Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsDivision 326 -- Demutualisation

Table of Subdivisions

Guide to Division 326

326 - A Application, key concepts and related expressions

326 - B How demutualisation is to be effected

326 - C CGT consequences of extinguishment of membership rights in mutual entity

326 - D CGT consequences of disposal of demutualisation shares or an interest in such shares by a member of a mutual entity where the entity or a holding company of the entity becomes a listed public company

326 - E CGT consequences of disposal of demutualisation shares or interests in such shares by a member of a mutual entity where the entity or a holding company of the entity becomes a company that is not a listed public company

326 - F Variation of amount taken to be paid for shares or an interest in shares by a member of a mutual entity who made a capital gain or capital loss from disposal of membership rights in another mutual entity

326 - G CGT consequences of disposal of rights or interests resulting from extinguishment of membership rights

326 - H CGT consequences of transfer of ordinary shares

326 - I CGT consequences of disposal of demutualisation shares or an interest in such shares by a trustee on behalf of a member

326 - J CGT consequences of change in rights attaching to special shares or replacement of special shares by ordinary shares

326 - K CGT consequences of disposal of shares or an interest in shares acquired under a roll - over provision

326 - L CGT consequences of payment to member of demutualised entity out of accumulated surplus of the entity

326 - M Indexation

326 - N Non - CGT consequences of issue of demutualisation shares

326 - 1 What this Division is about

This Division sets out the taxation consequences of the demutualisation of mutual entities other than insurance companies and health insurers.

Subdivision 326 - A -- Application, key concepts and related expressions

Table of sections

326 - 5 Application

326 - 10 Mutual entity and demutualisation

326 - 15 Provisions relating to listing on a stock exchange

326 - 20 Demutualisation resolutions etc.

326 - 25 Demutualisation shares

326 - 30 Existing members and new members

326 - 35 Pre - CGT members and post - CGT members

(1) This Division applies to the demutualisation of a mutual entity referred to in section 326 - 10 if, and only if:

(a) where the demutualisation resolution day was 14 March 2002 or was or is a later day--the members of the entity have passed a resolution, in accordance with the entity's constitution, that this Division is to apply to the demutualisation; and

(b) the entity was a resident immediately before the demutualisation resolution day; and

(c) the demutualisation has been or is implemented as mentioned in section 326 - 40; and

(d) the continuity of beneficial interest test in section 326 - 60 is satisfied in relation to the demutualisation; and

(e) the demutualisation of the entity was or is completed on or after 12 May 1998.

(2) For the purposes of paragraph (1)(e), the demutualisation of an entity is taken to have been or to be completed:

(a) if the demutualisation is implemented in accordance with the direct method or the distributing trust method of demutualisation--on the day on which all the shares in the company that the entity became or becomes that were or are to be issued in connection with the demutualisation have been issued; or

(b) if the demutualisation is implemented in accordance with the holding company method of demutualisation--on the day on which all the shares in the holding company that were or are to be issued in connection with the demutualisation have been issued; or

(c) if the demutualisation is implemented in accordance with the combined direct and holding company method of demutualisation--on the later of the following days:

(i) the day on which all the shares in the company that the entity became or becomes that were or are to be issued in connection with the demutualisation have been issued;

(ii) the day on which all the shares in the holding company that were or are to be issued in connection with the demutualisation have been issued.

(3) If this Division applies to the demutualisation of a mutual entity as mentioned in subsection (1), Subdivisions 326 - C to 326 - N provide for modifications of this Act and the Income Tax Assessment Act 1997 as those Acts have effect in respect of the entity.

(4) For the purposes of this Division, the giving of consideration (other than the payment of an amount) for the acquisition of shares or an interest in shares is taken to constitute the payment of an amount equal to the value of the consideration.

326 - 10 Mutual entity and demutualisation

(1) An entity is a mutual entity if, and only if, immediately before the demutualisation resolution day, it is a body corporate that:

(a) is not an insurance company within the meaning of subsection 121AB(2); and

(b) is not a mutual affiliate company within the meaning of section 121AC; and

(ba) is not an entity to which item 6.3 of the table in section 50 - 30 of the Income Tax Assessment Act 1997 (about private health insurers) applies; and

(bb) is not an entity in relation to whose demutualisation Division 316 (Demutualisation of friendly society health or life insurers) of that Act applies; and

(c) is not carried on for the object of securing a profit or pecuniary gain for its members; and

(d) does not have capital divided into shares held by its members; and

(e) does not hold property in which any of its members has a disposable interest (whether directly or indirectly) except in the event of the winding up of the entity.

(1A) If the entity is a mutual entity (within the meaning of the Corporations Act 2001 ), then, for the purposes of subsection (1), disregard the following:

(a) any MCIs (within the meaning of that Act) issued by the entity;

(b) any dividends or profits paid or payable in respect of such MCIs;

(c) any members of the entity who are members by virtue of holding such MCIs.

(2) A mutual entity that has passed a demutualisation resolution is called a demutualising entity .

(3) A mutual entity is demutualised if it ceases to be a mutual entity otherwise than by ceasing to be a body corporate. Such an entity is called a demutualised entity .

(4) A reference to a demutualising entity includes a reference to a demutualised entity.

326 - 15 Provisions relating to listing on a stock exchange

(1) A share is listed if it is listed for quotation in the official list of ASX Limited.

(2) The expression "listed public company" has the same meaning as in the Income Tax Assessment Act 1997 .

(3) A listing resolution , in relation to the demutualisation of a mutual entity, is a resolution passed by the members of the entity requiring the entity, or a holding company of the entity, to become a listed public company.

(4) The day on which demutualisation shares are first listed is the demutualisation listing day .

326 - 20 Demutualisation resolutions etc.

(1) The demutualisation resolution , in relation to the demutualisation of a mutual entity, is a resolution passed by the members of the entity to proceed with the demutualisation of the entity.

(2) The demutualisation resolution day , in relation to the demutualisation of a mutual entity, is the day on which the demutualisation resolution was or is passed.

(3) The limitation period , in relation to the demutualisation of a mutual entity, is the period of 2 years beginning on the demutualisation resolution day or such further period as the Commissioner allows.

326 - 25 Demutualisation shares

The demutualisation shares , in relation to a demutualised entity, are:

(a) the ordinary shares in the entity that are issued as mentioned in paragraphs 326 - 45(1)(c) and (d); and

(b) the ordinary shares in the holding company that are issued as mentioned in paragraphs 326 - 50(1)(d) and (e); and

(ba) the ordinary shares in the entity that are issued as mentioned in paragraphs 326 - 52(1)(c) and (e); and

(bb) the ordinary shares in the holding company that are issued as mentioned in paragraphs 326 - 52(1)(f) and (g); and

(c) the ordinary shares in the entity that are issued as mentioned in paragraphs 326 - 55(1)(f) and (g); and

(d) the special shares in the entity that are issued as mentioned in paragraph 326 - 55(1)(c).

326 - 30 Existing members and new members

(1) An existing member of a mutual entity that demutualises is:

(a) a person who was a member of the entity on the earlier of the following days:

(i) the demutualisation resolution day;

(ii) the share allocation cut - off day; or

(b) a person who became entitled to an allocation of demutualisation shares because of the death of a person referred to in paragraph (a).

(2) If the members of a mutual entity that is being demutualised have passed or pass a resolution to the effect that any person who became or becomes a member after a specified day is not entitled to an allocation of demutualisation shares, that day is the share allocation cut - off day in relation to the demutualisation of the entity.

(3) A new member of a mutual entity that demutualises is a person who is a member of the entity other than an existing member.

