Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The reduced cost base of a * CGT asset consists of 5 elements. It does not include indexation of those elements.

Note: The reduced cost base is reduced by net input tax credits: see section 103 - 30.

5 elements of the reduced cost base

(2) All of the elements (except the third one) of the reduced cost base of a * CGT asset are the same as those for the * cost base.

(3) The third element is:

(a) any amounts worked out under whichever of the following subparagraphs applies:

(i) if Division 58 does not apply to the asset--any amount included in your assessable income for any income year because of a balancing adjustment for the asset;

(ii) if Division 58 applies to the asset and an amount has been included in your assessable income for an income year because of a balancing adjustment for the asset--any part of that amount that was attributable to amounts you have deducted or can deduct for the decline in value of the asset; and

(b) any amount that would have been so included apart from any of these (which provide relief from including a balancing charge in your assessable income):

(i) section 40 - 365; or

(ii) any of these former sections--section 42 - 285, 42 - 290 or 42 - 293; or

(iii) former subsection 59(2A) or (2D) of the Income Tax Assessment Act 1936 .

What does not form part of the reduced cost base

(4) The reduced cost base does not include an amount to the extent that you have deducted or can deduct it (including because of a balancing adjustment) or could have deducted apart from paragraph 43 - 70(2)(h).

Note: That paragraph excludes from deductibility under Division 43 expenditure that qualifies for the heritage conservation rebate.

(5) The reduced cost base does not include an amount that you could have deducted for a * CGT asset had you used it wholly for the * purpose of producing assessable income.

(6) Expenditure does not form part of the reduced cost base to the extent of any amounts you have received as * recoupment of it. However, this rule does not apply to the extent that the amounts are included in your assessable income.

(6A) Expenditure does not form part of the reduced cost base to the extent that you chose a * tax offset for it under the former section 388 - 55 (about the landcare and water facility tax offset) instead of deducting it.

(7) If your * CGT asset is a * share in a company, its reduced cost base is reduced by the amount calculated under subsection (8) if:

(aa) you are a * corporate tax entity; and

(a) the company makes a distribution to you under an * arrangement; and

(b) an amount (the attributable amount ) representing the distribution or part of it is reasonably attributable to profits * derived by the company before you c acquired the share; and

(c) you are entitled to a * tax offset under Division 207 on the part of the distribution that is a * dividend (the dividend amount ); and

(d) you were a * controller (for CGT purposes) of the company, or an * associate of such a controller, when the arrangement was made or carried out.

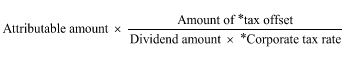

(8) The amount of the reduction is:

(9) The reduced cost base is to be reduced by any amount that you have deducted or can deduct, or could have deducted except for Subdivision 170 - D, as a result of a * CGT event that happens in relation to a * CGT asset. However, do not make a reduction for an amount that relates to a cost that could never have formed part of the reduced cost base or is excluded from the reduced cost base as a result of another provision of this section.

(9A) Expenditure does not form part of the reduced cost base to the extent that section 26 - 54 prevents it being deducted (even if some other provision also prevents it being deducted).

Note: Section 26 - 54 prevents deductions for expenditure related to certain offences.

(9B) Expenditure does not form part of the reduced cost base to the extent that it is a * bribe to a foreign public official or a * bribe to a public official.

(9C) Expenditure does not form part of the reduced cost base to the extent that it is in respect of providing * entertainment.

(9D) Expenditure does not form part of the reduced cost base to the extent that section 26 - 5 prevents it being deducted (even if some other provision also prevents it being deducted).

Note: Section 26 - 5 denies deductions for penalties.

(9E) Expenditure does not form part of the reduced cost base to the extent that section 26 - 47 prevents it being deducted.

Note: Section 26 - 47 denies deductions for the excess of boat expenditure over boat income.

(9F) Expenditure does not form part of the reduced cost base to the extent that section 26 - 22 prevents it being deducted.

Note: Section 26 - 22 denies deductions for political contributions and gifts.

(9G) Expenditure does not form part of the reduced cost base to the extent that section 26 - 100 prevents it being deducted.

Note: Section 26 - 100 denies deductions for certain expenditure on water infrastructure improvements.

(9H) Expenditure does not form any part of any element of the reduced cost base to the extent that section 26 - 97 prevents it being deducted (even if some other provision also prevents it being deducted).

Note: Section 26 - 97 denies deductions for National Disability Insurance Scheme expenditure.

(9J) Expenditure does not form part of the reduced cost base to the extent that section 26 - 31 prevents it being deducted.

Note: Section 26 - 31 denies deductions for travel related to the use of residential premises as residential accommodation.

(9K) Expenditure does not form part of the reduced cost base to the extent that a provision of Division 832 (about hybrid mismatch rules) prevents it being deducted.

Assume a CGT event for purposes of working out reduced cost base at a particular time

(10) If:

(a) it is necessary to work out the * reduced cost base at a particular time; and

(b) a * CGT event does not happen in relation to the asset at or just after that time;

assume, for the purpose only of working out the reduced cost base at the particular time, that such an event does happen in relation to the asset at or just after that time.