provider:

(a) must be financially viable; and

(b) must be likely to remain financially viable.

15 Financial information must be provided

(1) A * VET provider must give to the Minister a financial statement for each * annual financial reporting period for the provider in which a student of the provider receives assistance under this Schedule.

(2) The statement:

(a) must be in the form approved by the Minister; and

(b) must be provided with a report, on the statement, by:

(i) the Auditor - General of a State, of the Australian Capital Territory or of the Northern Territory; or

(ii) a registered company auditor (within the meaning of section 9 of the Corporations Act 2001 ), who is independent of the * VET provider; or

(iii) a person approved by the Minister under paragraph (d) of the definition of qualified auditor in subclause 1(1) of Schedule 1, who is independent of the VET provider; and

(c) must be provided within 6 months after the end of the * annual financial reporting period for which the statement was given.

(3) An annual financial reporting period , for a * VET provider, is the period of 12 months:

(a) to which the provider's accounts relate; and

(b) that is notified in writing to the Minister as the provider's annual financial reporting period.

16 Minister to have regard to financial information

In determining whether a * VET provider is financially viable, and likely to remain so, the Minister must have regard to:

(a) any financial statement provided by the provider under clause 15; and

(b) any financial information provided by the provider in response to a notice given to the provider under clause 24.

Subdivision 4 - C -- The VET quality requirements

17 Provider must maintain quality

(1) A * VET provider must operate, and continue to operate, at an appropriate level of quality for a VET provider.

(1A) To avoid doubt, subclause (1) covers the quality of all of a * VET provider's operations.

(2) The Minister must not determine that a * VET provider meets an appropriate level of quality for a VET provider unless the Minister is satisfied that the provider meets the requirements relating to quality set out, or referred to, in the * VET Guidelines.

(4) Despite subsection 14(2) of the Legislation Act 2003 , the * VET Guidelines may refer to a requirement by applying, adopting or incorporating any matter contained in an instrument or other writing as in force or existing from time to time.

Subdivision 4 - D -- The VET fairness requirements

18 Equal benefits and opportunity requirements

A * VET provider must comply with the requirements relating to equal benefits and opportunity for students that are set out in the * VET Guidelines.

19 Student grievance and review requirements

A * VET provider must comply with the requirements relating to student grievance and review procedures that are set out in the * VET Guidelines.

20 Tuition assurance requirements

(1) A * VET provider must comply with the * VET tuition assurance requirements.

(2) The Minister may, by declaration in writing, exempt a specified * VET provider from the requirement in subclause (1).

(3) An exemption:

(a) is subject to such conditions as are specified in the exemption; and

(b) may be expressed to be in force for a period specified in the exemption.

Note: A body will not be exempt if a condition of the exemption is not complied with.

(4) An exemption given under this clause is not a legislative instrument.

21 VET providers to appoint review officers

(1) A * VET provider must appoint a * review officer to undertake reviews of decisions made by the provider relating to assistance under Part 2.

Note: The Secretary may delegate to a review officer of a VET provider the power to reconsider decisions of the provider under Subdivision 16 - C: see subclause 98(2).

(2) A review officer of a * VET provider is a person, or a person included in a class of persons, whom:

(a) the chief executive officer of the provider; or

(b) a delegate of the chief executive officer of the provider;

has appointed to be a review officer of the provider for the purposes of reviewing decisions made by the provider relating to assistance under Part 2.

22 Review officers not to review own decisions

A * VET provider must ensure that a * review officer of the provider:

(a) does not review a decision that the review officer was involved in making; and

(b) in reviewing a decision of the provider, occupies a position that is senior to that occupied by any person involved in making the original decision.

23 Procedures relating to personal information

(1) A * VET provider must comply with the Australian Privacy Principles in respect of * VET personal information obtained for the purposes of Part 2 of this Schedule or Chapter 4.

(2) A * VET provider must have a procedure under which a student enrolled with the provider may apply to the provider for, and receive, a copy of * VET personal information that the provider holds in relation to that student.

(3) The provider must comply with:

(a) the requirements of the * VET Guidelines relating to * personal information in relation to students; and

(b) the procedure referred to in subclause (2).

Subdivision 4 - E -- The VET compliance requirements

A * VET provider must comply with:

(a) this Act and the regulations; and

(b) * VET Guidelines that apply to the provider; and

(c) a condition imposed on the provider's approval as a VET provider.

23B Entry procedure for students

(1) A * VET provider must make and publish a * student entry procedure in accordance with the * VET Guidelines.

(2) A * VET provider must comply with its * student entry procedure.

(3) A student entry procedure is a written procedure that specifies, in accordance with the * VET Guidelines:

(a) when a student is academically suited to undertake a * VET course of study; and

(b) how to assess whether a student is so suited; and

(c) how to report to the * Secretary about the results of such assessments; and

(d) how long the * VET provider must retain those results.

Note: The VET Guidelines could, for example, require a student entry procedure to:

(a) set out the literacy, numeracy and general academic skills needed by a student to undertake a VET course of study; and

(b) provide for assessments of those skills to be conducted online.

(4) For the purposes of subclause (3), the * VET Guidelines may empower:

(a) a person or body:

(i) to decide whether to approve a particular tool for use when assessing whether a student is academically suited to undertake a * VET course of study; and

(ii) to charge a fee for making such a decision; and

(b) a person or body to charge a fee for the use of a tool for such an assessment.

A fee so charged must not be such as to amount to taxation.

23C Receiving requests for Commonwealth assistance

(1) A * VET provider must not treat a student as being entitled to * VET FEE - HELP assistance for a * VET unit of study if:

(a) the student gives an * appropriate officer of the VET provider:

(i) a * request for Commonwealth assistance relating to the unit or a * VET course of study of which the unit forms a part; or

(ii) a form that would be such a request if it were signed by a * responsible parent of the student; and

(b) the student is not entitled to that assistance for that unit or course.

Note: To be a request for Commonwealth assistance, a responsible parent must sign the form if the student is under 18 years old and subclause 88(3A) applies (see paragraph 88(3)(aa)).

(2) Before a * VET provider enrols a student in a * VET unit of study less than 2 business days before the * census date for the unit, the VET provider must advise the student that the student will not be able to receive * VET FEE - HELP assistance for the unit.

(3) Before a * VET provider enrols a student in a * VET unit of study, the VET provider must advise the student that any * request for Commonwealth assistance by the student in relation to the unit must be given:

(a) at least 2 business days after the student enrols in:

(i) if the * VET course of study of which the unit forms a part is undertaken with the provider--the course; or

(ii) otherwise--the unit; and

(b) on or before the * census date for the unit;

if the student has not already given an * appropriate officer of the VET provider such a request relating to the course.