(4) A reference to a member of a mutual entity that demutualises is taken, unless the contrary intention appears, to be a reference to a person who is an existing member or a new member of the entity.

326 - 35 Pre - CGT members and post - CGT members

(1) A person is a pre - CGT member of a demutualising entity if:

(a) the person's membership rights in the entity are a pre - CGT asset within the meaning of the Income Tax Assessment Act 1997 ; or

(b) both of the following apply:

(i) the person acquired membership rights in the entity by disposing of membership rights in another mutual entity; and

(ii) the person acquired membership rights in the other entity before 20 September 1985.

(2) A person is a post - CGT member of a demutualising entity if the person is not a pre - CGT member.

Subdivision 326 - B -- How demutualisation is to be effected

Table of sections

326 - 40 Methods of demutualisation

326 - 45 Direct method

326 - 50 Holding company method

326 - 52 Combined direct and holding company method

326 - 55 Distributing trust method

326 - 60 Continuity of beneficial interest test

326 - 40 Methods of demutualisation

A demutualisation of a mutual entity is to be implemented in accordance with one of the methods set out in sections 326 - 45, 326 - 50, 326 - 52 and 326 - 55.

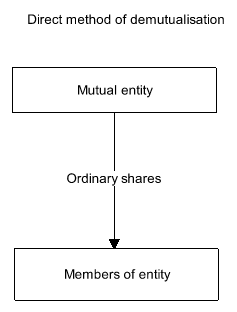

(1) The direct method of demutualisation is as follows:

(a) all membership rights in the entity are extinguished;

(b) the entity becomes a company with a share capital;

(c) shares ( ordinary shares ) of only one class in the entity are issued within the limitation period to existing members in exchange for the membership rights referred to in paragraph (a);

(d) shares (also ordinary shares ) of the same class in the entity may be issued within the limitation period to new members;

(e) if a listing resolution was passed by the members of the entity--the ordinary shares are listed within the limitation period.

Note: Other things may happen in connection with the implementation of the demutualisation.

(2) The following diagram shows, where this demutualisation method is used, the issue of shares to members of the entity.

326 - 50 Holding company method

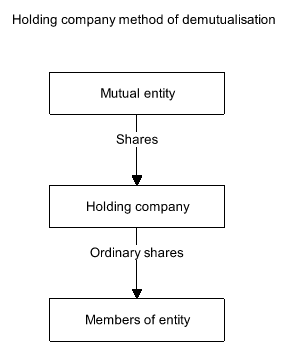

(1) The holding company method of demutualisation is as follows:

(a) all membership rights in the entity are extinguished;

(b) the entity becomes a company with a share capital;

(c) shares of only one class in the entity are issued to a company (the holding company ) within the limitation period;

(d) shares ( ordinary shares ) of only one class in the holding company are issued within the limitation period to existing members in exchange for the membership rights referred to in paragraph (a);

(e) shares (also ordinary shares ) in the holding company of the same class may be issued within the limitation period to new members;

(f) if a listing resolution was passed by the entity--the ordinary shares are listed within the limitation period.

Note: Other things may happen in connection with the implementation of the demutualisation.

(2) The following diagram shows the main events that occur where this demutualisation method is used.

326 - 52 Combined direct and holding company method

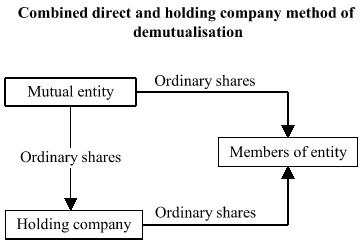

(1) The combined direct and holding company method of demutualisation is as follows:

(a) all membership rights in the entity are extinguished;

(b) the entity becomes a company with a share capital;

(c) shares ( ordinary shares ) of only one class in the entity are issued within the limitation period to existing members in exchange for the membership rights referred to in paragraph (a);

(d) shares (also ordinary shares ) of the same class in the entity are also issued to a company (the holding company ) within the limitation period;

(e) shares (also ordinary shares ) of the same class in the entity may be issued within the limitation period to new members;

(f) shares (also ordinary shares ) of only one class in the holding company are issued within the limitation period to existing members as a result of the extinguishment of the membership rights referred to in paragraph (a);

(g) shares (also ordinary shares ) of the same class in the holding company may be issued within the limitation period to new members;

(h) the total number of ordinary shares issued to members under paragraphs (f) and (g) is the same as the total number of ordinary shares issued to the holding company under paragraph (d);

(i) if a listing resolution was passed by the members of the entity--the ordinary shares in the entity are listed within the limitation period.

Note: Other things may happen in connection with the implementation of the demutualisation.

(2) The following diagram shows the main events that occur where this demutualisation method is used.

326 - 55 Distributing trust method

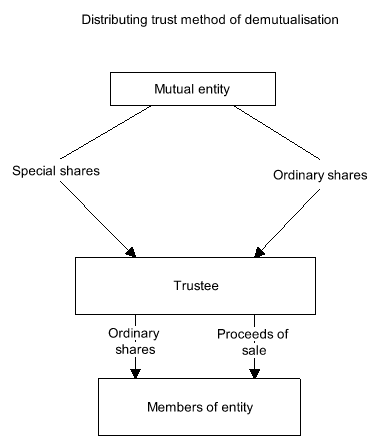

(1) The distributing trust method of demutualisation is as follows:

(a) all membership rights in the mutual entity are extinguished;

(b) the entity becomes a company with a share capital;

(c) shares ( special shares ) carrying only voting rights in respect of the demutualised entity are issued within the limitation period to a trustee to hold for the benefit of the members;

(d) the issue takes place before the issue of the ordinary shares mentioned in paragraphs (f) and (g);

(e) after the issue of all the ordinary shares, the rights attaching to the special shares become the same as those attaching to the ordinary shares and the special shares are dealt with in accordance with paragraph (h) as if they were ordinary shares;

(f) shares ( ordinary shares ) of only one class in the entity are, within the limitation period, issued to the trustee to hold on behalf of existing members in exchange for the membership rights referred to in paragraph (a) and, in accordance with the choice of each existing member, to transfer to the member the shares held on behalf of the member or to dispose of those shares on behalf of the member;

(g) shares (also ordinary shares ) of the same class in the entity may, within the limitation period, be issued to the trustee on behalf of new members and, in accordance with the choice of each new member, to transfer to the member the shares held on behalf of the member or to dispose of those shares on behalf of the member;

(h) within the limitation period the trustee:

(i) sells the ordinary shares issued to the trustee and distributes the proceeds to the member; or

(ii) transfers the ordinary shares to the member;

(i) if a listing resolution was passed by the entity--the ordinary shares are listed within the limitation period.

Note: Other things may happen in connection with the implementation of the demutualisation.

(2) The trustee must be the trustee of a trust established solely for the purposes of performing functions under subsection (1).

(3) The following diagram shows the main events that occur where this demutualisation method is used.

326 - 60 Continuity of beneficial interest test

(1) This section sets out a test (the continuity of beneficial interest test ) that must be satisfied before this Division applies to the demutualisation of a mutual entity.

