Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

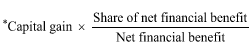

Commonwealth Consolidated Acts(1) A beneficiary of a trust estate is specifically entitled to an amount of a * capital gain made by the trust estate in an income year equal to the amount calculated under the following formula:

where:

"net financial benefit" means an amount equal to the * financial benefit that is referable to the * capital gain (after any application by the trustee of losses, to the extent that the application is consistent with the application of capital losses against the capital gain in accordance with the method statement in subsection 102 - 5(1)).

"share of net financial benefit" means an amount equal to the * financial benefit that, in accordance with the terms of the trust:

(a) the beneficiary has received, or can be reasonably expected to receive; and

(b) is referable to the * capital gain (after application by the trustee of any losses, to the extent that the application is consistent with the application of capital losses against the capital gain in accordance with the method statement in subsection 102 - 5(1)); and

(c) is recorded, in its character as referable to the capital gain, in the accounts or records of the trust no later than 2 months after the end of the income year.

Note: A trustee of a trust estate that makes a choice under section 115 - 230 is taken to be specifically entitled to a capital gain.

(2) To avoid doubt, for the purposes of subsection (1), something is done in accordance with the terms of the trust if it is done in accordance with:

(a) the exercise of a power conferred by the terms of the trust; or

(b) the terms of the trust deed (if any), and the terms applicable to the trust because of the operation of legislation, the common law or the rules of equity.

(3) For the purposes of this section, in calculating the amount of the * capital gain, disregard sections 112 - 20 and 116 - 30 (Market value substitution rule) to the extent that those sections have the effect of increasing the amount of the capital gain.