(4) A * VET provider must not encourage a student to give a * request for Commonwealth assistance relating to a * VET unit of study so that the request is given less than 2 business days after the student enrols in the unit.

24 VET provider to provide statement of general information

(1) A * VET provider must give to the Minister such statistical and other information that the Minister by notice in writing requires from the provider in respect of:

(a) the provision of vocational education and training by the provider; and

(b) compliance by the provider with the requirements of this Schedule.

(2) The information must be provided:

(a) in a form (if any) approved by the Minister for the information; and

(b) in accordance with such other requirements as the Minister makes.

(3) A notice under this section must not require the giving of information that a * VET provider is required to give to the Minister under clause 28.

(1) A * VET provider must, by writing, inform the Minister of any event affecting:

(a) the provider; or

(b) a * related body corporate of the provider;

that may significantly affect the provider's capacity to meet the * VET quality and accountability requirements.

(2) A * VET provider must, by writing, inform the Minister of any event that may significantly affect whether:

(a) if the VET provider was approved under subclause 6(1)--any of the conditions in subclause 6(1) are or could be met in relation to the provider after the event; or

(aa) if the VET provider was approved under subclause 6(1A)--any of the conditions in subclause 6(1A) are or could be met in relation to the provider after the event.

(3) A notice under subclause (1) or (2) must be given to the Minister as soon as practicable after the * VET provider becomes aware of the event mentioned in the subclause.

25A Copy of notice given to National VET Regulator about material changes

(1) If a * VET provider gives the * National VET Regulator a notice under section 25 of the National Vocational Education and Training Regulator Act 2011 , the provider must give a copy of the notice to the Minister.

(2) A copy of the notice must be given to the Minister at the same time it must be given to the * National VET Regulator.

26 Compliance assurance--provider

(1) The Minister may require a * VET provider to be audited:

(a) about compliance with any or all of the following requirements:

(i) the * VET financial viability requirements;

(ii) the * VET fairness requirements;

(iii) the * VET compliance requirements;

(iv) the * VET fee requirements;

(v) other requirements for VET quality and accountability set out in the * VET Guidelines; or

(b) about any or all of the following matters relating to * VET courses of study provided by the VET provider:

(i) the approaches used to recruit or enrol students (or potential students) of those courses who receive (or who could receive) * VET FEE - HELP assistance for * VET units of study forming part of those courses;

(ii) the veracity of enrolments in those courses of students who receive VET FEE - HELP assistance for VET units of study forming part of those courses;

(iii) the level of teaching resources, or the quality of those resources, for any of those courses;

(iv) the level of engagement in any of those courses of students who receive VET FEE - HELP assistance for VET units of study forming part of those courses;

(v) the completion rates for any of those courses of students who receive VET FEE - HELP assistance for VET units of study forming part of those courses.

(2) The audit must be conducted:

(a) by a body determined in writing by the Minister; and

(b) at such time or times, and in such manner, as the Minister requires.

(2A) To avoid doubt, if the Minister makes a determination under subclause (2) in relation to the * National VET Regulator, the determination is not a direction for the purpose of subsection 160(2) of the National Vocational Education and Training Regulator Act 2011 .

(3) The provider must:

(a) fully co - operate with the auditing body in the course of its audit; and

(b) pay to the auditing body any charges payable for such an audit.

(4) A determination made under paragraph (2)(a) is not a legislative instrument.

Grounds for giving a compliance notice

(1) The Minister may give a * VET provider a written notice (a compliance notice ) in accordance with this clause if the Minister is satisfied that the provider has not complied with, or is aware of information that suggests that the provider may not comply with, one or more of the following:

(a) this Act or the regulations;

(b) * VET Guidelines that apply to the provider;

(c) a condition imposed on the provider's approval as a VET provider.

Content of compliance notice

(2) The compliance notice must:

(a) set out the name of the provider to which the notice is given; and

(b) set out brief details of the non - compliance or possible non - compliance; and

(c) specify action that the provider must take, or refrain from taking, in order to address the non - compliance or possible non - compliance; and

(d) specify a reasonable period within which the provider must take, or refrain from taking, the specified action; and

(e) if the Minister considers it appropriate--specify a reasonable period within which the provider must provide the Minister with evidence that the provider has taken, or refrained from taking, the specified action; and

(f) in any case--state that a failure to comply with the notice is a breach of a * VET quality and accountability requirement which may lead to the provider's approval as a * VET provider being suspended or revoked; and

(g) in any case--set out any other matters specified in the * VET Guidelines for the purposes of this paragraph.

Matters that Minister must consider in giving compliance notice

(3) In deciding whether to give the compliance notice, the Minister must consider all of the following matters:

(a) whether the non - compliance or possible non - compliance is of a minor or major nature;

(b) the period for which the provider has been approved as a * VET provider;

(c) the provider's history of compliance with:

(i) this Act and the regulations; and

(ii) the * VET Guidelines that apply to the provider; and

(iii) any conditions imposed on the provider's approval as a VET provider;

(d) the impact of the VET provider's non - compliance or possible non - compliance, and of the proposed compliance notice, on:

(i) the VET provider's students; and

(ii) the provision of vocational education and training generally;

(e) the public interest;

(f) any other matter specified in the VET Guidelines for the purposes of this paragraph.

VET provider to comply with compliance notice

(4) A * VET provider must comply with a compliance notice given to the provider under this clause.

Note: A failure to comply with a compliance notice is a breach of a VET quality and accountability requirement which may lead to the provider's approval as a VET provider being suspended or revoked (see clauses 33 and 36).

Variation and revocation of compliance notice

(5) The Minister may, by written notice given to the * VET provider, vary or revoke a compliance notice if, at the time of the variation or revocation, the Minister considers that taking such action is in the public interest.

Note: A variation could, for example, specify different action to be taken by the provider or a different period for complying with the notice.

(6) In deciding whether to vary or revoke the compliance notice, the Minister must consider any submissions that are received from the * VET provider before the end of the period mentioned in paragraph (2)(d).

Subdivision 4 - F -- The VET fee requirements

27 Determining tuition fees for all students

(1) This section applies to a * VET unit of study that a * VET provider provides or proposes to provide during a period ascertained in accordance with the * VET Guidelines.

(2) The provider must determine, for the unit, the VET tuition fees that are to apply to students who may enrol in the unit during the period.

(3) In determining * VET tuition fees under subclause (2), the provider may have regard to any matters the provider considers appropriate, other than matters specified in the * VET Guidelines as matters to which a provider must not have regard.