(2) The continuity of beneficial interest test is satisfied if:

(a) an opportunity is given to each existing member of the mutual entity:

(i) to take up shares in the demutualised entity or in a holding company to which shares in the demutualised entity are issued; or

(ii) to have shares in the demutualised entity issued to a trustee on behalf of the member; and

(b) where the demutualisation is implemented by the method set out in section 326 - 45, 326 - 50 or 326 - 55--of the ordinary shares in the demutualised entity or holding company that are issued in connection with the demutualisation (the issued shares ), the total number that are issued to existing members or to a trustee on behalf of existing members constitutes at least 90% of the issued shares; and

(ba) where the demutualisation is implemented by the method set out in section 326 - 52:

(i) of the ordinary shares in the demutualised entity that are issued to members other than the holding company in connection with the demutualisation (the issued entity shares ), the total number that are issued to existing members constitutes at least 90% of the issued entity shares; and

(ii) of the ordinary shares in the holding company that are issued in connection with the demutualisation (the issued holding company shares ), the total number that are issued to existing members constitutes at least 90% of the issued holding company shares; and

(c) the accumulated surplus of the mutual entity is allocated or distributed in the form of shares, or cash from the sale of shares, to existing members in proportions that broadly accord with any one or more of the following:

(i) the respective amounts contributed by the members to the entity;

(ii) the respective values of the membership rights of the members;

(iii) the respective rights of the members on the winding up of the entity.

(3) In this section:

"accumulated surplus" , in relation to a demutualised entity, means the net assets of the entity on the demutualisation resolution day.

Subdivision 326 - C -- CGT consequences of extinguishment of membership rights in mutual entity

Table of sections

326 - 65 Extinguishment of membership rights

326 - 65 Extinguishment of membership rights

Application

(1) This section applies where membership rights are extinguished as mentioned in paragraph 326 - 45(1)(a), 326 - 50(1)(a), 326 - 52(1)(a) or 326 - 55(1)(a).

Modification

(2) A capital gain or capital loss arising from the extinguishment of the membership rights of a member is to be disregarded.

Subdivision 326 - D -- CGT consequences of disposal of demutualisation shares or an interest in such shares by a member of a mutual entity where the entity or a holding company of the entity becomes a listed public company

Table of sections

326 - 70 Application of Subdivision

326 - 75 Capital losses made from certain disposals to be disregarded

326 - 80 Disposal by pre - CGT member of a demutualisation share (other than a demutualisation original share) or an interest in such a share before demutualisation listing day where member did not acquire membership rights by disposing of membership rights in another mutual entity

326 - 85 Disposal by pre - CGT member of a demutualisation share (other than a demutualisation original share) or an interest in such a share on or after demutualisation listing day where member did not acquire membership rights by disposing of membership rights in another mutual entity

326 - 90 Disposal by pre - CGT member of a demutualisation share (other than a demutualisation original share) or an interest in such a share where member acquired membership rights by disposing of membership rights in another mutual entity

326 - 95 Disposal by post - CGT member of a demutualisation share (other than a demutualisation original share) or an interest in such a share

326 - 100 Disposal by pre - CGT member of a demutualisation original share or a non - demutualisation bonus share, or an interest in such a share, before demutualisation listing day where member did not acquire membership rights by disposing of membership rights in another mutual entity

326 - 105 Disposal by pre - CGT member of a demutualisation original share or a non - demutualisation bonus share, or an interest in such a share, on or after demutualisation listing day where member did not acquire membership rights by disposing of membership rights in another mutual entity

326 - 110 Disposal by pre - CGT member of a demutualisation original share or a non - demutualisation bonus share, or an interest in such a share, where member acquired membership rights by disposing of membership rights in another mutual entity

326 - 115 Disposal by post - CGT member of a demutualisation original share or a non - demutualisation bonus share or an interest in such a share

326 - 120 Adjusted market value

326 - 125 Undeducted membership costs

326 - 130 Adjusted first day trading price of demutualisation shares

326 - 70 Application of Subdivision

(1) This Subdivision applies where a member (the disposer ) of a mutual entity which, or a holding company of which, becomes a listed public company disposes of an asset consisting of:

(a) a demutualisation share in the listed public company or an interest in such a share; or

(b) other shares ( non - demutualisation bonus shares ) in the same company, or an interest in such shares, where the shares are bonus equities mentioned in Subdivision 130 - A of the Income Tax Assessment Act 1997 and any of the demutualisation shares (whether or not disposed of at the time) are the original equities mentioned in that Subdivision.

(2) For the purposes of this Subdivision, if any of the original equities mentioned in Subdivision 130 - A of the Income Tax Assessment Act 1997 is a demutualisation share, it is called a demutualisation original share .

326 - 75 Capital losses made from certain disposals to be disregarded

A capital loss that the disposer makes from a disposal to which section 326 - 80 or 326 - 100 applies is to be disregarded.

326 - 80 Disposal by pre - CGT member of a demutualisation share (other than a demutualisation original share) or an interest in such a share before demutualisation listing day where member did not acquire membership rights by disposing of membership rights in another mutual entity

(1) If:

(a) the disposal is a disposal of a demutualisation share (other than a demutualisation original share) or an interest in such a share; and

(b) the disposer did not acquire membership rights in the demutualising entity by disposing of membership rights in another mutual entity; and

(c) the disposer is a pre - CGT member; and

(d) the disposal occurs before the demutualisation listing day;

then, for the purpose of working out whether the disposer made a capital gain or capital loss from the disposal, the disposer is taken to have done the following:

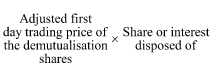

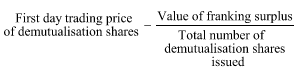

(e) to have paid for the acquisition of the share or interest the amount worked out by using the formula:

![]()

(f) to have paid that amount on the demutualisation resolution day;

(g) to have acquired the share or interest on the demutualisation resolution day.

(2) In the formula in paragraph (1)(e):

"total number of shares" means the total number of demutualisation shares issued.

326 - 85 Disposal by pre - CGT member of a demutualisation share (other than a demutualisation original share) or an interest in such a share on or after demutualisation listing day where member did not acquire membership rights by disposing of membership rights in another mutual entity

(1) If:

(a) the disposal is a disposal of a demutualisation share (other than a demutualisation original share) or an interest in such a share; and

(b) the disposer did not acquire membership rights in the demutualising entity by disposing of membership rights in another mutual entity; and

(c) the disposer is a pre - CGT member; and

(d) the disposal occurs on or after the demutualisation listing day;

then, for the purpose of working out whether the disposer made a capital gain or capital loss from the disposal, the disposer is taken to have done the following:

(e) to have paid for the acquisition of the share or interest the lesser of the following amounts:

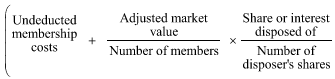

(i) the amount worked out by using the formula:

![]()

(ii) the amount worked out by using the formula:

(f) to have paid the amount referred to in paragraph (e) on the demutualisation resolution day;

(g) to have acquired the share or interest on the demutualisation resolution day.

(2) In the formula in subparagraph (1)(e)(i):

"total number of shares" means the total number of demutualisation shares issued.

326 - 90 Disposal by pre - CGT member of a demutualisation share (other than a demutualisation original share) or an interest in such a share where member acquired membership rights by disposing of membership rights in another mutual entity

(1) If:

(a) the disposal is a disposal of a demutualisation share (other than a demutualisation original share) or an interest in such a share; and

(b) the disposer acquired membership rights in the demutualising entity by disposing of membership rights in another mutual entity; and

(c) the disposer is a pre - CGT member;

then, for the purpose of working out whether the disposer made a capital gain or capital loss from the disposal, the disposer is taken to have done the following:

(d) to have paid for the acquisition of the share or interest both of the following amounts:

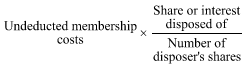

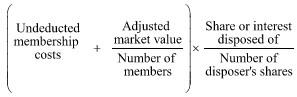

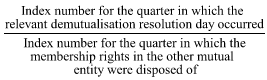

(i) the amount worked out by using the formula:

(ii) any amount actually paid for the acquisition;

(e) to have paid the amount referred to in subparagraph (d)(i) on the demutualisation resolution day;

(f) to have paid any amount referred to in subparagraph (d)(ii) when it was actually paid;

(g) to have acquired the share or interest on the demutualisation resolution day.

