Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) Subsection (2) applies if:

(a) an exempt entity is presently entitled to an amount of the income of a trust estate; and

(b) the exempt entity is not an exempt Australian government agency (within the meaning of the Income Tax Assessment Act 1997 ); and

(c) the exempt entity's adjusted Division 6 percentage of the income of the trust estate exceeds the benchmark percentage determined under subsection (3).

(2) Subject to subsection 100AA(3), for the purposes of this Act, treat the exempt entity as not being presently entitled, and having never been presently entitled, to the amount of the income of the trust estate mentioned in paragraph (1)(a) of this section, to the extent that ensures that the exempt entity's adjusted Division 6 percentage of the income of the trust estate equals the benchmark percentage determined under subsection (3) of this section.

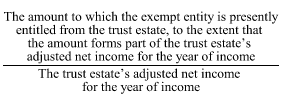

(3) Determine the benchmark percentage by working out the following fraction (expressed as a percentage):

(4) A trust estate's adjusted net income for a year of income is its net income for that year of income, with the following adjustments:

(a) firstly, in determining that net income, disregard any capital gain or franked distribution to the extent to which a beneficiary of the trust estate or the trustee is specifically entitled to that gain or distribution;

(b) next, in determining the net capital gain (if any) of the trust for the year of income, disregard steps 3 and 4 of the method statement in subsection 102 - 5(1) (CGT discount and small business concessions);

(c) next, reduce that net income by amounts (if any) that do not represent net accretions of value to the trust estate in that year of income (other than amounts included in that net income under Part IVA).

(5) Subsection (2) does not apply in relation to a trust estate in relation to a year of income if the Commissioner is of the opinion that it would be unreasonable that the subsection should apply in relation to that trust estate in relation to that year of income.

(6) In forming an opinion for the purposes of subsection (5), the Commissioner must consider the following matters:

(a) the circumstances that led to the exempt entity's adjusted Division 6 percentage exceeding the benchmark percentage determined under subsection (3);

(b) the extent to which the exempt entity's adjusted Division 6 percentage exceeds that benchmark percentage;

(c) the extent to which the exempt entity actually received distributions from the trust estate in respect of the year of income;

(d) the extent to which other beneficiaries of the trust estate were entitled to receive distributions of, or otherwise benefit from, amounts representing the adjusted net income of the trust estate ;

(e) any other matters that the Commissioner considers relevant.

(7) If subsection (2) applies, for the purposes of any application of section 99A in relation to the trust estate in relation to the relevant year of income, treat the trust estate as a resident trust estate.

(8) This section does not apply in relation to a trust estate that is a managed investment trust (within the meaning of the Income Tax Assessment Act 1997 ) in relation to a year of income.