(4) The provider must not vary a * VET tuition fee unless the provider:

(a) does so:

(i) before the date ascertained in accordance with the * VET Guidelines; and

(ii) in circumstances specified in the VET Guidelines; or

(b) does so with the written approval of the Minister.

27A Requirements in the VET Guidelines

A * VET provider must comply with any requirements set out in the * VET Guidelines relating to:

(a) fees for * VET units of study; or

(b) fees for * VET courses of study; or

(c) matters or things for which fees may be charged.

28 Schedules of VET tuition fees

General rule

(1) A * VET provider must give the Minister a schedule of the * VET tuition fees determined under clause 27 for all the VET units of study it provides or proposes to provide, other than under * VET restricted access arrangements, during a period ascertained in accordance with the * VET Guidelines. It must give the schedule:

(a) in a form approved by the Minister; and

(b) in accordance with the requirements that the Minister determines in writing.

(2) The provider must:

(a) ensure that the schedule provides sufficient information to enable a person to work out the person's * VET tuition fee for each * VET unit of study the provider provides or is to provide; and

(b) publish the schedule for a particular period by the date ascertained in accordance with the * VET Guidelines; and

(c) ensure that the schedule is available to all students enrolled, and persons seeking to enrol, with the provider on request and without charge.

Restricted access arrangements

(2A) A * VET provider must give the Minister a schedule of the * VET tuition fees determined under clause 27 for each * VET unit of study it provides or proposes to provide under a * VET restricted access arrangement during a period ascertained in accordance with the * VET Guidelines. It must give the schedule:

(a) in a form approved by the Minister; and

(b) in accordance with the requirements that the Minister determines in writing.

(2B) The provider must:

(a) ensure that the schedule provides sufficient information to enable a person to work out the person's * VET tuition fee for the * VET unit of study the provider provides or is to provide under the * VET restricted access arrangement; and

(b) ensure that the schedule is available, on request and without charge, to all students enrolled, or eligible to be enrolled, under the VET restricted access arrangement.

Replacement schedules

(3) If:

(a) the provider has given the Minister a schedule (the previous schedule ) under:

(i) subclause (1) or (2A); or

(ii) this subclause; and

(b) the provider varies a * VET tuition fee in the previous schedule;

the provider must:

(c) by written notice given to the Minister:

(i) withdraw the previous schedule; and

(ii) inform the Minister of the variation; and

(d) give the Minister a replacement schedule incorporating the variation.

Note: The provider must comply with subclause 27(4) when varying a tuition fee.

(4) Subclauses (1) to (2B) apply to the replacement schedule in a corresponding way to the way in which they apply to the previous schedule.

Division 5 -- Revocation of VET provider approvals

Revocation of approval

(1) If an approval of a body as a * VET provider is in force immediately before 1 July 2021, the approval is revoked at the start of that day.

Continuing application of Act etc.

(2) Despite the revocation of a body's approval as a * VET provider by subclause (1):

(a) the Act, and the * VET Guidelines, continue to apply in relation to the body on and after 1 July 2021 as if the body were still a VET provider; and

(b) any conditions:

(i) imposed on the approval of the body; and

(ii) in effect immediately before 1 July 2021;

continue to apply to the body on and after 1 July 2021 as if the body were still a VET provider.

(3) Subclause (2) applies for the purpose of dealing with or resolving any matter that arose under this Act during, or that relates to, the period when the body was approved as a * VET provider.

(4) To avoid doubt, if a body that has had its approval revoked by subclause (1) would be required or empowered, but for the revocation, to do a thing under, or for the purposes of, Subdivision 7 - B of Division 7 of Part 2 (which deals with re - crediting), the body is, on and after 1 July 2021, required or empowered to do the thing as if the body were still a * VET provider.

Interaction with the Acts Interpretation Act 1901

(5) This clause does not limit the effect of section 7 of the Acts Interpretation Act 1901.

Division 5A -- Civil penalty provisions and enforcement

Subdivision 5A - A -- Civil penalty provisions

Enforceable civil penalty provisions

(1) Each * civil penalty provision of this Division is enforceable under Part 4 of the * Regulatory Powers Act.

Note: Part 4 of the Regulatory Powers Act allows a civil penalty provision to be enforced by obtaining an order for a person to pay a pecuniary penalty for the contravention of the provision.

Authorised applicant

(2) For the purposes of Part 4 of the * Regulatory Powers Act, each of the following persons is an authorised applicant in relation to the * civil penalty provisions:

(a) the * Secretary;

(b) an SES employee, or an acting SES employee, in the Department.

Relevant court

(3) For the purposes of Part 4 of the * Regulatory Powers Act, each * applicable court is a relevant court in relation to the * civil penalty provisions.

39DB Civil penalty--publishing information that suggests VET FEE - HELP assistance is not a loan etc.

(1) A person contravenes this subclause if:

(a) the person is a * VET provider; and

(b) the VET provider publishes information, or causes information to be published; and

(c) the information suggests that:

(i) * VET FEE - HELP assistance for a * VET unit of study or * VET course of study is not in the nature of a loan, or does not need to be repaid; or

(ii) if a student receives VET FEE - HELP assistance for such a unit or course, that the unit or course is free from any fees or charges.

Civil penalty: 60 penalty units.

(2) A person contravenes this subclause if:

(a) the person publishes information; and

(b) the person does so as agent for a * VET provider; and

(c) the information suggests that:

(i) * VET FEE - HELP assistance for a * VET unit of study or * VET course of study is not in the nature of a loan, or does not need to be repaid; or

(ii) if a student receives VET FEE - HELP assistance for such a unit or course, that the unit or course is free from any fees or charges.

Civil penalty: 60 penalty units.

39DC Civil penalty--inappropriate inducements

(1) A person contravenes this subclause if:

(a) the person is a * VET provider; and

(b) the VET provider:

(i) offers a person a benefit; or

(ii) provides a person with a benefit; or

(iii) causes a person to be offered or provided with a benefit; and

(c) the benefit would be reasonably likely to induce a person (the student ) to:

(i) enrol in a * VET unit of study or * VET course of study; and

(ii) complete, sign and give an * appropriate officer of the VET provider a * request for Commonwealth assistance relating to the unit or course; and

(d) the student receives * VET FEE - HELP assistance for that unit or course.

Civil penalty: 60 penalty units.

