Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsLoans by a trustee through interposed entities

(1) For the purposes of paragraph 109XA(2)(a), a trustee is taken to have made a loan (the notional loan ) to a shareholder, or to an associate of a shareholder, (the target entity ) of a private company if:

(a) the trustee makes a payment or loan to another entity (the first interposed entity ) that is interposed between:

(i) the trustee; and

(ii) the target entity; and

(b) a reasonable person would conclude (having regard to all the circumstances) that the trustee made the payment or loan solely or mainly as part of an arrangement involving a loan to the target entity; and

(c) either:

(i) the first interposed entity makes a loan to the target entity; or

(ii) another entity interposed between the trustee and the target entity makes a loan to the target entity.

(2) For the purposes of this section, it does not matter:

(a) whether the interposed entity made the loan to the target entity before, after or at the same time as the first interposed entity received the payment or loan from the trustee; or

(b) whether or not the interposed entity lent the target entity the same amount as the trustee paid or lent the first interposed entity.

Notional loans

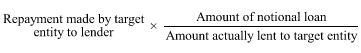

(3) When working out whether an amount is included in the assessable income of the target entity under section 109XB as a result of the notional loan under subsection (1) of this section, and the amount included in assessable income, assume that the target entity repays an amount of the notional loan equal to the amount worked out using the formula:

where:

"amount actually lent to target entity" is the amount the interposed entity lent to the target entity.

"repayment made by target entity to lender" is the amount of any repayment made by the target entity of the loan the interposed entity made to the target entity.

(4) For the purposes of section 109E (Amalgamated loan from a previous year treated as dividend if minimum repayment not made):

(a) treat the notional loan as an amalgamated loan from the private company to the target entity; and

(b) treat the amount of the notional loan worked out under section 109XH as the amount of the amalgamated loan; and

(c) treat the agreement under which the actual loan was made as the agreement under which the amalgamated loan was made; and

(d) treat repayments by the target entity of the amount of the notional loan worked out under subsection (3) of this section as payments by the target entity to the private company in relation to the amalgamated loan.

(5) For the purposes of section 109N (about certain loans not being treated as dividends), treat the agreement under which the actual loan was made as the agreement under which the notional loan was made.