Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) A * capital gain or * capital loss you make from a * collectable is disregarded if the first element of its * cost base, or the first element of its * cost if it is a * depreciating asset, is $500 or less.

Example: On 10 July 2001, Gayle buys a print for $450 and hangs it in her home. On 30 November 2001 she takes the print to her office and hangs it in the lobby. Gayle self assesses the effective life of the print to be 7 years.

Gayle sells the print to Anna for $700 on 2 January 2002.

How much can Gayle deduct for the 2001 - 02 income year?

The cost of the print is $450. Gayle chooses to use the prime cost method to calculate its decline in value.

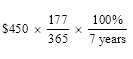

The print's decline in value is:

= $31

Gayle can deduct $6 as the taxable use portion of the decline in value under Division 40:

Due to the balancing adjustment event that occurred on 2 January 2002, $54 is included in Gayle's assessable income for the 2001 - 02 income year under section 40 - 285. The amount is reduced for non - taxable use by section 40 - 290.

A capital gain of $202 is disregarded under this section because the asset is a collectable acquired for less than $500.

(2) However, there is a special rule if the * collectable is an interest in one of these * CGT assets:

(a) * artwork, jewellery, an antique, or a coin or medallion;

(b) a rare folio, manuscript or book;

(c) a postage stamp or first day cover.

A * capital gain or * capital loss you make from the interest is disregarded only if the * market value of the asset (when you * acquired the interest) is $500 or less.

Note: If you last acquired the interest before 16 December 1995, a capital gain or loss is disregarded if you acquired the interest for $500 or less: see section 118 - 10 of the Income Tax (Transitional Provisions) Act 1997 .

(3) A * capital gain you make from a * personal use asset, or part of the asset, is disregarded if the first element of the asset's * cost base, or the first element of its * cost if it is a * depreciating asset, is $10,000 or less.

Note: A capital loss you make from a personal use asset is disregarded: see subsection 108 - 20(1).