(2) A person contravenes this subclause if:

(a) the person offers a person a benefit, or provides a person with a benefit; and

(b) the person does so as agent for a * VET provider; and

(c) the benefit would be reasonably likely to induce a person (the student ) to:

(i) enrol in a * VET unit of study or * VET course of study; and

(ii) complete, sign and give an * appropriate officer of the VET provider a * request for Commonwealth assistance relating to the unit or course; and

(d) the student receives * VET FEE - HELP assistance for that unit or course.

Civil penalty: 60 penalty units.

(3) To avoid doubt, the person in paragraph (1)(b) or (2)(a) who is offered, or provided with, the benefit need not be the student.

39DD Appropriate and inappropriate inducements

(1) Subclauses 39DC(1) and (2), and subclause (2) of this clause, do not apply in relation to any of the following benefits:

(a) the content and quality of the * VET unit of study or * VET course of study;

(b) the amount of * tuition fees of the unit or course (other than so much of the fees as is conditional on a person identifying other persons as prospective students for a unit or course);

(c) * VET FEE - HELP assistance for the unit or course;

(d) the use of a thing if:

(i) the use is limited to the period the student is participating in the unit or course; and

(ii) the use is required or necessary for the completion of the unit or course (having regard to the learning objectives and outcomes of the unit or course); and

(iii) the use of such a thing is available on the same terms to all students, of a kind specified in the * VET Guidelines for the purposes of this subparagraph, who are participating in the unit or course.

(2) Without limiting subclauses 39DC(1) and (2), those subclauses apply in relation to the following benefits:

(a) the use of an electronic device outside the period the student is participating in the * VET unit of study or * VET course of study;

(b) internet use, or the use of software, outside that period;

(c) travel, entertainment, hospitality or accommodation services;

(d) vouchers redeemable for goods or services;

(e) money (other than amounts covered by paragraph (1)(b) or (c)).

39DE Civil penalty--failure to provide VET FEE - HELP notices

A person contravenes this clause if:

(a) the person is a * VET provider; and

(b) the VET provider fails to comply with subclause 64(1), (2), (2A) or (3).

Civil penalty: 60 penalty units.

39DF Civil penalty--failure to comply with student requests

(1) A person contravenes this subclause if:

(a) the person is a * VET provider; and

(b) the VET provider enrols another person (the student ) in a * VET unit of study; and

(c) the student is entitled to * VET FEE - HELP assistance for the unit; and

(d) before the end of the * census date for the unit, the student requests, in writing, the VET provider to:

(i) cancel the enrolment; or

(ii) withdraw the student's * request for Commonwealth assistance relating to the unit or the * VET course of study of which the unit forms a part; and

(e) the VET provider fails to comply with the request before the end of that census date.

Civil penalty: 60 penalty units.

(2) For the purposes of paragraph (1)(c), disregard subparagraph 43(1)(f)(ii) and paragraph 45C(1)(c).

39DG Civil penalty--charging a fee etc. for a student to cancel an enrolment or request for assistance

(1) A person contravenes this subclause if:

(a) the person is a * VET provider; and

(b) the VET provider enrols another person (the student ) in a * VET unit of study; and

(c) the student is entitled to * VET FEE - HELP assistance for the unit; and

(d) before the end of the * census date for the unit, the student requests, in writing, the VET provider to:

(i) cancel that enrolment; or

(ii) withdraw the student's * request for Commonwealth assistance relating to the unit or the * VET course of study of which the unit forms a part; and

(e) the VET provider charges the student a fee, or imposes a penalty, (however described) in order to do so.

Civil penalty: 60 penalty units.

(2) For the purposes of paragraph (1)(c), disregard subparagraph 43(1)(f)(ii) and paragraph 45C(1)(c).

39DH Civil penalty--accepting requests for Commonwealth assistance etc. when student not entitled

(1) A person contravenes this subclause if:

(a) the person is a * VET provider; and

(b) an * appropriate officer of the VET provider is given a * request for Commonwealth assistance by another person (the student ) relating to a * VET unit of study or the * VET course of study of which the unit forms a part; and

(c) the VET provider treats the student as being entitled to * VET FEE - HELP assistance for the unit; and

(d) the student is not so entitled.

Civil penalty: 60 penalty units.

(2) A person contravenes this subclause if:

(a) the person is a * VET provider; and

(b) an * appropriate officer of the VET provider is given a form by another person (the student ); and

(c) subclause 88(3A) (about certain students under 18 years old) applies to the student; and

(d) that form is not signed by a * responsible parent of the student; and

(e) that form would have been a * request for Commonwealth assistance relating to:

(i) a * VET unit of study; or

(ii) the * VET course of study of which the unit forms a part;

if it had been signed by a responsible parent of the student; and

(f) the VET provider treats the student as being entitled to * VET FEE - HELP assistance for the unit.

Civil penalty: 60 penalty units.

39DI Civil penalty--failure to advise about requests etc.

(1) A person contravenes this subclause if:

(a) the person is a * VET provider; and

(b) the VET provider enrols another person (the student ) in a * VET unit of study; and

(c) the student has not already given an * appropriate officer of the VET provider a * request for Commonwealth assistance relating to the * VET course of study of which the unit forms a part; and

(d) the student enrols in the unit less than 2 business days before the * census date for the unit; and

(e) before enrolling the student, the VET provider failed to advise the student that the student would not be able to receive * VET FEE - HELP assistance for the unit; and

(f) the student completes, signs and gives an appropriate officer of the VET provider a request for Commonwealth assistance relating to the unit or the VET course of study of which the unit forms a part.

Civil penalty: 60 penalty units.

(2) A person contravenes this subclause if:

(a) the person is a * VET provider; and

(b) the VET provider enrols another person (the student ) in a * VET unit of study; and

(c) the student completes, signs and gives an * appropriate officer of the VET provider a * request for Commonwealth assistance relating to the unit or a * VET course of study of which the unit forms a part; and

(d) the request is so given less than 2 business days after the student enrols in the unit; and

(e) either or both of the following subparagraphs applies:

(i) before enrolling the student, the VET provider failed to advise the student that * VET FEE - HELP assistance for the unit can only be received if the request is given at least 2 business days after enrolling;

(ii) the VET provider encouraged the student to give the request so that it would be given less than 2 business days after enrolling.

Civil penalty: 60 penalty units.

39DJ Civil penalty--failure to apportion fees appropriately

A person contravenes this clause if:

(a) the person is a * VET provider; and

(b) the VET provider enrols another person (the student ) in a * VET unit of study; and

(c) the student receives * VET FEE - HELP assistance for the unit; and

(d) the VET provider charges the student * tuition fees for the unit; and

(e) for the purposes of clause 27A, the * VET Guidelines specify when the tuition fees may be charged; and

(f) the tuition fees are not charged in accordance with those VET Guidelines.

