Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If this section applies to expenditure incurred by a taxpayer in a year of income:

(a) the taxpayer cannot deduct all of the expenditure for the expenditure year; and

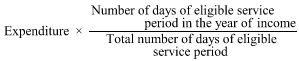

(b) instead, the taxpayer can deduct, for each year of income during which part of the eligible service period for the expenditure occurs, an amount worked out using this formula:

(2) This section has effect:

(a) despite section 8 - 1 of the Income Tax Assessment Act 1997 ; and

(b) subject to Division 245 of the Income Tax Assessment Act 1997 .

Note: Deductions under section 355 - 205 or 355 - 480 of the Income Tax Assessment Act 1997 for R&D expenditure are subject to this section (see subsection 8 - 5(2) and section 355 - 105 of that Act).