Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

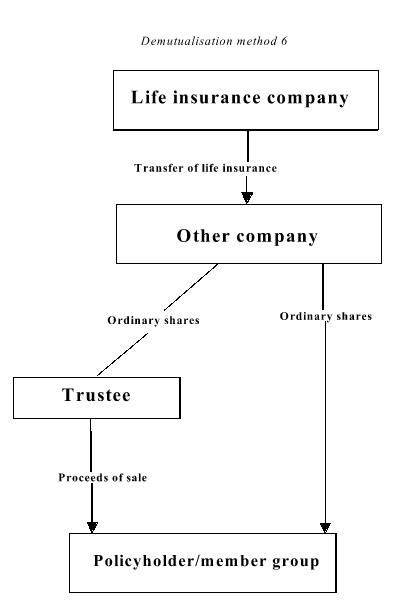

Commonwealth Consolidated Acts(1) Under demutualisation method 6 , in connection with the implementation of the demutualisation of a life insurance company:

(a) all membership rights in the company are extinguished; and

(b) the whole of the life insurance business of the company is, under a scheme confirmed by the Federal Court of Australia, transferred to another company formed for the purpose; and

(c) shares (the ordinary shares ) of only one class in the other company are:

(i) issued, at the election of each person in the policyholder/member group, to the person or to a trustee to sell on behalf of the person; or

(ii) issued to a trustee, at the election of each person in the policyholder/member group, to distribute to the person or to sell on behalf of the person; and

(d) the trustee sells the ordinary shares and distributes the proceeds of sale to the person or distributes the ordinary shares to the person; and

(e) the ordinary shares are listed within the listing period.

Note: Other things may also happen in connection with the implementation of the demutualisation.

(2) The following diagram shows the main events, where this demutualisation method is used.