Civil penalty: 60 penalty units.

39DK Civil penalty--failure to publish fees

A person contravenes this clause if:

(a) the person is a * VET provider; and

(b) the VET provider enrols another person (the student ) in a * VET unit of study; and

(c) the student receives * VET FEE - HELP assistance for the unit; and

(d) the VET provider charges the student * tuition fees for the unit; and

(e) on the day before the student enrols in the unit, the tuition fees were not available on the VET provider's website in a way that was readily accessible by the public.

Civil penalty: 60 penalty units.

39DL Civil penalty--failure to report data

A person contravenes this clause if:

(a) the person is a * VET provider; and

(b) the VET provider enrols another person (the student ) in a * VET unit of study; and

(c) the student receives * VET FEE - HELP assistance for the unit; and

(d) the VET provider is subject to a requirement under subclause 24(1) or (2) to provide information relating to the VET FEE - HELP assistance; and

(e) the VET provider fails to comply with the requirement.

Civil penalty: 60 penalty units.

Subdivision 5A - B -- Infringement notices

A * civil penalty provision of this Division is subject to an infringement notice under Part 5 of the * Regulatory Powers Act.

Note: Part 5 of the Regulatory Powers Act creates a framework for using infringement notices in relation to provisions.

For the purposes of Part 5 of the * Regulatory Powers Act, an infringement officer in relation to the * civil penalty provisions is:

(a) each * NVETR staff member who is:

(i) an SES employee or an acting SES employee; or

(ii) an APS employee who holds or performs the duties of an Executive Level 2 position or an equivalent position; or

(b) each SES employee, or an acting SES employee, in the Department.

For the purposes of Part 5 of the * Regulatory Powers Act, the relevant chief executive in relation to the * civil penalty provisions is:

(a) for an infringement notice given by an infringement officer covered by paragraph 39EB(a)--the * National VET Regulator; and

(b) for an infringement notice given by an infringement officer covered by paragraph 39EB(b)--the * Secretary.

Subdivision 5A - C -- Monitoring and investigation powers

(1) Subdivision 5A - A is subject to monitoring under Part 2 of the * Regulatory Powers Act.

Note: Part 2 of the Regulatory Powers Act creates a framework for monitoring whether Subdivision 5A - A has been complied with. It includes powers of entry and inspection.

(2) Information given in compliance or purported compliance with a provision of Subdivision 5A - A is subject to monitoring under Part 2 of the * Regulatory Powers Act.

Note: Part 2 of the Regulatory Powers Act creates a framework for monitoring whether the information is correct. It includes powers of entry and inspection.

39FB Monitoring powers--persons exercising relevant roles etc.

(1) For the purposes of Part 2 of the * Regulatory Powers Act, as it applies in relation to Subdivision 5A - A of this Schedule:

(a) each * civil penalty provision of this Division is related to Subdivision 5A - A of this Schedule; and

(b) each * Departmental investigator and * NVETR investigator is an authorised applicant; and

(c) each Departmental investigator and NVETR investigator is an authorised person; and

(d) a * judicial officer is an issuing officer; and

(e) for an authorised person who is a Departmental investigator, the * Secretary is the relevant chief executive; and

(f) for an authorised person who is a NVETR investigator, the * National VET Regulator is the relevant chief executive; and

(g) each * applicable court is the relevant court.

Person assisting

(2) An authorised person may be assisted by other persons in exercising powers or performing functions or duties under Part 2 of the * Regulatory Powers Act in relation to a provision of Subdivision 5A - A of this Schedule.

Each * civil penalty provision of this Division is subject to investigation under Part 3 of the * Regulatory Powers Act.

Note: Part 3 of the Regulatory Powers Act creates a framework for investigating whether a provision has been contravened. It includes powers of entry, search and seizure.

39FD Investigation powers--persons exercising relevant roles etc.

(1) For the purposes of Part 3 of the * Regulatory Powers Act, as it applies in relation to evidential material that relates to a * civil penalty provision of this Division:

(a) each * Departmental investigator and * NVETR investigator is an authorised applicant; and

(b) each Departmental investigator and NVETR investigator is an authorised person; and

(c) a * judicial officer is an issuing officer; and

(d) for an authorised person who is a Departmental investigator, the * Secretary is the relevant chief executive; and

(e) for an authorised person who is a NVETR investigator, the * National VET Regulator is the relevant chief executive; and

(f) each * applicable court is the relevant court.

Person assisting

(2) An authorised person may be assisted by other persons in exercising powers or performing functions or duties under Part 3 of the * Regulatory Powers Act in relation to evidential material that relates to a provision of Subdivision 5A - A of this Schedule.

Subdivision 5A - D -- Other matters

39GA Appointment of investigators

(1) The * Secretary may, in writing, appoint a person as a Departmental investigator for the purposes of this Division.

(2) The * National VET Regulator may, in writing, appoint a * NVETR staff member as a NVETR investigator for the purposes of this Division.

(3) A person must not be appointed as a * Departmental investigator, or a * NVETR investigator, unless the appointer is satisfied that the person has the knowledge or experience necessary to properly exercise the powers of such an investigator.

(4) A * Departmental investigator, and a * NVETR investigator, must, in exercising powers as such, comply with any directions of the appointer.

(5) If a direction is given under subclause (4) in writing, the direction is not a legislative instrument.

The functions and powers of a person referred to in:

(a) subclause 39DA(2) (about authorised applicants); or

(b) clause 39EB or 39EC (about infringement notices); or

(c) paragraph 39FB(1)(b), (c), (d), (e) or (f) (about monitoring powers); or

(d) paragraph 39FD(1)(a), (b), (c), (d) or (e) (about investigation powers);

include those conferred by Part 2, 3, 4 or 5 (as applicable) of the * Regulatory Powers Act in relation to this Division.

39GC Delegation by relevant chief executive etc.

(1) The * Secretary may, in writing, delegate his or her powers and functions that:

(a) arise under the * Regulatory Powers Act as the relevant chief executive; and

(b) relate to this Division;

to an SES employee, or an acting SES employee, in the Department.

(2) The * National VET Regulator may, in writing, delegate his or her powers and functions that:

(a) arise under the * Regulatory Powers Act as the relevant chief executive and relate to this Division; or

(b) arise under clause 39GA of this Schedule;

to an * NVETR staff member who is:

(c) an SES employee or an acting SES employee; or

(d) an APS employee who holds or performs the duties of an Executive Level 2 position or an equivalent position.

(3) A person exercising powers or performing functions under a delegation under subclause (1) or (2) must comply with any directions of the delegator.

