Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies if:

(a) you acquire the new interest in exchange for more than one original interest; and

(b) you started to * hold one or more of the original interests before 20 September 1985; and

(c) you started to hold one or more of the original interests on or after that day; and

(d) you did not start to hold any of the original interests on or after 1 July 2001.

(2) Each new interest is taken to be 2 separate * CGT assets that are both new interests:

(a) one (which you are taken to have started to * hold on or after 20 September 1985 and before 1 July 2001) representing the extent to which you started to hold the original interests on or after 20 September 1985 and before 1 July 2001; and

(b) another (which you are taken to have started to hold before 20 September 1985) representing the extent to which you started to hold the original interests before that day.

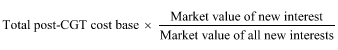

(3) The first element of the * cost base and * reduced cost base of the * CGT asset mentioned in paragraph (2)(a) in relation to a new interest is worked out under the formula:

where:

"market value of all new interests" is the total of the * market values of all of the new interests.

"market value of new interest" is the * market value of the new interest to which the * CGT asset mentioned in paragraph (2)(a) relates.

"total post-CGT cost base" is the total of the * cost bases of all the original interests that you started to * hold on or after 20 September 1985.