Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) CGT event D4 happens if you enter into a * conservation covenant over land you own.

(2) The time of the event is when you enter into the covenant.

(3) You make a * capital gain if the * capital proceeds from entering into the covenant are more than that part of the * cost base of the land that is apportioned to the covenant. You make a * capital loss if those capital proceeds are less than the part of the * reduced cost base of the land that is apportioned to the covenant.

Note: The capital proceeds from entering into the covenant are modified if you do not receive anything for entering into the covenant: see section 116 - 105.

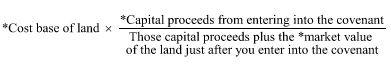

(4) The part of the * cost base of the land that is apportioned to the covenant is worked out in this way:

The part of the * reduced cost base of the land that is apportioned to the covenant is worked out similarly.

(5) The * cost base and * reduced cost base of the land are reduced by the part of the cost base or reduced cost base of the land that is apportioned to the covenant.

Example: Lisa receives $10,000 for entering into a conservation covenant that covers 15% of the land she owns. Lisa uses the following figures in calculating the cost base of the land that is apportioned to the covenant:

The cost base of the entire land is $200,000.

The market value of the entire land before entering into the covenant is $300,000, and its market value after entering into the covenant is $285,000.

Lisa calculates the cost base of the land that is apportioned to the covenant to be:

![]()

She reduces the cost base of the land by the part that is apportioned to the covenant:

![]()

Exceptions

(6) * CGT event D4 does not happen if:

(a) you did not receive any * capital proceeds for entering into the covenant; and

(b) you cannot deduct an amount under Division 31 for entering into the covenant.

Note: In this case, CGT event D1 will apply.

(7) A * capital gain or * capital loss you make is disregarded if you * acquired the land before 20 September 1985.

Table of sections

104 - 55 Creating a trust over a CGT asset: CGT event E1

104 - 60 Transferring a CGT asset to a trust: CGT event E2

104 - 65 Converting a trust to a unit trust: CGT event E3

104 - 70 Capital payment for trust interest: CGT event E4

104 - 71 Adjustment of non - assessable part

104 - 72 Reducing your capital gain under CGT event E4 if you are a trustee

104 - 75 Beneficiary becoming entitled to a trust asset: CGT event E5

104 - 80 Disposal to beneficiary to end income right: CGT event E6

104 - 85 Disposal to beneficiary to end capital interest: CGT event E7

104 - 90 Disposal by beneficiary of capital interest: CGT event E8

104 - 95 Making a capital gain

104 - 100 Making a capital loss

104 - 105 Creating a trust over future property: CGT event E9

104 - 107A AMIT--cost base reduction exceeds cost base: CGT event E10

104 - 107B Annual cost base adjustment for member's unit or interest in AMIT

104 - 107C AMIT cost base net amount

104 - 107D AMIT cost base reduction amount

104 - 107E AMIT cost base increase amount

104 - 107F Receipt of money etc. increasing AMIT cost base reduction amount not to be treated as income

104 - 107G Effect of AMIT cost base net amount on cost of AMIT membership interest or unit that is a revenue asset--adjustment of cost of asset

104 - 107H Effect of AMIT cost base net amount on cost of AMIT membership interest or unit that is a revenue asset--amount included in assessable income