Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies if you are the trustee of a deceased estate and, under the deceased's will, you * acquire an * ownership interest in a * dwelling for occupation by an individual.

(2) If a * CGT event happens to the interest in relation to the individual and you receive no money or property for it:

(a) a * capital gain or * capital loss you make from the event is disregarded; and

(b) the first element of the * dwelling's * cost base and * reduced cost base in the hands of the individual is its cost base and reduced cost base in your hands at the time of the event; and

(c) the individual is taken to have * acquired it when you did.

(3) If:

(a) you receive money or property for the * CGT event happening or the event happens in relation to another entity; and

(b) the dwelling was the main residence of the individual from the time you * acquired the interest until the time of the event;

you do not make a * capital gain or * capital loss from the CGT event.

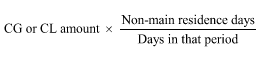

(4) However, if the * dwelling was the main residence of the individual during part only of that period, you make a * capital gain or * capital loss worked out using the formula:

where:

"CG or CL amount" is the * capital gain or * capital loss you would have made from the * CGT event apart from this Subdivision.

"non-main residence days" is the number of days in that period when the * dwelling was not the individual's main residence.

(5) Only these * CGT events are relevant:

(a) CGT events A1, B1, C1, C2, E1, E2, E5, F2, K3, K4 and K6 (except one involving the forfeiting of a deposit); and

(b) a CGT event that involves the forfeiting of a deposit as part of an uninterrupted sequence of transactions ending in one of the events specified in paragraph (a) subsequently happening.

Note: The full list of CGT events is in section 104 - 5.

(6) However, this section does not apply if, just before the deceased's death, the deceased was an * excluded foreign resident.