(4) A person must not exercise powers or perform functions under a delegation under subclause (1) or (2) in relation to an infringement notice given by the person.

To avoid doubt, action may be taken under this Division in addition to, or instead of, any action that may be taken under any other provision of this Act, including under any or all of the following provisions of this Schedule:

(a) clause 12A (about imposing conditions on an approval);

(b) clause 26A (about compliance notices);

(d) Subdivision 7 - B (about re - crediting * HELP balances).

Part 2 -- VET FEE - HELP assistance

A student may be entitled to VET FEE - HELP assistance for VET units of study if certain requirements are met.

The amount of assistance to which the student may be entitled is based on his or her VET tuition fees for the units, but there is a limit on the total amount of assistance that the student can receive. The assistance is paid to a VET provider to discharge the student's liability to pay his or her VET tuition fees.

Note 1: Amounts of assistance under this Part may form part of a person's HELP debts that the Commonwealth recovers under Chapter 4.

Note 2: VET FEE - HELP assistance will be phased out during 2017 and 2018: see subclauses 43(3) to (7).

(1) * VET FEE - HELP assistance is also dealt with in the * VET Guidelines. The provisions of this Part indicate when a particular matter is or may be dealt with in these Guidelines.

(2) * VET tuition fees are also dealt with in the * VET Guidelines.

Note: The VET Guidelines are made by the Minister under clause 99.

Division 7 -- Who is entitled to VET FEE - HELP assistance?

Subdivision 7 - A -- Basic rules

43 Entitlement to VET FEE - HELP assistance

(1) Subject to this clause, a student is entitled to * VET FEE - HELP assistance for a * VET unit of study if:

(a) the student meets the citizenship or residency requirements under clause 44; and

(b) the student's * HELP balance is greater than zero; and

(c) the * census date for the unit is on or after 1 January 2008; and

(d) the unit meets the course requirements under clause 45; and

(e) the unit is, or is to be, undertaken as part of a * VET course of study; and

(ea) the student meets the entry procedure requirements under clause 45B; and

(f) the student:

(i) enrols in the unit at least 2 business days before the census date for the unit; and

(ii) at the end of the census date, remained so enrolled; and

(fa) in a case where the student is not already entitled to VET FEE - HELP assistance for another VET unit of study forming part of the course--the body with whom the student is enrolled is approved as a * VET provider:

(i) for the day of the enrolment; or

(ii) if that day falls within a period when the body's approval as a VET provider is suspended under subclause 36(5)--for a later day because that suspension has ended; and

(fb) if the VET provider was approved as a VET provider after 2015, the course is:

(i) one of the * qualifying VET courses that enabled paragraph 6(1)(ca) or (1A)(da) to be satisfied for the purposes of that approval; or

(ii) a qualifying VET course that superseded such a course directly or indirectly without interruption; and

(g) the student * meets the tax file number requirements (see clause 80); and

(h) the student meets the request for Commonwealth assistance requirements under clause 45C; and

(i) the student meets any other requirements set out in the * VET Guidelines.

Note 1: For the purposes of paragraph (e), clause 45A affects whether a person undertakes a VET unit of study as part of a VET course of study.

Note 2: For the purposes of paragraph (fa), a body's approval as a VET provider ceases while the approval is suspended (see clause 29). If this approval is suspended when the student first enrols in units forming part of the course, the student can only become entitled to VET FEE - HELP assistance when that suspension ends.

(2) A student is not entitled to * VET FEE - HELP assistance for a * VET unit of study if:

(a) the unit forms a part of a * VET course of study; and

(b) the VET course of study is, or is to be, undertaken by the student primarily at an overseas campus.

(3) A student is not entitled to * VET FEE - HELP assistance for a * VET unit of study if:

(a) the * census date for the unit is on or after 1 January 2017; or

(b) if the student is covered by subclause (4)--the census date for the unit is on or after:

(i) unless subparagraph (ii) applies--1 January 2018; or

(ii) if the Minister is satisfied that exceptional circumstances justify continued entitlement to VET FEE - HELP assistance for the student--a day determined in writing by the Minister.

(4) A student is covered by this subclause if:

(a) immediately before 1 January 2017, the student was enrolled in the * VET course of study of which the * VET unit of study forms a part; and

(b) the unit is provided:

(i) by the * VET provider with whom the student was enrolled immediately before 1 January 2017; or

(ii) in compliance with the * VET tuition assurance requirements as they apply in relation to the provider; and

(c) before 1 January 2017, the student received * VET FEE - HELP assistance for another unit that formed a part of the course; and

(d) the Secretary is satisfied that, at all times from the commencement of this paragraph, the student has been a genuine student (within the meaning of the VET Student Loans Act 2016 ).

(5) A student is not entitled to * VET FEE - HELP assistance for a * VET unit of study if a * VET student loan has been approved for the student for the * VET course of study of which the unit forms a part.

(6) The * VET Guidelines may specify matters to which the Minister must or may have regard in deciding for the purposes of subparagraph (3)(b)(ii) whether exceptional circumstances justify continued entitlement to * VET FEE - HELP assistance for the student.

(7) A determination under subparagraph (3)(b)(ii) is not a legislative instrument.

44 Citizenship or residency requirements

(1) The citizenship or residency requirements for * VET FEE - HELP assistance for a * VET unit of study are that the student in question is:

(a) an Australian citizen; or

(b) a * permanent humanitarian visa holder who will be resident in Australia for the duration of the unit; or

(c) a student to whom subclause (3) applies.

(2) In determining, for the purpose of paragraph (1)(b), whether the student will be resident in Australia for the duration of the unit, disregard any period of residence outside Australia that:

(a) cannot reasonably be regarded as indicating an intention to reside outside Australia for the duration of the unit; or

(b) is required for the purpose of completing a requirement of that unit.

(3) This subclause applies to a student who:

(a) is a New Zealand citizen; and

(b) holds a special category visa under the Migration Act 1958 ; and

(c) both:

(i) first began to be usually resident in Australia at least 10 years before the day referred to in subclause (4) (the test day ); and

(ii) was a * dependent child when he or she first began to be usually resident in Australia; and

(d) has been in Australia for a period of, or for periods totalling, 8 years during the 10 years immediately before the test day; and

(e) has been in Australia for a period of, or for periods totalling, 18 months during the 2 years immediately before the test day.

(4) For the purposes of subclause (3), the day is the earlier of:

(a) if the student has previously made a successful * request for Commonwealth assistance under this Part for a * VET unit of study that formed part of the same * VET course of study--the day the student first made such a request; or

(b) otherwise--the day the student made the request for Commonwealth assistance in relation to the unit.