(2) In the formula in subparagraph (1)(d)(i):

"number of disposer's shares" means the number of demutualisation shares issued to the disposer or in which the disposer had an interest.

"number of members" means the total number of members of the other mutual entity at the time of the disposal of the membership rights in that entity.

326 - 95 Disposal by post - CGT member of a demutualisation share (other than a demutualisation original share) or an interest in such a share

(1) If:

(a) the disposal is a disposal of a demutualisation share (other than a demutualisation original share) or an interest in such a share; and

(b) the disposer is a post - CGT member;

then, for the purpose of working out whether the disposer made a capital gain or capital loss from the disposal, the disposer is taken to have done the following:

(c) to have paid for the acquisition of the share or interest both of the following amounts:

(i) the amount worked out by using the formula:

(ii) any amount actually paid for the acquisition;

(d) to have paid the amount referred to in subparagraph (c)(i) on the demutualisation resolution day;

(e) to have paid any amount referred to in subparagraph (c)(ii) when it was actually paid;

(f) to have acquired the share or interest on the demutualisation resolution day.

(2) In the formula in subparagraph (1)(c)(i):

"number of disposer's shares" means the number of demutualisation shares issued to the disposer or in which the disposer had an interest.

326 - 100 Disposal by pre - CGT member of a demutualisation original share or a non - demutualisation bonus share, or an interest in such a share, before demutualisation listing day where member did not acquire membership rights by disposing of membership rights in another mutual entity

(1) If:

(a) the disposal is a disposal of either:

(i) a demutualisation original share or an interest in such a share; or

(ii) a non - demutualisation bonus share or an interest in such a share; and

(b) the disposer did not acquire membership rights in the demutualising entity by disposing of membership rights in another mutual entity; and

(c) the disposer is a pre - CGT member; and

(d) the disposal occurs before the demutualisation listing day;

then, for the purpose of working out whether the disposer made a capital gain or capital loss from the disposal, the following paragraphs have effect:

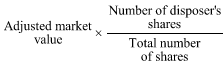

(e) for the purpose of applying Subdivision 130 - A of the Income Tax Assessment Act 1997 , the amount paid for the acquisition of all the demutualisation original shares that is to be taken into account under that Division or Subdivision, as the case may be, is taken to be the amount worked out by using the formula:

![]()

(f) if the disposal is a disposal of a demutualisation original share or an interest in such a share, the disposer is taken:

(i) to have paid the amount referred to in paragraph (e) on the demutualisation resolution day; and

(ii) to have acquired the share or interest on the demutualisation resolution day.

(2) In the formula in paragraph (1)(e):

"number of disposer's shares" means the number of demutualisation original shares issued to the disposer or in which the disposer had an interest.

"total number of shares" means the total number of demutualisation shares issued.

326 - 105 Disposal by pre - CGT member of a demutualisation original share or a non - demutualisation bonus share, or an interest in such a share, on or after demutualisation listing day where member did not acquire membership rights by disposing of membership rights in another mutual entity

(1) If:

(a) the disposal is a disposal of either:

(i) a demutualisation original share or an interest in such a share; or

(ii) a non - demutualisation bonus share or an interest in such a share; and

(b) the disposer did not acquire membership rights in the demutualising entity by disposing of membership rights in another mutual entity; and

(c) the disposer is a pre - CGT member; and

(d) the disposal occurs on or after the demutualisation listing day;

then, for the purpose of working out whether the disposer made a capital gain or capital loss from the disposal, the following paragraphs have effect:

(e) for the purpose of applying Subdivision 130 - A of the Income Tax Assessment Act 1997 , the amount paid for the acquisition of all the demutualisation original shares that is to be taken into account under that Division or Subdivision, as the case may be, is taken to be the lesser of the following amounts:

(i) the amount worked out by using the formula:

![]()

(ii) the amount worked out by using the formula:

(f) if the disposal is a disposal of a demutualisation original share or an interest in such a share, the disposer is taken:

(i) to have paid the amount referred to in paragraph (e) on the demutualisation resolution day; and

(ii) to have acquired the share or interest on the demutualisation resolution day.

(2) In the formulas in subparagraphs 1(e)(i) and (ii):

"number of disposer's shares" means the number of demutualisation original shares issued to the disposer or in which the disposer had an interest.

"total number of shares" means the total number of demutualisation shares issued.

326 - 110 Disposal by pre - CGT member of a demutualisation original share or a non - demutualisation bonus share, or an interest in such a share, where member acquired membership rights by disposing of membership rights in another mutual entity

(1) If:

(a) the disposal is a disposal of either:

(i) a demutualisation original share or an interest in such a share; or

(ii) a non - demutualisation bonus share or an interest in such a share; and

(b) the disposer acquired membership rights in the demutualising entity by disposing of membership rights in another mutual entity; and

(c) the disposer is a pre - CGT member;

then, for the purpose of working out whether the disposer made a capital gain or capital loss from the disposal, the following paragraphs have effect:

(d) for the purpose of applying Subdivision 130 - A of the Income Tax Assessment Act 1997 , the amount paid for the acquisition of all the demutualisation original shares that is to be taken into account under that Division or Subdivision, as the case may be, is taken to be the sum of the following amounts:

(i) the amount worked out by using the formula:

![]()

(ii) any amount actually paid for the acquisition;

(e) if the disposal is a disposal of a demutualisation original share or an interest in such a share, the disposer is taken:

(i) to have paid the amount referred to in subparagraph (d)(i) on the demutualisation resolution day; and

(ii) to have paid any amount referred to in subparagraph (d)(ii) when it was actually paid; and

(iii) to have acquired the share or interest on the demutualisation resolution day.

(2) In the formula in subparagraph (1)(d)(i):

"number of members" means the total number of members of the other entity at the time of the disposal of the membership rights in that entity.

326 - 115 Disposal by post - CGT member of a demutualisation original share or a non - demutualisation bonus share or an interest in such a share

If:

(a) the disposal is a disposal of either:

(i) a demutualisation original share or an interest in such a share; or

(ii) a non - demutualisation bonus share or an interest in such a share; and

(b) the disposer is a post - CGT member;

then, for the purpose of working out whether the disposer made a capital gain or capital loss from the disposal, the following paragraphs have effect:

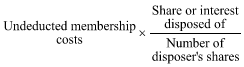

(c) for the purpose of applying Subdivision 130 - A of the Income Tax Assessment Act 1997 , the amount paid for the acquisition of all the demutualisation original shares that is to be taken into account under that Division or Subdivision, as the case may be, is taken to be the sum of:

(i) an amount equal to the undeducted membership costs; and

(ii) any amount actually paid for the acquisition;

(d) if the disposal is a disposal of a demutualisation original share or an interest in such a share, the disposer is taken:

(i) to have paid the amount referred to in subparagraph (c)(i) on the demutualisation resolution day; and

(ii) to have paid any amount referred to in subparagraph (c)(ii) when it was actually paid; and

(iii) to have acquired the share or interest on the demutualisation resolution day.

326 - 120 Adjusted market value

Where membership rights not acquired by disposal of rights in another entity

(1) For the purposes of this Subdivision, the adjusted market value , when the expression is used in relation to a disposer who did not acquire membership rights in the demutualising entity by disposing of membership rights in another mutual entity, is the market value, as determined by a qualified valuer, of the demutualising entity on the demutualisation resolution day. However, in making the determination the valuer is to disregard the franking surplus of that entity on that day.

Where membership rights acquired by disposal of rights in another entity

(2) For the purposes of this Subdivision but subject to subsection (3), the adjusted market value , when the expression is used in relation to a disposer who acquired membership rights in the demutualising entity by disposing of membership rights in another mutual entity, is the market value, as determined by a qualified valuer, of the other entity at the time immediately before the disposer disposed of membership rights in the other entity. However, in making the determination the valuer is to disregard the franking surplus of the other entity at that time.

Indexation of amount mentioned in subsection (2)

(3) If the indexation factor (see section 326 - 235) of the amount worked out under subsection (2) is more than one, that amount is taken to be replaced by that amount as indexed under Subdivision 326 - M.

326 - 125 Undeducted membership costs

(1) For the purposes of this Subdivision, the undeducted membership costs , when the expression is used in relation to a disposer who did not acquire membership rights in the demutualising entity by the disposal of membership rights in another mutual entity, are the sum of the undeducted amounts of the costs that were incurred by the disposer in acquiring and maintaining membership in the demutualising entity less any distributions that:

(a) were made by the demutualising entity to the disposer before any shares in the demutualised entity were issued; and

(b) were not included in the disposer's assessable income of any year of income.

(2) For the purposes of this Subdivision, the undeducted membership costs , when the expression is used in relation to a disposer who acquired membership rights in the demutualising entity by the disposal of membership rights in another mutual entity, are:

(a) if the disposer was a pre - CGT member--the sum of the undeducted amounts of the costs that were incurred by the disposer in maintaining membership in the demutualising entity less any distributions that:

(i) were made by the demutualising entity to the disposer before any shares in the demutualised entity were issued; and

(ii) were not included in the disposer's assessable income of any year of income; or

(b) if the disposer is a post - CGT member, the sum of:

(i) the undeducted amounts of the costs that were incurred by the disposer in acquiring and maintaining membership in the other entity; and

(ii) the undeducted amounts of the costs that were incurred by the disposer in maintaining membership in the demutualising entity;

less any distributions that:

(iii) were made by the demutualising entity or the other entity to the disposer before any shares in the demutualised entity were issued; and

(iv) were not included in the disposer's assessable income of any year of income.

(3) If at any time 2 or more persons were joint members of a mutual entity, any costs incurred by any one or more of them in acquiring or maintaining the joint membership are taken to have been incurred by each of them.

(4) Subject to subsection (5), the undeducted amount of a cost is the amount of the cost to the extent to which a deduction has not been allowed, and is not allowable, in respect of it.

(5) If:

(a) an amount of a cost referred to in subsection (1) or (2) was incurred before the demutualisation resolution day; and

(b) the indexation factor (see section 326 - 235) of the amount is more than one;

a reference in this section to the undeducted amount of that cost is a reference to the undeducted amount as indexed under Subdivision 326 - M.

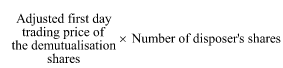

326 - 130 Adjusted first day trading price of demutualisation shares

(1) For the purposes of this Subdivision, the adjusted first day trading price of demutualisation shares is the amount worked out using the formula:

(2) In this section:

"first day trading price of demutualisation shares" means the price per share, as published by ASX Limited, at which the demutualisation shares were last traded, on the stock market operated by ASX Limited, on the demutualisation listing day.

"value of franking surplus" means the value, as determined by a qualified valuer, of the franking surplus of the demutualised entity on the demutualisation listing day.

Subdivision 326 - E -- CGT consequences of disposal of demutualisation shares or interests in such shares by a member of a mutual entity where the entity or a holding company of the entity becomes a company that is not a listed public company

Table of sections

326 - 135 Application of Subdivision

326 - 140 Disposal by pre - CGT member of a demutualisation share (other than a demutualisation original share) or an interest in such a share where a member did not acquire membership rights by disposing of membership rights in another mutual entity

326 - 145 Disposal by pre - CGT member of a demutualisation share (other than a demutualisation original share) or an interest in such a share where member acquired membership rights by disposing of membership rights in another mutual entity

326 - 150 Disposal by post - CGT member of a demutualisation share (other than a demutualisation original share) or an interest in such a share

326 - 155 Disposal by pre - CGT member of a demutualisation original share or a non - demutualisation bonus share, or an interest in such a share, where member did not acquire membership rights by disposing of membership rights in another mutual entity

326 - 160 Disposal by pre - CGT member of a demutualisation original share or a non - demutualisation bonus share, or an interest in such a share, where member acquired membership rights by disposing of membership rights in another mutual entity

326 - 165 Disposal by post - CGT member of a demutualisation original share or a non - demutualisation bonus share, or an interest in such a share

326 - 170 Various adjusted market values

326 - 175 Undeducted membership costs

326 - 135 Application of Subdivision

(1) This Subdivision applies where a member (the disposer ) of a mutual entity which, or a holding company of which, becomes a company that is not a listed public company disposes of an asset consisting of:

(a) a demutualisation share in that company that is not a listed public company or an interest in such a share; or

(b) other shares ( non - demutualisation bonus shares ) in the same company, or an interest in such shares, where the shares are bonus equities mentioned in Subdivision 130 - A of the Income Tax Assessment Act 1997 and any of the demutualisation shares (whether or not disposed of at the time) are the original equities mentioned in that Subdivision.

(2) For the purposes of this Subdivision, if any of the original equities mentioned in Subdivision 130 - A of the Income Tax Assessment Act 1997 , is a demutualisation share, it is called a demutualisation original share .

326 - 140 Disposal by pre - CGT member of a demutualisation share (other than a demutualisation original share) or an interest in such a share where a member did not acquire membership rights by disposing of membership rights in another mutual entity

(1) If:

(a) the disposal is a disposal of a demutualisation share (other than a demutualisation original share) or an interest in such a share; and

(b) the disposer did not acquire membership rights in the demutualisation entity by disposing of membership rights in another mutual entity; and

(c) the disposer is a pre - CGT member;

then, for the purpose of working out whether the disposer made a capital gain or capital loss from the disposal, the disposer is taken to have done the following:

(d) to have paid for the acquisition of the share or interest the amount worked out by using the formula:

![]()

(e) to have paid that amount on the demutualisation resolution day;

(f) to have acquired the share or interest on the demutualisation resolution day.

(2) In the formula in paragraph (1)(d):

"total number of shares" means the total number of demutualisation shares issued.

326 - 145 Disposal by pre - CGT member of a demutualisation share (other than a demutualisation original share) or an interest in such a share where member acquired membership rights by disposing of membership rights in another mutual entity

(1) If:

(a) the disposal is a disposal of a demutualisation share (other than a demutualisation original share) or an interest in such a share; and

(b) the disposer acquired membership rights in the demutualising entity by disposing of membership rights in another mutual entity; and

(c) the disposer is a pre - CGT member;

then, for the purpose of working out whether the disposer made a capital gain or capital loss from the disposal, the disposer is taken to have done the following:

(d) to have paid for the acquisition of the share or interest both of the following amounts:

(i) the amount worked out by using the formula:

(ii) any amount actually paid for the acquisition;

(e) to have paid the amount referred to in subparagraph (d)(i) on the demutualisation resolution day;

(f) to have paid any amount referred to in subparagraph (d)(ii) when it was actually paid;

(g) to have acquired the share or interest on the demutualisation resolution day.

(2) In the formula in subparagraph (1)(d)(i):

"number of disposer's shares" means the number of demutualisation shares issued to the disposer or in which the disposer had an interest.

"number of members" means the total number of members of the other mutual entity at the time of the disposal of the membership rights in that entity.

326 - 150 Disposal by post - CGT member of a demutualisation share (other than a demutualisation original share) or an interest in such a share

(1) If:

(a) the disposal is a disposal of a demutualisation share (other than a demutualisation original share) or an interest in such a share; and

(b) the disposer is a post - CGT member;

then, for the purpose of working out whether the disposer made a capital gain or capital loss from the disposal, the disposer is taken to have done the following:

(c) to have paid for the acquisition of the share or interest both of the following amounts:

(i) the amount worked out by using the formula:

(ii) any amount actually paid for the acquisition;

(d) to have paid the amount referred to in subparagraph (c)(i) on the demutualisation resolution day;

(e) to have paid any amount referred to in subparagraph (c)(ii) when it was actually paid;

(f) to have acquired the share or interest on the demutualisation resolution day.

(2) In the formula in subparagraph (1)(c)(i):

"number of disposer's shares" means the number of demutualisation shares issued to the disposer or in which the disposer had an interest.

326 - 155 Disposal by pre - CGT member of a demutualisation original share or a non - demutualisation bonus share, or an interest in such a share, where member did not acquire membership rights by disposing of membership rights in another mutual entity

(1) If:

(a) the disposal is a disposal of either:

(i) a demutualisation original share or an interest in such a share; or

(ii) a non - demutualisation bonus share or an interest in such a share; and

(b) the disposer did not acquire membership rights in the demutualising entity by disposing of membership rights in another mutual entity; and

(c) the disposer is a pre - CGT member;

then, for the purpose of working out whether the disposer made a capital gain or capital loss from the disposal, the following paragraphs apply:

(d) for the purpose of applying Subdivision 130 - A of the Income Tax Assessment Act 1997 , the amount paid for the acquisition of all the demutualisation original shares that is to be taken into account under that Division or Subdivision, as the case may be, is taken to be the amount worked out by using the formula:

(e) if the disposal is a disposal of a demutualisation original share or an interest in such a share, the disposer is taken:

(i) to have paid the amount referred to in paragraph (d) on the demutualisation resolution day; and

(ii) to have acquired the share or interest on the demutualisation resolution day.

(2) In the formula in paragraph (1)(d):

"number of disposer's shares" means the number of demutualisation original shares issued to the disposer or in which the disposer had an interest.

"total number of shares" means the total number of demutualisation shares issued.

326 - 160 Disposal by pre - CGT member of a demutualisation original share or a non - demutualisation bonus share, or an interest in such a share, where member acquired membership rights by disposing of membership rights in another mutual entity

(1) If:

(a) the disposal is a disposal of either:

(i) a demutualisation original share or an interest in such a share; or

(ii) a non - demutualisation bonus share or an interest in such a share; and

(b) the disposer acquired membership rights in the demutualising entity by disposing of membership rights in another mutual entity; and

(c) the disposer is a pre - CGT member;

then, for the purpose of working out whether the disposer made a capital gain or capital loss from the disposal, the following paragraphs have effect:

(d) for the purpose of applying Subdivision 130 - A of the Income Tax Assessment Act 1997 , the amount paid for the acquisition of all the demutualisation original shares that is to be taken into account under that Division or Subdivision, as the case may be, is taken to be both of the following amounts:

(i) the amount worked out by using the formula:

![]()

(ii) any amount actually paid for the acquisition; and

(e) if the disposal is a disposal of a demutualisation original share or an interest in such a share, the disposer is taken to have done the following:

(i) to have paid the amount referred to in subparagraph (d)(i) on the demutualisation resolution day;

(ii) to have paid any amount referred to in subparagraph (d)(ii) when it was actually paid;

(iii) to have acquired the share or interest on the demutualisation resolution day.

(2) In the formula in subparagraph (1)(d)(i):

"number of members" means the total number of members of the other mutual entity at the time of the disposal of the membership rights in that entity.

326 - 165 Disposal by post - CGT member of a demutualisation original share or a non - demutualisation bonus share, or an interest in such a share

If:

(a) the disposal is a disposal of either:

(i) a demutualisation original share or an interest in such a share; or

(ii) a non - demutualisation bonus share or an interest in such a share; and

(b) the disposer is a post - CGT member;

then, for the purpose of working out whether the disposer made a capital gain or capital loss from the disposal, the following paragraphs have effect:

(c) for the purpose of applying Subdivision 130 - A of the Income Tax Assessment Act 1997 , the amount paid for the acquisition of all the demutualisation original shares that is to be taken into account under that Division or Subdivision, as the case may be, is taken to be both of the following amounts:

(i) an amount equal to the undeducted membership costs;

(ii) any amount actually paid for the acquisition;

(d) if the disposal is a disposal of a demutualisation original share or an interest in such a share, the disposer is taken to have done the following:

(i) to have paid the amount referred to in subparagraph (c)(i) on the demutualisation resolution day;

(ii) to have paid any amount referred to in subparagraph (c)(ii) when it was actually paid;

(iii) to have acquired the share or interest on the demutualisation resolution day.

326 - 170 Various adjusted market values

Application

(1) This section has effect for the purposes of this Subdivision.

Where membership rights not acquired by disposal of rights in another entity

(2) The adjusted market value , when the expression is used in relation to a disposer who did not acquire membership rights in the demutualising entity by disposing of membership rights in another mutual entity, is the lesser of the issue day adjusted market value and the resolution day adjusted market value.

Where membership rights acquired by disposal of rights in another entity

(3) The adjusted market value , when the expression is used in relation to a disposer who acquired membership rights in the demutualising entity by disposing of membership rights in another mutual entity, is the disposal day adjusted market value.

Issue day adjusted market value

(4) The issue day adjusted market value is the market value, as determined by a qualified valuer, of the demutualised entity on the day on which the demutualisation shares were issued. However, in making the determination the valuer is to disregard the franking surplus of the demutualised entity on that day.

Resolution day adjusted market value

(5) The resolution day adjusted market value is the market value, as determined by a qualified valuer, of the demutualising entity on the demutualisation resolution day. However, in making the determination the valuer is to disregard the franking surplus of the demutualising entity on that day.

Disposal day adjusted market value

(6) Subject to subsection (7), the disposal day adjusted market value is the market value, as determined by a qualified valuer, of the other entity at the time immediately before the disposer disposed of membership rights in the other entity. However, in making the determination the valuer is to disregard the franking surplus of the other entity at that time.

Indexation of amount mentioned in subsection (6)

(7) If the indexation factor (see section 326 - 235) of the amount worked out under subsection (6) is more than one, that amount is taken to be replaced by that amount as indexed under Subdivision 326 - M.

326 - 175 Undeducted membership costs

(1) For the purposes of this Subdivision, the undeducted membership costs , when the expression is used in relation to a disposer who did not acquire membership rights in the demutualising entity by the disposal of membership rights in another mutual entity, are the sum of the undeducted amounts of the costs that were incurred by the disposer in acquiring and maintaining membership in the demutualising entity less any distributions that:

(a) were made by the demutualising entity to the disposer before any shares in the demutualised entity were issued; and

(b) were not included in the disposer's assessable income of any year of income.

(2) For the purposes of this Subdivision, the undeducted membership costs , when the expression is used in relation to a disposer who acquired membership rights in the demutualising entity by the disposal of membership rights in another mutual entity, are the sum of:

(a) if the disposer was a pre - CGT member--the undeducted amounts of the costs that were incurred by the disposer in maintaining membership in the demutualising entity less any distributions that:

(i) were made by the demutualising entity to the disposer before any shares in the demutualised entity were issued; and

(ii) were not included in the disposer's assessable income of any year of income; or

(b) if the disposer is a post - CGT member, the sum of:

(i) the undeducted amounts of the costs that were incurred by the disposer in acquiring and maintaining membership in the other entity; and

(ii) the undeducted amounts of the costs that were incurred by the disposer in maintaining membership in the demutualising entity;

less any distributions that:

(iii) were made by the demutualising entity or the other entity to the disposer before any shares in the demutualised entity were issued; and

(iv) were not included in the disposer's assessable income of any year of income.

(3) If at any time 2 or more persons were joint members of a mutual entity, any costs incurred by any one or more of them in acquiring or maintaining the joint membership are taken to have been incurred by each of them.

(4) Subject to subsection (5), the undeducted amount of a cost is the amount of the cost to the extent to which a deduction has not been allowed, and is not allowable, in respect of it.

(5) If:

(a) an amount of a cost referred to in subsection (1) or (2) was incurred before the demutualisation resolution day; and

(b) the indexation factor (see section 326 - 235) of the amount is more than one;

a reference in this section to the undeducted amount of that cost is a reference to the undeducted amount as indexed under Subdivision 326 - M.

Subdivision 326 - F -- Variation of amount taken to be paid for shares or an interest in shares by a member of a mutual entity who made a capital gain or capital loss from disposal of membership rights in another mutual entity

Table of sections

326 - 180 Amount taken to be paid for acquisition of shares or interest by member to be increased by capital gain or reduced by capital loss

326 - 180 Amount taken to be paid for acquisition of shares or interest by member to be increased by capital gain or reduced by capital loss

(1) This section applies if:

(a) a post - CGT member of a mutual entity that has been demutualised acquired membership rights in the entity by the disposal of membership rights in another mutual entity; and

(b) the member made a capital gain or capital loss from the disposal of membership rights in the other mutual entity; and

(c) the member has acquired shares or an interest in shares in the demutualised entity or in a company that holds shares in the demutualised entity.

(2) If the member disposes of a demutualisation original share or a non - demutualisation bonus share, the amount paid for the acquisition of all the demutualisation original shares is taken to be increased by the amount of the capital gain or reduced by the amount of the capital loss, as the case may be.

(3) If subsection (2) does not apply, the amount that is taken, under Subdivision 326 - D or 326 - E, to have been paid by the member for the acquisition of the share or interest is taken to be increased by the proportionate part of the amount of the capital gain or reduced by the proportionate part of the amount of the capital loss, as the case may be.

Subdivision 326 - G -- CGT consequences of disposal of rights or interests resulting from extinguishment of membership rights

Table of sections

326 - 185 Disposal of right to receive shares in demutualised entity

326 - 190 Extinguishment of right to shares in demutualised entity by the issue of the shares

326 - 195 Disposal of right to receive shares in holding company

326 - 200 Disposal of interest in trust that holds shares in demutualised entity

326 - 185 Disposal of right to receive shares in demutualised entity

(1) This section applies if:

(a) under the direct method of demutualisation, or the combined direct and holding company method of demutualisation, of a mutual entity, the membership rights of an existing member of the entity are extinguished; and

(b) as a result of the extinguishment of the rights, the member acquires a right or an interest in a right to have shares in the demutualised entity issued to the member; and

(c) the member disposes of the whole or a part of the right or interest otherwise than by receiving the shares.

(2) For the purpose of working out whether the member made a capital gain or capital loss from the disposal, the member is taken to have done the following:

(a) to have paid for the acquisition of the right or interest in the right the amount worked out by using the formula:

![]()

(b) to have paid that amount, and to have acquired the right or interest, on the demutualisation resolution day.

(3) In the formula in paragraph (2)(a):

"cost of a share or interest" means the amount that would have been taken to have been paid by the member for the acquisition of a share or an interest in a share in the demutualised entity under Subdivisions 326 - D, 326 - E and 326 - F if the disposal had been the disposal of the shares to which the right or interest in the right related.

"number of shares" means the number of shares to which the right or interest in the right related.

(4) If the member is a pre - CGT member who did not acquire membership rights in the demutualising entity by disposing of membership rights in another mutual entity, any capital loss made from the disposal before the demutualisation listing day, or, if there is no such day, before the day on which the shares in the demutualised entity were issued, is to be disregarded.

326 - 190 Extinguishment of right to shares in demutualised entity by the issue of the shares

(1) If, under the direct method of demutualisation or the holding company method of demutualisation, shares in a demutualised entity are issued to an existing member, Parts 3 - 1 and 3 - 3 of the Income Tax Assessment Act 1997 do not apply in respect of any CGT event constituted by the extinguishment of the member's right to have the shares issued to the member.

(2) If, under the combined direct and holding company method of demutualisation, shares in a demutualised entity or in a holding company are issued to an existing member, Parts 3 - 1 and 3 - 3 of the Income Tax Assessment Act 1997 do not apply in respect of any CGT event constituted by the extinguishment of the member's rights to have the shares issued to the member.

326 - 195 Disposal of right to receive shares in holding company

(1) This section applies if:

(a) under the holding company method of demutualisation, or the combined direct and holding company method of demutualisation, of a mutual entity:

(i) the membership rights of an existing member of the entity are extinguished; and

(ii) shares in the demutualised entity are issued to a company (the holding company ); and

(b) as a result of the extinguishment of the rights, the member acquires a right or an interest in a right to have shares in the holding company issued to the member; and

(c) the member disposes of the whole or a part of the right or interest otherwise than by receiving the shares.

(2) For the purpose of working out whether the member made a capital gain or capital loss from the disposal, the member is taken to have done the following:

(a) to have paid for the acquisition of the right or interest in the right the amount worked out by using the formula:

![]()

(b) to have paid that amount, and to have acquired the right or interest, on the demutualisation resolution day.

(3) In the formula in paragraph (2)(a):

"cost of a share or interest" means the amount that would have been taken to have been paid by the member for the acquisition of a share or an interest in a share in the holding company under Subdivisions 326 - D, 326 - E and 326 - F if the disposal had been the disposal of the shares in the holding company to which the right or interest in the right related.

"number of shares" means the number of shares in the holding company to which the right or interest in the right related.

(4) If the member is a pre - CGT member who did not acquire membership rights in the demutualising entity by disposing of membership rights in another mutual entity, any capital loss made from the disposal before the demutualisation listing day, or, if there is no such day, before the day on which the shares in the holding company were issued, is to be disregarded.

326 - 200 Disposal of interest in trust that holds shares in demutualised entity

(1) This section applies if:

(a) under the distributing trust method of demutualisation of a mutual entity:

(i) the membership rights of an existing member of the entity are extinguished; and

(ii) shares in the demutualised entity are issued to a trustee; and

(b) as a result of the extinguishment of the rights, the member acquires an interest in the trust constituted by the right to have shares in the demutualised entity held by the trustee transferred by the trustee to the member or disposed of by the trustee on behalf of the member; and

(c) the member disposes of the whole or a part of the interest otherwise than by receiving the shares or proceeds of the sale of the shares.

(2) For the purpose of working out whether the member made a capital gain or capital loss from the disposal, the member is taken to have done the following:

(a) to have paid for the acquisition of the interest in the trust the amount worked out by using the formula:

![]()

(b) to have paid that amount, and to have acquired the interest, on the demutualisation resolution day.

(3) In the formula in paragraph (2)(a):

"cost of a share" means the amount that would have been taken to have been paid by the member for the acquisition of a share in the demutualised entity under Subdivisions 326 - D, 326 - E and 326 - F if the disposal had been the disposal of the shares to which the interest or the part of the interest in the trust related.

