Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsThe table below sets out modifications of the application of Parts 3 - 1 and 3 - 3 (about CGT) of the Income Tax Assessment Act 1997 in respect of events that are described in, or relate to events that are described in, particular demutualisation methods.

TABLE 1--MODIFICATIONS OF CGT RULES | |

Item Event | Modifications |

|

|

1 Any demutualisation method: Extinguishment of membership rights as mentioned in paragraph (1)(a) of sections 121AF to 121AL. |

A capital gain or capital loss arising from a CGT event constituted by the extinguishment is disregarded. |

2 Demutualisation method 6: The whole of the life insurance business of the life insurance company is transferred to the other company as mentioned in paragraph 121AK(1)(b). |

Subdivision 126 - B of the Income Tax Assessment Act 1997 as in force immediately before 21 October 1999 (about roll - overs for transfers) applies as if the life insurance company and the other company were members of the same wholly - owned group within the meaning of that Act. |

3 Any demutualisation method: A person (the disposer ) in the policyholder/ member group disposes of a right to have ordinary shares issued or distributed to the person, or the proceeds of sale of ordinary shares distributed to the person, as mentioned in paragraph 121AF(1)(b), 121AG(1)(c) or (d), 121AH(1)(c), 121AI(1)(e) or (f), 121AJ(1)(c) or (d), 121AK(1)(c) or (d) or 121AL(1)(c) or (d). |

1. A capital loss that the disposer makes from the disposal is disregarded if the disposal takes place before the demutualisation listing day (see note 4 to this table). 2. For the purpose of working out whether the disposer made a capital gain, or made a capital loss (where modification 1 does not apply), from the disposal, he or she is taken: (a) to have paid, as consideration for the acquisition of the right disposed of, an amount worked out using the following formula:

(b) to have paid the amount in paragraph (a), and to have acquired the right disposed of, on the demutualisation resolution day. |

4 Demutualisation method 2, 4, 5, 6 or 7: A person (the disposer ) in the policyholder/member group disposes of an asset consisting of all or part of the person's interest in the trust property of the trustee mentioned in paragraph 121AG(1)(b) or (c), 121AI(1)(c) or (e), 121AJ(1)(c), 121AK(1)(c) or 121AL(1)(c). |

1. A capital loss that the disposer makes from the disposal is disregarded if the disposal takes place before the demutualisation listing day (see note 4 to this table). 2. For the purpose of working out whether the disposer made a capital gain, or made a capital loss (where modification 1 does not apply), from the disposal, he or she is taken: (a) to have paid, as consideration for the acquisition of the interest disposed of, an amount worked out using the following formula:

(b) to have paid the amount in paragraph (a), and to have acquired the interest disposed of, on the demutualisation resolution day. |

|

|

5 Demutualisation method 3, 4 or 5: After the issue of the shares (each of which is a demutualisation share ) in the mutual insurance company as mentioned in paragraph 121AH(1)(b), 121AI(1)(b) or 121AJ(1)(b), the holding company (the disposer ) disposes of an asset consisting of: (a) a demutualisation share, or an interest in such a share; or (b) another share (a non - demutualisation bonus share) in the mutual insurance company, or an interest in such a share, where the share is a bonus share mentioned in Division 8 of former Part IIIA and any of the demutualisation shares are the original shares mentioned in that Division. |

1. A capital loss that the disposer makes from the disposal of the demutualisation share or interest in such a share is disregarded if the disposal takes place before the demutualisation listing day (see note 4 to this table). 2. If the disposal is of a demutualisation share (other than a demutualisation original share) or an interest in such a share then, for the purpose of working out whether the disposer made a capital gain, or made a capital loss (where modification 1 does not apply), from the disposal, the disposer is taken: (a) to have paid as consideration for the acquisition of the share or interest both: (i) the amount worked out using the formula:

(ii) any consideration actually paid or given for the acquisition; and |

(For the purposes of the modifications relating to this item, if any of the original shares mentioned in Division 8 of former Part IIIA is a demutualisation share, it is called a demutualisation original share .) | (b) to have paid the amount in subparagraph (a)(i) on the demutualisation resolution day and the amount in subparagraph (a)(ii) when it was actually paid; and (c) to have acquired the share or interest on the demutualisation resolution day. 3. If the disposal is of either: (a) a demutualisation original share, or an interest in such a share; or (b) a non - demutualisation bonus share, or an interest in such a share; then, for the purpose of working out whether the disposer made a capital gain, or made a capital loss (where modification 1 does not apply), from the disposal: (c) for the purposes of applying section 130 - 20 (about bonus shares) of the Income Tax Assessment Act 1997 , the consideration for the acquisition of all of the demutualisation original shares to be taken into account under that section is taken to consist of both: (i) if the disposal and all previous disposals of the demutualisation original shares and the non - demutualisation bonus shares, or interests in them, take place after the demutualisation listing day--the amount worked out using the formula:

|

| (ii) if subparagraph (i) does not apply--the amount worked out using the formula:

(iii) any consideration actually paid or given for the acquisition of the share or interest disposed of; and |

| (d) if the disposal is of a demutualisation original share or an interest in such a share, the disposer is taken: (i) to have paid the amount in subparagraph (c)(i) or (ii) on the demutualisation resolution day and the amount in subparagraph (c)(iii) when it was actually paid; and (ii) to have acquired the share or interest on the demutualisation resolution day. |

6 Demutualisation method 7 : After the issue of the shares (each of which is a demutualisation share ) in the mutual insurance company and the mutual affiliate company as mentioned in paragraph 121AL(1)(b), the holding company (the disposer ) disposes of an asset consisting of: (a) a demutualisation share, or an interest in such a share; or (b) another share (a non - demutualisation bonus share ) in the mut ual insurance company or the mutual affiliate company, or an interest in such a share, where the share is a bonus share mentioned in section 130 - 20 (about bonus shares) of the Income Tax Assessment Act 1997 and any of the demutualisation shares are the original shares mentioned in that section. |

1. A capital loss that the disposer makes from the disposal of the demutualisation share or interest in such a share is disregarded if the disposal takes place before the demutualisation listing day (see note 4 to this table). 2. If the disposal is of a demutualisation share (other than a demutualisation original share) or an interest in such a share then, for the purpose of working out whether the disposer made a capital gain, or made a capital loss (where modification 1 does not apply), from the disposal, the disposer is taken: (a) to have paid as consideration for the acquisition of the share or interest both: (i) the amount worked out using the formula:

(ii) any consideration actually paid or given for the acquisition; and |

(For the purposes of the modifications relating to this item, if any of the original shares mentioned in that section is a demutualisation share, it is called a demutualisation original share .) | (b) to have paid the amount in subparagraph (a)(i) on the demutualisation resolution day and the amount in subparagraph (a)(ii) when it was actually paid; and (c) to have acquired the share or interest on the demutualisation resolution day. 3. If the disposal is of either: (a) a demutualisation original share, or an interest in such a share; or (b) a non - demutualisation bonus share, or an interest in such a share; then, for the purpose of working out whether the disposer made a capital gain, or made a capital loss (where modification 1 does not apply), from the disposal: (c) for the purposes of applying section 130 - 20 (about bonus shares) of the Income Tax Assessment Act 1997 , the consideration for the acquisition of all of the demutualisation original shares to be taken into account under that section is taken to consist of both: |

| (i) the amount worked out using the formula:

(ii) any consideration actually paid or given for the acquisition of the share or interest disposed of; and (d) if the disposal is of a share connected with the demutualisation or interest in such a share, the disposer is taken: (i) to have paid the amount in subparagraph (c)(i) on the demutualisation resolution day and the amount in subparagraph (c)(ii) when it was actually paid; and (ii) to have acquired the share or interest on the demutualisation resolution day. |

7 Demutualisation method 3, 4, 5 or 7: After the issue of the shares in the mutual insurance company to the holding company as mentioned in paragraph 121AH(1)(b), 121AI(1)(b), 121AJ(1)(b), or in the mutual insurance company and the mutual affiliate company as mentioned in paragraph 121AL(1)(b): (a) the ultimate holding company (the disposer ) disposes of an asset consisting of either of the following shares in the holding company or an interposed holding company: (i) a share (a demutualisation share ) acquired before the issue of the shares in the mutual insurance company, or an interest in such a share; or |

The same modifications apply as for item 5. |

(ii) another share (a non - demutualisation bonus share ), or an interest in such a share, where the share is a bonus share mentioned in section 130 - 20 (about bonus shares) of the Income Tax Assessment Act 1997 and any of the demutualisation shares (whether or not disposed of at the time) are the original shares mentioned in that section; or (b) the interposed holding company, or any of the interposed holding companies, (the disposer ) disposes of an asset consisting of either of the following shares in the holding company or an interposed holding company: (i) a share (a demutualisation share ) acquired before the issue of the shares in the mutual insurance company, or an interest in such a share; or |

|

(ii) another share (a non - demutualisation bonus share ), or an interest in such a share, where the share is a bonus share mentioned in section 130 - 20 (about bonus shares) of the Income Tax Assessment Act 1997 and any of the demutualisation shares (whether or not disposed of at the time) are the original shares mentioned in that section. (For the purposes of the modifications relating to this item, if any of the original shares mentioned in that section is a demutualisation share, it is called a demutualisation original share .) (The ultimate holding company and interposed holding company are those mentioned in paragraph 121AH(1)(c), 121AI(1)(c), 121AJ(1)(c) or 121AL(1)(c)). |

|

8 Demutualisation method 2 or 4: The rights attaching to the special shares held by the trustee become the same as those attaching to the ordinary shares as mentioned in subparagraph 121AG(1)(b)(ii) or paragraph 121AI(1)(d). |

