Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies to a deduction under section 290 - 60 of the Income Tax Assessment Act 1997 in respect of a contribution made in relation to a person who was an employee of a prescribed excluded STB when it ceased to be an STB.

(2) A deduction to which this section applies is not allowable to the body for any year of income unless the requirements of subsections (3) and (4) are complied with.

(3) For the deduction to be allowable, the body must obtain a certificate by an authorised actuary stating the actuarial value, as at the time the body ceases to be an STB, of liabilities of the STB to provide superannuation benefits for, or for SIS dependants of, employees of the body, where the liabilities:

(a) accrued after 30 June 1995 and before the time when the body ceased to be an STB; and

(b) were, according to actuarial principles, unfunded at that time.

(4) The certificate must be in a form approved in writing by the Commissioner. The body must obtain the certificate:

(a) before the date of lodgment of its return of income of the year of income in which the body ceased to be an STB; or

(b) within such further time as the Commissioner allows.

(5) If the body obtains the certificate, a deduction to which this section applies is nevertheless not allowable for a year of income if the sum of all deductions to which this section applies for the year of income is less than or equal to the unfunded liability limit (see subsection (6)) for the year of income.

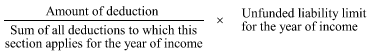

(6) If the sum is greater than that limit, so much of the deduction as is worked out using the following formula is not allowable:

where:

"Unfunded liability limit" for a year of income is:

(a) if the year of income is the one in which the body ceases to be an STB--the actuarial value of the liabilities set out in the actuary's certificate; or

(b) in any other case--that actuarial value as reduced by the total amount of deductions to which this section applies that, because of subsection (5), have not been allowable to the body for all previous years of income.

(7) Expressions used in this section that are also used in section 290 - 60 of the Income Tax Assessment Act 1997 have the same respective meanings as in that section.