"number of shares" means the number of shares in the demutualised entity to which the interest in the trust related.

(4) If the member is a pre - CGT member who did not acquire membership rights in the demutualising entity by disposing of membership rights in another mutual entity, any capital loss made from the disposal before the demutualisation listing day, or, if there is no such day, before the day on which the shares in the demutualised entity were issued, is to be disregarded.

Subdivision 326 - H -- CGT consequences of transfer of ordinary shares

Table of sections

326 - 205 Transfer of share or distribution of proceeds of sale of share not to have any CGT consequences

326 - 205 Transfer of share or distribution of proceeds of sale of share not to have any CGT consequences

If a trustee transfers an ordinary share or distributes the proceeds of the sale of an ordinary share as mentioned in subparagraph 326 - 55(1)(h)(ii), Parts 3 - 1 and 3 - 3 of the Income Tax Assessment Act 1997 do not apply in respect of any CGT event constituted by or arising from the transfer or distribution.

Subdivision 326 - I -- CGT consequences of disposal of demutualisation shares or an interest in such shares by a trustee on behalf of a member

Table of sections

326 - 210 Disposal by a trustee

326 - 210 Disposal by a trustee

If:

(a) under the distributing trust method of demutualisation, shares in a demutualised entity are issued to a trustee on behalf of a member; and

(b) the trustee disposes of a share or an interest in a share, or disposes of a non - demutualisation bonus share or an interest in such a share, on behalf of the member;

the disposal is taken for the purposes of Subdivisions 326 - D, 326 - E and 326 - F to have been a disposal of the share or interest by the member.

Subdivision 326 - J -- CGT consequences of change in rights attaching to special shares or replacement of special shares by ordinary shares

Table of sections

326 - 215 Change of rights to, and replacement of, special shares

326 - 215 Change of rights to, and replacement of, special shares

(1) This Subdivision applies where, under the distributing trust method of demutualisation of a mutual entity, the rights attaching to special shares issued to a trustee on behalf of a member become the same as the rights attaching to ordinary shares.

(2) Parts 3 - 1 and 3 - 3 of the Income Tax Assessment Act 1997 do not apply in respect of the change in rights.

Subdivision 326 - K -- CGT consequences of disposal of shares or an interest in shares acquired under a roll - over provision

Table of sections

326 - 220 Disposal of shares or interest in shares

326 - 220 Disposal of shares or interest in shares

(1) This section applies where:

(a) under any method of demutualisation, a mutual entity, or a holding company of a mutual entity, becomes a listed public company; and

(b) a disposal of a share, or of an interest in a share, in the entity or holding company takes place before the demutualisation listing day; and

(c) a roll - over provision applies to the disposal; and

(d) the person who disposed of the share or interest would, except for section 326 - 75 and paragraph (c) of this subsection, have made a capital loss as a result of the disposal; and

(e) the person who is taken to acquire the share or interest under the roll - over provision (the transferee ) disposes of the share or interest.

(2) If the disposal by the transferee takes place before the demutualisation listing day, any capital loss that the transferee makes from that disposal is disregarded.

(3) If the disposal by the transferee takes place on or after the demutualisation listing day, Subdivision 326 - D applies to the disposal referred to in paragraph (1)(b) as if that disposal had taken place on or after that day.

(4) In this section:

"disposal" includes a disposal that would have occurred except for former section 160X.

"roll-over provision" means:

(a) former section 160X; or

(b) any provision of Division 17 of Part III; or

(c) Division 128 of the Income Tax Assessment Act 1997 ; or

(d) any provision of Divisions 122 and 126 of Part 3 - 3 of the Income Tax Assessment Act 1997 .

Subdivision 326 - L -- CGT consequences of payment to member of demutualised entity out of accumulated surplus of the entity

Table of sections

326 - 225 Payment out of assets of demutualised entity that is not included in assessable income is taken not to be a dividend

326 - 225 Payment out of assets of demutualised entity that is not included in assessable income is taken not to be a dividend

If:

(a) a payment out of the assets of a demutualised entity is made to a taxpayer who holds shares or an interest in shares in the entity; and

(b) the amount paid is a dividend that is not included in the taxpayer's assessable income;

the payment is taken, for the purposes of section 104 - 135 of the Income Tax Assessment Act 1997 , not to be the payment of a dividend.

Subdivision 326 - M -- Indexation

Table of sections

326 - 230 Indexing of amounts

326 - 235 Indexation factor

326 - 240 Index number

Some provisions of this Division require amounts to be indexed. An amount is indexed by multiplying it by its indexation factor.

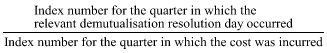

(1) For the indexation of the amount worked out under subsection 326 - 120(2) or 326 - 170(6) in relation to a person who acquired membership rights in a demutualising entity by the disposal of membership rights in another mutual entity, the indexation factor is:

(2) For the indexation of an undeducted amount referred to in subsections 326 - 125(1) and (2) or 326 - 175(1) and (2) of a cost incurred by a person in acquiring or maintaining membership in a demutualising entity or another entity, the indexation factor is:

(3) An indexation factor is to be worked out to 3 decimal places (rounding up if the fourth decimal place is 5 or more).

(1) The index number for a quarter is the All Groups Consumer Price Index number (being the weighted average of the 8 capital cities) first published by the Australian Statistician for the quarter.

(2) If the Australian Statistician changes the index reference period for an index number, only index numbers published in terms of the new index reference period are to be used after the change.

Subdivision 326 - N -- Non - CGT consequences of issue of demutualisation shares

Table of sections

326 - 245 General taxation consequences of issue of demutualisation shares

326 - 245 General taxation consequences of issue of demutualisation shares

If any demutualisation shares are issued to a taxpayer under any method of demutualisation, no amount is to be included in the taxpayer's assessable income because of the issue of the shares to the taxpayer.

Income Tax Assessment Act 1936

No. 27, 1936

Compilation No. 186

Compilation date: 14 October 2024

Includes amendments: Act No. 38, 2024

This compilation is in 7 volumes

Volume 5: Schedules

Volume 6: Endnotes 1-4

Volume 7: Endnote 5

Each volume has its own contents

About this compilation

This compilation

This is a compilation of the Income Tax Assessment Act 1936 that shows the text of the law as amended and in force on 14 October 2024 (the compilation date ).

The notes at the end of this compilation (the endnotes ) include information about amending laws and the amendment history of provisions of the compiled law.

Uncommenced amendments

The effect of uncommenced amendments is not shown in the text of the compiled law. Any uncommenced amendments affecting the law are accessible on the Register (www.legislation.gov.au). The details of amendments made up to, but not commenced at, the compilation date are underlined in the endnotes. For more information on any uncommenced amendments, see the Register for the compiled law.

Application, saving and transitional provisions for provisions and amendments

If the operation of a provision or amendment of the compiled law is affected by an application, saving or transitional provision that is not included in this compilation, details are included in the endnotes.

Editorial changes

For more information about any editorial changes made in this compilation, see the endnotes.

Modifications

If the compiled law is modified by another law, the compiled law operates as modified but the modification does not amend the text of the law. Accordingly, this compilation does not show the text of the compiled law as modified. For more information on any modifications, see the Register for the compiled law.

Self - repealing provisions

If a provision of the compiled law has been repealed in accordance with a provision of the law, details are included in the endnotes.

Contents

Endnotes

Endnote 1--About the endnotes

Endnote 2--Abbreviation key

Endnote 3--Legislation history

Endnote 4--Amendment history