Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies if:

(a) an entity (the minerals explorer ) issues a * share in the minerals explorer to another entity (the investor ) during the 2017 - 18, 2018 - 19, 2019 - 20, 2020 - 21, 2021 - 22, 2022 - 23, 2023 - 24 or 2024 - 25 income year; and

(b) the Commissioner makes a determination under section 418 - 101 allocating exploration credits to the minerals explorer for the income year in which the share is issued; and

(c) the share is issued to the investor on or after the day on which the Commissioner's determination is made; and

(d) the share is an * equity interest.

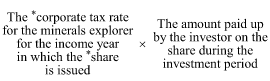

(2) The * reduced cost base of the * share is to be reduced immediately before the disposal of the share by the amount worked out as follows:

where:

"investment period" means the period, within the income year in which the * share is issued to the investor, that:

(a) begins on the day on which the Commissioner makes the determination mentioned in paragraph (1)(b); and

(b) ends at the end of the income year.

Table of sections

132 - 1 Lessee incurs expenditure to get lease term varied or waived

132 - 5 Lessor pays lessee for improvements

132 - 10 Grant of a long - term lease

132 - 15 Lessee of land acquires reversionary interest of lessor