Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section has rules that are relevant if a * CGT asset is owned by joint tenants and one of them dies.

(2) The survivor is taken to have * acquired (on the day the individual died) the individual's interest in the asset. If there are 2 or more survivors, they are taken to have acquired that interest in equal shares.

Note: Joint tenants are treated as owning a CGT asset in equal shares: see section 108 - 7.

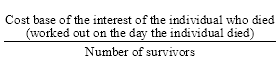

(3) If the individual who died * acquired his or her interest in the asset on or after 20 September 1985, the first element of the * cost base of the interest each survivor is taken to have acquired is:

The first element of the * reduced cost base of the interest each survivor is taken to have * acquired is worked out similarly.

Example: In 1999 2 individuals buy land for $50,000 as joint tenants. Each one is taken to have a 50% interest in it. On 1 May 2001 one of them dies.

The survivor is taken to have acquired the interest of the individual who died on 1 May 2001. If the cost base of that interest on that day is $27,000, the survivor is taken to have acquired that interest for that amount.

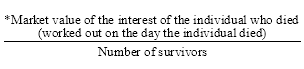

(4) If the individual who died * acquired his or her interest in the asset before 20 September 1985, the first element of the * cost base and * reduced cost base of the interest each survivor is taken to have acquired is:

Note: There is a special indexation rule for surviving joint tenants: see section 114 - 10.

Table of Subdivisions

Guide to Division 130

130 - A Bonus shares and units

130 - B Rights

130 - C Convertible interests

130 - D Employee share schemes

130 - E Exchangeable interests

130 - F Exploration investments