Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) These rules are relevant to working out what are the liabilities in respect of an asset.

(2) A liability incurred for the purposes of a * business that is not a liability in respect of a specific asset or assets of the business is taken to be a liability in respect of all the assets of the business.

Note: An example is a bank overdraft.

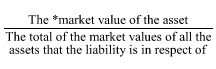

(3) If a liability is in respect of 2 or more assets, the proportion of the liability that is in respect of any one of those assets is equal to: