Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsYou are the only beneficiary

(1) If you are the only beneficiary with an interest in the trust capital and you * dispose of that interest, you work out if you have made a * capital loss in this way:

Working out your capital loss

Step 1. Work out the * capital proceeds from the * disposal.

Step 2. Work out the * reduced net asset amount.

Step 3. If the Step 1 amount is less , you make a capital loss equal to the difference.

(2) The reduced net asset amount is worked out in this way:

Working out the reduced net asset amount

Step 1. Work out the total of the * reduced cost bases (at the time of the disposal) of the * CGT assets that the trustee * acquired on or after 20 September 1985 and that formed part of the trust capital at that time.

Step 2. Work out the total of the * market values (at the time of the disposal) of the * CGT assets that the trustee * acquired before 20 September 1985 and that formed part of the trust capital at that time.

Step 3. Work out the amount of money that formed part of the trust capital at the time of the disposal.

Step 4. Add up the Step 1, 2 and 3 amounts.

Step 5. Subtract from the Step 4 amount any liabilities of the trust at the time of the disposal.

Step 6. The result is the reduced net asset amount .

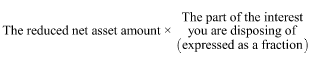

(3) If you * dispose of only part of that interest, any * capital loss is worked out using the method statement in subsection (1), except that the Step 2 amount is replaced by:

There is more than one beneficiary

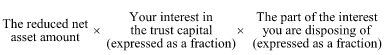

(4) If you are not the only beneficiary with an interest in the trust capital and you * dispose of your interest, any * capital loss is worked out using the method statement in subsection (1), except that the Step 2 amount is replaced by:

![]()

(5) If you are not the only beneficiary with an interest in the trust capital and you * dispose of part of your interest, any * capital loss is worked out using the method statement in subsection (1), except that the Step 2 amount is replaced by:

Exception

(6) A * capital loss you make is disregarded if you * acquired the * CGT asset that is the interest in the trust capital before 20 September 1985.