Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsObject

(1) The object of this section is to increase the discount percentage to the extent that the * discount capital gain relates to a * dwelling used to * provide affordable housing.

When this section applies

(2) This section applies to a * discount capital gain if:

(a) you are an individual; and

(b) either:

(i) you make the discount capital gain from a * CGT event happening in relation to a * CGT asset that is your * ownership interest in a * dwelling; or

(ii) because of section 115 - 215, Division 102 applies to you as if you had made the discount capital gain for a * capital gain of a trust covered by subsection (3); and

(c) where subparagraph (b)(ii) applies--the trust's capital gain was made directly, or indirectly through one or more entities that are all covered by subsection (3), from a CGT event happening in relation to a CGT asset that is an ownership interest in a dwelling; and

(d) the dwelling was used to * provide affordable housing on at least 1095 days:

(i) before the CGT event; and

(ii) during your, or the relevant trustee's or partner's, * ownership period of that dwelling; and

(iii) on or after 1 January 2018.

The days mentioned in paragraph (d) need not be consecutive.

Note: 1095 days is the same as 3 years.

(3) This subsection covers the following:

(a) a trust, other than a * superannuation fund or a public unit trust (within the meaning of section 102P of the Income Tax Assessment Act 1936 );

(b) a * managed investment trust;

(c) a partnership.

Discount percentage

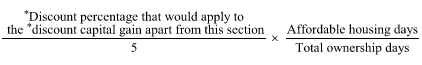

(4) The percentage resulting from this section is the sum of:

(a) the * discount percentage that would apply to the * discount capital gain apart from this section; and

(b) the result (expressed as a percentage) of subsection (5).

(5) Work out the following:

where:

"affordable housing days" means the number of days during that * ownership period (see paragraph (2)(d)) of the * dwelling, and on or after 1 January 2018, on which:

(a) the dwelling was used to * provide affordable housing; and

(b) you were neither a foreign resident nor a * temporary resident.

"total ownership days" means the number of days during that * ownership period (see paragraph (2)(d)) of the * dwelling, less the number of days after 8 May 2012 during that ownership period that you were a foreign resident or a * temporary resident.