(1) The course requirements for * VET FEE - HELP assistance for a * VET unit of study are that the unit:

(a) is being undertaken as part of a * VET course of study that meets any requirements set out in the * VET Guidelines; and

(b) is not being undertaken as part of a VET course of study that:

(i) is subject to a specification under subclause (2); or

(ii) is with a * VET provider that is subject to a specification under subclause (2).

Note: For the purposes of paragraph (1)(a), clause 45A affects whether a person undertakes a VET unit of study as part of a VET course of study.

(1A) For the purposes of paragraph (1)(a), the * VET Guidelines:

(a) may set out different requirements relating to different students undertaking the * VET unit of study; and

(b) may set out requirements relating to only some students undertaking the VET unit of study (while not setting out requirements relating to other students undertaking the unit).

(2) The * VET Guidelines may specify that:

(a) a specified course or a specified kind of course provided by a specified * VET provider or a specified kind of VET provider is a course in relation to which * VET FEE - HELP assistance is unavailable; or

(b) all courses provided by a specified VET provider or a specified kind of VET provider are courses in relation to which VET FEE - HELP assistance is unavailable.

(3) In deciding whether to make a specification for the purposes of subclause (2), the Minister must have regard to the effect of the specification on students undertaking the course or courses.

45A VET unit of study not undertaken as part of VET course of study

For the purposes of paragraphs 43(e) and 45(1)(a), a student is taken not to undertake a * VET unit of study as part of a * VET course of study if undertaking the unit involves the student doing more than he or she needs to do to be awarded a * VET qualification that the course leads to.

45B Entry procedure requirements

The entry procedure requirements for * VET FEE - HELP assistance for a * VET unit of study are that the student, in accordance with the * VET provider's * student entry procedure, has been assessed as academically suited to undertake the * VET course of study of which the unit forms a part.

45C Request for Commonwealth assistance requirements

(1) The request for Commonwealth assistance requirements for * VET FEE - HELP assistance for a * VET unit of study are that:

(a) the student completes, signs and gives an * appropriate officer of the * VET provider a * request for Commonwealth assistance that:

(i) if the * VET course of study of which the unit forms a part is undertaken with the provider--relates to the course, and is so given at least 2 business days after the student enrols in the course; or

(ii) otherwise--relates to the unit, and is so given at least 2 business days after the student enrols in the unit; and

(b) the request is so given on or before the * census date for the unit; and

(ba) if the student enrols in the course after the day the Higher Education Support Amendment (VET FEE - HELP Reform) Act 2015 receives the Royal Assent--the student being entitled to the VET FEE - HELP assistance for the unit:

(i) would not cause the VET provider's * VET FEE - HELP account to be in deficit at the end of that census date (see subclause 45D(7)); and

(ii) would not cause or contribute to that account being in deficit at the end of 2016 or a later calendar year; and

(c) the request is not withdrawn before the end of that census date.

If VET provider incorrectly treats student as being entitled

(2) However, for the purposes of this Act (other than clause 39DH), if:

(a) either or both of the following things happen:

(i) the student fails to comply with paragraph (1)(a) of this clause by not giving the request at least 2 business days after the enrolment referred to in that paragraph;

(ii) paragraph (1)(ba) of this clause is not complied with; and

(b) the * VET provider treats the student as being entitled to * VET FEE - HELP assistance for the unit;

those paragraphs of this clause are taken to have been complied with.

Note 1: The VET provider should not treat the student as being entitled to VET FEE - HELP assistance:

(a) if the student requests the assistance during the 2 business day cooling - off period after the enrolment; or

(b) if being entitled would cause or contribute to the provider's VET FEE - HELP account being in deficit.

Note 2: However, if the provider does treat the student as being entitled, the provider will contravene subclause 39DH(1) (a civil penalty provision), and the student may still be able to receive the assistance.

45D Notional VET FEE - HELP accounts

(1) There is a notional VET FEE - HELP account for each * VET provider.

Note 1: The VET provider will need to monitor the balance of its account, as it will have to repay an amount to the Commonwealth if the account is in deficit at the end of 2016 or a later year.

Note 2: This account applies in relation to all students entitled to VET FEE - HELP assistance for VET units of study with census dates on or after 1 January 2016 (whether or not the student received VET FEE - HELP assistance for earlier units before that day). See subclause (7).

Credits to the VET provider's VET FEE - HELP account

(2) A credit arises in the * VET provider's * VET FEE - HELP account as follows:

(a) if the VET provider is already a VET provider on 1 January 2015, a credit arises on the first day of each later calendar year that is equal to the amount worked out under subclause (3);

(b) if the VET provider becomes a VET provider during 2015, a credit arises on the first day of each later calendar year that is equal to the amount worked out under subclause (4);

(c) if the VET provider becomes a VET provider on a day after 2015, a credit arises on that day that is equal to the amount worked out under subclause (5);

(d) if the VET provider pays on a particular day any part of any amount that becomes due under subclause 45E(2), a credit arises on that day that is equal to the amount of that payment;

(e) if another body ceases to be a VET provider, a credit may arise:

(i) in accordance with a determination under subclause (6) at the time of the cessation; and

(ii) that is equal to the amount worked out under that determination;

(f) if the * Secretary, on application by the VET provider, is satisfied on a particular day that:

(i) the VET provider is offering a VET course of study that confers skills in an identified area of national importance; and

(ii) the course is relevant for employment in a licensed occupation; and

(iii) one or more students are unable to readily access training places in courses of this kind with any other VET provider; and

(iv) insufficient credits have arisen in the VET provider's VET FEE - HELP account for an appropriate number of students to undertake the course with the VET provider; and

(v) granting an extra credit of a particular amount is appropriate (which need not be the amount specified in the application);

the Secretary may grant a credit, which arises on that day, that is equal to the amount considered appropriate under subparagraph (v).

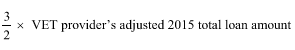

(3) For the purposes of paragraph (2)(a), the amount to be credited is the amount equal to:

where:

"VET provider's adjusted 2015 total loan amount" means the sum of the amounts of * VET FEE - HELP assistance paid for students undertaking, with the * VET provider, * VET units of study that had * census dates during the period starting on 1 January 2015 and ending on 31 August 2015.

(4) For the purposes of paragraph (2)(b), the amount to be credited is the amount equal to the sum of:

(a) the * VET provider's fee revenue for the period:

(i) starting on 1 January 2015; and

(ii) ending on the day before the VET provider was approved as a VET provider;

for * domestic students undertaking * qualifying VET courses in that period; and

(b) the sum of the amounts of * VET FEE - HELP assistance paid for students undertaking, with the VET provider, * VET units of study that had * census dates during 2015.