A capital gain or capital loss arising from a CGT event constituted by the change in the rights is disregarded. |

9 Demutualisation method 2, 4, 5, 6 or 7: The trustee (the disposer ): (a) sells an ordinary share (a demutualisation share ) in the company as mentioned in paragraph 121AG(1)(d), 121AI(1)(f), 121AJ(1)(d), 121AK(1)(d) or 121AL(1)(d); or (b) sells another share (a non - demutualisation bonus share ), where the share is a bonus share mentioned in section 130 - 20 (about bonus shares) of the Income Tax Assessment Act 1997 and any of the demutualisation shares (whether or not sold at the time) are the original shares mentioned in that section. (For the purposes of the modifications relating to this item, if any of the original shares mentioned in that section is a demutualisation share, it is called a demutualisation original share .) |

1. The person in the policyholder/member group, instead of the trustee, is taken: (a) to have sold the demutualisation share or non - demutualisation bonus share; and (b) to have paid, given and received any consideration that was paid, given or received by the trustee in respect of either share; and (c) to have done any other act in relation to either share that was done by the trustee. 2. The modifications in item 5 apply to the sale of the demutualisation share or non - demutualisation bonus share in the same way as they do to the disposal of such shares covered by that item. |

10 Demutualisation method 2, 4, 5, 6 or 7: The trustee distributes an ordinary share as mentioned in paragraph 121AG(1)(d), 121AI(1)(f), 121AJ(1)(d), 121AK(1)(d) or 121AL(1)(d). |

A capital gain or capital loss arising from a CGT event constituted by the distribution is disregarded. |

|

|

11 Any demutualisation method: A person (the disposer ) in the policyholder/member group disposes of an asset consisting of: (a) a share (a demutualisation share ), or an interest in such a share , issued or distributed to the person as mentioned in paragraph 121AF(1)(b), 121AG(1)(c) or (d), 121AH(1)(c), 121AI(1)(e) or (f), 121AJ(1)(c) or (d), 121AK(1)(c) or (d) or 121AL(1)(c) or (d); or |

The same modifications apply as for item 5. |

(b) another share (a non - demutualisation bonus share ) in the same company, or an interest in such a share, where the share is a bonus share mentioned in section 130 - 20 (about bonus shares) of the Income Tax Assessment Act 1997 and any of the demutualisation shares (whether or not disposed of at the time) are the original shares mentioned in that section. (For the purposes of the modifications relating to this item, if any of the original shares mentioned in that section is a demutualisation share, it is called a demutualisation original share .) |

|

|

|

12 Various demutualisation methods: A disposal of an asset takes place before the demutualisation listing day, where: (a) modification 1 of item 3, 4, 5, 6, 7 or 11 of this table applies to the disposal; and (b) a roll - over provision (see note 5 to this table) applies to the disposal. |

1. If the person who is taken to acquire the asset under the roll - over provision disposes of it before the demutualisation listing day, a capital loss that the person makes from the disposal is disregarded. 2. If the person disposes of the asset on or after the demutualisation listing day, then for the purposes of applying the roll - over provision to that disposal, the modifications in the item in this table apply as if modification 1 were not made. |

|

|

Notes:

1. For the purposes of the table, the applicable company valuation amount , in relation to the disposal of an asset or the allocation of an amount to a member in the records of a superannuation fund, is:

(a) if the asset is disposed of, or the amount is allocated, before the demutualisation listing day--the pre - listing day company valuation amount; or

(b) in any other case--the listing day company valuation amount.

2. The pre - listing day company valuation amount is:

(a) in relation to demutualisation methods 1 to 6, where the mutual insurance company is a life insurance company--the embedded value of the company; or

(b) in relation to demutualisation methods 1 to 6, where the mutual insurance company is a general insurance company--the net tangible asset value of the company; or

(c) in relation to demutualisation method 7--the sum of the net tangible asset values of the general insurance company and the mutual affiliate company.

3. The listing day company valuation amount is the lesser of:

(a) the pre - listing day company valuation amount; and

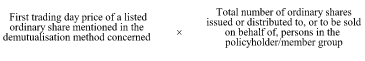

(b) the amount worked out using the formula:

4. The demutualisation listing day is the day on which the ordinary shares mentioned in the demutualisation method concerned are listed.

5. A roll - over provision is:

6. A trustee who gets a roll - over under Subdivision 124 - M of the Income Tax Assessment Act 1997 for an original interest consisting of shares issued as part of a demutualisation may be eligible for a further roll - over under Subdivision 126 - E of that Act when a beneficiary becomes absolutely entitled to the replacement shares.