(5) For the purposes of paragraph (2)(c), the amount to be credited is the amount equal to the * VET provider's fee revenue for the 2015 calendar year for * domestic students undertaking in that year the * qualifying VET courses that enabled paragraph 6(1)(ca) or (1A)(da) to be satisfied for the purposes of the VET provider's approval as a VET provider.

(6) The Minister may, by legislative instrument, determine:

(a) whether credits arise in the * VET FEE - HELP accounts of specified * VET providers when another body ceases to be a VET provider; and

(b) the amounts of such credits.

Debits to the VET FEE - HELP account

(7) A debit arises in the * VET provider's * VET FEE - HELP account if a student is entitled to * VET FEE - HELP assistance for a * VET unit of study:

(a) that is to be undertaken with the VET provider; and

(b) that has a * census date on or after 1 January 2016.

The debit arises at the end of that census date, and is equal to the amount of that assistance.

45E Effect of VET FEE - HELP account being in deficit at the end of a calendar year

(1) If:

(a) a * VET provider's * VET FEE - HELP account is in deficit at the end of a calendar year; and

(b) the * Secretary gives the VET provider a written notice about the deficit;

the VET provider must pay to the Commonwealth an amount equal to the amount of the deficit (the excess loan amount ).

(2) The excess loan amount is due on the seventh day (the due day ) after the day the notice is given.

Late payments of the excess loan amount attract the general interest charge

(3) If some or all of the excess loan amount remains unpaid after the due day, the * VET provider must pay to the Commonwealth an amount (the general interest charge ) relating to the unpaid amount for each day in the period that:

(a) starts at the beginning of the day after the due day; and

(b) ends at the end of the last day on which, at the end of the day, any of the following remains unpaid:

(i) the excess loan amount;

(ii) general interest charge on any of the excess loan amount.

(4) The general interest charge for a particular day is worked out by multiplying the * general interest charge rate for that day by the sum of so much of the following amounts as remains unpaid:

(a) the general interest charge from previous days;

(b) the excess loan amount.

(5) The general interest charge for a day is due and payable to the Commonwealth at the end of that day.

(6) The * Secretary may give written notice to the * VET provider of the amount of the general interest charge for a particular day or days. A notice given under this subclause is prima facie evidence of the matters stated in the notice.

(7) The * Secretary may remit all or a part of the general interest charge payable by the * VET provider if the Secretary is satisfied:

(a) that:

(i) the circumstances that contributed to the delay in payment were not due to, or caused directly or indirectly by, an act or omission of the VET provider; and

(ii) the VET provider has taken reasonable action to mitigate, or mitigate the effects of, those circumstances; or

(b) that it is otherwise appropriate to do so.

(8) An amount payable under this clause may be recovered by the Commonwealth from the * VET provider as a debt due to the Commonwealth.

Subdivision 7 - B -- Re - crediting HELP balances in relation to VET FEE - HELP assistance

46 Main case of re - crediting a person's HELP balance in relation to VET FEE - HELP assistance

(1) If clause 46A, 46AA or 51 applies to re - credit a person's * HELP balance with an amount equal to the amounts of * VET FEE - HELP assistance that the person has received for a * VET unit of study, then this clause does not apply in relation to that unit.

Note: For HELP balance , see section 128 - 15, and for HELP loan limit , see section 128 - 20.

(2) A * VET provider must, on the * Secretary's behalf, re - credit a person's * HELP balance with an amount equal to the amounts of * VET FEE - HELP assistance that the person received for a * VET unit of study if:

(a) the person has been enrolled in the unit with the provider; and

(b) the person has not completed the requirements for the unit during the period during which the person undertook, or was to undertake, the unit; and

(c) the provider is satisfied that special circumstances apply to the person (see clause 48); and

(d) the person applies in writing to the provider for re - crediting of the HELP balance; and

(e) either:

(i) the application is made before the end of the application period under clause 49; or

(ii) the provider waives the requirement that the application be made before the end of that period, on the ground that it would not be, or was not, possible for the application to be made before the end of that period.

Note: A VET FEE - HELP debt relating to a VET unit of study will be remitted if the HELP balance in relation to the unit is re - credited: see section 137 - 18.

(3) If the provider is unable to act for one or more of the purposes of subclause (2), or clause 48, 49 or 50, the * Secretary may act as if one or more of the references in those provisions to the provider were a reference to the Secretary.

Decision to re - credit due to unacceptable conduct

(1) The * Secretary must re - credit a person's * HELP balance with an amount equal to the amounts of * VET FEE - HELP assistance that the person received for a * VET unit of study if the Secretary is satisfied that:

(a) the person has been enrolled in the unit with a * VET provider; and

(b) the person has not completed the requirements for the unit during the period the person undertook, or was to undertake, the unit; and

(c) circumstances exist, of a kind specified in the * VET Guidelines for the purposes of this paragraph, involving unacceptable conduct by the VET provider (or an agent of the VET provider) relating to the person's * request for Commonwealth assistance relating to:

(i) the unit; or

(ii) the * VET course of study of which the unit forms a part; and

(d) the person has applied in writing to the Secretary for re - crediting of the HELP balance under this subclause; and

(e) the application is in the form approved by the Secretary, and is accompanied by such information as the Secretary requests; and

(f) either:

(i) the application was made during the first 3 years after the period during which the person undertook, or was to undertake, the unit; or

(ii) it would not be, or was not, possible for the application to be made during those 3 years.

Note: A VET FEE - HELP debt relating to a VET unit of study will be remitted if the HELP balance in relation to the unit is re - credited: see section 137 - 18.

(2) If:

(a) the person received the * VET FEE - HELP assistance as a result of giving an * appropriate officer of the * VET provider a form; and

(b) the form would have been a * request for Commonwealth assistance relating to the unit if it had been signed by a * responsible parent of the person;

paragraph (1)(c) applies as if the form were the person's request for Commonwealth assistance relating to the unit.

Note: To be a request for Commonwealth assistance, a responsible parent must sign the form if the student is under 18 years old and subclause 88(3A) applies (see paragraph 88(3)(aa)).

Inviting submissions before making a decision

(3) Before making a decision under subclause (1), the * Secretary must give the applicant and the * VET provider a notice in writing:

(a) stating that the Secretary is considering making the decision; and

(b) describing the decision and stating the reasons why the Secretary is considering making it; and

(c) inviting the applicant and the VET provider to each make written submissions to the Secretary within 28 days on either or both of the following matters:

(i) why that decision should not be made;